DeFi's coming to Bitcoin

Mastercard & Amazon strike new partnerships in the space, and bank failures continue while BRC-20 assets are now available on the Bitcoin network.

Reading time: 6 minutes

Welcome to Stay on-chain! Today, we'll document the happenings that defined the DeFi industry over the last week. Don't forget to subscribe below to get the next issue of the newsletter delivered straight to your inbox!

In today’s edition:

Market performance

Weekly news round-up

Upcoming catalysts

One tool you should try

Further readings

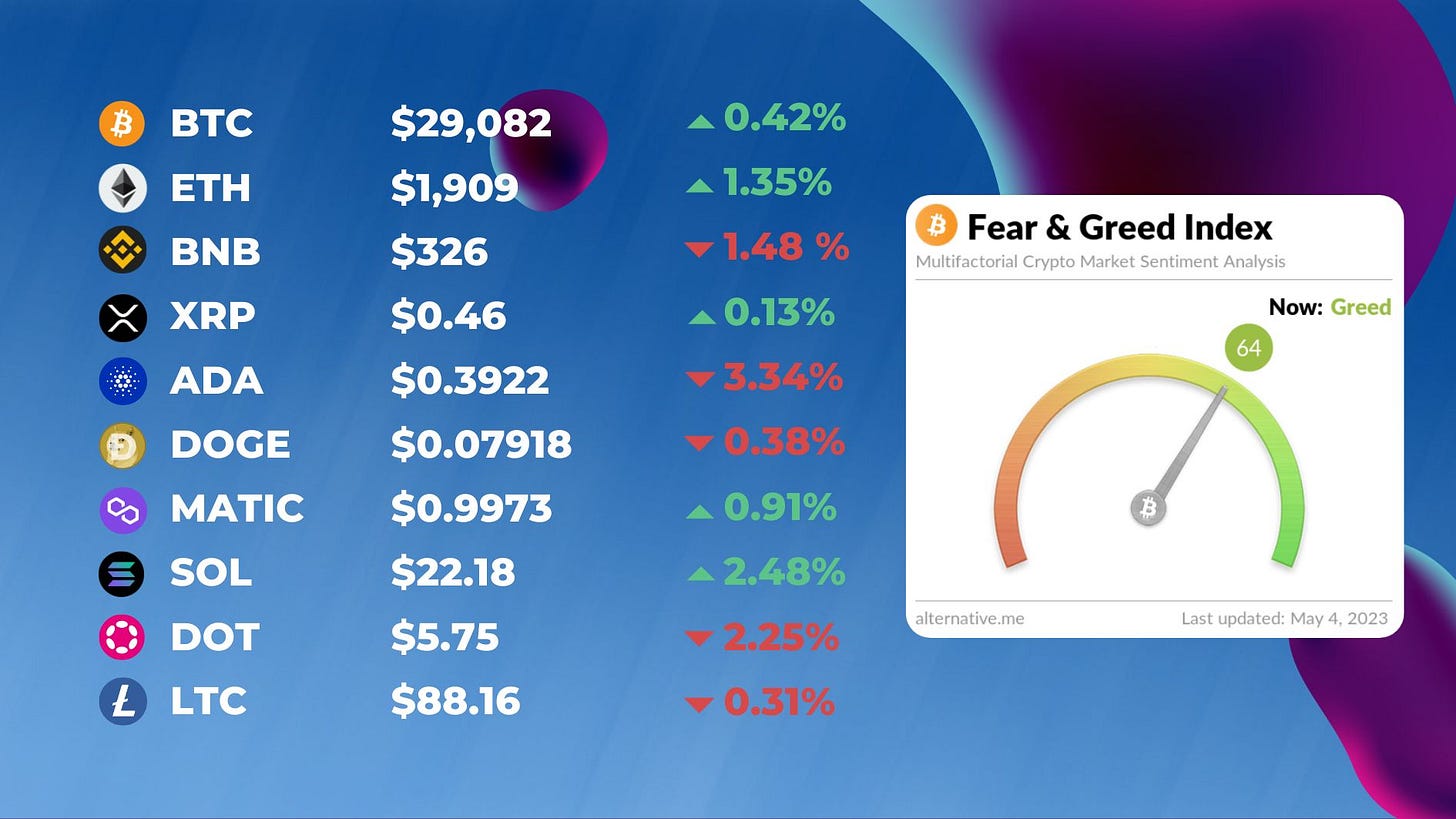

Market performance 🏄🏼♂️

If you haven't been keeping up with the markets, here's a summary of what happened during the past week:

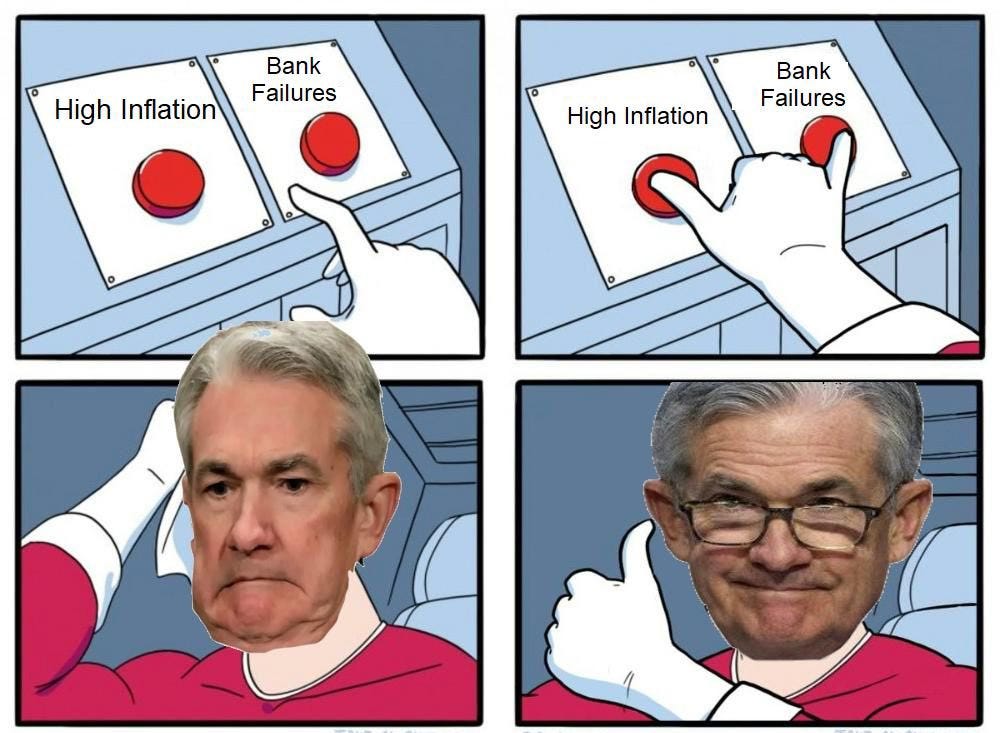

Abstract of Powell’s speech at yesterday’s FOMC after raising interest rates by 25bps:

Weekly red pills for you 💊

Mastercard launches Crypto Credential service partnering with Solana, Polygon, and others

Mastercard has launched a Crypto Credential service designed to verify and ensure compliance between users' wallets in cross-border transfers of digital assets. The new service, called Mastercard Crypto Credential, uses a set of common standards for attestation of interactions and technology from CipherTrace, the blockchain analytics platform that Mastercard agreed to acquire in late 2021. The initial project will enable transfers between the U.S. and Latin America and the Caribbean corridors, with more use cases to follow, such as non-fungible token (NFT) transactions. To support this, Mastercard is partnering with public blockchain network organizations Aptos Labs, Ava Labs, Polygon, and the Solana Foundation.

Blend, a Collateralized Lending Protocol for NFTs

Blur, a platform for NFTs, has launched its collateralized lending protocol called Blend. The platform allows users to borrow against their existing NFT holdings and pay back the loan over time. Blend offers a new way for users to access liquidity without selling their valuable assets, which is particularly useful for those who believe their NFTs will appreciate in value over time. The launch of Blend is a significant development for the NFT market and has garnered attention from the NFT community, with some praising it as a major development, while others remain cautious. Regulators have been called on to protect users against potential scams and frauds associated with the new product.

Circle’s USDC shifts paradigm for cross-chain transfers

The company, which holds strong ties with Coinbase, has just released its Cross-Chain Transfer Protocol (CCTP). Already available on Ethereum and Avalanche thanks to the integration with numerous bridge solutions, USDC can now be burned on the origin chain and then minted on the destination chain. Until now the approach was an inefficient mint-and-lock, needing expensive liquidity pools to always guarantee liquidity. This further fortifies USDC’s presence in DeFi, allowing for greater and faster influx of capital. Read more here.

Curve’s stablecoin crvUSD launches

Yesterday, Curve Finance launched its crvUSD stablecoin on the Ethereum mainnet. The contract has minted $20m in crvUSD tokens within five minutes. The token is overcollateralized and backed by crypto assets. The supply will be controlled by a mint-and-burn mechanism similar to MakerDAO’s DAI or Aave’s forthcoming GHO. Curve’s stablecoin differs from competitors in its lending-liquidating algorithm called LLAMA, which constantly rebalances users’ collateral as crypto prices fluctuate, offering a smoother, continuous liquidation process. The collateral is stored in an automated market maker pool, providing liquidity for trading. The crvUSD stablecoin won’t be accessible to the public until later as it is not yet integrated into Curve’s user interface.

Bitcoin’s network hits daily transactions ATH thanks to Ordinals-mania

The network reached 682,000 daily transactions on May 1, recording an all-time-high fueled by Ordinals: thanks to the SegWit (2017) and Taproot (2021) Bitcoin Core updates, Casey Rodarmor found a way to inscribe metadata into individual satoshis de-facto making them non-fungible assets. Using compatible wallets, users are now able to inscribe data such as text, images, and videos — with the only requirement of not exceeding 4MB, which is the limit size for each individual block. This allowed the creation of NFTs collections, but also BRC-20 tokens that emulate the functionalities of Ethereum-based tokens. NFTs aren’t a novelty on Bitcoin, but this is the first time they’re being added on-chain rather than using Layer 2 solutions like Stacks. The system is still in its infancy and can hardly be considered user-friendly to use, but shows an interesting use case of Bitcoin’s block space; in the meantime, some BTC maximalists see it as a waste of resources, and Litecoin devs try to emulate the solution. Read more here.

Pancake swap reducing rewards to 4%

The native token of PancakeSwap, CAKE, has dropped by 20% over the past week following a proposal to reduce its inflation rate from over 20% to around 4%, resulting in stakers receiving considerably fewer rewards for staking the token. While this proposal is technically beneficial for the ecosystem, stakers are finding it difficult to ignore the immediate impact on their returns. The proposal was introduced due to flaws in the project’s underlying tokenomics, which required new funds to be introduced frequently to maintain the token's price. CAKE is widely held among BNB Chain users, and further shifts in sentiment could have implications for the chain itself.

Coinbase launches international perps

Coinbase has launched its international perpetual futures exchange, starting with Bitcoin and Ether derivatives. The new platform, called Coinbase International Exchange, will allow users based in eligible jurisdictions outside of the US to trade perpetual futures with up to 5x leverage. The exchange will be located in Bermuda and will be run under the regulatory framework of the island. Coinbase has partnered with external market makers to provide liquidity and a liquidation framework that "meets rigorous compliance standards." This move by Coinbase comes amidst the uncertain regulatory environment in the US and is seen as an opportunity to fill the gap left by fallen rivals like FTX. Read more here.

Moooore stuff for you

Crypto VCs to fund ChatGPT an additional $300M (TechCrunch)

Kingdom of Bhutan has been HODLing BTC since $5K, and looks to invest more (Bloomberg)

OPNX reprimanded by Dubai regulators (CoinDesk)

Wholesome reaction to Tornado Cash developer release (Twitter)

Cronos is on a partnership spree, most notably with AWS and Samsung

Balaji loses its $1M bet on US Dollar hyperinflation (TheBlock)

CertiK downgrades the rating of Merlin DEX from 90 to 38 after it Rugpulls (DLnews)

Future events you should keep in mind

The unemployment rate is scheduled to be released tomorrow, May 5th.

The CPI (YoY, MoM and core inflation) will be released on May 10th.

The European Commission will publish the Digital Euro proposal in May.

Bitcoin’s halving is a year away!

Hong Kong releasing Crypto & BTC framework in May.

IRS is looking to issue crypto tax guidance in about 12 months.

Tools you should try

In today’s newsletter, we will introduce you to DeBank!

DeBank is one of the best portfolio-tracking tools in the DeFi space. With DeBank, you can easily monitor your DeFi investments and keep track of their performance over time. It allows you to track all your wallets, their holdings and transaction history in a very user-friendly way. One particularly interesting feature of DeBank is the tracking of whales’ wallets. Whales are individuals or organizations that hold large amounts of crypto. Their trading and investment activity can have a significant impact on the overall market. DeBank allows you to monitor your favourite whales in real time, providing you with market insights and potential new market trends.

Learn from great minds

Noah Smith on the banking crisis and the First Republic Bank’s collapse

CrypoCred’s new article: How to use leverage effectively and safely when trading crypto

See you next Thursday!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.