Cobie got acquired

Welcome back to our weekly chat!

First, a quick update on Stay on-chain: as the first step in bringing SOC to the next level, I’ve launched a proper website built on Ghost. To bring to life some of the ideas I have in mind, I needed a proper home base. Nothing changes for you as a subscriber. Your account is already set up, and you can log in directly. A few pieces are still missing, but I'm shaping it up. I’ll share updates every week as it evolves. Check it out at stayonchain.co.

Coinbase acquires Echo for $400m

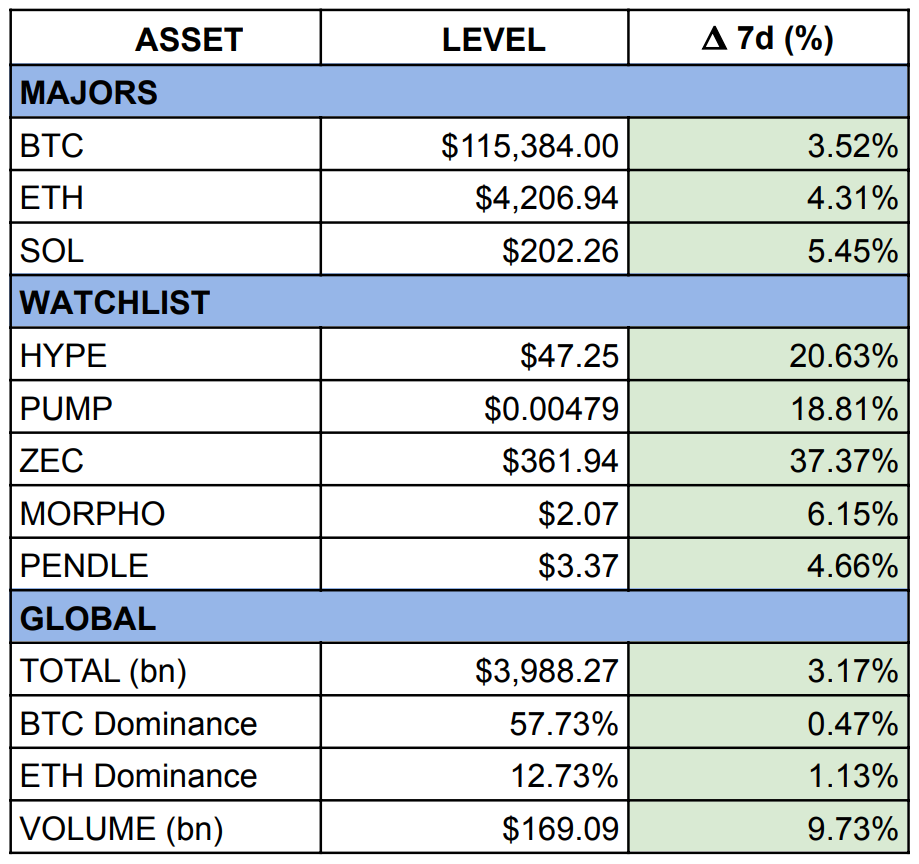

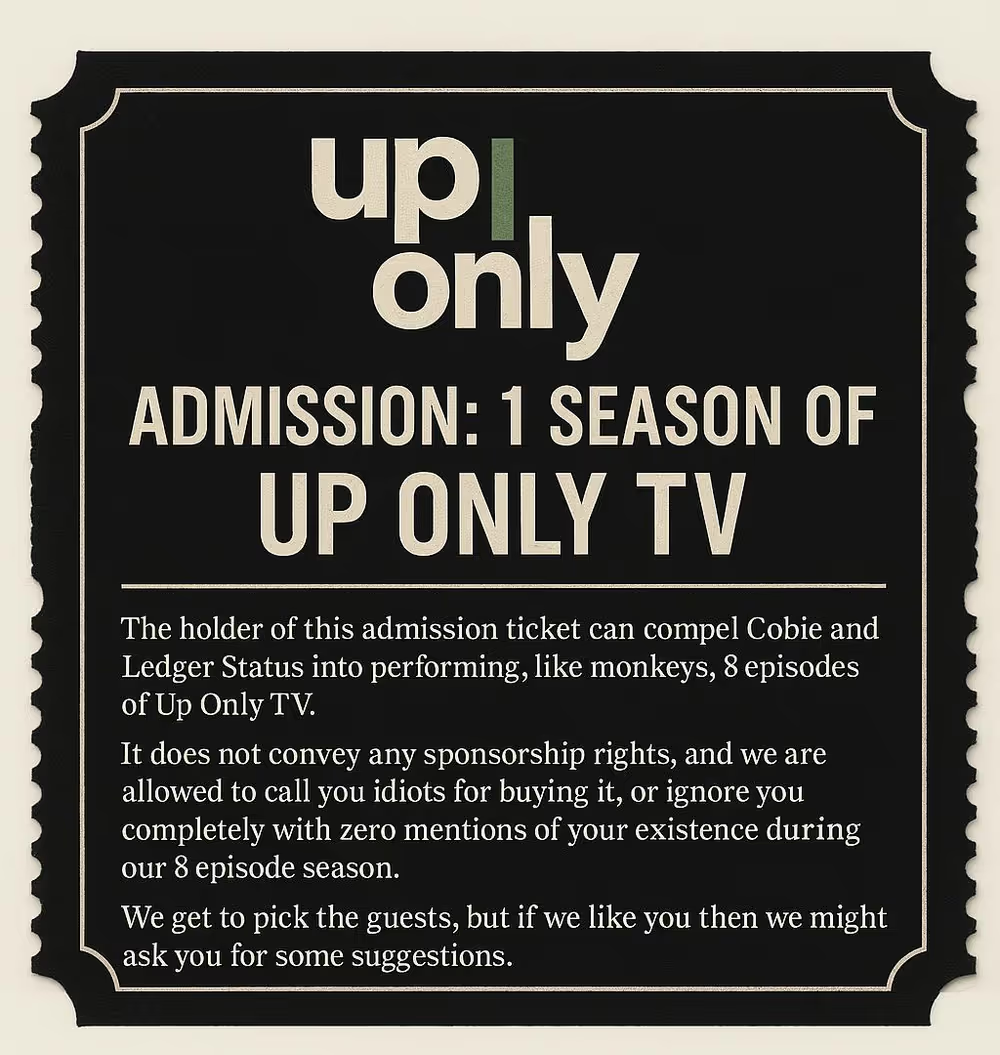

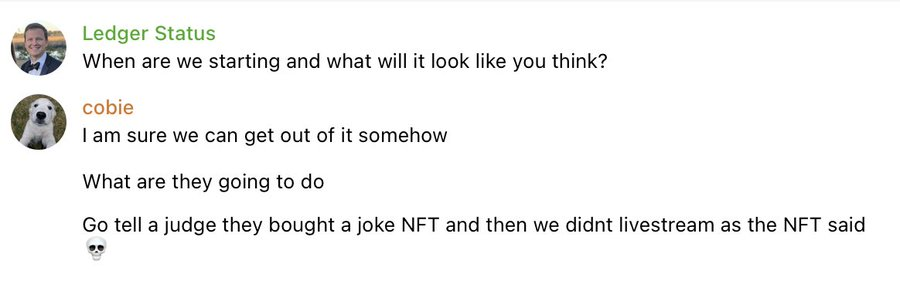

It started with one of the funniest moves I’ve seen lately. Coinbase.eth bought an NFT on OpenSea representing a season of the Up Only podcast ... for $25m. That’s over $3m per episode. If those are one-hour episodes, that’s much more than Hollywood top actor rates (lol).

How it’s going:

Turns out, it's probably just a meme. The next day, Coinbase officially acquired Echo, Cobie’s angel investing platform, for $375m. For those who don't know, Echo is a crypto-native investment platform that lets individuals invest in early-stage projects alongside VCs and founders. The move makes sense for Coinbase, especially given their push into on-chain infrastructure and social investing.

Still, I kind of wish Echo had stayed independent. Cobie’s vibe fits it perfectly. But either way, Cobie is now a Coinbase employee.

MegaETH ICO

Let’s talk about what’s easily the most interesting launch of the week: MegaETH’s public sale. We’ll cover MegaETH’s tech and design in a deep dive soon. For now, here’s how the ICO works and why it matters.

MegaETH is doing something between a fair launch and a directed public sale. The sale runs on Sonar (by Echo) with a starting FDV of $1m and a ceiling at $999m. Users can set their own max price per token between $0.0001 and $0.0999, and bid between $2,650 and $186,282 USDT. There’s also an optional 1-year lock-up for a 10% discount (mandatory for U.S. persons). If the sale is oversubscribed, allocation will favour broad distribution and reward key contributors (like ETH ecosystem active users and MegaETH community).

Total supply: 10B $MEGA, public sale: 5%, currently 7.2x oversubscribed.

Monad is finally launching

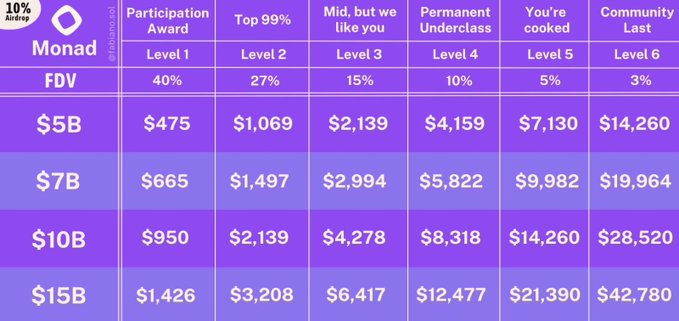

The Monad mainnet, finally. This has been one of the most hyped projects last year, and many have been farming it since then. I’d expect a high valuation, probably around $5–10B. Whether that’s justified depends on the post-launch traction, but everybody knows that competition among L1s is crazy high, and launching around the same time as MegaETH definitely takes some of the attention away.

The airdrop is tiered by “strength levels”:

And if it ends up being around 10% of supply, rough napkin math from CT looks like this:

Not bad. Though I'm afraid it's going to be a straight dump for many.

DeFi

- Aave proposes a $50m buyback program [link] → bullish long-term, hopefully it becomes more over time.

- Infinex plans to TGE [link] → buyers of the Patron NFT with a 3-year lock got in at 125m valuation. Liquid buyers at 500m. The NFTs were below floor for a while, now up to 1.55 ETH. For reference, DeFi App's $HOME (direct competitor) trades at $230m FDV. Let's see.

- Limitless dumped its own token at launch [link] → team wallets dumped at TGE, killing price discovery despite high demand, and the same wallets are now buying back lower. Founder calls it “on-chain market making”. Sure. Still bullish on the project, but not a good look at all.

TradFi

- China and US reach trade consensus [link] → if they end this tariff drama, it’s up-only season.

- JPMorgan to allow BTC and ETH as collateral [link] → ETFs only likely, but bullish nevertheless.

- U.S. CPI: +3% YEAR-OVER-YEAR (EST. +3.1%) [link] → cuts incoming this week.

VC

- FalconX acquired 21 Shares [link] → biggest crypto prime broker gets one of the leaders in crypto asset management.

- Pump.fun acquired Padre [link] → acquiring a trading terminal, the missing piece of infra for memecoins.

- Aave acquired Stable Finance [link] → Aave going into the savings app business. Total no-brainer and they can outcompete most with ease.

From Great Minds

- Life lessons from trading by Thiccy [link] → on trading edge, philosophy, and balance.

- Buy your freedom first [link] → good life/career advice.

We talked last week about points farming on perp DEXs. It’s still going strong everywhere, but after testing many, I have to say none match Hyperliquid’s level (though maybe I’m biased). That said, the pie is big. Hyperliquid, Aster, Lighter have their chunk, but there's likely space for 1/2 more. The trade is getting very crowded, obvious, and low-edge, but if you can move your trading volume somewhere and earn along the way, it can still be +EV.

Right now, the best mix of UX and opportunity is Extended: smooth UI, wide token coverage, very Hyperliquid-like feel. For stock trading instead, Vest Markets is another good pick.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, forward this email to a friend. Means a lot!

Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA