Blast recovers $62M exploit by North Korea

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! While the markets went pretty much side-ways this week, the industry is guzzling with news. The US government’s back at it, going hard on KuCoin, Coinbase, and the Ethereum foundation. Meanwhile, the EU released new regulations affecting our beloved crypto wallets, and Blast suffered a $67M exploit.

Now sit back, relax, and let us sift through the noise for you.

By the way, make sure to join our Telegram community 👾

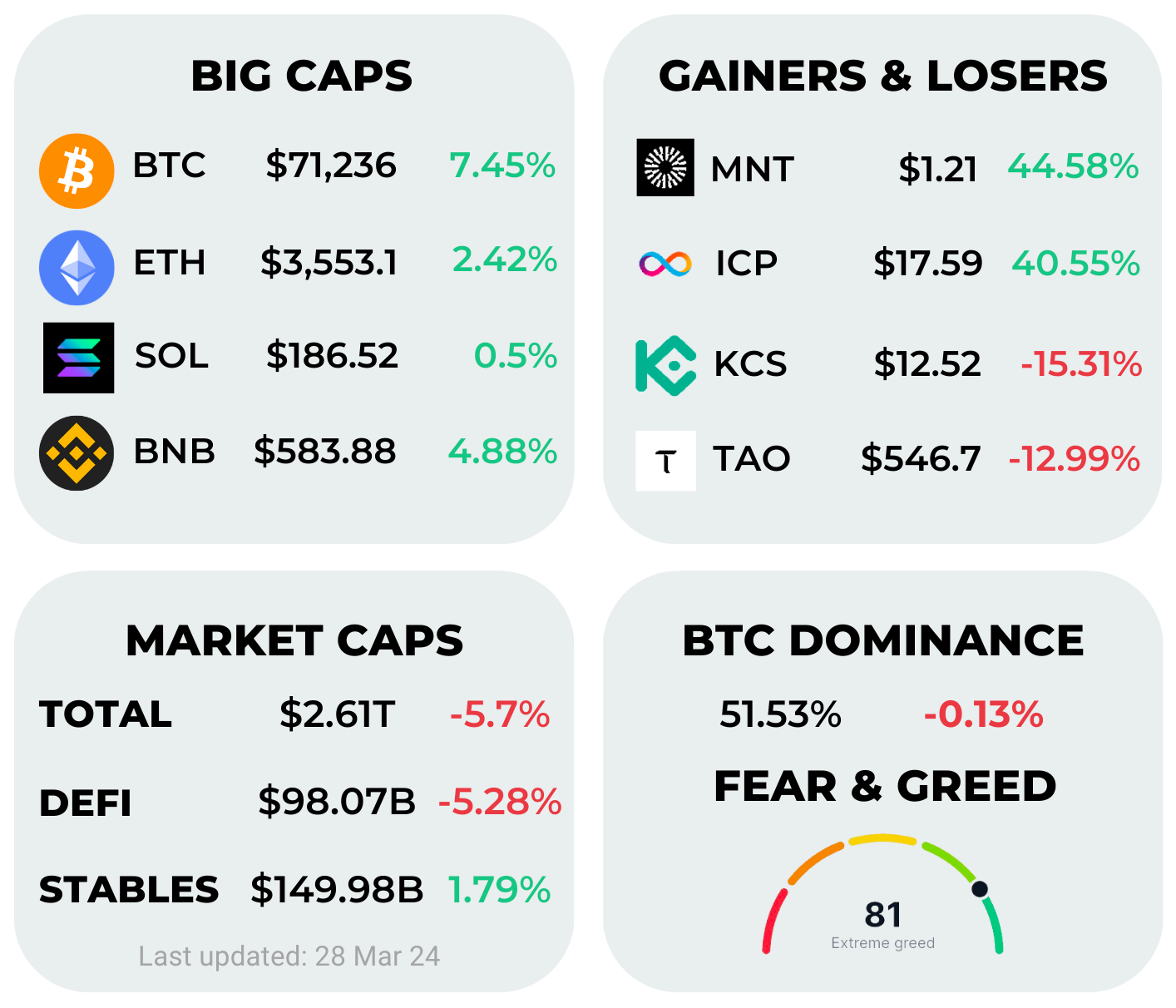

The markets have been pretty chill this week. Bitcoin has bounced back from its dip and is up 7% this week, while ETH has been struggling a bit, with everyone anticipating that the Ethereum spot ETF won't get the green light from the SEC in May. Mantle's MNT has been the star performer of the week, especially since it launched its staking for rewards program, where it will initially be distributing Ethena shards earned by the Mantle treasury. On the flip side, the worst performer is Kucoin's KCS, which, given its legal woes that we'll dive into shortly, is down 15%. The fear & greed index still indicates market greed and a noteworthy observation is the steady rise in the stablecoin market cap, pulling more and more dollars on-chain.

The Stay on-chain wallet has performed well this week. We have a substantial MNT holding, which was the top performer this week, bringing in nice gains. Nevertheless, there is more potential. 😎 We are staking our MNT in Mantle's staking rewards program. Additionally, we have decided to allocate the 80 USDC we had on Aptos to purchase more APT, expanding our L1 exposure. For all the details, head over to the Google Sheet.

Check out Rabby Wallet — the best EVM wallet we use for everything on-chain. Use our referral code to give Stay on-chain a boost. Thanks for the support!

SEC doesn’t like ‘ultra-sound’ money

The judge handling the SEC case against Coinbase has denied the motion to dismiss the case, stating that the SEC has sufficient grounds for alleging that Coinbase operates as an unregistered exchange, broker, and clearing agency. And it argues that, through its staking program, it engages in the unregistered offer and sale of securities. Coinbase and the SEC are set to go to court.

Moreover, the documents highlight the SEC's disapproval of deflationary coins.

Blast suffers $67M exploit

Munchables, a prominent GameFi protocol built on Blast, suffered a $62.5M exploit as 17,500 ETH were drained by a North Korean employee who had access to the smart contracts governing the platform. However, as all bridges out of Blast have been frozen and the official Blast bridge taking two weeks back to Ethereum, the exploiter decided to hand back the stolen funds and a recovery process is now in the works.

Recently, another GameFi protocol on Blast called Super Sushi Samurai suffered the same fate, losing $4.6M to a white-hat exploiter that later returned the funds in exchange for a 5% ETH and 2.5% 1-month vested SSS tokens bounty. In addition, he’s been hired as a tech advisor at the company.

Debunking EU’s AMLR regulations

The European Anti-Money Laundering Regulation (AMLR) made headlines in the past few days, however, the EU is not banning anonymous crypto transactions or self-custodial wallets. Essentially, the AMLR reinforces KYC requisites for exchanges and crypto assets service providers (think of a crypto payment processor, like BitPay). Moreover, there’s an emphasis on the ban of privacy coins from exchanges and CASPs, like Monero (XMR).

While the AMLR regulations do not apply to self-custodial wallets (think Metamask, Ledger), the worrying bit is that going forward you technically won’t be able to pay for goods or services anonymously if the merchant uses a CASP (again, like BitPay) to process payments, but will instead need to identify yourself. Here’s a detailed breakdown by Patrick Hansen.

You know, I’m kind of an artist myself: Marathon Digital mining company mined a Bitcoin block with their logo in it — 𝕏/ord_io

KuCoin is being investigated in the US

The popular cryptocurrency exchange and its two founders Chun Gan and Ke Tang are being accused of allegedly violating U.S. anti-money laundering laws, and implementing bogus KYC practices — making the platform accessible to U.S. customers, even though the exchange didn’t hold the license to do so. KuCoin’s token KCS dropped 25% after the news.

EIP4844 reduced fees, but it’s actually more expensive to use Base: why?

The latest Dencun upgrade made posting Rollup states on the Ethereum mainnet orders of magnitudes cheaper, yet, Base has seen its fees skyrocket and it’s now more expensive than pre-EIP4844 to use it. Base fees consist of the cost of posting the data on the L1 (Ethereum) for security, and in addition the L2 (Base) execution fee.

Whilst the former has been reduced by a lot, the latter went up as the Dencun-frenzy drove up Base activity to levels not seen since September last year, hence creating on-chain congestion and driving up fees. No worries though, a solution seems on the way. TL;DR? Degens landed on Base.

The Artificial Superintelligence Alliance

The three most well-known crypto AI projects are merging their tokens into one. SingularityNET, a decentralized artificial intelligence network; Fetch.ai, a web 3 platform for the AI economy; and Ocean Protocol, a decentralized data exchange platform, have announced the Artificial Superintelligence Alliance.

But what does this mean? They plan to merge their multibillion-dollar tokens—$FET, $OCEAN, and $AGIX—into a single $ASI token. This token will function across the combined decentralized AI network, significantly increasing the scale and power of all three networks. Collaboration benefits everyone they say.

🏦 TRADFI

Larry Fink is surprised at how much Bitcoin has rallied — The Block

21Shares launched TON staking ETP on a Swiss Exchange — The Block

Ondo Finance to Move $95M to BlackRock's Tokenized Fund — Coindesk

Binance charged with tax evasion in Nigeria after detained senior exec escapes — Coindesk

Binance's successor in Russia, CommEx, halting deposits and undergoing phased closure — The Block

SEC delays Grayscale futures Ethereum ETF — sec.gov

High Court orders temporary suspension of Telegram's services in Spain — Reuters

SEC to seek $2B in fines and penalties from Ripple Labs — 𝕏/s_alderoty

London Stock Exchange to launch Bitcoin and Ethereum ETN markets on May 28 — CoinDesk

⛓️ DEFI

Avalanche kicks off liquidity mining incentives for meme coins — avax.network

Arbitrum DAO wants to create a meme coin fund — forum.arbitrum.foundation

Liquity v2 introducing BOLD, decentralized & market-driven stablecoin — 𝕏/LiquityProtocol

eBTC protocol to launch no fee stETH backed Bitcoin loans — 𝕏/eBTCprotocol

f(x) launches $rUSD in collaboration with EtherFi and reaches $45M TVL — 𝕏/protocol_fx

Proposal to launch Mancake as PCS affiliate on Mantle — pancakeswap.finance

Whales market launched its pro version — pro.whales.market

AltLayer launched ALT staking — 𝕏/alt_layer

Celo integrates native USDT — Blockbeats

Ethena introduces ENA token — 𝕏/ethena_labs

🛰️ TECH

The Polygon zkEVM experienced a 10h downtime — The Block

Fantom will leverage Sonic to build a 'shared sequencer' for other chains — X/Fantomfoundation

Ethereum Pectra upgrade will raise the max validator stake to between 32 and 2,048 ETH — The Block — EIP-7251

Aevo teases about creating their own Layer-2 — 𝕏/aevoxyz

Prisma Finance suffered $10M exploit — Cointelegraph

📱 WEB3

Worldcoin eliminates the option of storing user data — The Block

Arbitrum and Azuki are launching an anime-based Web 3 network — The Block

Polygon releases free NFT collection in collaboration with Manifold and Galactic Ribbits — 𝕏/0xPolygon

Crypto Punk NFT #7084 has been sold for $16.42M, marking 2nd largest sale for the collection — 𝕏/SharpeSignals

💰 VC

FTX to sell 2/3 of its Anthropic stake for $884M — 𝕏/News_Of_Alpha

0G Labs launches with whopping $35M pre-seed to build a modular AI blockchain — TechCrunch

Mantle is a stake & chill kind of blockchain. After introducing EigenLayer points for holding mETH on Mantle, they now kicked off a Ethena Shards campaign, where you’re able to farm shards for a month by locking your MNT tokens, and eventually convert shards into ENA tokens. Our quant analyst doing napkin math says that assuming an average of 50M staked MNT tokens throughout this period, and ENA’s pre-market price of ~ $0.75, the return on this is ~ 6.3%, or 76% APR.

Aptos, on the other hand, goes hard with DeFi incentives. Aries just launched a points system, and offers a 22.07% APY on USDC or 13.17% APY on wETH. Cellana, instead, pays you up to 88% APR on stablecoin LPs.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.