CZ to get out of prison in a month

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

If there’s a word to describe how the market feels right now — it’s jittery. It’s been more than a month since the Ether ETFs, and they’re clearly not following the ‘BTC pattern’ e.g. dump followed by a strong uptrend. However, crypto investment products are seeing their largest inflows in five weeks with $543M in BTC-related ETFs alone.

The sentiment is quite negative, with the F&G hardly going over 50 and sitting at a mere 29 today.

On a bright note, stablecoins supply hit an all-time high beating the past bull market record.

Speaking of macro, Powell finally said the word: “The time has come [for rate cuts]”. The question, though, is whether this is going to be a soft landing or a painful hard landing. Just look at the monthly SPX chart, can it keep going up? Sure, but looks pretty over-extended. Still, BTC’s monthly chart looks more bullish than ever.

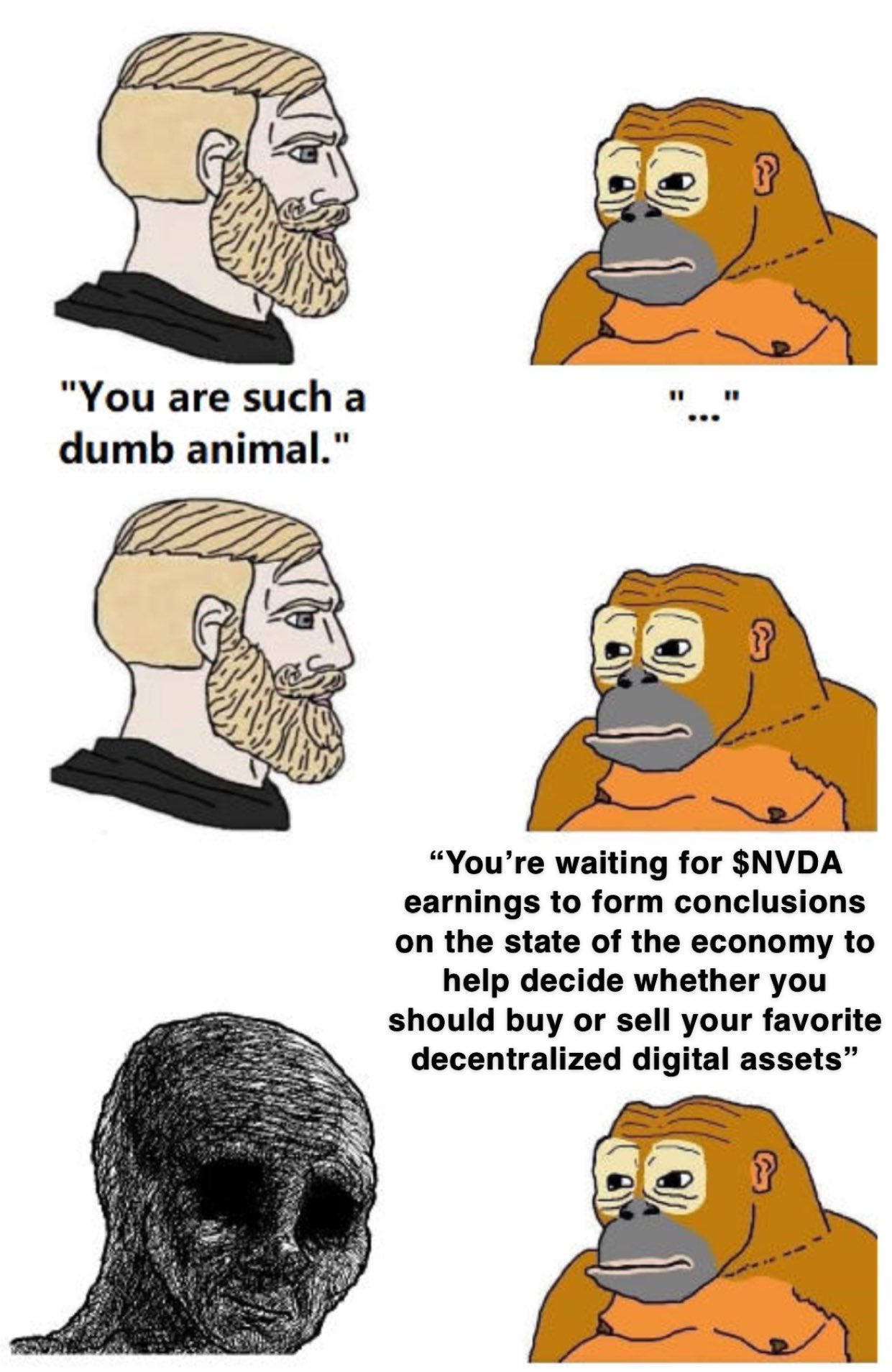

Furthermore, positive NVDA earnings yesterday didn’t really cause a hike in prices — if anything, the opposite, showing levered positions being de-risked on the news (i.e. a proper ‘sell the news’). As we near elections, there could nevertheless be some volatility and noise as odds keep favoring one candidate over another. Generally speaking, the consensus seems that a Trump win will positively affect markets while Harris’ presidency is seen as more neutral, if not negative predicting huge budget deficits for democratic policies.

