Airdrops: is it over?!

Welcome to Stay on-chain! Even though prices are going sideways (except for your meme bags), crypto never sleeps. Let’s unpack the past week together!

By the way, make sure to join our Telegram group: a cozy venue for crypto minds to debate and discover the new meta in advance 🫡

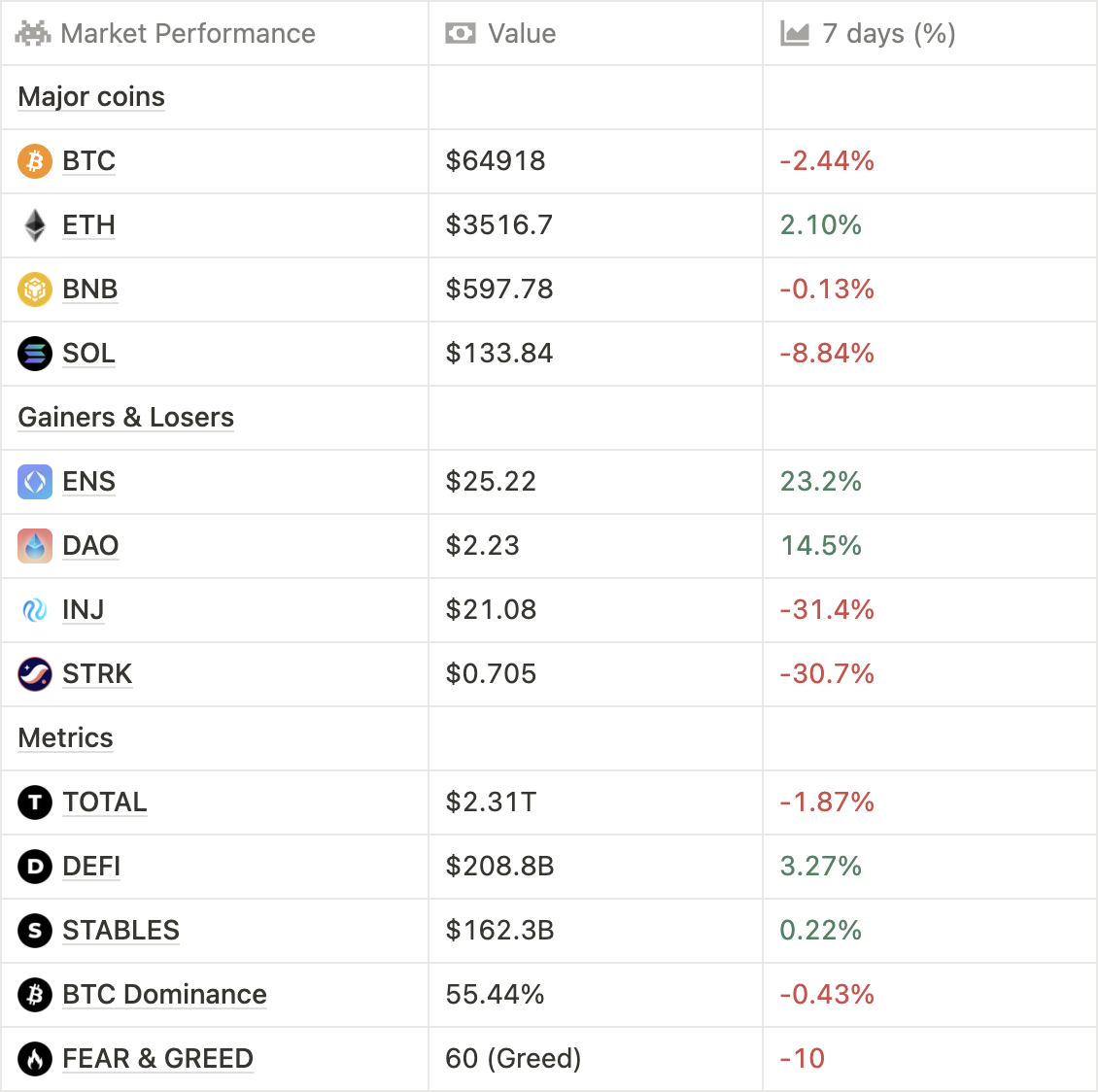

The markets have become quite risk-averse in the past few weeks, with BTC & ETH holding the fort signaling a true flight to safety behavior by investors. Curiously, SOL is cooling off a bit after the insane run it had the past year — it’s noteworthy to mention that during the past months, Solana had the spotlight, while Ethereum-native protocols were overshadowed: perhaps, as we near the ETFs to begin trading the trend could invert.

Meanwhile, VC-fueled altcoins keep bleeding together with memes. Bitcoin ETFs are, too, cooling off a bit with a streak of four consecutive days of outflows (~ $700M total).

Essentially, majors are going sideways while risk-on bets are getting hammered. Unless you positioned yourself during the past year, you’re probably at a loss if you invested heavily into altcoins instead of sticking to majors.

While this market feels extremely boring, we shouldn’t forget the months ahead. The Ethereum ETF is rumored to start trading in a couple of weeks, and U.S. elections are starting to heat up with the first Trump-Biden debate coming up next week.

Perhaps, this is just the calm before the storm.

LayerZero airdrop goes live

The long-awaited LayerZero airdrop went live today, let’s go over the important bits. The token, ZRO, is going to have a total supply of 1B tokens: 38.3% (plus an additional 4% pledged by the Foundation) is reserved for the community. 32.2% goes to investors, and 25.5% to the team (both have a 3yrs linear unlock).

At TGE, 8.5% of the supply is going towards retroactive activities (that’s you pushing transactions back and forth in the past months), while the rest is stored for future initiatives. That’s further split in a 5.5% share to reward protocol activity, and 3% for protocols built on top of it.

The claim is live here, with a peculiarity: for every ZRO token you claim, you must donate $0.10 in USDC/T or ETH to Protocol Guild, a collective funding mechanism for Ethereum Developers.

The token is currently trading at ~ $4.4, meeting pre-market expectations and featuring an FDV of $4.4B. Its direct competitor is Wormhole’s W, which launched at an astounding valuation of $14.5B and now settled around $3.6B.

If you’re planning to HODL your bag, delegating your votes might pay off with later (potential) airdrops.

On a more sour note, the backlash and anger these airdrops generate seem to outweigh the benefits they bring (mainly, distributing the supply in a “fair” manner”. Is it over for airdrops?

Breadcrumbs along the way: a Solana bot earned $30M through sandwich attacks in a mere two months — cryptonews.com

SEC closes investigation on Consensys and Ethereum 2.0

The decision marks a huge win for the industry, and essentially clears doubts on whether Ethereum is a security or not (it’s not, Gary). The SEC has been somewhat forced to close the case following the pre-approval of Ethereum spot ETFs a month ago, which implies ETH is a commodity.

Meanwhile, Consensys had received a Wells Notice from the SEC in April, and filed a countersuit themselves. The company has been heavily involved in Ethereum since its beginning, and is currently seeking a declaration that MetaMask staking & swap do not produce security transactions as well.

The richest U.S. inmate: it is estimated that former Binance CEO, CZ, owns 64% of BNB’s supply and is worth $61B — 𝕏/DefiIgnas

Tether launches aUSDT, a stablecoin backed by Tether Gold

The stablecoin giant is relentless — following its recent re-organization in multiple divisions (Data, Finance, Power, and Education), they just launched aUSDT: a dollar stablecoin over-collateralized by Tether Gold (XAUT), which is in turn backed by physical gold stored in Switzerland.

The mint & redeem process takes place on Ethereum through smart contracts, however terms and conditions will apply. Here, Tether is going for the ‘hard money’ route, backing its new digital asset with Gold, a proven store-of-value — which is quite different compared to traditional USDT, mostly backed by American Treasury Bills.

Speculations could lead to thinking that Tether is looking to ‘decentralize’ its collateral for stablecoins, reducing its reliance on U.S. Treasury Bills — however, they seem to have been improving their relationships with government entities lately.

What remains clear is that stablecoins are critical to propel crypto growth and adoption.

Slowly, then all at once: stablecoin issuers are the 18th biggest holders of U.S. treasuries — CoinDesk

Telegram, the gate to mass adoption?

Everyone keeps saying how Telegram is going to facilitate mass adoption. They have 900M users, alright, but how does that convert to start dabbling into crypto using the Ton blockchain?

The answer seems to be minigames. Notcoin had users tap for months, and then airdropped $NOT in May — after taking some rest at $500M FDV, the token tripled in price leaving sellers in disbelief.

The saga goes on, and other copy-pasta clicker games are ready to take up the baton. Hamster Kombat took the spotlight, registering 100M (!) daily active users just a few days ago. Other projects are Pixelverse, TapSwap, Blum, and MemeFi.

As silly as these games may seem, they have traction, and get people to set up wallets and trade coins. People seem more interested in learning about coins in an interactive and easy-going fashion, rather than in MEV-protected algorithmically-backed stablecoin swaps. Perhaps, it’s a step in the right direction.

Mass adoption? The number of mobile wallet users in crypto is now at an all time high of 28M — 𝕏/DarenMatsuoka

Happens on-chain

- Jupiter puts forward proposal to burn 30% of JUP supply — 𝕏/weremeow

- Who’s behind the alleged Trump-coin $DJT? — 𝕏/zachxbt

- CertiK security researchers allegedly hacked Kraken, and only at last agreed to return funds — 𝕏/tayvano_ ; 𝕏/c7five

- EtherFi introduces weETHs, restaking token for Symbiotic yielding 3x EtherFi points — 𝕏/ether_fi

- Mantle introduces cmETH liquid restaking token, along with COOK governance token — 𝕏/0xMantle ; Snapshot.org

- Ethena revamps tokenomics introducing $ENA restaking and locking mechanisms — mirror.xyz

- Velodrome confirms 7th expansion to Fraxtal — 𝕏/VelodromeFi

- DRIFT staking goes live — drift.trade

- Kinto mining program goes live — Medium

- inshAllah introduces Goldsand: Halal Ethereum Staking — 𝕏/inshAllah_l2

- Lens received 5.6M ZK tokens to build on ZkSync — DLnews

- UwU lend offers $5M bounty to “identify and locate” its exploiter — Etherscan

Traditional rails

- MicroStrategy has acquired an additional 11,931 BTC for ~ $786M — 𝕏/saylor

- Bloomberg analysts estimate Ether ETFs coming July, 2nd, if not earlier

- SEC’s head of Crypto Assets and Cyber Unit departs after nine years — The Block

- Hashdex files to list Bitcoin & Ethereum spot ETF in 70/30 ratio — 𝕏/NateGeraci

- Arkham labels address with 50,000 BTC (~$3B) on the move as “German Government” — arkhamintelligence.com

- VanEck’s Bitcoin spot ETF has been listed on the Australian stock market — Bloomberg

- Binance has been ordered to pay a $2.25M fine by India’s Financial Intelligence Unit — The Block

- Binance launches “HODLer” airdrops to reward BNB holders — Decrypt

- Coinbase starts offering pre-launch markets trading — The Block

- Worldcoin expands in Argentina, ramping up investments in the country — worldcoin.org

- FoxNews launches a L2 using Polygon CDK — 𝕏/sandeepnailwal

Tech go up

- Bitcoin “L2” Stacks experienced 9-hours outage — Decrypt

- Ronin announces Rollup-as-a-Service to deploy L2s using Polygon’s zkEVM stack — 𝕏/ronin_network

VCs go brrr

- Paradigm raised an $850M venture fund focused on early-stage projects — 𝕏/matthuang

- Lens protocol is seeking to raise $50M at $500 valuation — DLnews

- Liquid restaking protocol Renzo raised $17M Round led by Brevan Howard and Galaxy, highlighting their commitment to expand restaking to other ERC-20 tokens as well in the future - Coindesk

- Chain-abstraction company Particle Network raised $15M in Series A round — The Block

- Solana L2 Sonic raised $12M Series A led by Bitkraft Ventures — The Block

- Crypto-fueled LinkedIn rival Bondex raised $10M+ — The Block

Airdrops

- Claims for EigenLayer S1 Phase 2 stakedrop went live — eigenfoundation.org

- EtherFi S2 ends on June, 30 specifying linear distribution — 𝕏/ether_fi

Upcoming events

- June, 26: Blast airdrop

- June, 27: Biden-Trump debate

- June, 30: European MiCa regulations go into effect

- July, 15: ASI token merger launch (delayed, again)

- September, 18-19: Token2049 in Singapore

- September, 20-21: Solana Breakpoint in Singapore

- December, 5-6: Emergence conference in Prague

- Q1 2025: Ethereum’s Pectra upgrade

- Stargate released its V2, and APYs are JUICY! USDC single-sided on Aurora (Near’s EVM-compatible blockchain) is paying 18.72% APY.

- Aptos aficionado? Say no more. By LPing wUSDC/zUSDC on Cellana, you can earn a 28.64% APR paid in CELL tokens.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.