🔹A Google insider and Lighter turns on spot

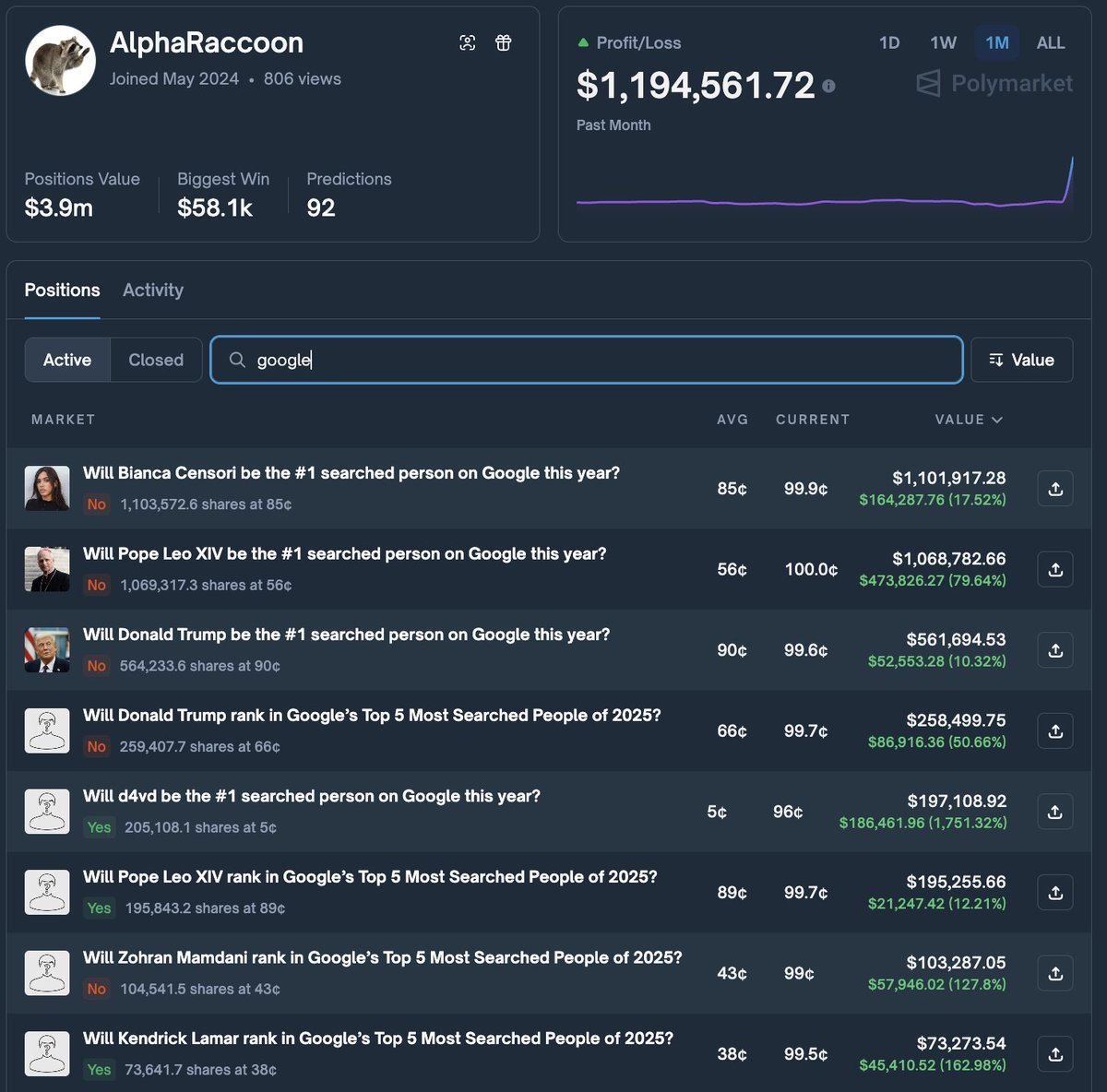

Google insider extracting Polymarket

AlphaRaccoon, a Polymarket trader, somehow nailed 22 out of 23 bets on Google’s Year in Search and walked away with a nice million. Google briefly pushed the rankings early by mistake, then deleted them, but his positions were placed long before that. This same trader also made over 150k earlier this year by predicting the exact release date of Gemini 3.0. At this point it’s hard to call it anything other than a Google insider.

And honestly, that's the issue of prediction markets. If you sit on privileged data, you print. (Let your grandma click the buttons)

Lighter rolls out spot markets

Lighter has been on a steady rollout lately. After adding equities and FX pairs, the team now launched spot trading, starting with ETH. It’s a logical next step for a perps-first exchange that has quickly grown into one of the few real competitors to Hyperliquid. The timing also lines up with expectations that Lighter will TGE in December or January. The market seems to assume it will come out trading somewhere near Hyperliquid’s FDV, though conditions today are very different from when HYPE launched.

Bullish, but let’s see how much of the momentum carries into the token.

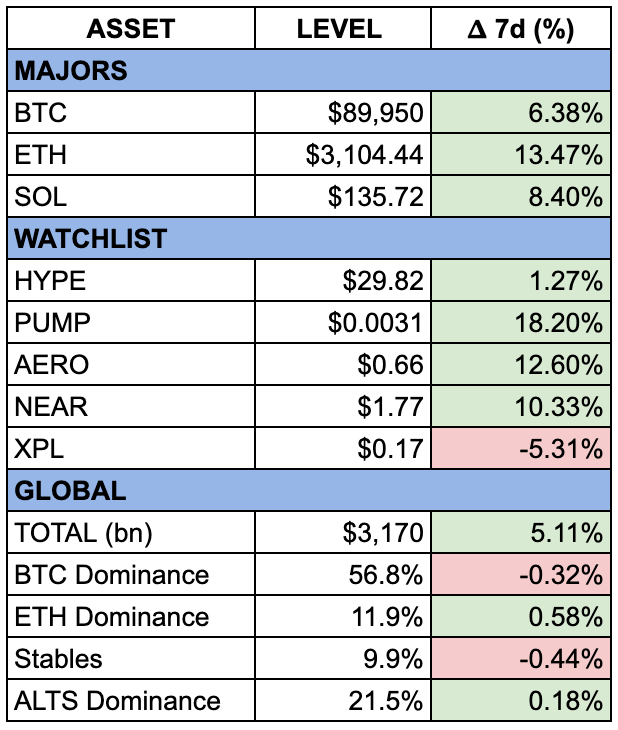

Crypto

- Stable, the competitor of Plasma, launches mainnet and token → Tether/Bitfinex backing this one too. Curious to see how it plays out. Plasma is still down only.

- Vitalik proposing a gas fee futures market → honestly, get people to use the network first before letting them hedge their gas fees (lol)

- Kalshi becomes CNN's official partner →big. Kalshi is really pushing.

DeFi

- Aave partners with CowSwap to improve the swap experience → love CowSwap, and great to see Aave adding swap features as well.

- Yearn got exploited for $9m in yETH → apparently a very sophisticated exploit that let the attacker infinitely mint LP tokens.

TradFi

- Blackrock files for skaked Ethereum ETF → bullish, but a 2% yield doesn’t help much when your position is down 50%.

- Hyperliquid Strategies Inc starting a $30m stock buyback program → this can improve the situation, but in my view all DATs should be at or below 1 mNAV. ETFs are better, and DATs just add extra costs.

- 21Shares is launching the first SUI ETF → not needed, but better than a DAT.

VC

- Ostium raises $24m → strong perp dex foor RWAs: FX, commodities, and stocks

- Kraken acquires Backed Finance → makes sense after their xStocks rollout.

From Great Minds

- A deep dive on the yETH exploit → very interesting if you want to dig deeper.

- I wasted 8 years of my life in crypto → a bit pessimistic, but he makes some good points.

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA