Circle's USDC to rule Europe under MiCA

Welcome to Stay on-chain!

Enjoy reading our weekly roundup? Send this newsletter to your friends, it’ll be greatly appreciated and motivate us to improve the content we offer you every Thursday.

By the way, make sure to join our Telegram group 👾

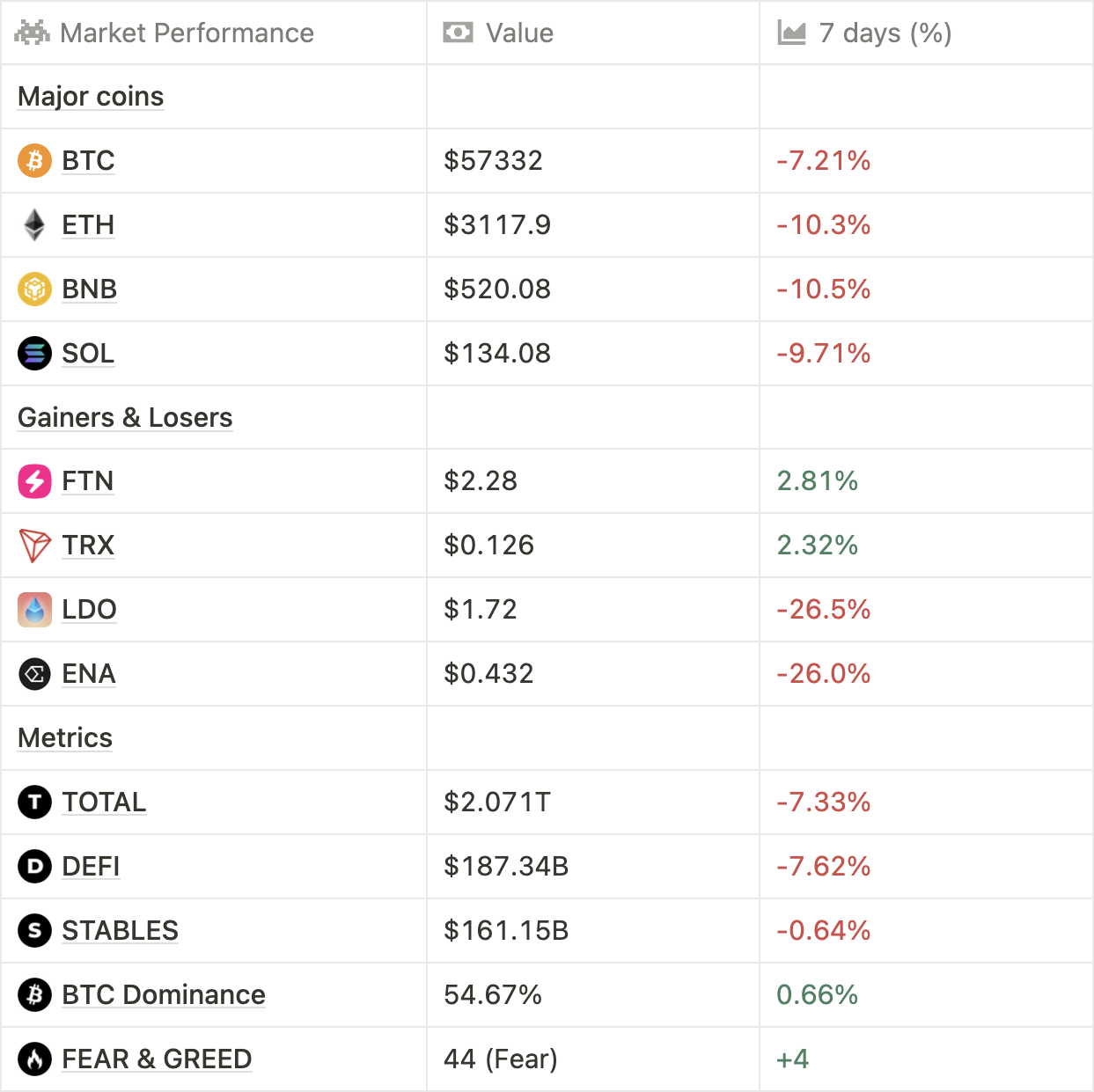

The situation, unfortunately, hasn’t changed much from the past week. Altcoins and meme coins are getting absolutely crushed across the board, with investors fleeing to BTC and ETH as a relatively safe haven.

On a short-term horizon, the outlook is — bluntly said — bleak. The German government keeps moving bitcoins around (they still hold $2.5B!), Mt.Gox is set to distribute $8B BTC to customers starting this month (they’ve been making test transactions), and the Ether ETFs have been delayed to mid-July.

All in all, no bueno. There’s plenty of overhang supply that can potentially be sold, which isn’t a problem per se — but who’s bidding on the other side?

Whilst Ether ETFs are overall a big achievement for the industry, they still lack staking: presumably, people familiar with crypto will rather keep using liquid staking tokens rather than buy this instrument. This is to say that while long-term it’s something bullish for Ethereum, the performance in this uncertain environment might be disappointing at first.

But hey, let’s zoom out. FTX, the former #2 biggest crypto exchange, is set to distribute $16B in cash to its creditors later this year, or in Q1 ‘25. This could propel huge buying pressure, aligning with the U.S. presidential elections (historically good for markets overall — especially if Trump ends up winning) and the beginning of much-awaited FED rate cuts.

To wrap it up, we must do the hardest thing: sit on our hands, don’t get blown out for excessive leverage, and wait.

USDC and EURC become MiCA-compliant

MiCA regulations finally went into effect for the European economic area, and its first-order effects didn’t take much to manifest themselves.

While USDT is failing to comply with MiCA for a variety of reasons (mostly, banking reserves requirements) and is slowly being marginalized on exchanges, Circle with its USDC and EURC products grabbed the opportunity to make a name for itself in Europe — In fact, they’ve become the first global stablecoin to become an accredited e-money institution and thus comply with MiCA.

This means that USDC and EURC are now considered ‘electronic money’, making them almost equivalent to FIAT money. This comes at a cost, though, as banking requirements for e-money are strict and require issuers to keep reserves in European banks instead of earning a juicy 5% in Treasury Bills.

So, it’s a kind of a trade-off for Circle: they have 30% the supply of USDT, and most futures contracts are settled in USDT as of now. Yet, this development allows them to gain an edge on the European market becoming the go-to stablecoin for businesses and consumers.

Talk about mass adoption: Binance has 200M registered users. At 8B population, 1 person in every 40 uses Binance.

SEC sues Consensys over MetaMask swaps and staking services

The Security and Exchange Commission of the United States strikes again. As Consensys sued the agency last month over its approach to regulating Ethereum, the S.E.C. pushed back by suing the company and alleging that their leading product MetaMask is essentially a broker (because of its swap interface — where they take a cut), and also facilitates the sale of unregistered securities through its liquid staking interface.

Factually, this is not the case, as Consensys doesn’t hold at any time custody of the funds, but the case could still end up being tricky as the company withholds a fee for offering the user interface.

Some Insights from the Digital Asset Conference by Goldman Sachs — 𝕏/tomwanhh

Polkadot’s aggressive spending leaves the treasury two years runway

The project, considered to be one of the most promising during the last bull run, has been struggling for the past few years — in fact, they’ve been sitting on a huge pile of money given by investors, but no product-market-fit and down-only price performance.

Their treasury is worth about $250M to date, with $86M spent in the first six months of 2024 alone. Running the numbers, the biggest spending categories are development (26.7%) and marketing (42.4%).

The case sparked controversy in the space, not so much because of the amount itself, but because of the program's ineffectiveness and the huge amount of key opinion leaders (KOLs) found guilty of receiving money to advertise the project while not disclosing it.

Most notably, Polkadot spent $6.8M to get on Messi’s soccer club (Inter Miami), $7.9M on various kinds of events, and $500K to get an animated logo on CoinMarketCap and CoinGecko price feeds.

Meanwhile, the token is down 32% since the beginning of the year, while BTC’s up 30%.

Arkham estimates that Ethereum’s co-founder Vitalik Buterin holds ~ $800M ETH — 𝕏/ArkhamIntel

Wen Ether ETFs?!

According to Nate Geraci and Bloomberg analysts, the ETFs are expected to begin trading in mid-July, two weeks from now. The final S-1 forms are expected to be submitted by July, 12th. This implies a delay from the initial forecasts that saw them launching right before or after the U.S. Independence Day — July, 4th.

Happens on-chain

- The bittensor chain goes into ‘Safe mode’ as some validators have been hacked — The Block

- Aptos Foundation puts forward a proposal to deploy Aave v3 on the Move-based chain — aave.com

- Aave deploys its GHO stablecoin on Arbitrum — The Block

- Pendle’s total value locked plummets 50% as restaking airdrops fade — Defillama

- EigenLayer competitor Symbiotic opens up deposits, sUSDe being filled within minutes — symbiotic.fi

- Rabby starts charging 0.25% swap fee with no prior announcement — 𝕏/intocryptoast

- JLP can now be used as collateral on Solana perps protocol Dirft.trade

- Celo is transitioning to a L2 using EigenDA, receives grant from foundation — celo.org

- Curve Finance adopts crvUSD for fee distribution — Cointelegraph

Traditional rails

- Tron founder Justin Sun offers to negotiate with the German government to purchase all of their BTC OTC in order to ‘minimize impact on the market’ — 𝕏/justinsuntron

- Pudgy Penguins parent company Igloo announces efforts to build consumer-oriented blockchain AbstractChain — 𝕏/pudgypenguins

- Coinbase partnered with Stripe to better serve Base — 𝕏/Coinbase

- Kraken founder Jesse Powell donates $1M (mostly ETH) to Donal Trump — The Block

- SEC sued Silvergate, bank settled to pay a $50M fine — sec.gov

- Tether partners with Uquid, allowing Filipinos to pay for social security using USDT on the TON blockchain — 𝕏/Tether_to

- Consensys acquired popular extension Wallet Guard — The Block

- 21Shares files for spot Solana ETF as well — The Block

- UAE Real Estate Giant partners with MANTRA to tokenize $500M in Real Estate assets - medium.com

- Bolivia lifts ban on Bitcoin and Cryptocurrencies — CoinDesk

- Sony is set to launch its own exchange in Japan — The Block

- Robinhood is considering offering crypto futures to US and Europe — Bloomberg

Tech go up

- ZkSync to deploy over a dozen Zk chains using its interoperability layer — 𝕏/zksync

- Dan Romero introduces ‘Pay on Warpcast’ enabling USDC payments in under 10 seconds — 𝕏/dwr

- Ethereum developers introduced EIP-7732 to overhaul the block validation process and speed up the blockchain — Cointelegraph

- Aptos Connect introduces 1-click wallet creation — 𝕏/AptosLabs

VCs go brrr

- Peter Thiel’s Founders Fund co-leads $85M Seed Round for open-source AI platform Sentient, set to use Polygon — The Block

- Ethereum L2 MegaETH raised $20M, backed by Vitalik — The Block

- Polychain Capital leads $16M Seed Round for BTC restaking protocol Lombard — The Block

Airdrops

- EtherFi’s S2 checker coming on July, 5th, claim on the 9th

- Scroll adds three new assets to its points program: wBTC, solvBTC, weETH — 𝕏/Scroll_ZKP

- Milkyway introduces multipliers — 𝕏/milky_way_zone

- Mantle’s S1 of Metamorphosis to farm $COOK is live — 𝕏/0xMantle

- Starknet unveils DeFi Spring 2.0, adding another 50M STRK incentives, bringing the total budget to 90M tokens — 𝕏/StarknetFndn

- Blast allocates 10B BLAST tokens for Phase 2 rewards — The Block

- Gnosis Pay is giving out their card for free until July 19th — gnosispay.com

Upcoming events

- July, 8-11: EthCC in Brussels

- July, 11-13: Modular Summit 3.0 in Brussels

- July, 9: ETHFI S2 claim

- July, 15: STRK unlocks 4.92% of its circulating supply

- July, 25: ALT unlocks 42.08% of its circulating supply

- July, 25: Trump is rumored to be speaking at Nashville’s Bitcoin convention — Axios

- August, 3: W unlocks 33.3% of its circulating supply

- September, 18-19: Token2049 in Singapore

- September, 20-21: Solana Breakpoint in Singapore

- December, 5-6: Emergence conference in Prague

- Flat & hungry for yield? Combining Silo’s borrowing feature with liquidity providing on Velodrome lets you earn a ~ 52% APR on USDC with little to no impermanent loss — 𝕏/SiloIntern

- Infinex, backed by Synthetix’s founder Kain Warwick, is set to bring a CEX-alike user experience to DeFi by creating a hub where decentralized applications seamlessly interact with each other. Right now, you can participate in their ‘Craterun’ campaign — infinex.xyz

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.