Aave and Maker waging war over USDe

Welcome to Stay on-chain! While markets cool off a bit and we enjoy some sideways, Ethena’s USDe is raising stablecoin rates across DeFi while polarizing discussion around its risks. Many call it the next Luna & UST. What’s your take?

Read along, and let us sift through the noise for you.

By the way, make sure to join our Telegram group 👾

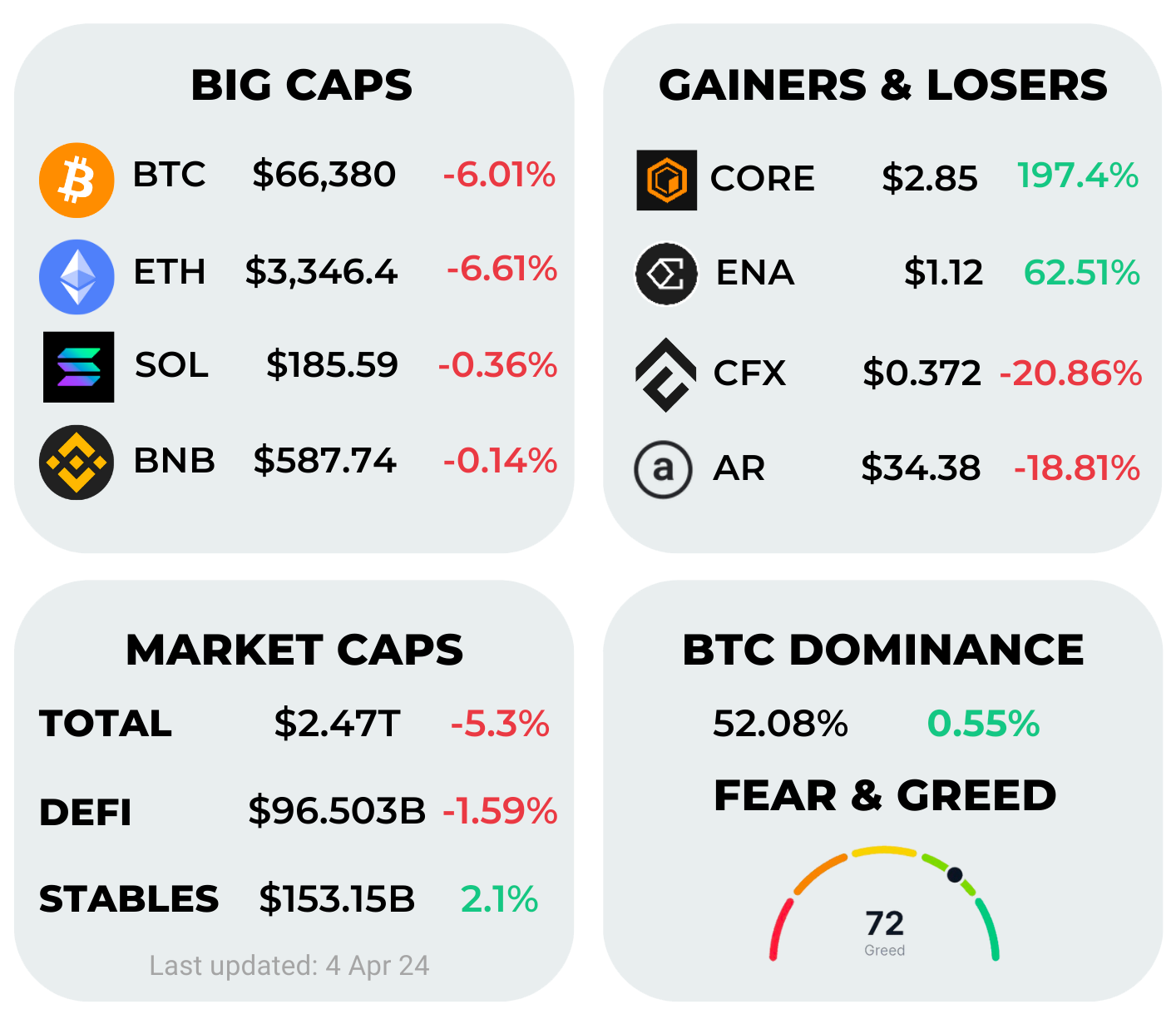

There's a tangible sense of suspense in the crypto markets this week. The two leading coins, BTC and ETH, have both slipped by 6%, while the subsequent two L1s, BNB and SOL, have been demonstrating significant strength. There's no major market-impacting news this week, leaving the markets relatively calm. So, what's next? That remains the million-dollar question.

Naturally, there's hope that the inflow into Bitcoin spot ETFs will persist, propelling BTC to new all-time highs. This week's standout performers are CORE and ENA, with ENA being the latest from the synthetic stablecoin project Ethena, whose token has just hit the market. On the flip side, CFX and AR have been the laggards.

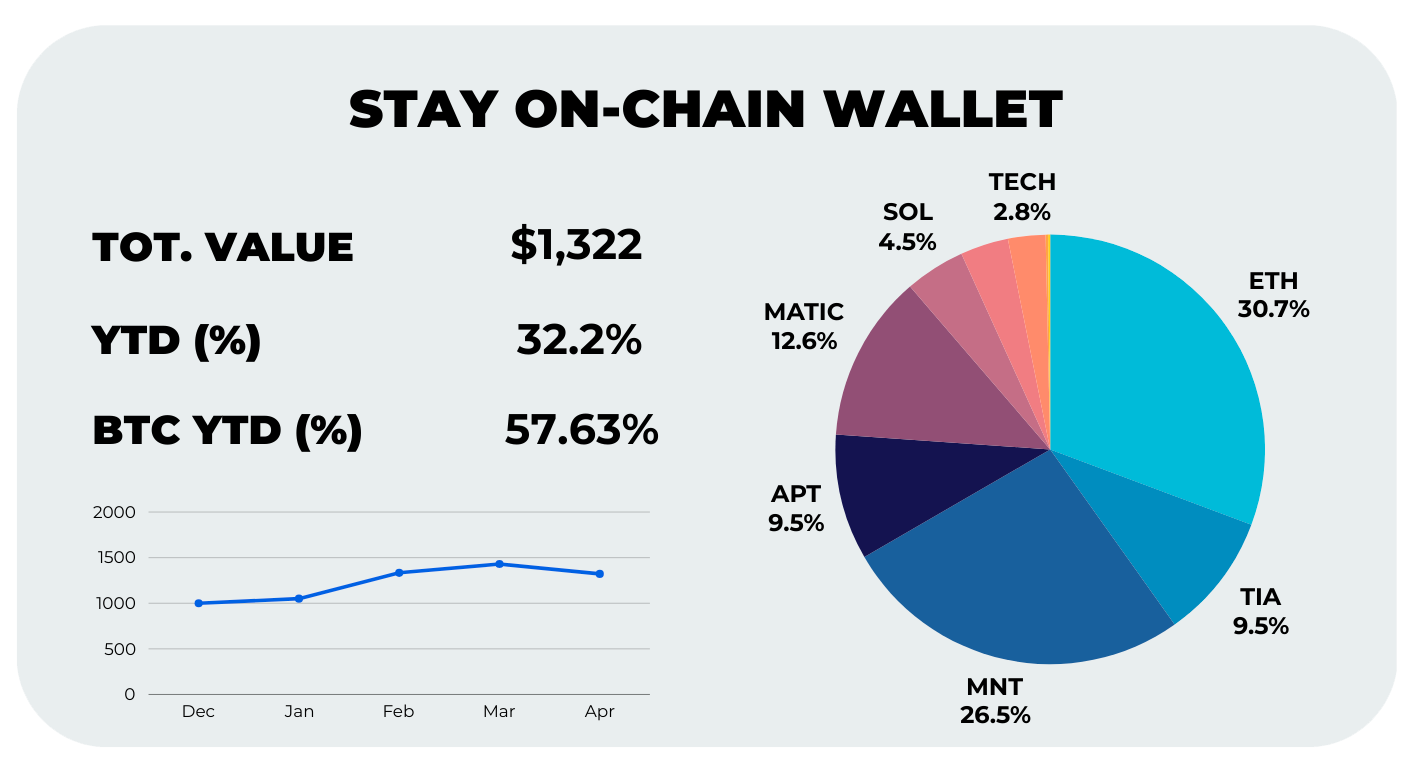

Our wallet is performing well—nothing out of the ordinary. According to the line chart, we're experiencing a slight downtrend compared to March. MNT remains strong following its impressive rally last week, and we've been engaging in staking to partake in the Mantle rewards program. This program is set to grant us Ethena shards, which we’ll be able to convert into ENA. In this week's strategic move, we've divested from our ATOM holdings and allocated some $ to TECH, a high-caliber meme coin on Avalanche, and reinforced our investment in the MATIC thesis, increasing our allocation to approx. 12.5%. For a breakdown of our strategies and results, feel free to check our Google sheet.

Check out Rabby Wallet — the best EVM wallet we use for everything on-chain. Use our referral code to give Stay on-chain a boost. Thanks for the support!

Aave looks for shelter as MakerDAO and Frax Finance integrate USDe

Ethena’s USDe product has been a polarizing topic within the space, with factions already forming. MakerDAO and Frax Finance are eyeing it as an opportunity to increase their cash flow, with the former proposing to mint up to 1B DAI backed by USDe deposits, while the latter passed a proposal to allocate 250M FRAX to sUSDe lending pools and LPs. On the other hand, Aave is the Central Bank of DeFi and must constantly monitor risks on the assets they allow as collateral on their platform — while Maker’s proposal hasn’t passed yet, the Aave Chain Initiative has already put up a proposal to counter Maker’s move by removing DAI as collateral on Aave.

Ethena’s been creating huge ripple effects on all of DeFi increasing stablecoins rates across the board, and while teams have been announcing bold decisions, the governance will likely decide for milder actions on both chains: Maker could be pressured into reducing the cap for DAI’s USDe backing, and Aave might end up only reducing DAI’s loan-to-value instead of disabling it as collateral. Besides, Aave is taking steps to integrate sUSDe as an asset on Aave V3. On a side note, Nostrafinance on Starknet has already paused the borrowing and lending of DAI.

Restaking mania: liquid restaking tokens now control 5.3% of ETH’s supply — dune.com

SBF gets 25 years of jail

Sam Bankman-Fried received a 25-year prison sentence for his fraudulent activities in the FTX case, and he's set to serve his time in a lower-security California prison. Moreover, with good behavior, there's a possibility that he might only serve around 12 years. The crypto community's sentiment is that the sentence is somewhat soft.

Beyond the prison term, he must also reimburse creditors $11 billion, funds that will be recovered from FTX's assets. Following his sentencing, SBF said: "I never thought that what I was doing was illegal."

Beating the odds: Bitcoin ETFs are now securing $55B, 4.22% of BTC’s market cap — sosovalue.xyz

Cobie is launching an angel investing platform

The renowned crypto trader and CT influencer Cobie, has recently launched the beta version of Echo, a platform aimed at democratizing the world of crypto angel investing. This platform may be a game-changer for retail investors who typically lack access to early-stage investment opportunities, which are often reserved for individuals with extensive networks or significant assets.

However, it's worth noting that Echo is tailored for self-certified sophisticated investors, adhering to the varying regulatory requirements across different countries. To get started, users must undergo KYC and complete a comprehensive questionnaire about their financial background. Currently, Echo is operating on an invite-only basis.

Can’t make this up: even the Wormhole exploiter received the $W airdrop — 𝕏/Pland_

Telegram and its grand plan for TON

The communication platform enabled revenue sharing for channels with at least 1,000 subscribers, allowing them to rake in 50% of the revenue generated by ads shown on the channel. The TON rewards will be credited on Figment, where users can choose to either withdraw the tokens, or use them for in-app purchases such as buying ads, collectible usernames, or premium giveaways.

Overall, this move is bolstering TON’s role within Telegram’s economy, creating a positive flywheel to increase its usage. Telegram currently has about 900M monthly active users, and generates over one trillion views per month.

Back to the future: CZ introducing Binance’s office in Shangai in 2017 — Youtube.com

🪂 AIRDROPS

- You can now claim Wormhole’s W token — wormhole.com

- Ethena launches ENA token and the second phase of its campaign ‘Sats’ — mirror.xyz

- The snapshot for Parcl’s airdrop on Solana has been taken — 𝕏/Parcl

- ZEUS token went live on Solana as first Jupiter’s launchpad — 𝕏/JupiterExchange

🏦 TRADFI

- Multicoin Capital's hedge fund has grown 9,281% since 2017 — The Block

- Tether bought 8,888 more BTC in Q1 ‘24, and now holds $5B+ bitcoins — The Block

- Craig Wright's assets worth $7.6M have been frozen by a UK judge to prevent him from evading court costs — Coindesk

- China launches Belt and Road blockchain initiative, but no cryptos are involved — 𝕏/WuBlockchain

- DOJ sends $139M Silk Road confiscated funds to Coinbase after alleged sale — Decrypt.co

- Forbes publishes article on useless blockchains — forbes.com

- Coinbase partners with Lightspark to enable Bitcoin Lightning Network across its services — 𝕏/davidmarcus

⛓️ DEFI

- Vitalik Buterin wrote a blog post about memecoins — vitalik.eth

- FRAX stablecoin to be natively issued on Cosmos — Blockworks

- 1intro is challenging Jupiter’s hegemony in Solana launchpads — 𝕏/1intro

- Someone created blobscriptions, adding inscriptions inside Ethereum’s blobs — Coindesk

- Solana 1.18 is coming soon — 𝕏/ansel_sol

- DeFi frontends as we know them might disappear in 2025 for European users due to MiCa — 𝕏/RuneKek

- Revenue sharing to veFXS holders to begin as early as Wednesday — 𝕏/fraxfinance

- Zeus is bringing Bitcoin to Solana — Substack/thiccy

- Hyperliquid will support native spot trading — 𝕏/hyperliquidx

- Manta TVL down 60% after opening withdrawals for StONE — Defillama

🛰️ TECH

- Developers can now launch Orbit chains on Arbitrum and Base using Celestia DA — 𝕏/CelestiaOrg

- Velodrome will be deploying on Build on Bitcoin (BOB), a Bitcoin L2 with EVM compatibility — 𝕏/build_on_bob

- $24M stSOL are trapped because of a bug — DLnews

- Facet introduces an ERC20 wrapper to trade coins on Ethereum using up to 99% less gas — 𝕏/0xFacet

- The Bitcoin Cash halving occurred on April, 3 — bitdegree.org

- Dymension introduces 2D upgrade, enabling permissioned RollApp deployment — forum.dymension.xyz

📱 WEB3

- Friend.tech hints airdrop, again — 𝕏/friendtech

- Notcoin plans to launch its token on April 20, alongside Bitcoin halving — Decrypt.co

- BNB Chain is allocating $1M to attract memecoin developers — Cointelegraph

- Minecraft-inspired crypto game Hytopia launching beta after $8M node sale — The Block

- Tensor’s Season 4 has started — 𝕏/TensorFdn

💰 VC

- Jump Capital co-leads $7.5 million seed round for web3 AI firm Raiinmaker — The Block

- Crypto angel investing platform Echo by Cobie closes first deal, raising $300,000 for Ethena - The Block

- Crypto investments reach 18-month high, with increasing early-stage deals — The Block

- Paradigm is in talks with investors to raise between $750M - $850M for a new fund — Bloomberg

- News-powered hedge fund raises $100mn to trade on reporters’ scoops — FT

🗓️ UPCOMING

- April 10th: US announces March CPI

- April 19th: Deadline for SEC and Coinbase to reach agreement on case arrangement

- April 20th: Expected BTC block reward halving

- April 30th: Binance’s former CEO CZ sentencing hearing

- End of month: expected launch of EigenLayer’s mainnet

- Aries on Aptos recently launched a points system, and offers a 18.27% APY on USDC or 12.42% APY on wETH. Looping the two, you can increase your APY to a staggering 68.60% and 27.06% APY.

- Cellana is a lesser-known Aptos DEX, paying you up to 50% APR on stablecoin LPs.

- Flexlend is an easy-to-use yield aggregator that moves your Solana assets hourly looking for the best yield among the bigger protocols. Notably, you can achieve up to 29% APY on stablecoins.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.