FTX ex-CEO appeals and asks for new trial

Welcome to Stay on-chain! Given our attendance at Token2049 in Singapore, this week’s edition will feature a concise and value-filled rundown of news. Expect a summary of the conference soon!

By the way, make sure to join our Telegram group 👾

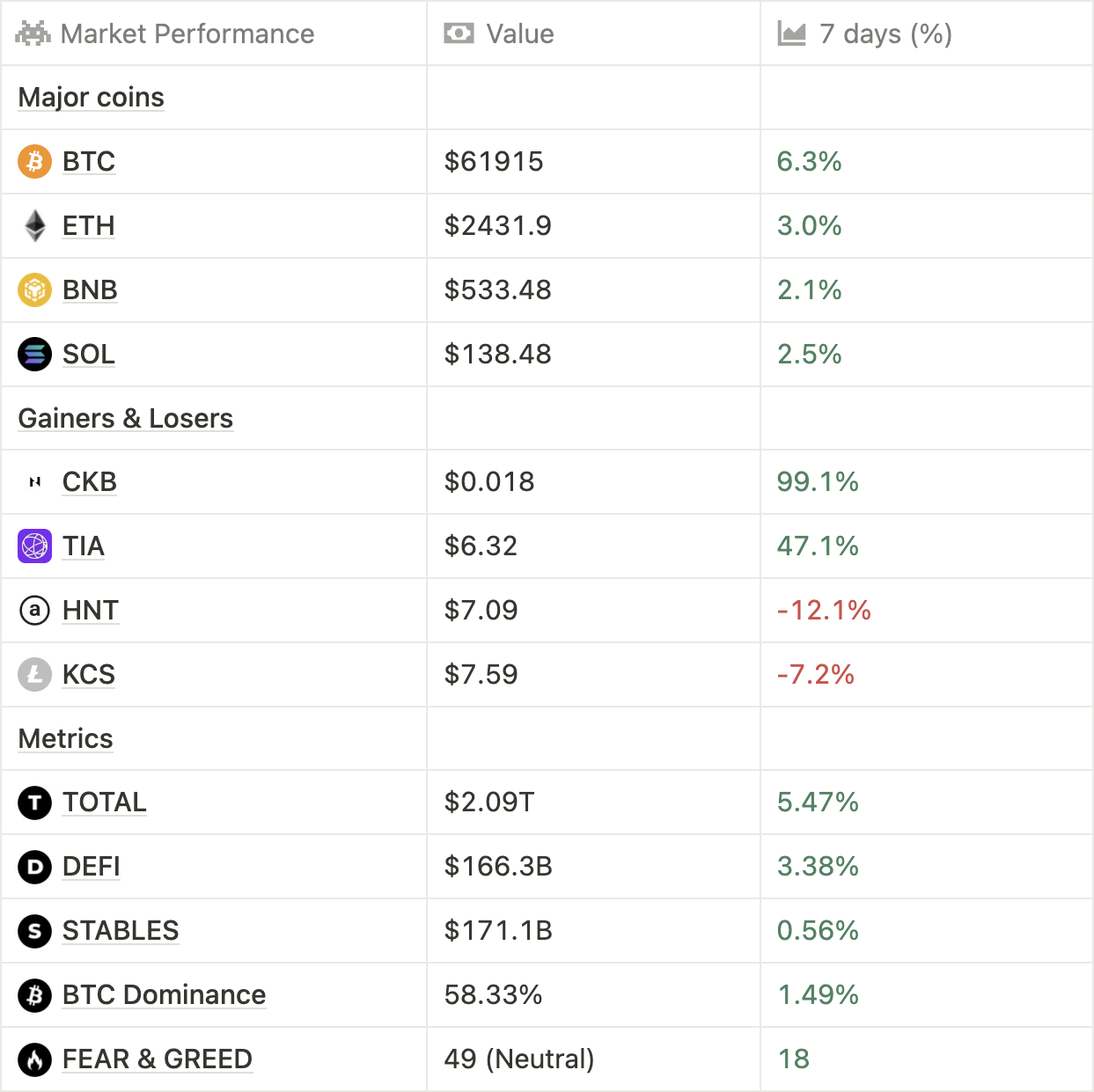

Notably, this week saw the U.S. Federal Reserve proceed with the first rate cut in years since Covid: 50 bps i.e. 0.50%, with the FED rates now sitting at 4.75-5%. Markets expect this to drop another 100bps in 2025, and another 50 bps in 2026.

As of now, the markets are taking it positively, as much as many predicted 50 bps instead of a ‘safer’ 25 bps would end up being bearish as it’d signal panic.

Meanwhile, major DeFi metrics keep growing in a slow & steady manner, and TIA rises after it’s 80%+ bloodbath even though massive token unlocks are on the horizon in October.

More often than not, major crypto conferences end up being a ‘sell the conference’ event as speculators offload positions that they built in anticipation of news shared there. So far, this hasn't been true. This time’s different?

Happens on-chain

- Llama Risk proposes to set WBTC’s loan-to-value on Aave to 0%, but ACI dissents — governance.aave.com

- Sky Money (formerly MakerDAO) set to offset wBTC as collateral because of concerns about its recent merge with Justin Sun entity — CoinDesk

- Circle is launching USDC on Sui blockchain, making its 15th network integration — The Block

- Flappy Bird gets crypto reboot on Telegram with Notcoin — The Block

- Wintermute set to launch prediction market ‘OutcomeMarket’ leveraging Chaos Labs’ Edge oracle — wintermute.com

Bhutan, a country featuring a $3B GDP, holds over $780M in BTC — CoinDesk

Traditional rails

- Trump unveils details on WLFI tokenomics, with 63% allocated for a public sale estimated to net hundreds of millions as hype builds up — The Block

- Former FTX CEO Sam Bankman-Fried files appeal and calls for a new trial — The Block

- Former Celsius CEO Alex Mashinky’s trail set for January next year — DL news

- Michael Saylor’s Microstrategy purchased 18.3K more Bitcoins for $1.1B — CoinDesk

- Microstrategy is selling $700M more in convertible senior notes to buy back debt and more bitcoin (i.e. leverage long) — The Block

- Mark Cuban allegedly wants to buy 𝕏 from Elon Musk — DL news

- Crypto exchange Bitget seals eight-figure deal with Spanish football league LaLiga — CoinDesk

- DeFi lending platform Rari Capital settles SEC charges — CoinDesk

- Kalshi launches regulated prediction market for U.S. elections despite ongoing battle with the CFTC — Blockworks

- ZKB, fourth-biggest Swiss bank, offers crypto trading and storage — DL news

Trump makes his first BTC purchase on a burger at PubKey bar in NYC — The Block

Tech go up

- WBTC issuer BitGo to launch yield-bearing stablecoin USDS this year — CoinDesk

- Solana Mobile unveils Saga successor ‘Seeker’, surpassing 140,000 presales and $70M in orders. Priced at $450 until Sep, 21 — The Block

- Starknet’s plan to enable staking for STRK has been ratified — CoinDesk

- Solana apps to ‘prioritize real humans’ thanks to World ID integration — The Block

- Lens network to use Avail’s data availability solution for scalability — The Block

- BGD Labs announces the Aave v3.2 upgrade — Notion

- USDC is now available in Brazil and Mexico through local bank rails — Circle

- Monerium rolls out Euro-backed stablecoin on Cosmos via Noble — The Block

VCs go brrr

- Crypto VC Fund Dragonfly seeking to raise a $500M fund — Bloomberg

- Bitget, Foresight ventures buy $30M TON tokens from whales — CoinDesk

- TON foundation collaborates with Curve Finance to incubate stablecoin swap project — The Block

- Modular L2 Hemi Labs raised $15M Seed Round led by Binance Labs, Breyer Capital and Big Brain Holdings — crypto-fundraising.info

Some insights into Bitcoin DeFi by CoinMarketCap and Footprint — CoinMarketCap

Airdrops

- WalletConnect set to airdrop 185M WCT as token launches — The Block

Upcoming events

- September, 20: Bank of Japan interest rate decision (0.25% expected)

- September, 20-21: Solana Breakpoint in Singapore

- September, 26: Hamster Kombat to airdrop 60% of HMSTR supply — The Block

- September, 29: Chengpeng Zhao released from prison

- September, 30: Supposed deadline to make $EIGEN transferable

- December, 5-6: Emergence conference in Prague

- MakerDAO has rebranded to Sky, and their stablecoin DAI to USDS. You can now stake the stablecoin to earn a 23.5% APR paid out in SKY tokens.

- Security first. Aave offers a 15.16% APY for supplying their stablecoin GHO on Arbitrum, or 11.5% APY for pyUSD on EtherFi’s Ethereum market, or 18.78% APR if you stake it on Ethereum (in this case, you risk slashing, hence the higher yield).

- The USDY chakra pool on Mantra is currently paying out an astounding 571.91% APR. On top of that, you’ll get 5.35% in USDY yield. Note that here your deposit is locked until Mantra launches its mainnet, and rewards are bound to be diluted over time as more people join the pool.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.