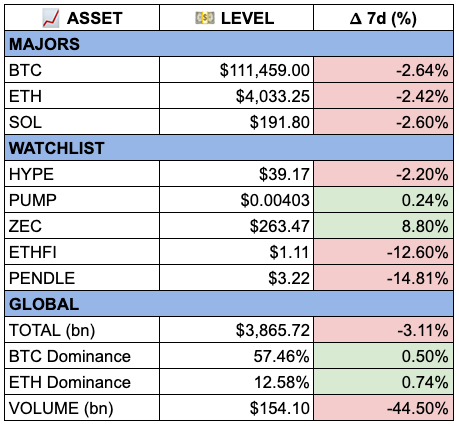

Binance glitched, $20bn evaporated

Get rid of the noise. Weekly signals of what matters in crypto.

The big liquidation & Binance drama

Last Friday night was wild. Donald Trump announced 100% tariffs on China and the macro risk-aversion hit crypto hard. Then about an hour later the real dominos fell: market-makers pulled liquidity from major order books, bid-ask spreads blew out, and leveraged traders lost … everything.

On Binance, three assets, USDe, BNSOL and wBETH, de-pegged briefly. Binance’s mistake. It was using its own order-book based oracle (with then thin liquidity) rather than deep cross-venue data. Ethena worked perfectly fine, but the exchange’s pricing mis-marked collateral and triggered even more liquidations. It wasn’t a collapse of protocol fundamentals, it’s no FTX or Terra/Luna type of collapse. This was a micro-structure / venue failure + leverage + withdrawal of liquidity.

Net result: leverage and OI got COMPLETELY cleaned ($15bn to $6bn on Hyperliquid alone), and fundamentals (for many projects) remain intact. The Binance drama? Arguably bullish for other venues.

What happened with market-makers? They simply made the rational decision to pull back in an adverse market environment. When Binance (~50% of global spot volume) becomes black-boxed, you don’t show standing bids for something you can’t model or properly hedge. You dump or retreat. That created the “liquidity vacuum”, i.e. no one was there to take the other side.

Compared to TradFi: MMs have obligations, there are circuit-breakers, halts in case of high volatility. In crypto: 24/7, permissionless, no duties. So when volatility goes wild and the leading venue glitches, liquidity disappears, volatility gets even wilder, cascades of liquidations follow, and alts go to zero (see: ATOM).

But again: this was technical, not fundamental insolvency. The nuance matters.

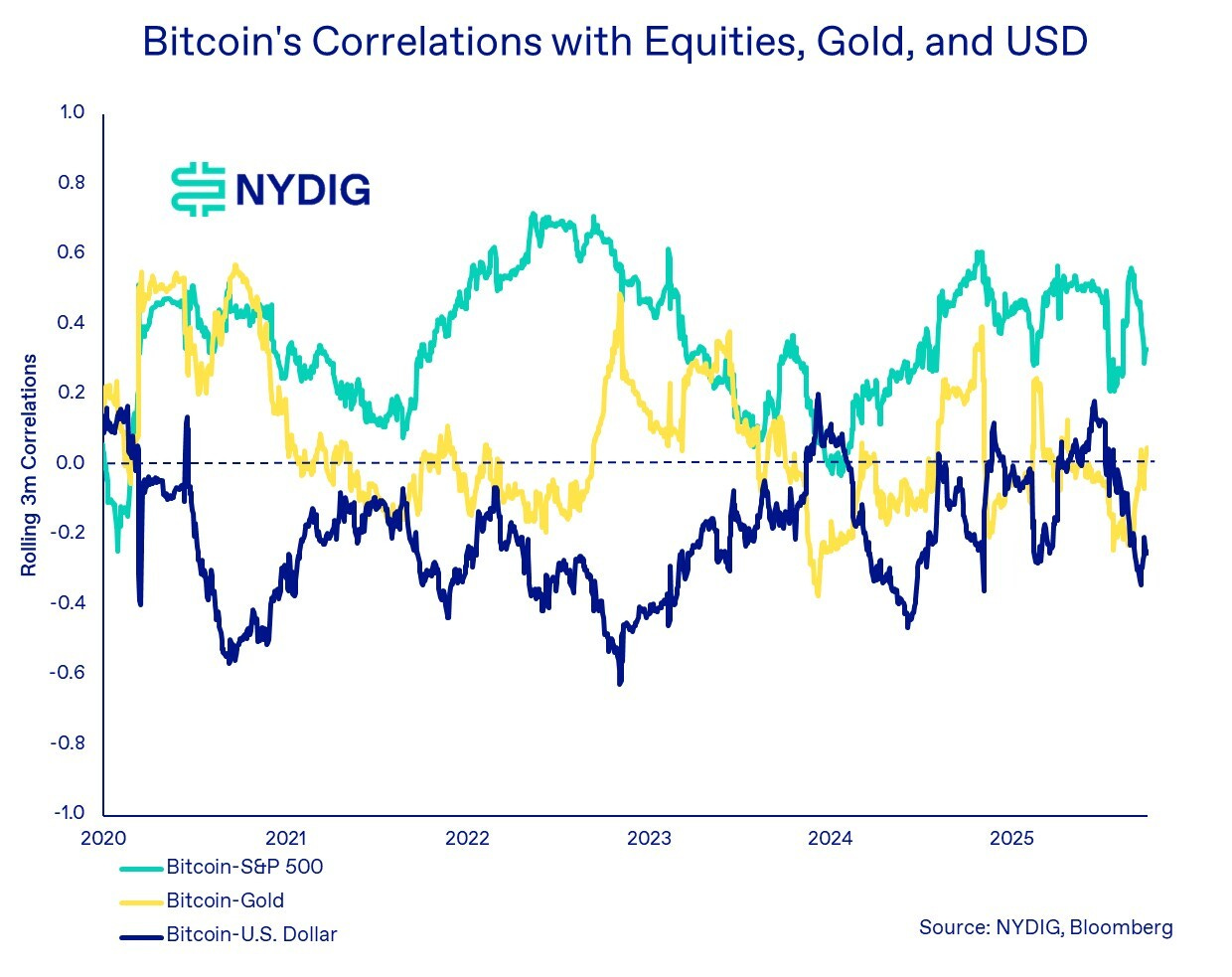

Bitcoin is not gold (yet yet yet?)

The data still shows weak BTC-gold correlation. Bitcoin is not yet behaving like gold. Its correlation with U.S. equities remains elevated (~0.33 in 90-day rolling) while correlation with gold stays very low.

Meanwhile, gold keeps printing all-time highs ($4,100–$4,200/oz last week), with literal queues outside bullion shops (top signal).

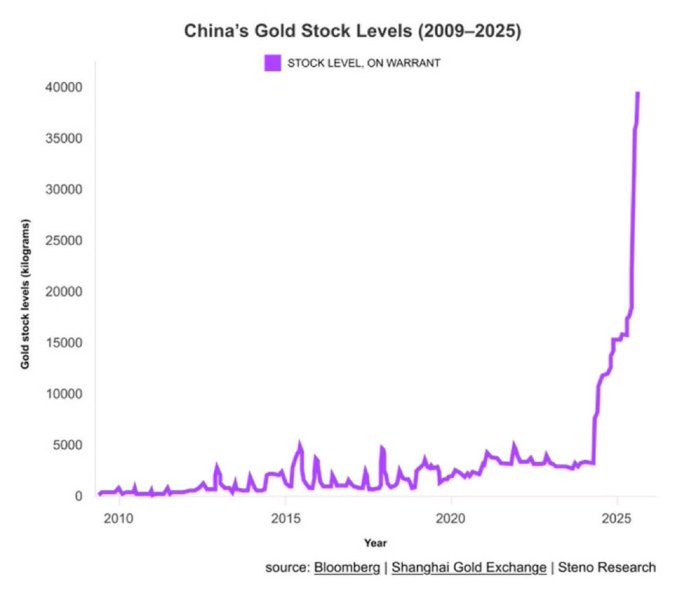

Guess what has China been doing:

My take: Bitcoin will catch that wave as well. Macro shifts, liquidity easing, dollar rolling over, digital gold narrative etc. Watch the divergence to close in the following months with classic BTC delayed reactions.

Perp DEXs popping up everywhere

Hyperliquid, Lighter, EdgeX, Extended, Pacifica, Ostium, Vest Markets, Paradex, GTE, plus older ones like GMX, Synthetix, Jupiter and Drift. Many run points or “airdrop” incentive programmes to lure users. Early users on Lighter definitely printed, with points trading at ~$100 each OTC. While for Extended points trade at ~$3.

The first-mover edge is shrinking. Farming volume purely for points is risky: points ≠ tokens, tokens ≠ value, trend = diluted. May still be worth it, but pick DEXs with real open interest, decent infrastructure and tech, cracked team.

My take:

Hyperliquid > Aster > Lighter > EdgeX > Extended > Pacifica > Paradex > Vest >>>>>>>>> Synthetix >>>>>>>>>>>>>>>>> Drift

And I probably forgot some..

DeFi

Monad Airdrop Claim Portal is live → Lots of people are eligible, so I expect heavy dilution and no big payouts. Simply being an Echo user made you eligible. Let’s see what val it trades. I’d expect $6-10bn FDV.

$LAUNCHCOIN migrates 1:1 to $BELIEVE → No major upgrade, but a catchier ticker. Zora on Base has done well, so it might follow with this clean new chart.

Superstate partners with Backpack for tokenized equities on Solana → Getting the feeling that progress in tokenized equities (big deal) is happening on Solana, not Ethereum.

Ethena is launching a stablecoin-as-a-service stack → Stablecoins are everywhere, we knew. Seeing apps launch their own is bullish for ENA, though this fragmentation isn’t healthy long term imo.

OpenSea set to launch $SEA in Q1 2026 → Opensea has been a ghost town for a while. Many NFT traders from 2021-22 could get a juicy airdrop, but not sure if this alone will revive the app.

VC

a16z invests $50m in Jito → Jito is solid tech, and the team knows what they’re doing. Feels like the Solana version of the huge bets on Eigenlayer they did.

MegaETH buys back 4.75% equity and token warrants from pre-seed investors → Fundamentally not bullish nor bearish. Just buying back equity from a closing fund. Still good sign of confidence imo.

TradFi

Ethereum treasuries and spot ETFs now hold over 10% of ETH supply → DATs and ETFs holding over 10%, yet ETH hasn’t broken $5k. Concerning.

Blackrock is developing its own tokenization tech → And you thought that the tokenization value would flow to a public chain? RIP Ethereum?

From Great Minds

A sober assessment of Prediction Markets → Prediction markets are a key meta this cycle. Interesting view on how that could play out.

The Humanoid thesis → Anon, we should diversify, right? Right? Robotics is definitely cool.

Inside the Flash Crash: Market Microstructure Breakdown of October 10th → Worth reading to understand the full picture of last Friday’s crash.

Cobie on his journey in crypto → Always read Cobie with respect.

As we’ve discussed before, perp DEXs are clearly the meta of this cycle. Even if the farming of them is super crowded, there’s still room to farm selectively. Pacifica and Vest Markets imo worth watching. We’ll deep dive into both soon. Lighter, on the other hand, feels too late.

From what’ve seen, wash trading (opening and closing trades) doesn’t work. It gets detected. What matters is authentic activity: normal trading, holding positions, using the platform as you naturally would. The refs give you access to beta and the discounted fees:

Merci!

If you found this worth your time, pass it to a friend. Means a lot! Click below or just forward this email.

Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA