Let's dive into Trump's ties with Aave

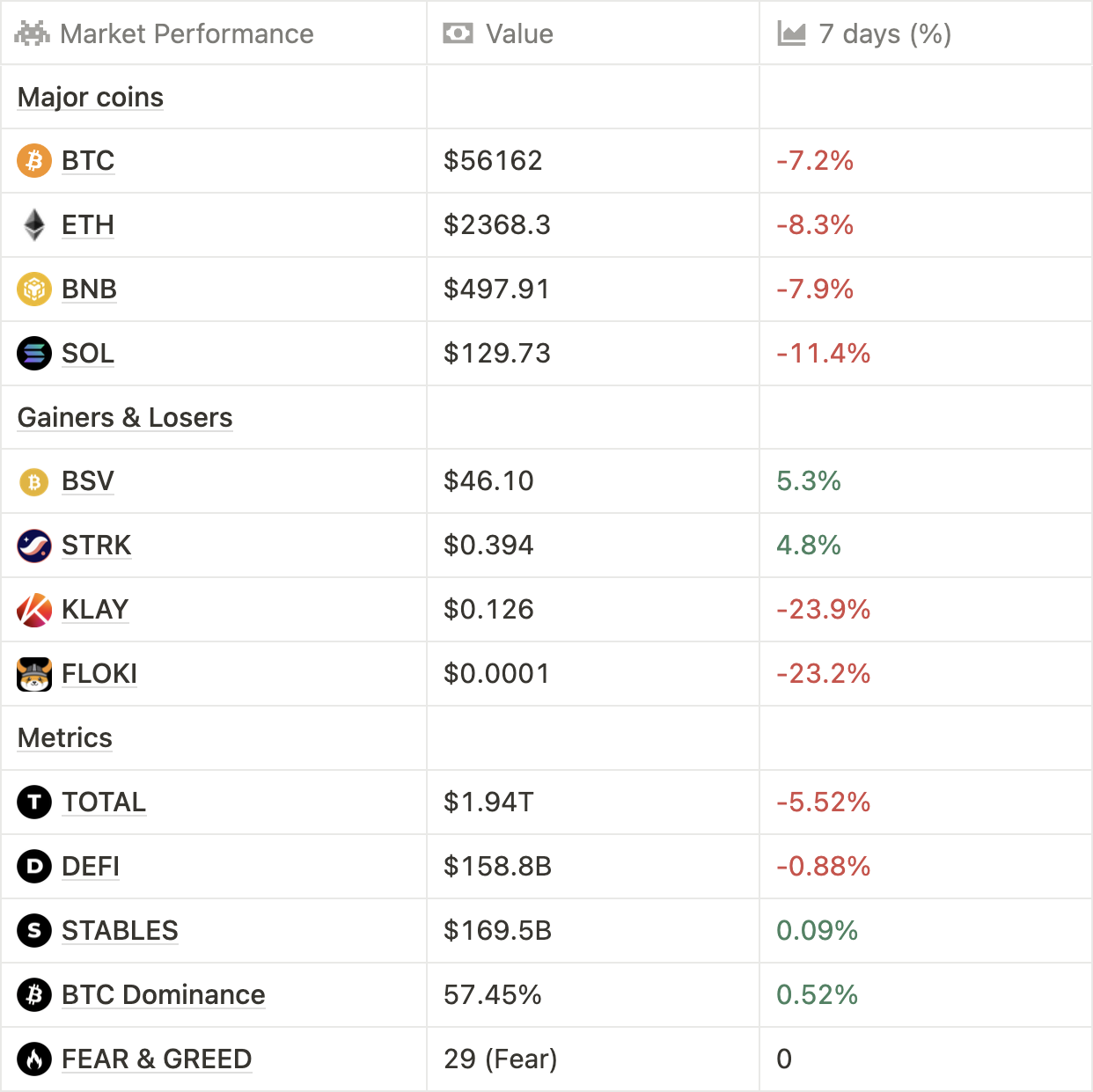

Since the last week, our view of the markets didn’t change much. There’s a need for catalysts, otherwise, the bleeding will continue. However, there are some outliers: AAVE has been showing strength for weeks, being one of the biggest gainers amidst the hype coming back to DeFi 1.0 ‘Dino’ coins & the Trumps’ project influence.

Furthermore, among majors, the so-called ‘Digital Silver’ LTC closed the week positively showing insane strength given its usual high correlation to BTC, down 7% on the same period.

To date, the Ether ETFs have been wildly disappointing. After a bit more than a month, the net inflows are negative considering Grayscale’s trust outflows: $562M have been withdrawn in total.

Right now, everyone’s eyeing September’s rate cuts by the FED — but whether it’ll be 25 bps or 50 bps it’s unknown. Meanwhile, the Bank of Japan reiterated its intention to hike rates shouldn’t the economy improve (remember the Aug, 5 dump? That was the YEN carry trade unwind).

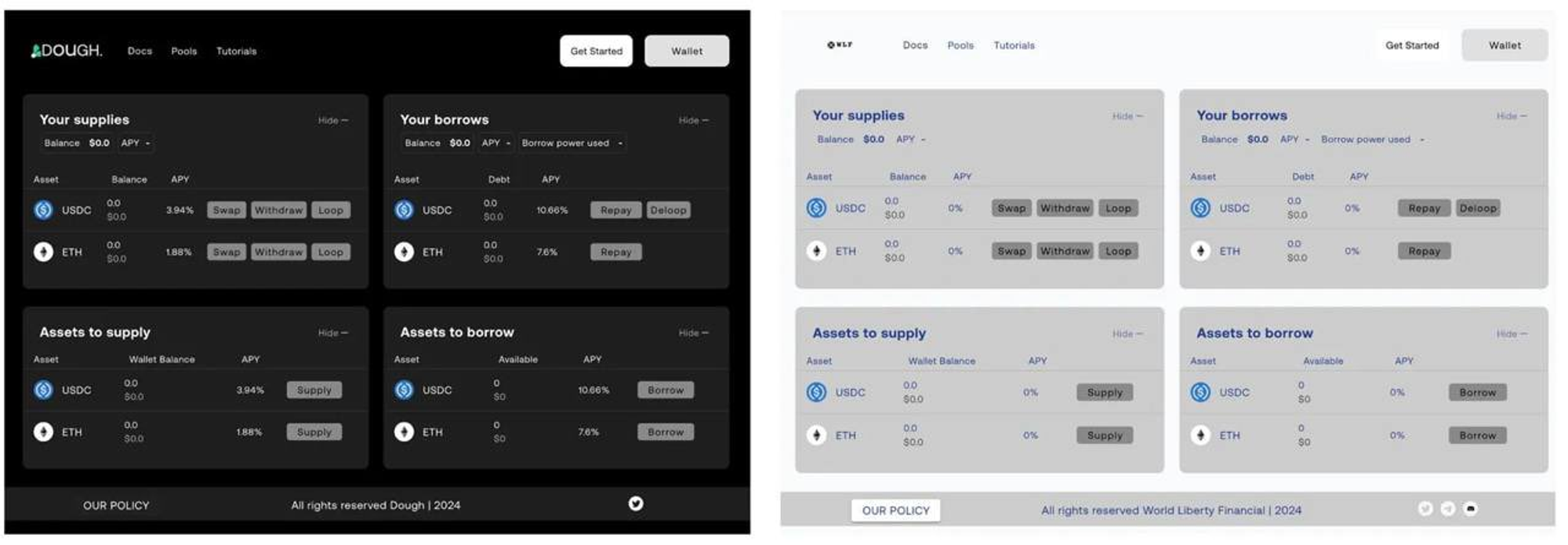

The Trumps are going to build on top of Aave, and launch a token

Until now, everything we knew about World Liberty Financial (the Trumps new DeFi project) was vague — but now, the pieces seem to start falling into the puzzle.

Supposedly, the project will be built on top of Aave (instead of being a risky fork), leveraging its security while adding its own touch. Besides various family members such as Eric and Donald Jr., they’ve recruited various crypto natives to lead the work — including Dough Finance team members (previously hacked for $2M), crypto lawyers, and the best auditing firms in town.

Dough Finance created DeFi Smart Accounts (DSA), allowing for account abstraction that lets you seamlessly interact easily with major apps such as Aave and Uniswap. Perhaps that’s the plan for World Liberty Financial?

All in all, the chances of this being a grift are high. They’re going to sell a token (WLFI) at overpriced valuations, and everyone is going to ape because — c’mon — it’s Trump launching it. Whilst we don’t really need another copy-paste project, we could use the influence to further legitimize the industry and ‘make stablecoins great again’.

Eyes open: Trump’s daughter and daughter-in-law Tiffany & Lara Trump saw their 𝕏 accounts hacked to promote fake versions of the WLFI token.

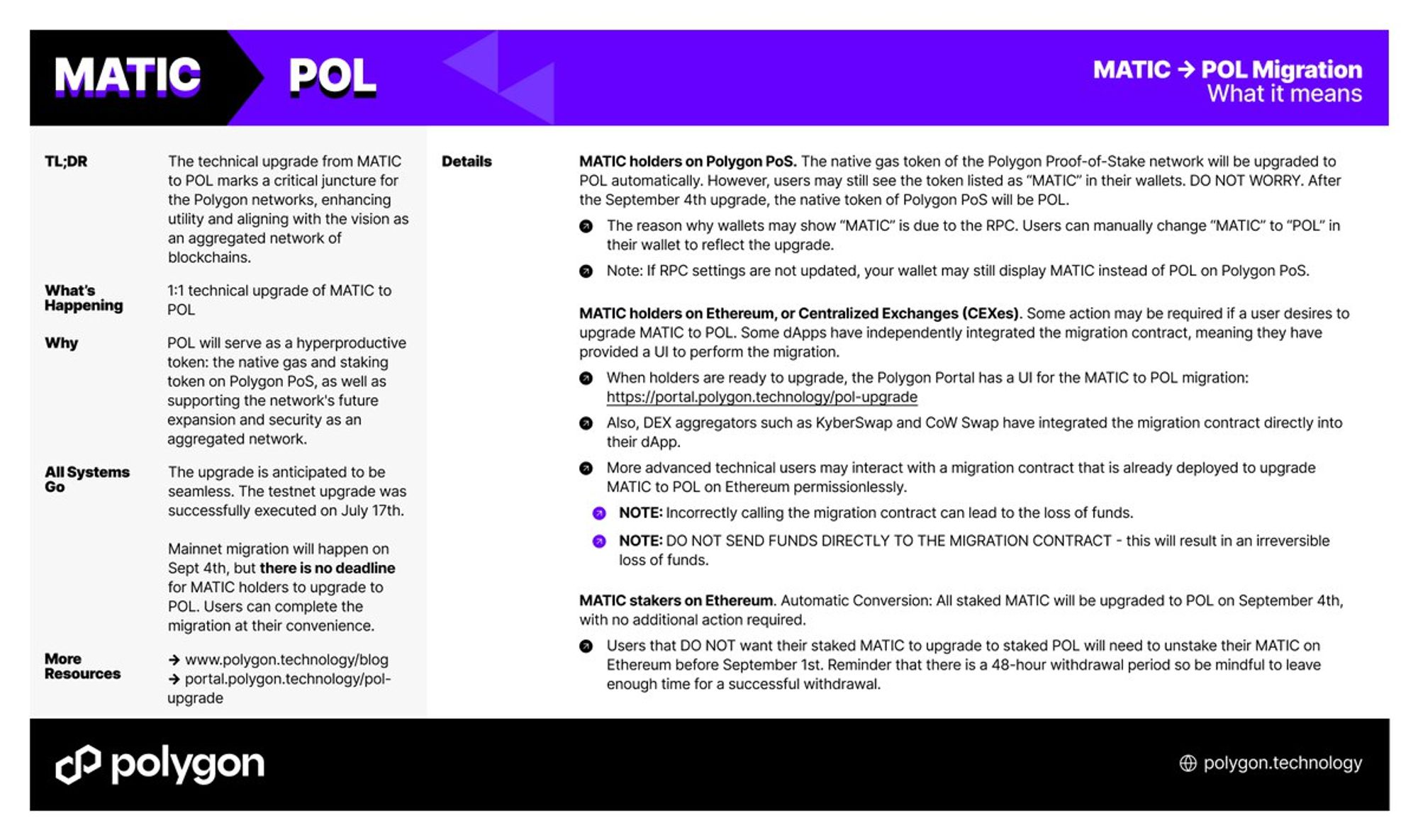

Polygon completes MATIC transition to POL

What changes? To the end user, essentially nothing. Everything’s managed beautifully in the background. If you held MATIC, you’ll get POL in case you held it on a exchange or Polygon POS, or you staked it. Should you have it on Ethereum, you’ll need to send it to a migration contract.

The reasoning behind the transition lies in an effort to upgrade the token’s functionality so that it’s capable of consolidating liquidity and state across multiple chains to accomplish the ‘AggLayer’ vision. Essentially, the validation of multiple chains that share Polygon’s security and liquidity.

Furthermore, the transition enables an increase of 2% in emissions over 10 years to continue rewarding validators.

The price didn’t really benefit from the migration, complicit with the general downturn, as POL is down 10% since yesterday.

Lending market Euler launches its V2 post $197M exploit

Euler was, no doubt, one of the biggest hacks ever. $197M went off with a flash loan attack in March 2023 — yet, the team showed off an incredible resilience. They rolled up their sleeves and got back to work: Euler v2 went live on Wednesday, notably offering highly customizable borrowing and lending vaults aiming to eliminate capital inefficiency from the lending sector in DeFi.

What’s incredible, though, is the security aspect. Euler managed to obtain 31 audits, offering millions in bug bounties competitions.

Uniswap settles $175K dispute with CFTC over derivates offering

Leave the boy alone, for god’s sake. It’s been a rollercoaster for Uniswap, really. Announcing the intention to enable the fee switch in February saw its token double to $12, yet, the movement has been fully retraced due to negative market conditions and the U.S. government actions. Notably, the SEC sent Uniswap a Wells Notice (i.e. anticipating their intention to sue them) alleging they act as an unregistered broker of securities. Fast forward, they settled for a $175K fine with the CFTC because in the past you could trade leveraged tokens (hence, derivatives, subject to stronger regulations) on Uni’s front end. Furthermore, a16z and Union Square Ventures received a subpoena about Uniswap.

Meanwhile, the Uniswap front-end generated more than $50M in fees for Uniswap Labs, the company behind it.

The good side of it all is that the CFTC considers both BTC and ETH to be commodities, and — as of now — the rest of the platform is considered to be compliant!

EigenLayer details its S2 airdrop distribution

Following the Season 1 distribution (6.75% of supply) back in June this year, EigenLayer followed suit with the Season 2 distribution through its foundation branch (nothing really changes here, just a change to make it harder for the SEC to go after them) — set to happen on, or before, the 17th of September. The airdrop will distribute 86M EIGEN (or 5.15% of its supply) to stakers, operators, partners, and community members using August, 15th as a snapshot date.

The pressing question remains, though: when transferability? In fact, EIGEN tokens claimed on S1 still cannot be transferred hence traded — meaning EIGEN is illiquid. Supposedly, this should happen in Q4 this year with Polymarket quoting September with an 88% probability.

Happens on-chain

- Crypto.com supposedly became the biggest USD exchange in terms of volume — The Block

- Solana unlock schedule to flood markets with 10M+ SOL tokens in Q1 next year — 𝕏/SolarEtherPunk

- Siemens issues $330M digital bonds using private blockchain SWIAT — CoinDesk

- DWF Labs received $11.8M in FET tokens from the Fetch.ai foundation — 𝕏/lookonchain

- Terraform Labs transferred $62M in BTC to a new address — Arkham

- Canto’s stablecoin $NOTE depegged to $0.50, now rebounded to $0.98 — Geckoterminal

- Fantom’s Road to Sonic: Series 3 is Live — 𝕏/0xSonicLabs

- Frax launches Frax Name Service (FNS) — 𝕏/fraxfinance

- Cardano CEO plans decentralized social network following Brazil’s ban of 𝕏 — DLnews

- Ethervista launched a pumpdotfun competitor on Ethereum, with main token $VISTA reaching $30M mcap — ethervista.app

- GMX introduces ‘GLV’: GMX Liquidity Vaults — 𝕏/GMX_IO

Traditional rails

- Matter Labs, who’s behind ZkSync, lays off 16% (24 employees) of the team — 𝕏/gluk64

- Political action committee linked to Kamala Harris to accept crypto donations via Coinbase — CoinDesk

- Former Mt. Gox CEO’s to launch transparency-focused exchange this month — The Block

- Telegram had a revenue of $342.5M last year, but an op. loss of $108M. Most of its assets are in TON, currently valued $400M — FT

- Qatar introduces regulatory framework for digital assets — 𝕏/mobymedia

- Ripple CEO says new stablecoin is very close to launch, and rules out an IPO in the US — The Block

- Elon Musk & Tesla cleared of lawsuit alleging DOGE market manipulation — CoinDesk

- DELL didn’t add BTC holdings to its balance sheet in Q2 despite bull-posting from its CEO — Cointelegraph

- SEC charges and settles for $225K with crypto-focused Galois Capital over custody issues — The Block

- Skyscanner integrates with Travala, enabling hotel bookings in over 100 cryptocurrencies — The Block

Tech go up

- USDe can now be deposited on Ether.fi to mint restaking token eUSDe — The Block

- Binance to release liquid staking token bnSOL by end of month — The Block

- Penpie, built atop Pendle, lost $27M in a exploit — CoinDesk

- Arbitrum launches Stylus increasing its programmability features — 𝕏/arbitrum

- Cardano’s Chang Hard Fork goes live introducing on-chain governance — CoinDesk

- Gnosis to migrate away from xDAI as gas token for its chain due to centralization concerns — The Block

- Unstoppable domains expands to Base — The Block

- Karak launched its SDK — 𝕏/Karak_Network

VCs go brrr

- Stablecoin payment network Bridge raised $58M round — Cointelegraph

- Security platform Hypernative raised $16M Series A led by QuantStamp — crypto-fundraising.info

- Sound simulation & metaverse startup Treble Technologies raised $12.16M Series A round led by Kompas — crypto-fundraising.info

Airdrops

- DePin project Grass announced its airdrop — 𝕏/getgrass_io

- Tokenless blockchain Scroll publishes video teasing ‘Soon’ — 𝕏/Scroll_ZKP

- Ethena introduces Season 3 — mirror.xyz

Upcoming events

- September, 1-7: Korea Blockchain Week

- September, 10: Sushi to launch own memecoin launch platform

- September, 10: Harris and Trump debate leading to presidential elections

- September, 10: Optimism Granite hard-fork

- September, 18-19: Token2049 in Singapore

- September, 20-21: Solana Breakpoint in Singapore

- September, 26: Hamster Kombat to airdrop 60% of HMSTR supply — The Block

- September, 29: Chengpeng Zhao released from prison

- September, 30: Supposed deadline to make $EIGEN transferable

- December, 5-6: Emergence conference in Prague

- Security first. Aave offers a 12% APY for supplying their stablecoin GHO on Arbitrum 34.15% APY for crvUSD on Ethereum, or 20.9% APR if you stake it on Ethereum (in this case, you risk slashing, hence the higher yield).

- The USDY chakra pool on Mantra is currently paying out an astounding 505% APR. On top of that, you’ll get 5.35% in USDY yield. Note that here your deposit is locked until Mantra launches its mainnet, and rewards are bound to be diluted over time as more people join the pool.

- Good ol’ Avalanche: secure a 17.76% APR providing liquidity for the USDT/USDC pair on TraderJoe

- Aptos aficionado? Cellana Finance offers a 16.08% APR on zUSDC/zUSDT LPs

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.