Bitcoin's DeFi is at risk

Welcome to Stay on-chain! Enjoy today’s edition, and make sure to join our Telegram group 👾

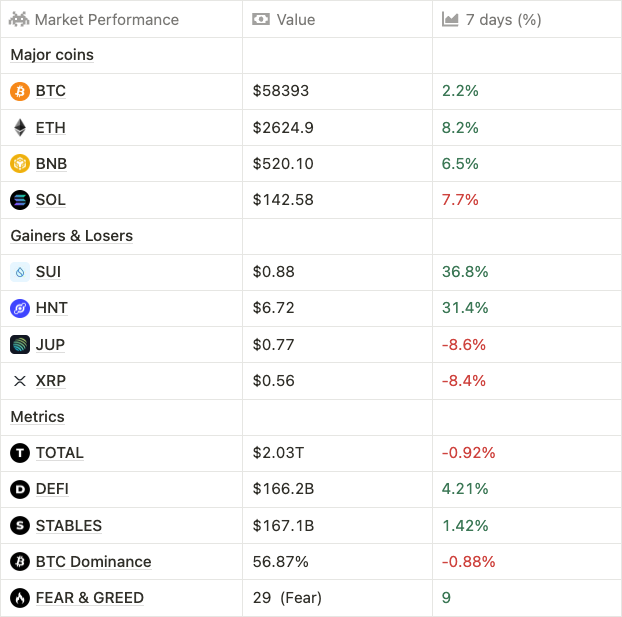

Markets have been pretty much uneventful in the past few days. There’s been a slight rebound, but we’re nonetheless still in a chop market ranging in the $55-75K interval.

Let’s focus on the BNB vs SOL fierce competition, with the two coins flipping each other every other week. SOL definitely had strong momentum for months, and the general consensus (which is often wrong!) says it’s time for some rest — in fact, SOLETH is down 18% from the highs, and SOLBTC is down 12%.

On the other hand, ETH’s breathing a bit again. Grayscale’s trust ETHE recorded its first 0 outflows day, and we’re seeing consistent inflows in the past days, although it’s ‘just’ tens of millions. ETHBTC is up 12% from the bottom, and everyone’s hoping for Ethereum to finally have its time. Should it follow the same pattern BTC followed after its ETF went live, we’re going to Valhalla.

What’s up with SUI? The recent pump, increasing its price by 140% from the lows, was fueled with leverage and aggressive shilling on 𝕏. Many speculated that this was orchestrated by paid shilling to sustain the heavy ongoing unlocks, however nothing is confirmed.

Although the fear & greed index shows fear in the market, there’s hope. Stablecoins are on the rise again, with about $2B minted in the past few days that could very well flow into risk assets. Let’s not forget about all the catalysts we have in Q4, such as elections, rate cuts, and FTX starting to pay back creditors with cash — fasten your seatbelt, and join the ride.

WBTC is posing a system risk to DeFi

WBTC is a wrapped version of BTC, securing $10B in collateral and powering most of Bitcoin’s DeFi outside the Bitcoin blockchain.

The issue here is simple: you cannot bridge native BTC to chains like Ethereum, Solana etc. So you lock it as collateral, and issue wrapped versions on-chain that represent it. Given there’s no smart contracts on Bitcoin, this passage is extremely centralized and for WBTC it’s performed by BitGo.

So far, so good. Launched in 2019, there haven’t been notable issues with it. However, the custodians (BitGo) recently announced a change in leadership that is going to include Justin Sun’s in a strategic role and a company he’s affiliated with — BiT Global. The changes are taking effect in 60 days, so early October.

Sun’s past is far from perfect. There are many rumors surrounding him, and his lack of transparency with collateral when issuing wrapped products such as WBTC on Tron ($3B unaccounted for), stUSDT, and USDD. The collateral of these products is, in turn, used in the Proof Of Reserves of the exchange HTX (formerly Huobi).

Well, pitchforks went out. MakerDAO is currently considering removing WBTC as backing for its stablecoin DAI, and removing it from SparkLend. The Aave DAO instead is having a more balanced take, without jumping the gun and doing due diligence first.

Besides existing alternatives, Coinabse’s cbBTC and Frax’s frxBTC are soon going to be deployed putting at risk WBTC’s hegemony.

Here you can find detailed research by Stay on-chain with insights on the change in leadership, how WBTC works, and its alternatives.

The Hyperliquid bridge now accounts for 36% of the USDC supply on Arbitrum — 𝕏/parsec_finance

Trump organization dives into Digital Real Estate

As Polymarket odds for Trump winning this election keep decreasing, Donald Trump Jr. — oldest son of the former president, and president of the Trump Organization — is making some noise regarding his newly found love for cryptocurrencies. While the details are yet to be known, he released an exclusive interview to the NYPost leaking that they’re about to launch ‘Digital Real Estate’ in an effort to provide financial services to the unbanked. Possibly, it could involve un-collateralized lending with fewer intermediaries and done on-chain.

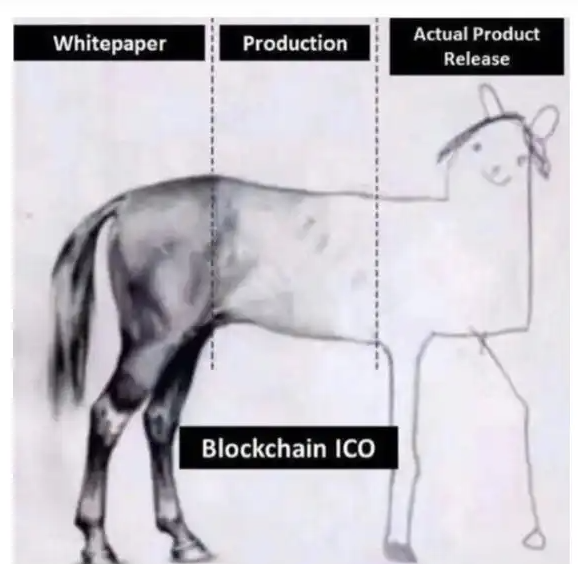

On paper, it definitely sounds interesting, however many tried to solve this issue to no avail. To date, all the biggest lending protocols built on blockchains are in fact collateralized (i.e. you post more collateral than what you’re borrowing).

Furthermore, Donald Trump Jr. denied any association with the memecoin $RTR.

DePin was present at the Olympics thanks to WeatherXM and its weather tracking devices — Blockworks

Lemongrass: Celestia’s first upgrade as unlocks near

Coming on Testnet in August, the mainnet upgrade is expected in mid-September. Let’s dive into the CIPs (Celestia Improvement Proposal) included in the upgrade.

- CIP-6: Brings a mechanism to enforce minimum gas price to transact, minimizing spam.

- CIP-9: Enables multi-hop bridging, making it possible to bridge TIA between chains different from Celestia in one sign instead of having to bring it back to Celestia first.

- CIP-10: Introduces a new signaling mechanism for upgrading the network.

- CIP-14: Enables interchain management, making it possible to control Celestia accounts by accounts on other IBC-enabled (Cosmos) chains.

- CIP-20: Disable the Blobstream module, in favor of lighter Zero-knowledge clients

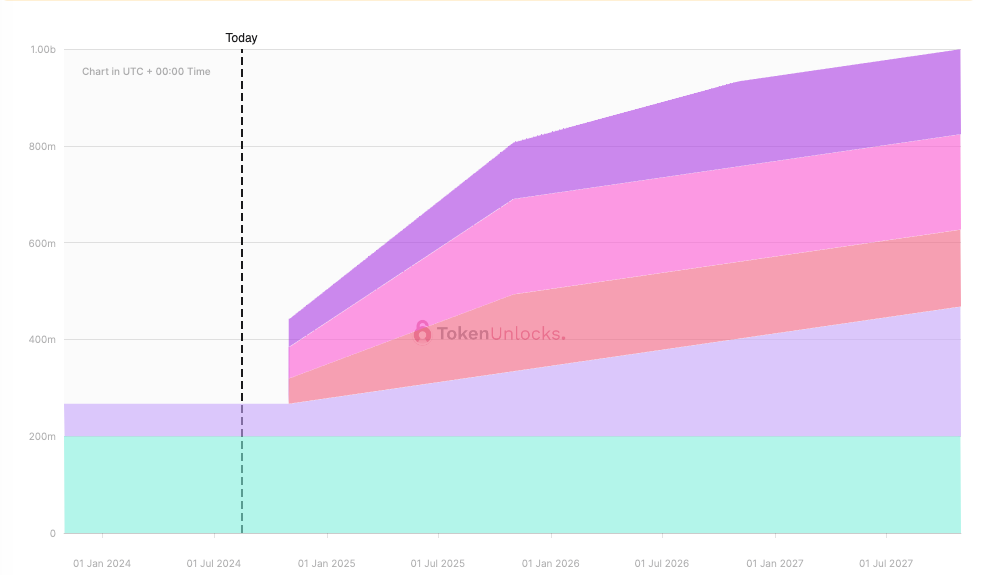

However, it’s important to note that besides this technical upgrade, Celestia is set to experience significant token unlocks in October. In fact, its supply will increase by 86% ($1.09B) and then start vesting $6.18M daily.

This is not a small feat — Celestia is seemingly good tech that has gained significant adoption in the space. It features an FDV of $6B, four times that of competitor AVAIL. Furthermore, EigenLayer’s token EIGEN is set to launch in Q4, which will be an important benchmark given they’re competitors as well with their EigenDA solution.

The Norwegian sovereign fund indirectly holds 2446 BTC — 𝕏/VetleLunde

Happens on-chain

- $600M seized BTC linked with Silk Road have been moved to Coinbase Prime — Arkham

- EigenLayer competitor Symbiotic launches Devnet, plans mainnet in Q3 — 𝕏/TheBlock__

- $CRV emissions reduced from 20.17% to 6.34% (375k CRV per day) on its fourth anniversary — 𝕏/CurveFinance

- OKX is terminating accounts linked with Tornado Cash — cryptosavingexpert.com

- Lido to bring stETH on BNB Chain — Cryptonomist

- Andre Cronje becomes CTO of Sonic Labs (formerly Fantom Labs) — 𝕏/0xSonicLabs

- Creating a Pump.fun coin is now free — 𝕏/pumpdotfun

- The Canto blockchain hasn’t produced blocks in two days due to consensus issues — cantoscan.com

- Coinbase adds ZETA and ACX to its listing roadmap — Coinspeaker

Traditional rails

- Celsius files lawsuit against Tether, demands restitution of $2.4B worth of BTC; but also files minor lawsuits against Compound and BadgerDAO — tether.io

- Marathon Digital to offer $250M in Convertible Notes to buy more BTC — The Block

- The State of Wisconsin Investment Board acquired $40M more BTC — The Block

- Pump.fun exploiter pleads guilty in London court, faces 7 years in prison — Decrypt

- Grayscale Ether ETF recorded its first zero outflows day — farside.co.uk

- SEC files fraud charges against promoters of NovaTech, alleged $650M crypto pyramid scheme — CoinDesk

- Metamask launches Metamask Card — consensys.io

- Tether set to double its workforce by mid-2025 — The Block

- Do Kwon’s extradition to South Korea has been delayed — The Block

- The Venezuelan government has blocked access to Binance, 𝕏, and other online services amid unrest over July’s presidential elections — Cointelegraph

- SEC postpones decision on Hashdex’s proposed ETF to hold BTC & ETH — The Block

- Solana Mobile teases Solana CEO announcement at Token 2049 this September — 𝕏/solanamobile

- Marathon Digital is going to stamp every BTC it mines with “Made in USA” — bitcoinmagazine.com

- Polymarket partners with Perplexity to show news summaries - TechCrunch

Tech go up

- EigenLayer adds Permissionless Token Support, allowing any asset to be restaked — 𝕏/eigenlayer

- Swell introduces swBTC, restaked version of wBTC — CoinDesk

- Renzo to launch ezSOL as Jito develops Solana restaking platform — CoinDesk

- Tap to pay USDC on iPhones is coming soon — 𝕏/jerallaire

- Cronos zkEVM using zkSync Elastic chain launches mainnet — 𝕏/Cronos_chain

- Blackrock might be launching its own Ethereum L2 — 𝕏/LukeYoungblood

- Robinhood might be cooking an L2 and a stablecoin — 𝕏/deelabsxyz

- Celo to deploy its Layer 2 testnet Alfajores in September — celo.org

- dYdX introduces Unlimited upgrade, featuring additional permissionless features and affiliate programs — 𝕏/dYdX

VCs go brrr

- USC professor lands $43M in funding for Crypto-AI Startup Sahara — Bloomberg

- TON Foundation alumni raised $40M to create TON Ventures — The Block

- Payments platform Sling Money raised $15M Series A — crypto-fundraising.info

Airdrops

- Hyperlane introduces its token HYPE — 𝕏/hyperlane_fdn

- $DBR deBridge airdrop checker is live — debridge.foundation

- Popular Telegram game Hamster Kombat has turned down every VC offer, and reserved 60% of its token supply for players — Cointelegraph

Upcoming events

- September, 4: MATIC plans to migrate to POL

- September, 10: Harris and Trump debate leading to presidential elections

- September, 18-19: Token2049 in Singapore

- September, 20-21: Solana Breakpoint in Singapore

- September, 29: Chengpeng Zhao released from prison

- December, 5-6: Emergence conference in Prague

- Security first. Aave offers an 11% APY for supplying their stablecoin GHO on Arbitrum, or 27.9% APR if you stake it on Ethereum (in this case, you risk slashing, hence the higher yield).

- PYUSD, backed by PayPal, is incentivizing lending pools on Kamino and Drift. There you can earn respectively 16.64% and 22.5% APY.

- The USDY chakra pool on Mantra is currently paying out an astounding 1328.34% APR. On top of that, you’ll get 5.35% in USDY yield. Note that here your deposit is locked until Mantra launches its mainnet, and rewards are bound to be diluted over time as more people join the pool.

- Looping USDC, wstETH, weETH, ETH, and cbETH you can achieve up to 144.79% APY on Radiant Capital on Base. However, make sure to understand their locking and vesting mechanics first.

- Aptos aficionado? Cellana pays a 20.88% APR on wUSDC/zUSDC LPs.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.