Ledger has a 'Backdoor'? Tether buys BTC with profits

Never a dull week in crypto. Ethereum fails to finalize blocks, Binance faces regulatory issues and Solana sees increased activity.

Reading time: 5 minutes.

Welcome to Stay on-chain! In this edition, we'll cover the latest happenings in the world of decentralized finance from the past week. Don't miss out on the next issue of the newsletter — subscribe below and get it directly in your inbox!

In today’s issue:

Market performance

Weekly news round-up

Upcoming catalysts

One tool you should try

Further readings

Ledger launches Recovery: the right path to mass adoption?

Ledger, the most prominent Hardware wallet company, announced the soft launch of its Recovery service on their Nano X device, saying it might be made available on other devices as well in the future. Recovery lets users re-gain access to their seed phrase in the case of losing it by going through a meticulous and lengthy KYC (know your customer) process — in simpler terms; you’d be linking your identity to your crypto wallet, creating a sort of social login to access your funds. The service has yet to be launched and will cost $10 monthly. Fear and doubt spiked among the community, scared of the company’s ability to manipulate users’ seed phrases with a firmware update, arguing how this could mean Ledger now has a backdoor jeopardizing its security model. On the other hand, Ledger executives promptly tried to tackle any doubts by explaining in-depth how the system works, assuring that the seed phrase actually never leaves the device in its plain form but is instead encrypted into three different shards using Shamir’s secret sharing and sent to three companies in different jurisdictions (Ledger, Coincover, EscrowTech). The shards could then be decrypted only on a Ledger device after verifying one’s identity. Read more about Ledger Recovery from their CTO here, while here you can find some counter-arguments.

Tether expands its Bitcoin holdings with 15% of profits

Tether, the issuer of the most capitalized stablecoin USDT, has announced that it will use up to 15% of its operating profits to buy Bitcoin, following the revelation that it already holds Bitcoin in its reserve portfolio. Paolo Ardoino, the CTO of Tether, emphasized that the decision aligns with their strategy of diversifying reserves and that the company has no plans to sell its Bitcoin holdings. As of March 31 (end of Q1), Tether owns $1.5 billion worth of Bitcoin, positioning itself as one of the largest Bitcoin holders. Despite Tether's success, it still faces criticism for lacking registration with the SEC and for previous legal battles, including allegations of misrepresenting reserves and using falsified documents.

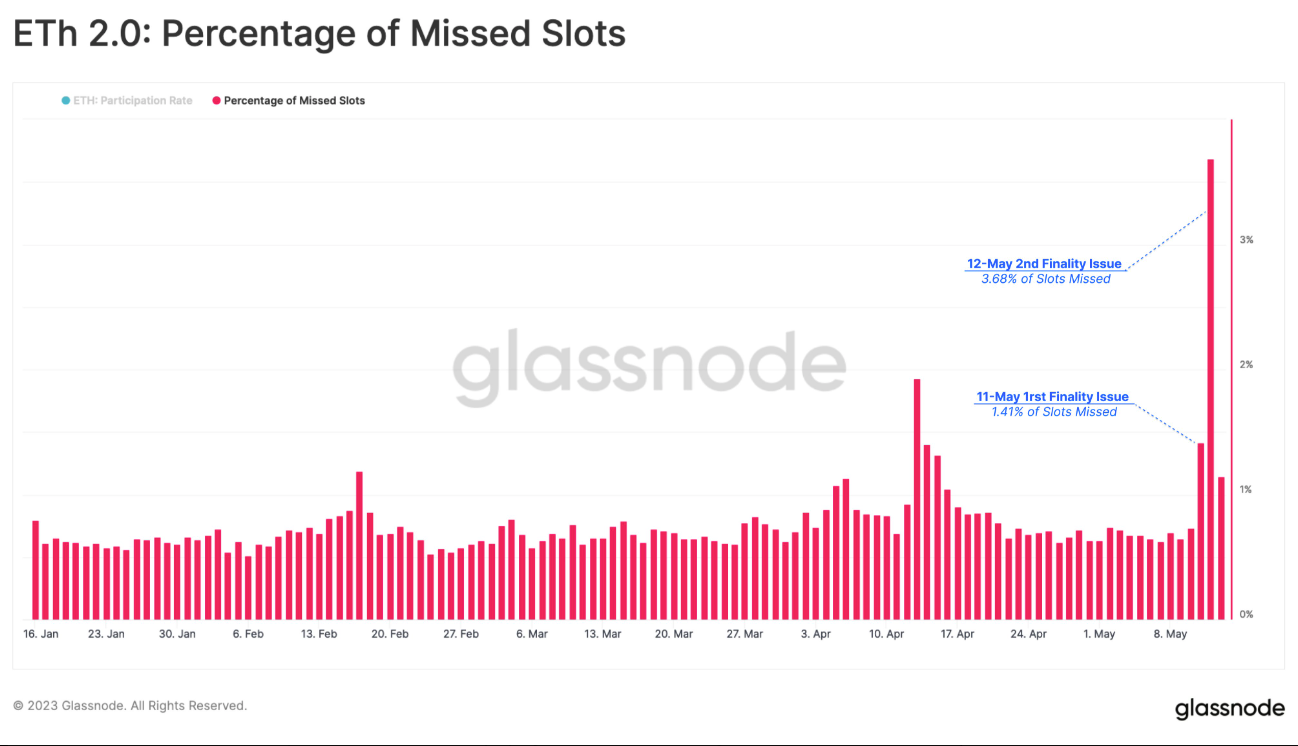

Ethereum suffers finality issues, twice

The beacon chain experienced two incidents of finality disruption this week, with the first lasting 25 minutes and the second over an hour. However, end users did not encounter transaction issues. The Ethereum Foundation stated that client diversity played a role in resolving the problem, as not all clients were affected. Offchain Labs published a Post-Mortem, and a summary can be found here. The response from the Ethereum community is seen as positive for the blockchain's development, though it highlights that the beacon chain is still a work in progress. Ethereum developers have released software updates for the Prysm and Teku clients to address the recent finality issues on the Ethereum beacon chain. The patches aim to restore stability to the network.

Binance exits Canada

Binance, the cryptocurrency exchange giant, is exiting the Canadian market, succumbing to the country's tightened regulations. The Canadian Securities Administrators (CSA) has implemented stringent rules, including new preregistration undertakings and restrictions that have made the environment untenable for Binance. The crux of the issue lies with CSA's stance on stablecoins and investor limits. Binance has advised its Canadian users to close their positions by September 30, 2023, as they will be transitioned to liquidation-only mode from October 1, 2023. However, Binance remains hopeful for a more balanced future regulatory framework. Meanwhile, exchanges like Kraken have committed to staying, offering Canadian crypto enthusiasts viable alternatives. As of now, CSA lists 11 authorized platforms for Canadian users.

The FED’s first steps towards CBDCs?

The Federal Reserve's upcoming instant payment service, FedNow, will be connected to Metal Blockchain, allowing Metal users to convert funds to stablecoins and back instantly. FedNow is a round-the-clock, near-instant payment system developed by the US Federal Reserve, filling the gap for instant domestic payments. Metal Blockchain, developed by Metallicus, focuses on providing compliance-friendly options for decentralized finance (DeFi) users, emphasizing Bank Secrecy Act (BSA) compliance. Metal's integration with FedNow prepares banks for potential CBDCs and bank-issued stablecoins, but Metallicus dismisses these concerns. Instead, the Governor of Florida, Ron DeSantis, proposed a law to ban CBDCs.

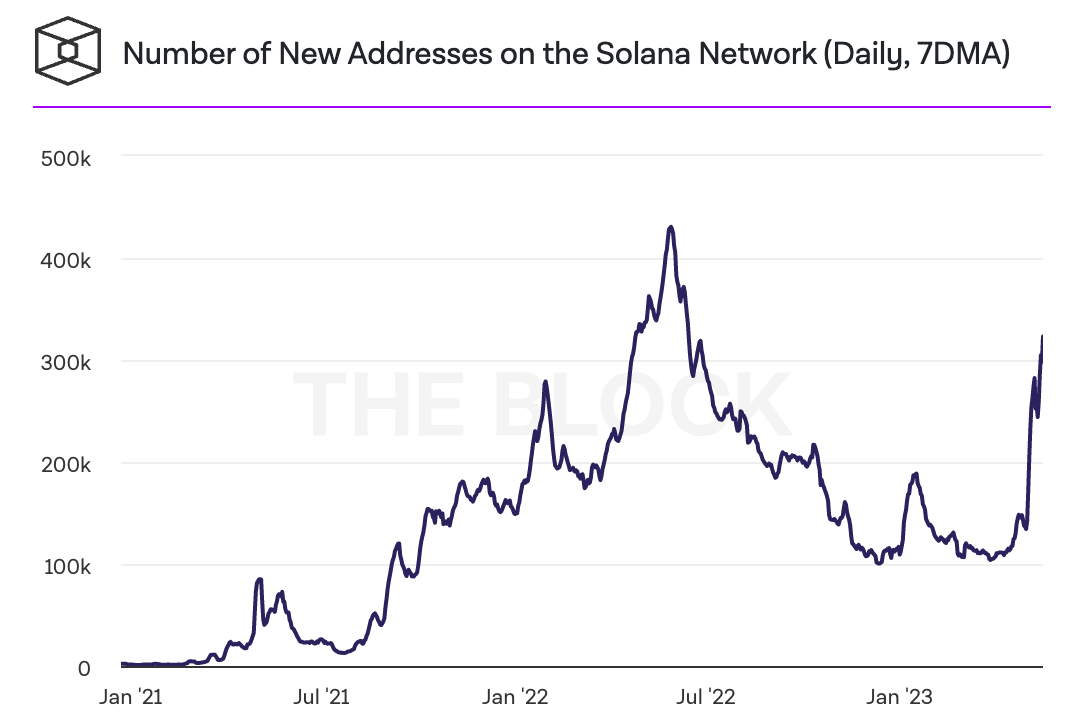

Surge in Solana new addresses as Ethereum and Bitcoin fees rise

Solana is experiencing a surge in new users as transaction fees on Ethereum and Bitcoin reach high levels. The average number of new daily addresses on Solana has reached its highest level in nearly a year, with the seven-day moving average hitting 304,640 on Monday. This increase in new addresses has already surpassed the number seen in the entire month of April. The rise in Solana's popularity could be attributed to the rising fees on Ethereum and Bitcoin and concerns over Ethereum's network issues. Despite past challenges, Solana's native token, SOL, has significantly recovered this year, rising 109% year-to-date.

Will Celsius stETH withdrawals impact the market?

Lido, the leading DeFi protocol and Ethereum's largest staking entity launched its v2 version, introducing staked ETH withdrawals and expanding its validator set.

According to Dune Analytics, there are a total of 442,000 stETH in the withdrawal queue from 141 requests, valued at around $808 million. Celsius, the insolvent CeFi lender, is responsible for the majority. Celsius has initiated the withdrawal process for its Lido Staked ETH, requesting the withdrawal of 428,084 stETH in batches of 1,000, as per transaction data. The total value of the withdrawal request is approximately $784.7 million (based on current prices). Will Celsius proceed to sell the unstaked ETH amount to repay its creditors?

..We couldn’t cover everything

UK Treasury Committee says crypto trading is akin to gambling and thus not subject to capital gains tax — link

Metamask updates its ToS — link

Trezor skipped a firmware version as some devices were compromised — link

MEXC referrals can see sub-affiliate trading data — link

LayerZero and ImmuneFi launch the largest crypto bug bounty program with up to $15M in rewards — link

Dogecoin’s daily transactions peak at 720,000 as inscriptions gain traction on the network

Optimism plans to execute ‘Bedrock’ update on June 6

Litecoin halving at the end of July

In today's edition, we are excited to introduce you to one of the simplest yet incredibly useful tools: Coin Market Cap.

Coin Market Cap is a highly popular website (and mobile app) providing comprehensive crypto information. The platform tracks crucial metrics such as market capitalization, prices, trading volumes, etc. Furthermore, it offers real-time updates on the rankings and performance of the asset in the respective crypto sectors. Coin Market Cap enables users to explore and study a vast array of cryptocurrencies and their associated projects while also providing the ability to monitor them using both real-time and historical data. It’s a reliable source of news, insights, and educational material, making it an indispensable tool for cryptocurrency enthusiasts.

Jordi Alexander (known CT game theorist, poker player turned quantitative trader, and founder of Selini Capital) on Trading, Macro-fundamentals and Balaji’s Bet.

Ram Ahluwalia on market liquidity

The stablecoin trilemma by Thor Hartvigsen

A comprehensive guide on safely storing your crypto.

And that’s a wrap! See you next Thursday!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.