Blackrock's ETF playing hide and seek

Tether embraces transparency announcing real-time reserves, while Polygon is set to transition to 2.0 soon

Welcome to Stay on-chain! The markets were tumultuous this week, showing strong greed for the upcoming BTC ETFs. Meanwhile, many blockchains and projects have started rolling out major upgrades to take advantage of positive market conditions.

No need to sift through the chaos - we've distilled it all for you.

In today’s edition:

DTCC playing with Blackrock's ETF ticker

Tether to publish real-time data on reserves in 2024

POL set to replace MATIC, en route to transition to Polygon 2.0

The US crypto market is driven by institutional activity

Reading time: 5 min

It's been an extremely green week. That green, that we had no losers to report in our market performance analysis. The only ones that could be considered 'losers' were the stablecoins 😅.

Bitcoin skyrocketed, delivering a 22.67% gain, setting a new yearly high at $35,198 and outperforming all other major coins. The number one performer of the week, with an almost 2x increase, has been PEPE, the new shit-coin king. Crypto degens are smelling a new bull market and going all-in on low-cap coins.

In terms of market sentiment, the Fear & Greed Index accelerated showing that greed is in the markets, and the DeFi TVL has recovered all its losses from the previous weeks (partly attributed to assets rising in value).

DTCC playing with Blackrock's ETF ticker

BlackRock's Bitcoin ETF is getting closer every day. The iShares Bitcoin Trust (IBTC) has now its ticker listed by the Depository Trust & Clearing Corporation (DTCC). DTCC is the world's largest financial clearinghouse, handling an astonishing $2.3 quadrillion and playing a key role in the world of ETFs. This announcement, observed by a Bloomberg analyst, sent Bitcoin to new yearly highs, and the entire crypto market followed suit.

Furthermore, the latest update of the fund's application reveals that a seed investor might be getting ready to back the product, with plans to purchase the first shares in October. A seed capital investor typically kickstarts an ETF to prepare it for trading on a stock exchange, a common practice when listing an ETF. However, this doesn't guarantee an immediate launch; it simply means the product is ready to go.

Funny enough, the IBTC ticker for BlackRock's ETF briefly disappeared from DTCC's list that afternoon, leaving many questions in its wake. But it reappeared soon after.

Is someone playing tricks on us, huh?

FTX, but on Youtube: Bloomberg releases a documentary titled “RUIN: Money, Ego and Deception at FTX”

Tether to publish real-time data on reserves in 2024

Set to become the company’s CEO in December, Tether’s frontman Paolo Ardoino told Bloomberg News that Tether plans to start publishing real-time data on USDT reserves starting in 2024.

The most capitalized stablecoin issuer currently publishes transparency reports quarterly, and has a dashboard detailing USDT’s distribution across supported blockchains. Looking at their numbers USDT has $84.4B in liabilities (issued stablecoins) and declares $87.7B in assets — with an excess liquidity of roughly $3.3B.

The company received strong criticism during the years for never allowing an open-books audit, but rather kept publishing assurance opinions — not equivalent to audits — produced by BDO Italy.

Can’t make this up: Ripple’s former CTO has 7,002 BTC idling in an Iron-Key hardware wallet, but forgot the password. Unciphered offers to help but he declines.

POL set to replace MATIC, en route to transition to Polygon 2.0

Polygon Labs has recently deployed POL, the soon-to-be main cryptocurrency of the Polygon ecosystem — it will serve as a gas token, enable governance rights, and offer staking rewards while securing various blockchains.

Marketed as a hyperproductive token POL will be replacing the MATIC coin with the release of Polygon 2.0, which includes several steps: launching a staking layer to fuel Layer-2 chains, transitioning Polygon from a Proof-of-Stake to a zkRollup and implementing further interoperability and shared liquidity for the Layer-2s.

Self-executing donation: the Railgun DAO sent $365K to Harmony, exploited by Lazarus for $100M in 2022. The process was self-executing through DAO votes.

The US crypto market is driven by institutional activity

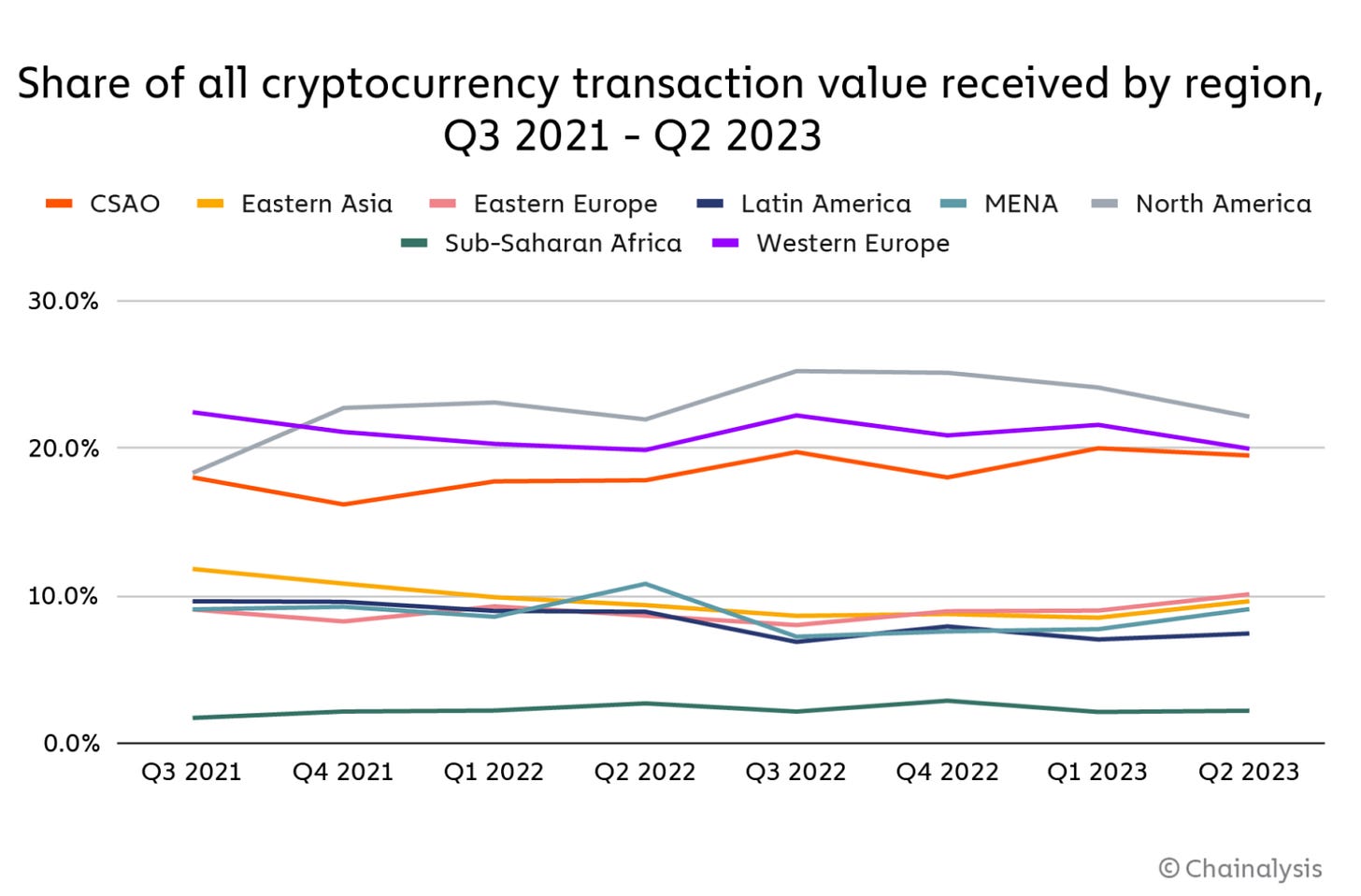

North America is the biggest player in the crypto world, with around $1.2 trillion in on-chain transactions, making up about a quarter of the global total. The next important regions are Western Europe and Central and Southern Asia.

According to Chainalysis, crypto activity in North America has gone down in the past year, especially after events like the FTX collapse in November 2022. Things got even worse after the banking trouble in March, which saw banks like Silicon Valley Bank and crypto-friendly ones like Signature and Silvergate closing down. But, the activity started to pick up again in June.

One eye-catching detail is that North America's crypto market is mostly influenced by big institutions, with 76.9% of transactions being for $1 million or more, including a significant number of them exceeding $10 million.

Uniswap drama: Hayden Adams, Uniswap’s CEO, announced burning the majority of HAY’s supply, only for the second biggest holder to dump it all on speculators. HAY was Uniswap’s first LP.

Polygon proposes a 13 members committee to supervise smart contract upgrades, including well-known figures in the crypto space — link

Consensys’ founder Joe Lubin was sued by 26 former employees claiming they’ve been cut out from receiving equity in the company — link

Polkadot fires ~ 30% of the workforce, with company spending increasing.

The SEC retreated its lawsuit against Ripple executives

DyDx v4 is live, open-sourcing the Cosmos-based code — link

AAVE plans to add FXS on AAVE v3 — link

Mastercard teamed up with MoonPay to push Web3 efforts — link

Prisma Finance announces PRISMA token generation event on November 2 — link

Ledger officially rolls out its Recover feature, a controversial backup solution for lost seed phrases — link

FTX is in talks to restart the exchange, with options ranging from selling the business to restarting it themselves — link

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.