Dencun upgrade lowers L2 fees tenfold

Welcome to Stay on-chain! This week the memecoin frenzy kept going, while we saw major technological upgrades such as the Ethereum Dencun go live. Besides, Ethena’s sUSDe is raising rates across the board, but no worries, our yield farming section got you covered with hand-picked strategies. Now sit back, relax, and enjoy today’s edition.

By the way, make sure to join us on Telegram 👾

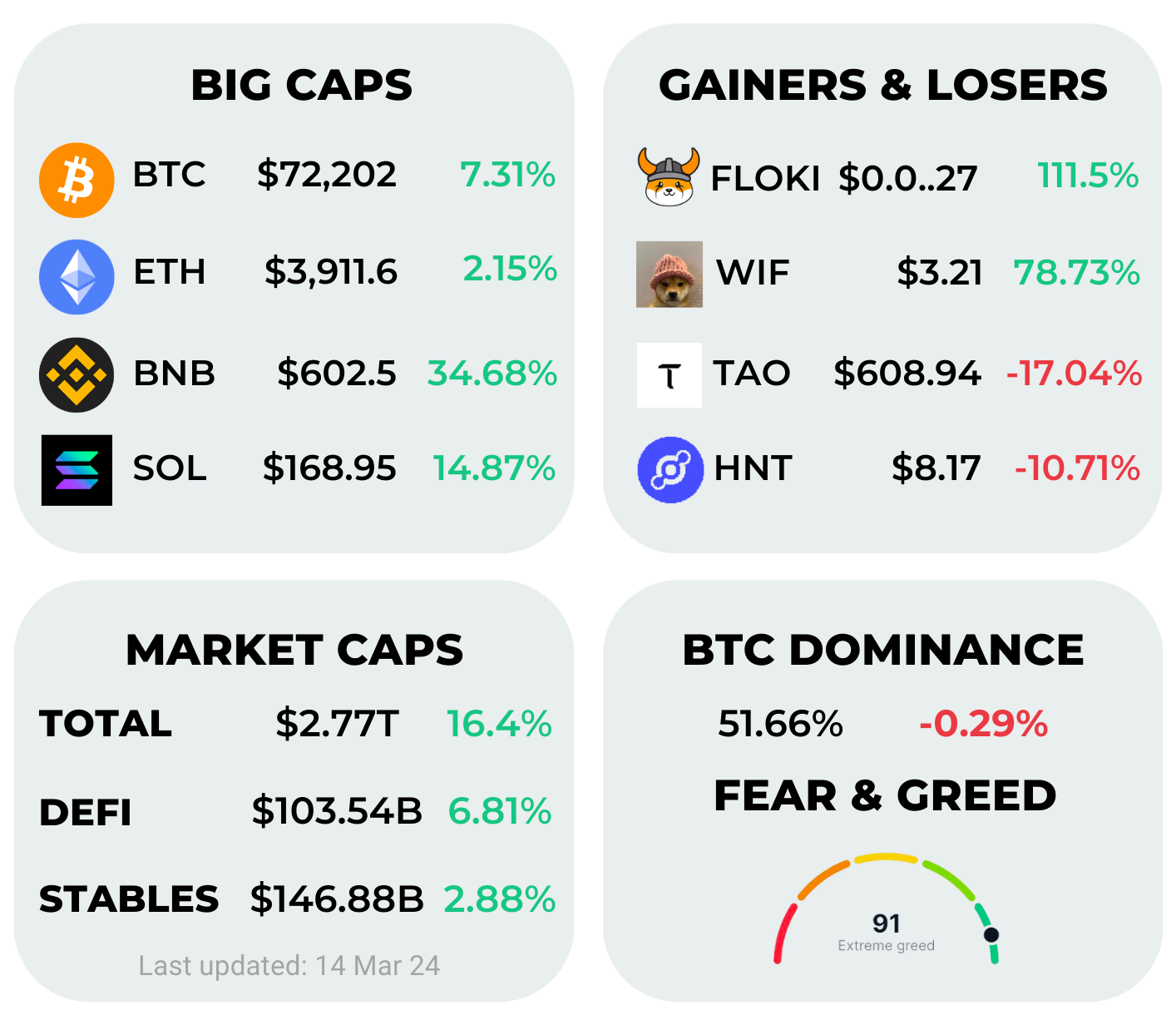

The bull market is officially here, with lots of green numbers. This week, Bitcoin hit a record high of $74,000, and Ethereum also did well, surpassing $4,000. However, Ethereum has struggled since yesterday's Dencun upgrade. Is this a "sell the news" case?

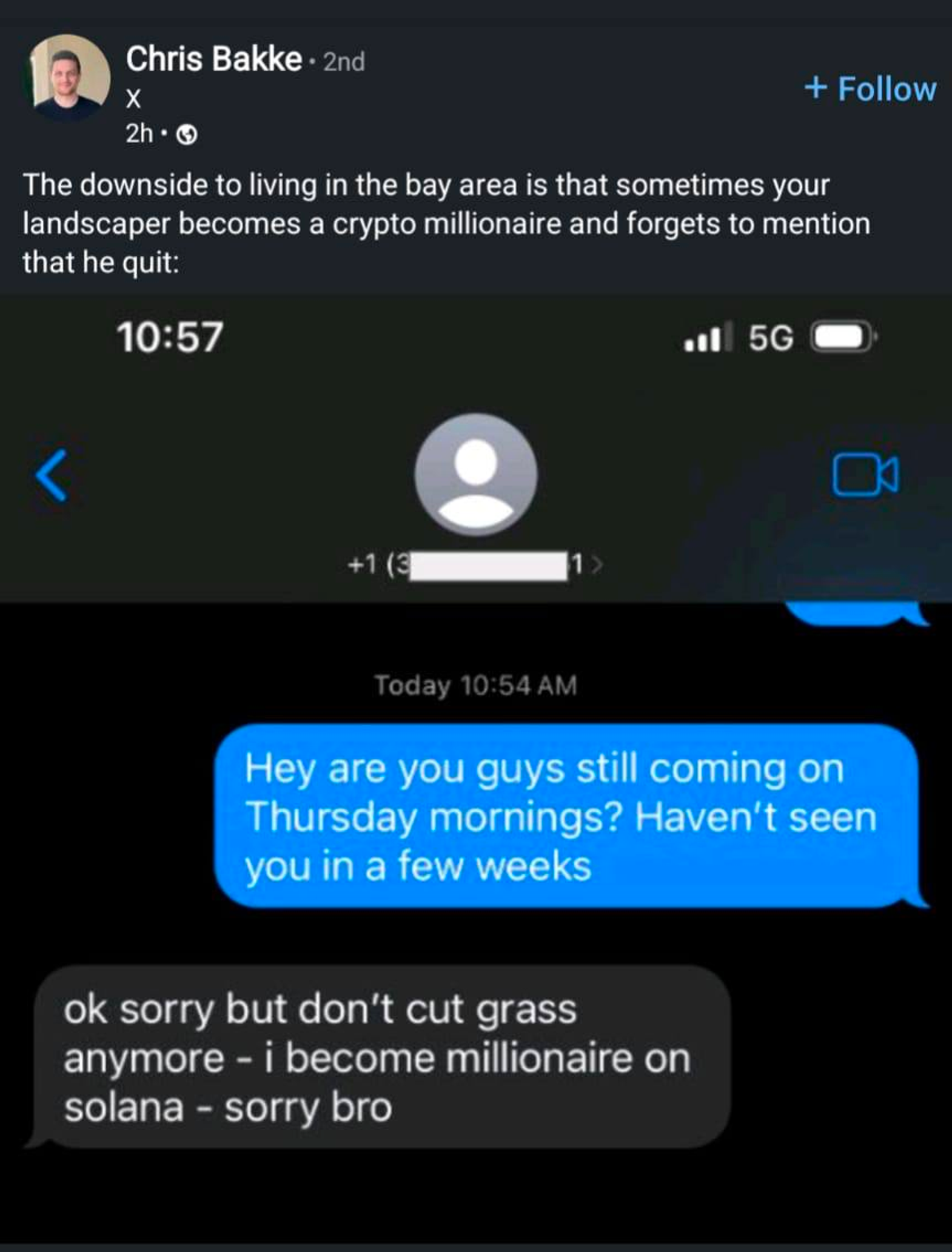

Meanwhile, BNB unexpectedly surged by 34% and Solana is also gaining momentum. Despite all this, meme coins like FLOKI and WIF are the stars, bringing in triple-digit performances. On the other hand, TAO, an AI-related coin, is losing ground after its recent surge. The total market cap spiked to $2.77 trillion and the DeFi TVL reached over $100 billion.

Stay safe, there's greed in the markets!🫡

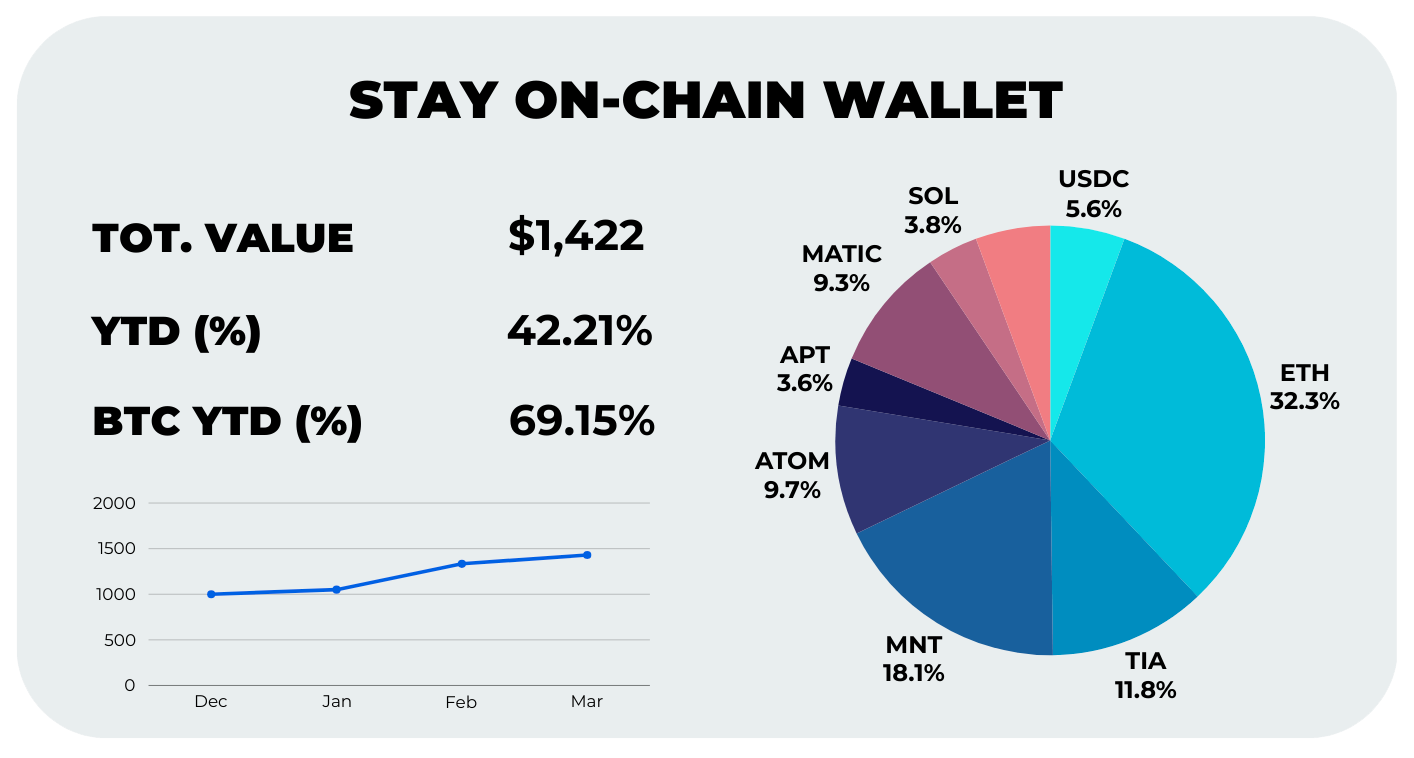

Our on-chain wallet hasn't seen much change since last week. We're mostly invested in altcoins, so our value stayed the same while Bitcoin saw significant gains. Our small Solana investment did well, but it's a tiny part of our portfolio. We're sticking to our strategies, aiming to beat Bitcoin's performance in this bull market. For more details, check our Google sheet here.

Check out Rabby Wallet — the best EVM wallet we use for everything on-chain. Use our referral code to give Stay on-chain a boost. Thanks for the support!

Promising future for Ethereum scaling solutions

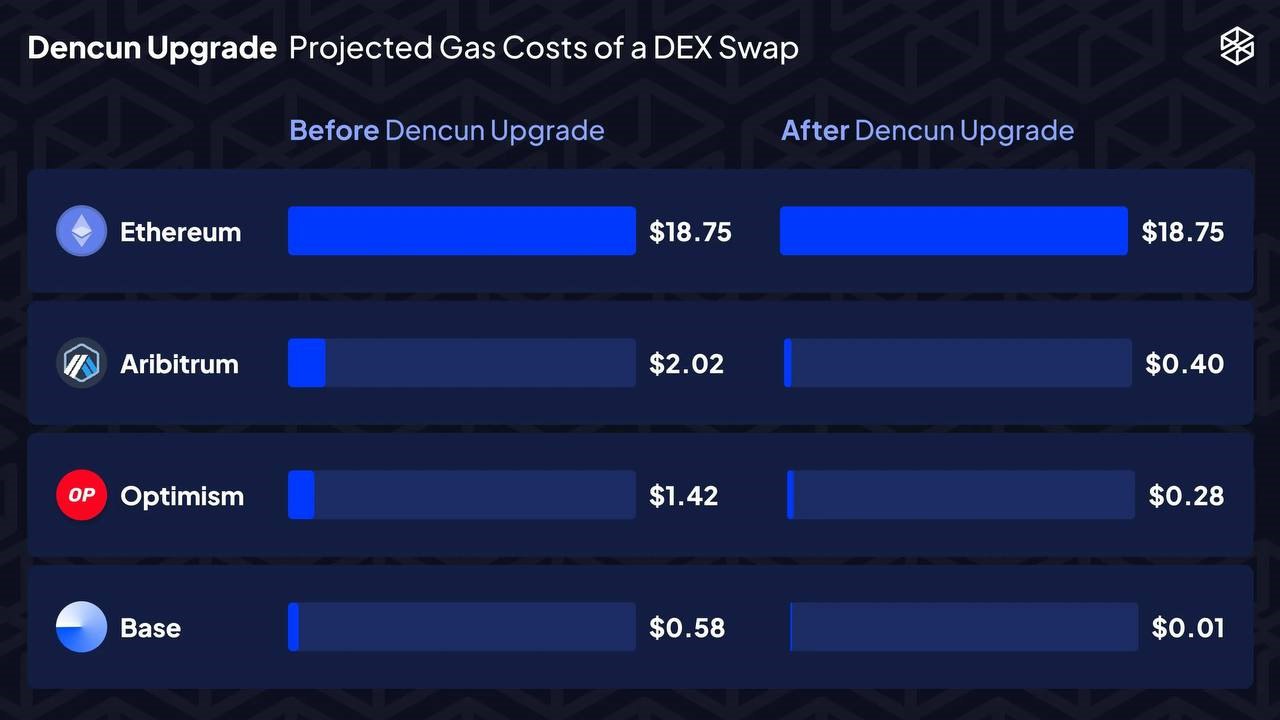

Yesterday, the Ethereum network was updated with the Dencun upgrade. Dencun is designed to significantly lower Ethereum roll-up fees by introducing blob transactions, known as EIP-4844, or protodanksharding. Let's check some stats on how it’s going to affect the Ethereum ecosystem:

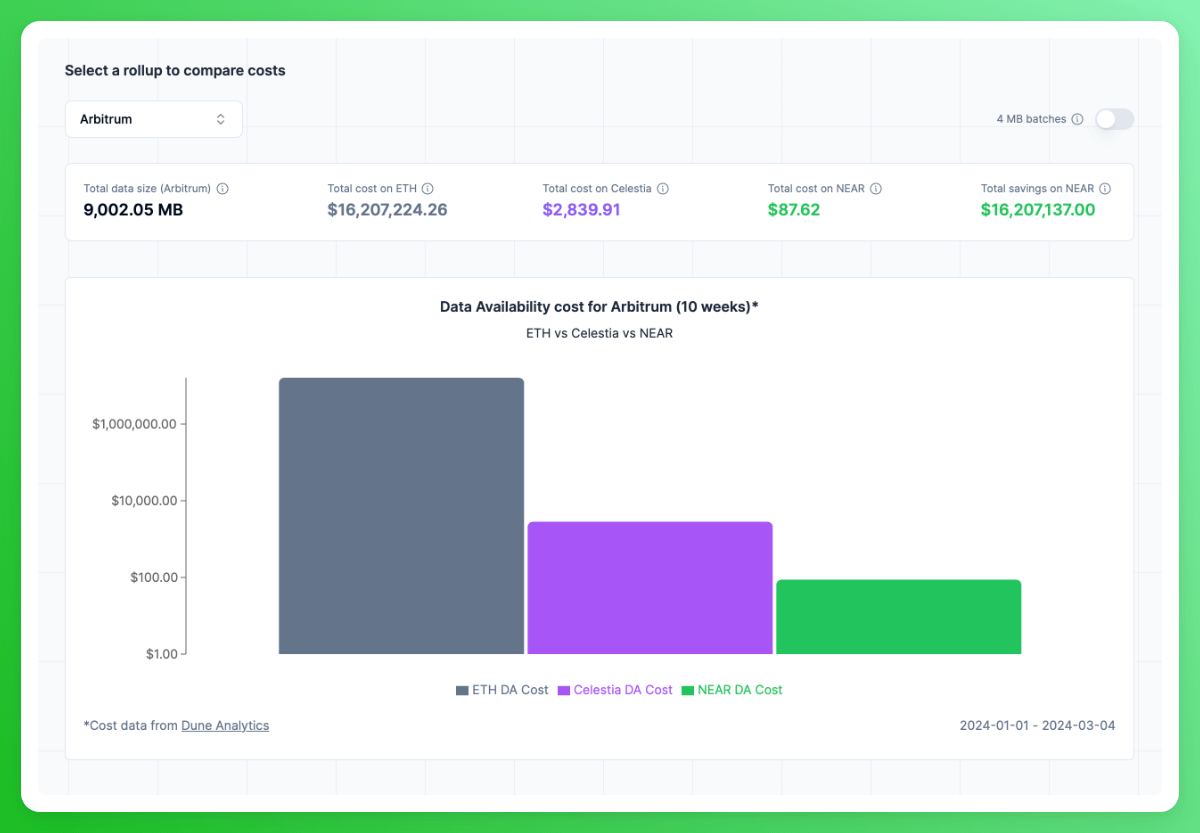

You can clearly see how the upgrade hugely affects L2s, while Ethereum’s mainnet fees remain unchanged. Moreover, data availability is also becoming radically cheap. Until now, roll-ups primarily used Ethereum for data storage. However, costs are dropping dramatically with new options like Celestia and Near. Here's a bar chart showing the differences in cost:

Fun fact: BlackRock hired the analyst who predicted a 75% chance of spot ether ETF approval by May.

Ethena’s sUSDe is raising the bar on stablecoin yields

Ethena Labs launched sUSDe at, perhaps, the best moment it could. With perpetuals funding rates raising tremendously as more and more and people take on leveraged long positions, sUSDe takes advantage of that by holding spot staked ETH positions and shorting ETH perpetuals, hence earning said funding. The yield, minus fees, is redistributed to sUSDe stakers — currently at 67.2%.

Consequences are now fairly visible: a larger amount of users are selling their FIAT-backed (USDC, USDT..) and algorithmic (DAI, mkUSD, LUSD..) stablecoins to accumulate sUSDe; what happens is that this is driving borrowing rates through the roof, and increasing downward pressure on other stablecoins.

Ethena’s ripple effects have resulted in AAVE proposing to onboard sUSDe as collateral, MakerDAO is proposing to raise borrow rates and the yield it pays DAI stakers to 15%, and Prisma Finance proposes to introduce 5% mint fees. Whilst we’re not expecting bigger stablecoins to match sUSDe yields given the risk premium they offer, its success is nonetheless raising stablecoin yields across the board.

Stay safe: Defillama released llamasearch, a crypto-focused search engine.

FTX holds 10% of SOL’s supply, but that might end

Many have been worried throughout Solana’s run citing the FTX estate, which is holding roughly 41M SOL coins, previously acquired by its former CEO Sam Bankman-Fried as cheap as $0.20. Yet, Pantera Capital is reportedly looking to raise funds from large investors to buy the whole of FTX’s stack and create the Pantera Solana Fund — the deal would in fact include a 4-year lock-up period, a management fee of 0.75%, and a price of $59.95 per SOL.

Hail to the king of memecoins: Elon Musk says Tesla will enable DOGE payments — 𝕏/WatcherGuru

Jito Labs stops its mempool functionality

Jito Labs is pausing its mempool feature, which allowed validators using the Jito client to earn fees from MEV operations on Solana. This suspension is due to a surge in sandwich attacks on the Solana network.

Let’s delve a little bit into the technicalities. MEV, or Miner Extractable Value, is the profit validators can make by modifying the order of transactions, adding new ones, or blocking existing ones within blockchain blocks. A MEV sandwich attack occurs when an individual capitalizes on price changes by executing a trade before and quickly after a large order, knowing it will increase (or decrease) the asset's price.

Jito Labs provided this functionality through its validator client, which was seen as a positive for Solana as it "democratized" MEV earnings on the network. However, this feature adversely impacted on-chain users by pre-empting their trades, leading to less favorable prices. This was particularly problematic for on-chain traders and Telegram bot users, who often set high slippage rates for their trades in volatile assets but then faced maximum slippage when caught in these sandwich attacks.

The decision by Jito Labs to pause its mempool feature has sparked significant debate among engineers, with valid arguments on both sides. While pausing the feature may improve the on-chain experience temporarily, it doesn't stop individuals from conducting MEV operations privately and profiting from them. Whereas Jito Labs made its software available to all, enabling the distribution of MEV revenue to its stakers, individuals could now run similar operations privately and retain all profits for themselves.

🏦 TRADFI

- London Stock Exchange to start accepting BTC product applications in Q2 — LSE

- BlackRock plans to buy its own spot bitcoin ETFs with its Global Allocation Fund — The Block

- Deribit is launching SOL, XRP, and MATIC options — Deribit

- Microstrategy acquired 12,000 BTC for $821.7M at an average price of $68,477 per BTC — 𝕏/saylor

- Telegram hits 900M and hints at IPO — Capital Brief

- Patient Capital Management files with SEC for investing up to 15% of its $1.7T fund into BTC — 𝕏/bitcoinnewscom

- Grayscale’s LINK fund is trading at a 700% premium — DLnews

- Franklin Templeton releases investor note on memecoins — CoinTelegraph

⛓️ DEFI

- Tether is launching USDT on the Celo network — Tether

- Kamino announces TGE in April — 𝕏/KaminoFinance

- Optimism sold 19.5M OP tokens in a private token sale — 𝕏/0xBoboShanti

- Dymension sees RollApp applications from DogMond, and Rivalz

- CRV weekly revenue hits ATHs, with over $1M per week from crvUSD loans — 𝕏/gatheringgwei

- The Unibot core teams part ways with Unibot Solana — 𝕏/TeamUnibot

- New L3 ZkLink Nova aggregates liquidity across zkSync, Linea, Arbitrum, Manta, and Mantle — DLnews

- MakerDAO is preparing for Endgame launch in summer this year — forum.makerdao.com

- Manta network introduces Renew Paradigm incentives — 𝕏/MantaNetwork

- Crypto 𝕏 raised $650,000 to put dogwifhat on the Las Vegas sphere — 𝕏/blknoiz06

- The AEVO airdrop claim is live — 𝕏/aevoxyz

- Stride launches stDYM — 𝕏/stride_zone

🛰️ TECH

- Mastercard is testing the first blockchain-powered payment card — Coindesk

- BNB Chain introduces rollup-as-a-service solution — The Block

- Rollchains launches, enabling Cosmos Layer1s to post data on Celestia — 𝕏/rollchains

- COPA wins case against Craight Wright, with judge ruling Wright didn’t author the Bitcoin whitepaper — Coindesk

- Monad Devnet goes live and achieves 10,000 TPS — 𝕏/monad_xyz

- Mantle is undergoing Tectonic V2 upgrade on March, 15 at 2 p.m. GMT — 𝕏/0xMantle

- Blast momentarily stopped producing blocks due to issues related to Ethereum’s Dencun upgrade — 𝕏/Blast_L2

📱 WEB3

- The Solana NFT marketplace Tensor is launching its governance token TNSR — X/TensorFnd

- Circle.tech launches pay-to-chat on Base

- Iconig MMORPG MapleStory confirms its Avalanche Subnet by the end of this years — The Block

💰 VC

- Studio 369, the game developer behind the blockchain-powered video game "MetalCore," has raised $5 million by Delphi Digital and Spartan Group — The Block

- Elixir has closed a $8M Series B round at an $800M valuation — 𝕏/elixir

- OKX Ventures invests in DLC.Link, an innovative native Bitcoin cross-chain protocol — Medium

- Eclipse raised another $50M, and is expected to launch in Q2 — 𝕏/EclipseFDN

- Want to dive into Aptos and capture high yields? Cellana might be the one for you. You can get 51.07% for USDC/USDC LPs, or 236.15% for APT/sthAPT

- Sui blockchain is no less, though. Scallop offers you a 36.19% APY on USDT, or 27.13% APY on SUI. Be aware that if you’re borrowing against your assets you’ll forfeit incentives.

- To counter a not-very-successful launch, Starknet’s DeFi Spring has no issue in paying well to get liquidity on-china. Right now, ZkLend offers a 197.54% APY on USDT, and a 32.51% APY on ETH.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions. Thumbnail sourced from CryptoSlate.