Telegram’s founder has been arrested

Pavel Durov founded Telegram with his brother Nikolai in 2013 (he’s the one behind TG’s encryption, and later on left to work for the Russian government), and a year later he left his other business VKontakte (Russia’s most-used social network) because of growing governmental pressure. He’s not new to political tensions between his platform and governments, but this time’s quite different: Durov supposedly holds dual citizenship, UAE and French. Durov himself said he was lured into France by President Macron (facing a hard time right now in French politics) to have dinner together, to then be escorted into custody by police as soon as he landed with his personal jet.

The French are indicting him (as CEO) for Telegram’s lack of moderation, and facilitation of sex, drugs, and fraud-related crimes through the platform’s tools. After 96 hours in custody, he’s now been released under special surveillance — even though he’s required to remain in France and post a $5M bail.

As one could expect, TON tanked 40% on the news — with many memecoins on TON created to speculate around the event, with one in particular (REDO) trading higher than $100M mcap. To date, despite a small unrelated outage for TON, Telegram’s been running just fine.

Keep it coming: El Salvador keeps buying 1 BTC a day — Arkham

Ethereum Foundation undergoes drama as $100M yearly budget makes headlines

The Ethereum Foundation is back in the eye of the storm. A $100M-worth ETH transfer made huge headlines (just cut the damn transactions into smaller ones), and brought up debate on how this money is being spent, and if it’s worth it. Exec of the non-profit company Aya Miyaguchi explained how the EF runs on a $100M/year budget. Critics from people like Marc Zeller, governance head of Aave, emerged. On the other hand, people working there defended the huge budget.

Later on, we got a somewhat detailed report from Josh Stark, an EF employee, detailing the spending. Even though they’re not ‘employees’ but rather contracted contributors, the LinkedIn page of the EF says it has 201-500 employees (Vitalik’s pay hovers around $139,000 per year) — Furthermore, 36.5% (~ $36.5M) of the past year budget has been spent on new institutions like L2Beat and others. The Second biggest spending category is ‘L1 R&D’, amounting to 24.9% of the budget.

If anything, there should be more debate around this stuff. Is the budget excessive? Are they spending in an efficient manner? Can Vitalik pump our bags?

CZ to get out of prison in a month

Changpeng Zhao (CZ), the former Binance CEO, has been moved from his prison to the RRM Long Beach halfway house in California — essentially, a residential structure to facilitate the transition back to freedom. Supposedly, he’ll be out on September, 29th (however, he and Binance have been sued again recently). Despite that, he won’t be able to have anything to do with Binance for three years. Pump some coins, CZ?

Record after record: Base activity has been in a steady uptrend since mid-March, now at 4M daily txs — 𝕏/parsec_finance

MakerDAO rebrands to ‘Sky’ and migrates away from DAI and MKR

Part of Maker’s endgame plan, the company is undergoing significant renovations. Starting September, 18 users will be able to migrate 1:1 DAI to USDS, a new kind of decentralized stablecoin aiming to simplify yield strategies by offering in-house solutions on ‘Sky’ rather than having to roam around blockchains to get the best yield. Furthermore, users will also have the option to migrate 1:24,000 MKR tokens to SKY tokens — the reason here might simply be unit bias, so that tokens are perceived as more valuable despite being the same as before, just in a different ratio. To complete it, Maker itself will rebrand to ‘Sky’ changing its whole brand image, website, etc. with other entities built around it (e.g. SparkLend) to be called ‘stars’.

On a sour note, USDS has been built with the optionality to freeze funds (similarly to USDT & USDC, both controlled by centralized entities that comply with regulators). Whilst this function is not enabled by default, it can be enabled by governance at any time. In any case, DAI will keep functioning since it’s an immutable smart contract, and it’ll be up to users whether to keep maintaining it or not.

SEC notifies Wells Notice to OpenSea

Gary Gensler is back at it. With SEC’s fiscal year coming to an end (Sept, 30), it makes to take home as many trophies as possible claiming to be ‘saving crypto’ from fraud — this time, it’s OpenSea’s time. If you asked anyone in crypto, they’d tell you he’s beating a dead horse. OS’s volume is down 90%+ since the past bull run NFT craze, and most of its market share has been passed over to Blur due to them being more reactive to market dynamics and releasing a token.

The SEC is now essentially claiming that OpenSea is selling NFTs that they deem are securities i.e. constitute an investment contract and is communicating through the Wells Notice its intention to press charges on this. The CEO, David Finzer, wrote a post on 𝕏 expressing his disappointment and announcing a $5M fund to cover legal fees of any artists involved in the claims. On another note, the SEC also charged the Earn platform Abra for selling unregistered securities.

Happens on-chain

Aave proposes integrating GHO’s stability module with Blackrock’s BUIDL tokenized fund — The Block

Trump released the fourth drop of his NFT trading cards, realizing $2.17M — The Block

Polygon’s Discord hack resulted in a $145,000 theft of assets — The Block

Crowdfunding platform Echo.xyz launches Arcade machine to multiple prizes (even a Lambo!) — arcade.echo.xyz

Rarible to deploy on Aptos — 𝕏/rarible

Traditional rails

Celsius distributed $2.5B to 251K creditors, 93% of eligible value — The Block

former FTX exec Ryan Salame’s partner Michelle Bond faces up to 15 years in prison over campaign law violation — DLnews

Tether has decided not to pursue launching its own blockchain, citing market saturation and strategic considerations — Bloomberg

Crypto-friendly Robert F. Kennedy JR drops out of U.S. presidential race — Blockworks

China may have banned crypto, but is paying Taiwan spies with it — DLnews

Trumps’ project has been renamed ‘World Liberty Financial’ — 𝕏/worldlibertyfi

Thailand extradites Malaysian fugitive to China over $14B scam — Scmp

Colombia regulator notifies Worldcoin of alleged data violation — CoinDesk

Gate announced a partnership to become sleeve partner for FC Internazionale Milano, one of the most prestigious clubs in Italy and the World — gate.io

Martin Shkreli lost conflict with PleasrDAO over Wu-Tang Clan's unreleased album — apnews.com

Crypto-friendly Wyoming to launch state stablecoin in Q1 2025 — CNBC

Crypto-friendly browser Brave lays off 15% of its workforce — The Block

Executive of Haru, company being prosecuted for stealing as much as $826M from its users, stabbed in court — digitalasset.works

Tech go up

TON blockchain suffered a 6-hour outage allegedly due to DOGS txs, and then another 4-hours long one, now back online — The Block

Story protocol launches testnet, mocking projects teasing it for months — 𝕏/WeileyY

EigenLayer adds support to restake any ERC-20 token — 𝕏/eigenlayer

Sony-backed Soneium testnet goes live — 𝕏/soneium

Echo Protocol’s restaking token aBTC to deploy on Aptos — 𝕏/EchoProtocol_

VCs go brrr

Multi-chain infrastructure project Edge Matrix Chain raised $20M led by Amber and P2 Ventures — The Block

Decentralized Data platform Space and Time raised $20M Series A led by Framework, Lightspeed Faction, Arrington Capital, and Hive Mind — crypto-fundraising.info

Solana restaking platform Solayer raised $12M Seed Round led by Polychain Capital and HackVC — crypto-fundraising.info

Game Trial Xtreme raised $11.17M Seed led by Blockchain Capital and Merit Circle — crypto-fundraising.info

Airdrops

DOGS memecoin on Ton has been launched — CoinMarketCap

Orderly’s airdrop can be claimed and staked — orderly.network

Magic Eden ME token to launch in the next few months, Whales.market opens up pre-market — DLnews

Pair-trading platform Pear campaign announces 6-week airdrop campaign — 𝕏/Pear_protocol

Someone built a constant product to trade Hyperliquid points, currently at ~ $8 — 𝕏/RealDegenGMX

Upcoming events

September, 4: MATIC to migrate to POL

September, 10: Harris and Trump debate leading to presidential elections

September, 10: Optimism Granite hard-fork

September, 18-19: Token2049 in Singapore

September, 20-21: Solana Breakpoint in Singapore

September, 26: Hamster Kombat to airdrop 60% of HMSTR supply — The Block

September, 29: Chengpeng Zhao released from prison

September, 30: Supposed deadline to make $EIGEN transferable

December, 5-6: Emergence conference in Prague

Security first. Aave offers a 9% APY for supplying their stablecoin GHO on Arbitrum 30.19% APY for crvUSD on Ethereum, or 24.3% APR if you stake it on Ethereum (in this case, you risk slashing, hence the higher yield).

The USDY chakra pool on Mantra is currently paying out an astounding 456.64% APR. On top of that, you’ll get 5.35% in USDY yield. Note that here your deposit is locked until Mantra launches its mainnet, and rewards are bound to be diluted over time as more people join the pool.

Good ol’ Avalanche: secure a 20.45% APR providing liquidity for the USDT/USDC pair on TraderJoe

Fell in love with JLP? Storm.trade offers SLP, similar to JLP but on the Ton Blockchain, averaging a 45.49% APR on your USDT.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.