BTC breaks $44K, bull market's back?

We stay on-chain, so you don't have to. Get ahead of the curve in 5 minutes.

Welcome to Stay on-chain! Our shiny internet coins seem to have been performing well these past weeks. As a result, we were finally able to quit flipping burgers at McDonald’s and get back to keeping you informed on the latest.

In today’s edition:

Market performance

News roundup

Farms of the week

Meme of the week

Reading time: 5 min

Yes, the bull market has officially begun. Bitcoin has surged by an impressive 14%, overperforming all other major coins, and now comfortably sits above $40,000. The DeFi TVL has also experienced a significant uptick, the stablecoin market cap is increasing, and yields are becoming more attractive. We're back, baby.

The Fear and Greed Index shows extreme greed in the markets. The top performer of the week is ORDI, the platform for Bitcoin Ordinals. The volume of Bitcoin Ordinals is on the rise, and its listings on Binance add to its appeal. On the other hand, DyDx and MKR did not fare well this week. MKR, once highly hyped, and DYDX, which had its largest token unlock last week, both underperformed.

El Salvador boasting BTC profits

El presidente, Nayib Bukele, has finally been able to resuscitate the 𝕏 draft in which he mocks all the media that portrayed the country’s BTC accumulation as a failure. Given BTC’s positive price action in the past few weeks, El Salvador seems to be up 1.83%, or ~ $2M, on their investment. Meanwhile, Michael Saylor is laughing at these rookie numbers, sitting on $2B in unrealized gains.

Telephone game: Max Keiser reports rumors that Qatar’s Sovereign Wealth Fund could scoop up as much as $500B of BTC

Mantle rolls out mETH

Mantle, the L2 network, has recently launched a liquid staking protocol on the Ethereum mainnet. This protocol enables users to deposit ETH and engage in network staking through validator nodes. The non-custodial liquid staking protocol introduces mETH as a liquid staking derivative for ETH stakers, which will probably be available for broad use within Mantle’s DeFi.

Coinbase makes you send money via links

Coinbase, the US crypto exchange, is launching a cool new feature for the Coinbase Wallet. Now, you can send money to others using popular apps like Facebook, Whatsapp, TikTok, or Instagram. It works with a link, it's free and it's borderless. The catch is you need the Coinbase Wallet.

This is crypto in action – quick, cheap, and global transactions. It's a big leap in making the crypto user experience better.

Are ya winning, son? November records highest monthly crypto losses of 2023 so far, with over $343 million lost due to hacks and fraud — The Block

Celo network, yet another Layer 2?

Celo is a Layer-1 blockchain — it shares smart contract compatibility with Ethereum, but it’s a standalone network. Ranking #34 with a mere $110M in TVL, the chain once had over $1B in assets during the past cycle thanks to a mix of juicy stablecoin yields, great user experience, and an innovative approach to micropayments and digital identities. Celo’s developers, falling under the umbrella of cLabs, are working closely with the community to migrate the existing network to a Layer-2 solution in order to join the dominant Ethereum ecosystem. The Layer-2 technology is to be chosen by mid-January, while the migration should take place in July 2024.

Neutron is making moves within Cosmos

Neutron acquired a 25% stake in Confio, a software company known for creating CosmWasm. CosmWasm is the virtual machine that backs Cosmos-based blockchains. Neutron's investment is meant to boost CosmWasm adoption among devs and improve the tech side, focusing on zero-knowledge proofs for privacy and scaling.

Additionally, Neutron has proposed to integrate the Mars app chain into the Neutron chain. The Mars protocol currently holds the position of the largest credit protocol within Cosmos, generating revenue across various chains, particularly on Osmosis. Neutron aims to bring Mars onto its chain to enhance the chain's GDP, offering 3 million per quarter for this acquisition-like integration. This move has sparked discontent from Osmosis, a direct competitor of Neutron.

Lost your job? The French government makes unemployed people go on blockchain awareness courses run by Binance, where if they gain sufficient blockchain awareness they're given an NFT diploma. Really. This is a thing that actually happens — FT

The Bitcoin Ordinals frenzy has returned

Bitcoin Ordinals are back at it. Consisting in metadata inscribed onto the smallest bitcoin unit, the satoshi, they’re rapidly polarizing the public debate. To keep it simple, think of them as NFTs on the Bitcoin network.

Following this principle, they allow you to encode images, timestamps, text, and other types of lightweight files directly on Bitcoin’s Timechain (as Satoshi called it, later renamed to Blockchain).

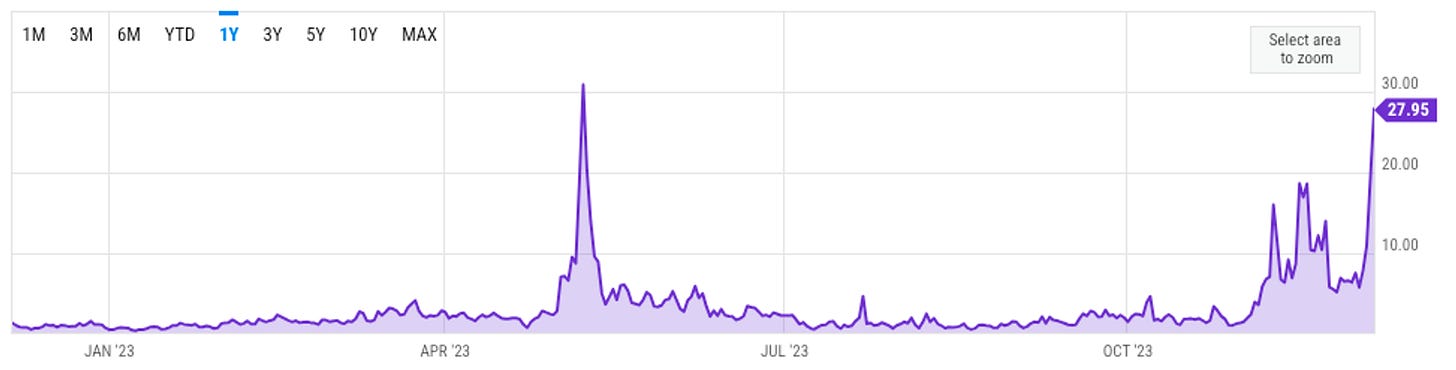

Ordinals experienced their first wave of popularity in May this year, sending Bitcoin fees as high as $30, but the hype was short-lived and only lasted half a month. Months went by, and the hype came back stronger than ever, matching May’s fee levels.

This comes at a (huge) cost for the network in terms of usability, as smaller transactions become prohibitive, and Bitcoin becomes a terrible medium of exchange — pushing further the need for a scaling solution, so-called Layer2. The debate is strongly polarized (see here, and here), but what’s clear here is that the Ordinals frenzy helped surface and highlight some sort of vulnerability (or feature, depending on your stance) — with some individuals going as far as proposing an update that bans inscriptions.

On the speculative side, tokens like $ORDI went from a low of $2.89 in September to December’s $63 all-time high, with a staggering 21.7x return. Others, more recent, like $SATS and $MUBI follow suit. Developers are heads-down building decentralized applications that use the Bitcoin network as their base layer, though the current user experience is years behind Ethereum.

Circle announces open-source protocols to allow USDC transactions reversibility, threatening blockchain’s immutability — 𝕏/jerallaire

Coinbase CEO takes a step back: no plans to launch Base token — Decrypt

EigenLayer to increase staking caps on December 18th — 𝕏/eigenlayer

Worldcoin launches grant program and outlines decentralization plans — The Block

Ark Invest is selling Coinbase and buying Robinhood — The Block

Montenegro plans to extradite Do Kwon to the U.S. — WSJ

Starknet Foundation confirms screenshots of draft airdrop plans, assures users snapshot has already been taken and eligibility cutoff date is fixed — The Block

Telegram’s Ton blockchain suffers technical incident following the release of TON-20 inscriptions — Telegra.ph

JPMorgan Chase CEO Jamie Dimon said he would shut down crypto if he were the government. Twitter Community notes had something to point out:

Ambient, a DEX aiming to solve liquidity fragmentation and gas inefficiency. By interacting with it on Scroll, you’re potentially farming two airdrops at once.

Ekubo, the premier DEX on Starknet. Still tokenless, it gives you the chance to farm two airdrops at the same time as well.

GMX, decentralized perpetual exchange on Arbitrum. Thanks to Arbitrum’s STIP incentives, we’re looking at 49.68% APR on SOL/USDC, and 22.17% on BTC/USDC.

Want more? This section is powered by HFA Research, which covered these farms in-depth, check them out here:

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.