Welcome to DeFi Dive!

In today’s edition, we’ll explore Aave and its latest product, $GHO.

Key takeaways

Aave stands as the third-largest DeFi protocol, boasting a TVL of $4.5 billion, and has all the cards in place to launch a successful decentralized stablecoin, $GHO.

$USDT and $USDC, the currently most known stablecoins, aren’t decentralized nor permissionless. Tether and Circle, the companies backing them, are able to freeze your funds anytime and they store the collateral in a centralized and non-transparent way.

$GHO comes to life as an ERC-20 token on the Ethereum Mainnet and can be minted by supplying collateral to the Aave protocol.

If $GHO steps up as a big player in the stablecoin landscape, it could give Aave the chance to influence the general stablecoin interest rates in DeFi, making Aave kind of like a DeFi central bank.

An introduction

For any DeFi enthusiast, Aave stands out as the protocol that needs no introduction. Think of it as the big brother of all DeFi protocols. It was one of the earliest DeFi protocols to launch, and nevertheless, it’s always at the forefront of innovation: from Flash Loans to V3, and now with the recent launch of the $GHO stablecoin, which we'll explore in-depth today.

Aave stands as the third-largest DeFi protocol, boasting a TVL (Total Value Locked) of $4.6 billion. Its products are seamlessly available across multiple EVM chains, being for many the go-to protocol for borrowing and lending crypto assets.

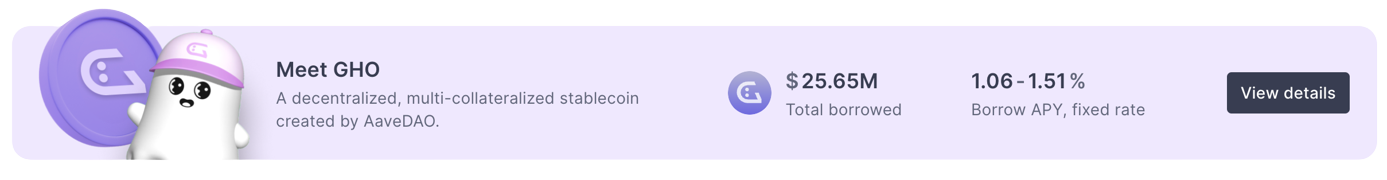

What’s $GHO?

$GHO is a decentralized stablecoin launched by Aave. It's a fully backed, multi-collateral stablecoin that's natively integrated into the Aave protocol and it's minted by using assets provided to the Aave protocol itself. As a stablecoin, $GHO is designed to maintain a steady value without price fluctuations by being pegged to the US dollar.

Even though $GHO is backed by assets like Ether that can swing in value, there's excess collateral that acts as support. And, with collateral value fluctuations, a stabilization mechanism kicks in, preventing $GHO from fluctuating away from its peg.

Do we need another stablecoin?

Stablecoins are the killer app of crypto. They're a blend of regular FIAT money and crypto, allowing you to have stable funds on a permissionless network like Ethereum. They are instant, efficient, and borderless way to transfer value.

Now, wait a second. Aren't there already coins like $USDT and $USDC?

Yup, and those two together hold a whopping $108 billion market cap. The stablecoin market ain’t peanuts.

There is a “but” though. They're not decentralized. A single company, Tether and Circle respectively, have full control over them, which means they can freeze your funds anytime, not really making them permissionless. Additionally, they hold the collateral in a centralized way, by holding the respective amount of dollars in bank accounts.

Here's where Aave steps in. A permissionless, open-source, and transparent protocol, Aave is the perfect spot for a stablecoin to launch, having already everything it needs to run it smoothly. Aave can make it decentralized, over-collateralized but still capital efficient (we’ll see how), and configurable.

That’s why $GHO. Native to the Aave V3 Ethereum protocol and controlled by the Aave Governance, $GHO can provide decentralization, censorship resistance, and transparency.

How?

$GHO comes to life as an ERC-20 token on the Ethereum Mainnet and it’s being minted by the so-called Facilitators. They must be approved by the Aave DAO and can trustlessly mint and burn $GHO tokens within an upward limit (capacity). Guess what? Aave with the Aave V3 Ethereum Pool will be the first facilitator.

Minting $GHO is equivalent to borrowing it. As with normal borrowing, to be able to borrow $GHO, users will have to supply collateral. To borrow/mint $GHO, users will have to pay an interest rate, which will be fixed and determined by the Aave Governance. When, instead, repays the borrowed $GHO (or if they get liquidated), the $GHO gets burned. This way, Aave will act as a DeFi bank, where all the interest paid by minters of $GHO will flow as revenue to the Aave DAO treasury.

It’s interesting to note that $GHO will be multi-collateralized, which means that users will be able to mint based on their entire set of supplied assets. $GHO will thus be backed by a variety of crypto assets. This is a very important benefit for users as it creates a very flexible way of using multiple assets within the same borrowing position, removing the need to balance out between different positions and making it easy to increase the health factor by directly funding a position instead of swapping between assets.

Interest-Earning Collateral

As I mentioned before, Aave will make the over-collateralization of a stablecoin much more capital efficient. And Interest-Earning Collateral is the how.

When users supply assets to mint $GHO, others will be able to borrow the supplied assets. Consequently, interest will be earned on the supplied collateral, which will accordingly decrease the interest that the first user will be paying for borrowing $GHO, making the final rate very competitive.

$GHO interest rates

A very important aspect that we should keep in mind is that $GHO won’t have its Aave pool. The supply of $GHO will be minted (and burned) on demand and in real-time by a smart contract. In other words, if someone would like to borrow $GHO, there is no requirement for another user to have supplied $GHO — the mechanism that is necessary for any other crypto assets being borrowed. This means that $GHO won’t follow usual supply and demand dynamics, as the supply side does not exist. Interest rates won’t be determined by utilization rates but by the Aave Governance. As GHO is not supplied, there are no suppliers to pay and the interest is pure profit for the Aave DAO. Currently at 1.51% minus the borrow APY, the final rate of borrowing becomes 0.45%. $GHO interest rates could become even more competitive in the future.

How does $GHO maintain its peg?

$GHO is pegged to the US dollar, where 1 $GHO is equal to 1 US dollar. It’s important to keep in mind that the GHO price is fixed at $1 on the Aave Protocol, where instead, it can be different in other markets. No matter what the market price of $GHO is, the Aave Protocol and the other facilitators will always value it as $1. The price of $1 set on the Aave Protocol (without oracle), helps to maintain price stability, as it immediately creates arbitrage opportunities when the price deviates from $1. Let’s look at an example:

When $GHO's pricing is above $1, users can mint 1 GHO for $1 worth of debt and sell GHO for more than $1, which increases the supply of GHO while decreasing the asset price. The user can then repay the debt at $1 while keeping the difference as profit. When instead the price of $GHO is below $1, users can buy 1 $GHO on the market for less than $1 and cancel $1 worth of debt, again, keeping the difference as a profit. This action shrinks the supply of GHO while increasing the asset price.

$GHO is without a doubt a significant innovation in DeFi. A decentralized stablecoin, that has all the pieces in place to become a valid alternative to mainstream stablecoins such as $USDT and $USDC. And if $GHO steps up as a big player in the stablecoin landscape, it could give Aave the chance to influence the general stablecoin interest rates in DeFi, making Aave kind of like a DeFi central bank.

And that’s all you should know about $GHO. But if you want to dig deep, I ain’t stopping you. Check the $GHO whitepaper and the docs. Thanks for reading!

Disclosure: Authors may own crypto assets named in this newsletter. DeFi Leaks is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.