🔹Lighter TGE on Dec 29?

Will Lighter TGE be in December?

Looks increasingly likely that the Lighter token launches in December. An insider has been aggressively betting on Polymarket that the TGE happens before year-end, with roughly $125k placed across FDV outcome markets that auto-resolve to “No” if there is no TGE by Dec 31. Wallet analysis strongly links the bettor to early Lighter deposits made before invite-only access even opened, plus interactions with Lighter contracts back when only the team had access. In short, this is not retail but rather a team member or someone very close to them putting real money behind a December launch.

And it looks like we already know the date too, thanks to another insider.

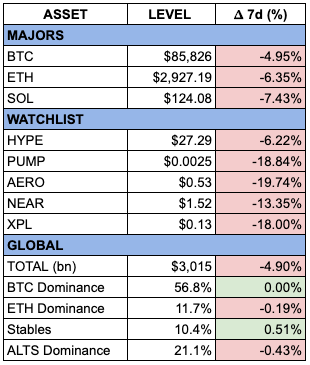

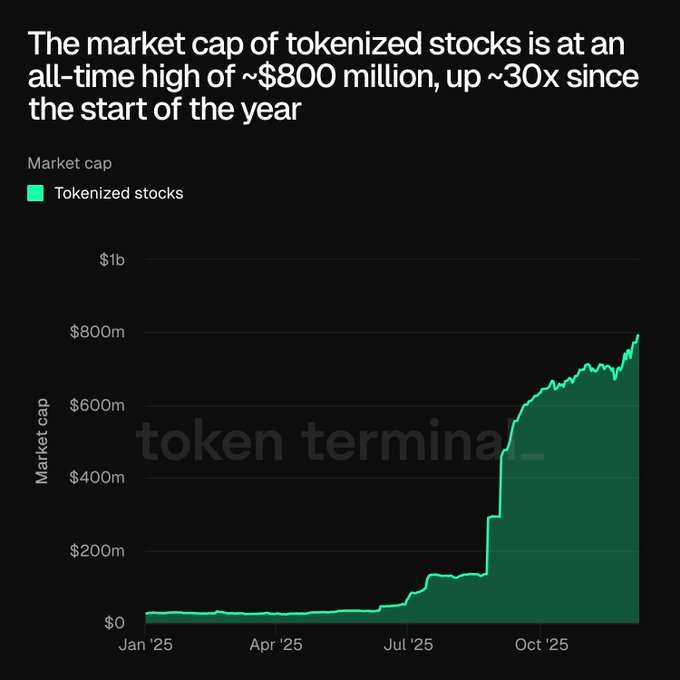

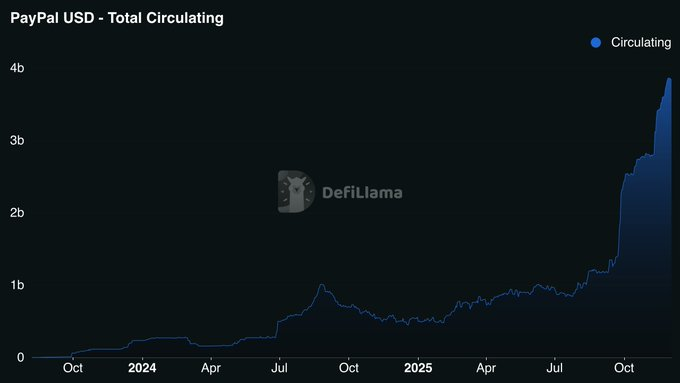

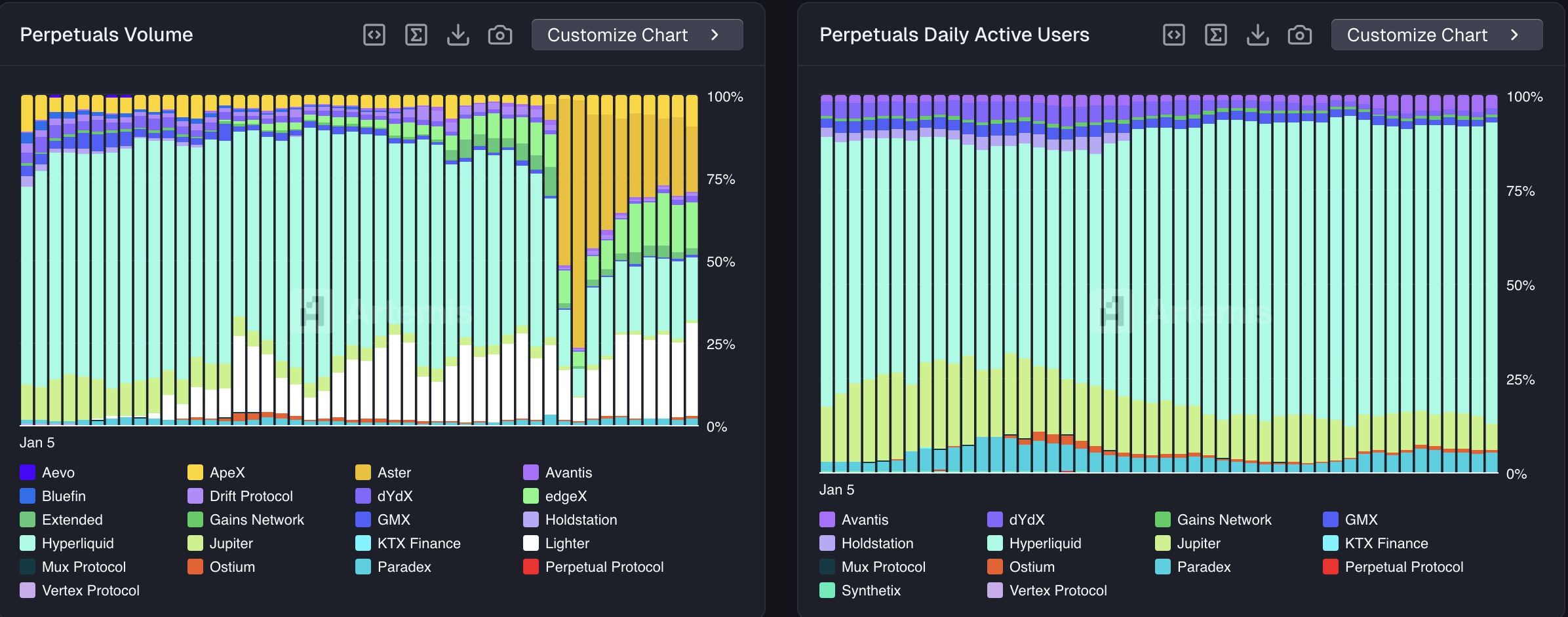

Four charts that actually look good

Markets have been bloody as hell, but not everything is falling apart.

Tokenized stocks. Total market cap just hit a new ATH at roughly $800m. That’s ~30x since the start of the year. Like stablecoins in 2019. Tiny in absolute terms, easy to ignore, but clearly moving in one direction.

PayPal’s PYUSD. PYUSD went from ~$1.2bn in September to over $3.8bn today. That’s a payments giant pushing on-chain rails because it makes economic sense. A bit boring but real.

Hyperliquid. X keeps saying Hyperliquid is dead, as Lighter launches and a new perp DEX pops up every day. BUT, it still accounts for ~80% of all perp DEX users and ~52% of open interest.

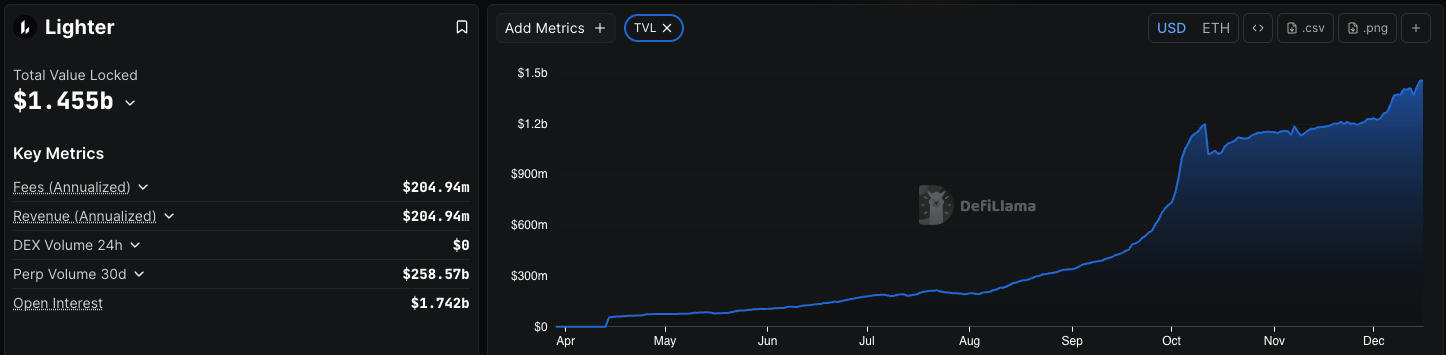

🕯️. Don't worry, I'm a Lighter bull too. TVL. And that's gonna go above $3bn once spot launches properly.

Crypto

- Fogo cancels the $20m pre-sale and will do airdrop instead → Yes, farmers will farm. Still, this is generally good for the protocol. Much cleaner than another ICO.

- Bitmine continues buying ETH and owns more than 3.2% of the supply → Pretty wild. Supply is clearly not decentralizing (lol). That said, I’ve been getting more bullish on ETH lately. It’s holding up well compared to BTC, actually, and the protocol has quietly scaled a lot from a tech POV.

- Saylor buys the dip with $1bn → Average buys around 92k and we’re somehow still below 90k. Not much else to add.

- Aster is doing stage 3 airdrop → Feels like we’re competing for airdrops. It'd be SO COOL to see Hyperliquid launching the second one too.

- Firedancer by Jump Crypto goes live → Still bullish. It’s been a bit in the shade lately, but nothing structurally changed. I covered Firedancer in detail here if you're interested.

DeFi

- Hyperliquid is launching portfolio margin with spot → That's how you onboard big funds.

- HyENA launches → USDe-margined perpetuals DEX built on Hyperliquid’s HIP-3 standard. Traders earn yield on their USDe margin while trading, so idle collateral becomes productive. Cool.

- Pyth launches token buyback program → More buybacks please.

TradFi

- JP Morgan launches a tokenized money market fund on Ethereum → Live on mainnet. Institutions still clearly prefer Ethereum.

- Interactive Brokers allows accounts to get funded with stablecoins → Genuinely interesting. Crypto bros gonna diversify.

- Tether plans to tokenize its stock together with the last round → Curious to see where this ends up and how it’s actually implemented.

- Vanguard now allows crypto ETFs on its platform → Aged quickly. We started the year with “Vanguard will never touch crypto.”

VC and M&A

- Tether wants to buy Juventus → Feels like Paolo from Torino finally living his childhood dream.

From Great Minds

- 17 things we're excited about for crypto in 2026 → Tokenization, Stablecoins, AI agents and payments.

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA