Ethereum gears up to dominate 2024

We stay on-chain, so you don't have to. Get ahead of the curve in 5 minutes.

Welcome to Stay on-chain! As always, we've got your back. We've wrapped up the market research for you, so settle in, cozy up near your Christmas tree 🎄, and let us be your eyes and ears in the crypto world!

In today’s edition:

Market performance

News roundup

Extra content from great minds

Farms of the week

Venture Capital

Meme of the week

Reading time: 5 min

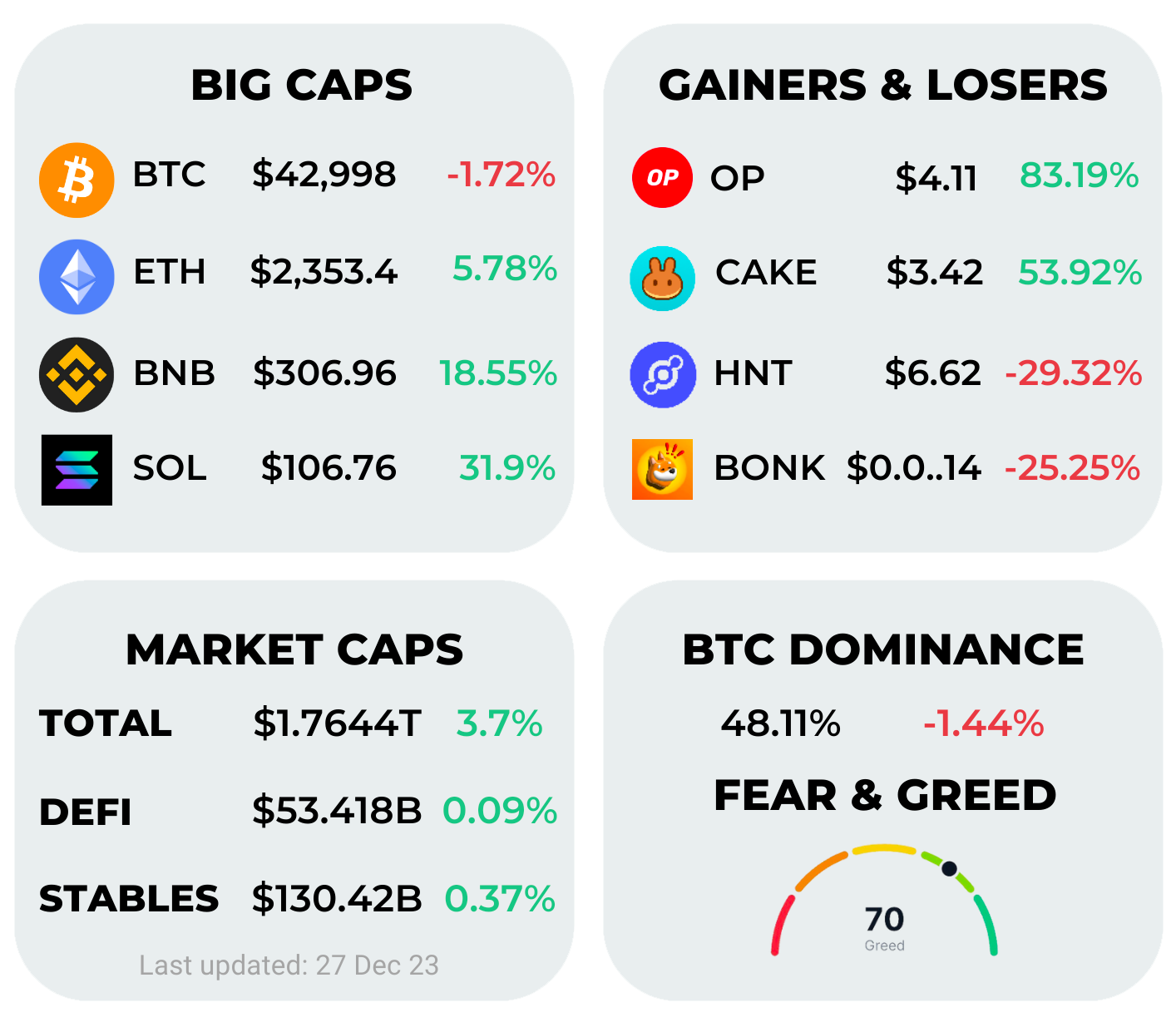

Even during the Christmas week, market prices didn't take a break. While Bitcoin experienced a slight cooldown, other altcoins surged significantly, with Ethereum putting up a strong performance. Could this mark a bottom for the ETH/BTC chart? BNB also showed impressive gains, and rumors suggest CZ's wealth has grown by several billions this year, despite negative news surrounding Binance and his public image.

Altcoins are gaining momentum, causing a decline in Bitcoin dominance. This might be signaling the start of an alt season. The top performer is OP, the Ethereum scaling solution, boasting an impressive 83% gain. On the other hand, BONK, the Solana meme-coin, retraced and closed with a 25% decline. And the Fear and Greed Index indicates a greedy sentiment in the markets.

Solana — $127, on-chain records, and Paxos stablecoin

Solana is currently making waves on various fronts. Beyond its remarkable price surge, reaching the YTD all-time high at $127, the on-chain metrics are equally encouraging. The network has set new records for monthly new and active addresses, showcasing its growing user base.

Another trend worth mentioning is Solana protocols transitioning from over 70% closed source in mid-2021 to over 85% open source now, highlighting a significant shift toward transparency.

Additionally, Saga phones, bundled with BONK and other airdrops, continue to fetch four-digit prices on eBay.

Solana's stablecoin ecosystem is expanding rapidly. A significant development comes with Paxos, a major stablecoin issuer, securing approval from a New York regulator to extend its operations to the Solana blockchain. Previously confined to Ethereum, Paxos is set to launch USDP, a USD-backed stablecoin, on Solana to the public on January 17th.

Ads reap casualties: A malware script used phishing campaigns on Google searches and Twitter ads to steal approximately $58 million through wallet drainers from more than 63,000 victims in nine months, according to Scam Sniffer.

Ethereum’s Dencun upgrade ushers in the new year

The long-awaited mainnet upgrade has a soft target for the end of February, while the Goerli testnet should see the upgrade on January 17 already.

Dencun is set to implement “proto-danksharding”, a way to increase capacity for data storage on mainnet reducing Layer-2s fees and scaling the blockchain.

The upgrade announcement has been welcomed with euphoria by the markets, with the whole Ethereum ecosystem and its Rollups experiencing positive price action after several weeks passed under Solana’s shadow.

Will the first quarter of 2024 be Ethereum’s moment to shine?

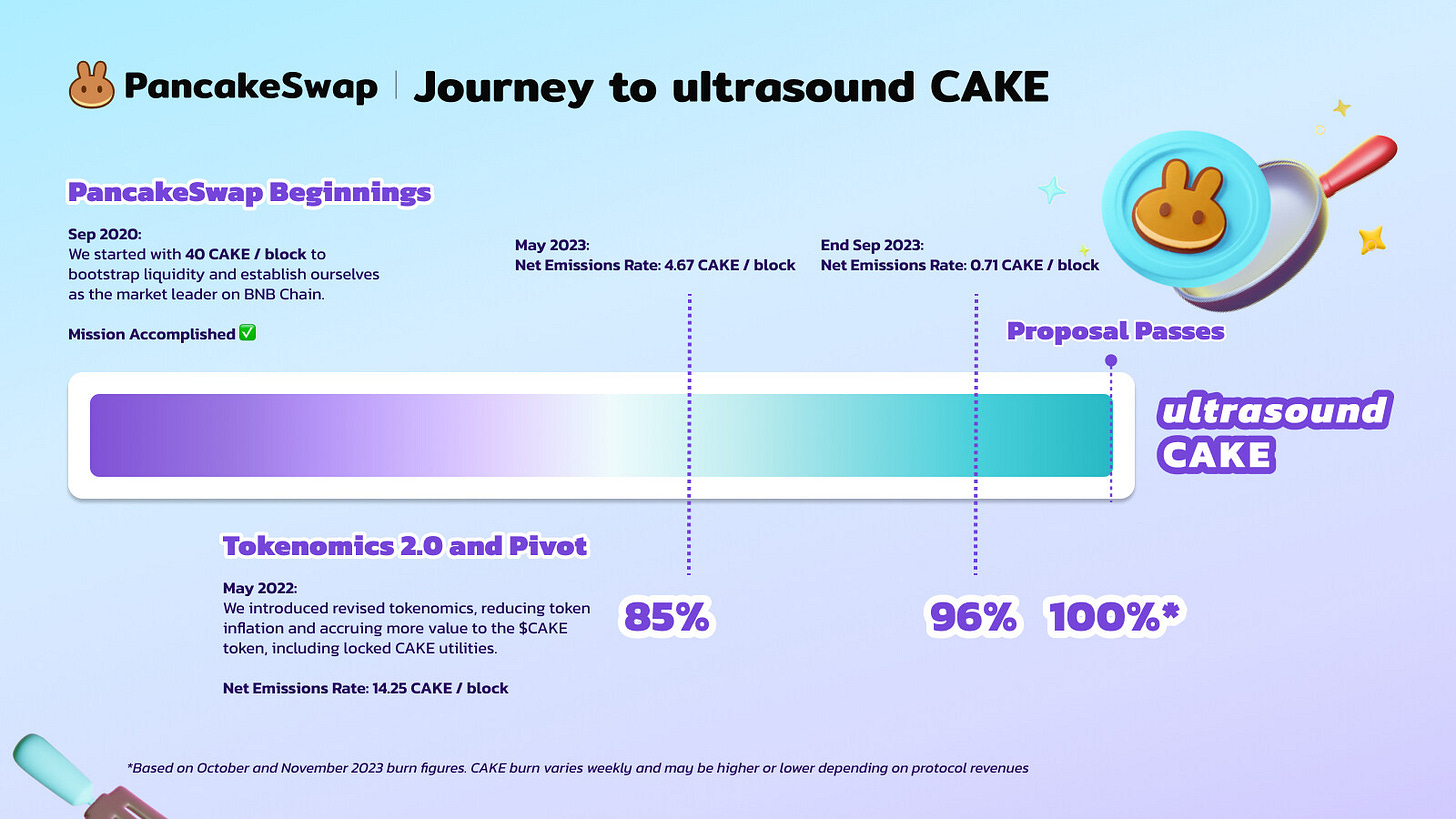

PancakeSwap’s path to ultrasound CAKE

The leading decentralized exchange on the BNB Smart Chain has already implemented several tokenomics adjustments in order to foster healthy and sustainable development for its governance token, $CAKE — including the $veCAKE gauges system recently.

Nevertheless, the DAO now aims to reduce the total supply from the 750M figure to a much smaller 450M, with a current circulating supply of 388M — claiming the buffer left will be enough to enhance development across new chains and sustain the $veCAKE model.

The Chef’s end goal is to shift PCS from its original hyperinflationary model that kickstarted liquidity mining incentives back in the day to a more sustainable deflationary model, with markets cheering with a 10% increase in the price of $CAKE.

Let’s settle in bitcoin! Argentina has approved contracts that can be settled in Bitcoin, along with other cryptocurrencies and commodities such as beef or milk, Foreign Minister Diana Mondino said.

Thunder Terminal got exploited for $192k

The on-chain trading platform Thunder Terminal faced an exploit, resulting in the attacker moving 86.5 ETH (equivalent to $192,000) to Railgun, as reported by ZachXBT. The exploit occurred through withdrawal requests, considered authorized due to leaked session tokens.

Thunder assured users that no private keys were compromised, clarifying that only 114 wallets out of 14,000 were affected. The attacker instead contested Thunder's statements, claiming to hold user data and demanding 50 ETH for its deletion. Approximately 86.5 ETH and 439 SOL (worth $47,800) were lost, but Thunder committed to full refunds, 0% fees, and $100k in credits for affected users.

It’s been a broken Christmas for zkSync

Shortly after the last outage that lasted about 15 minutes, zkSync Era experienced another one lasting roughly 2 hours on Christmas day.

The incident has been reportedly due to excessively defensive safety procedures put in place at the Network’s genesis, which prevented transactions from being processed in a timely manner until an upgrade was pushed to fix the issue.

Etherscan introduces multi-chain portfolio, with 19 mainnet chains tracked in a single interface — 𝕏/etherscan

Sources close to the matter say recent guidance from SEC officials is that a green light for the BTC spot ETF will likely come by January 10, 2024

Bulgaria ends investigation into crypto lender Nexo, finding no criminal activity — The Block

MicroStrategy has purchased another 14,620 bitcoins — MicroStrategy

Barn Bridge DAO agrees to stop offering crypto bonds — SEC.gov

Solana Mobile mismanages Saga inventory and cancels an undisclosed amount of orders — The Block

Dolomite introduces vote-enabled ARB, $vARB, usable both as collateral and to exercise governance rights — 𝕏/Dolomite_io

Mt. Gox, the Japanese defunct exchange, has started sending out repayments to its creditors over Paypal using JPY after a decade-long bankruptcy process

An insightful article on the crypto-macro situation by Arthur Hayes.

A great Bitcoin explanation by Peter Van Valkenburgh.

Camelot is one of the largest DEXes on Arbitrum, and with STIP incentives still underway one of the best places to earn a yield on your tokens. ARB/ETH currently provides 240.72% APR, whilst ARB/USDC a 429.92% APR; since these are concentrated LP pools, consider using Gamma for automatic rebalancing.

Vivacity Finance is an RWA-focused lending protocol on Canto, offering a staggering 46.81% APY on Canto’s stablecoin $NOTE.

Kelp DAO is a liquid restaking protocol that leverages EigenLayer. You can deposit LST tokens to earn both EigenLayer points and Kelp miles, making it a great way to gain exposure to EigenLayer’s airdrop.

Celestia’s $TIA token is certainly an inflated term within the crypto ecosystem right now. Yet, the upside potential seems to justify so — their huge ecosystem, using Celestia’s Data Availability service, includes many token-less projects that are rumored to be planning to airdrop tokens to $TIA stakers following the Cosmos’ airdrop ethos. Hence, staking some $TIA seems quite an asymmetric bet.

Arkon Energy raised $110M in a round led by Bluesky Capital. Description: creating renewable microgrids powered by solar energy for remote areas and businesses, aiming to provide reliable and sustainable electricity while fostering local economic growth and environmental conservation.

Medallion raised $13.7M in a Series A round led by Dragonfly and Lightspeed faction. Description: direct-to-fan sales and marketing platform designed to empower musical artists to cultivate and monetize their fan base.

Addressable raised $6M in a round led by Bitkraft. Description: web3 marketing startup helping web3 marketers to gather data from social media accounts and wallets and matches the information based on similarity to build more accurate audience profiles to target.

Eclipse Fi raised $1.90M from Big Brain Holdings, rarestone, and others. Description: modular multi-chain launch protocol built on Cosmos, specializing in token launches and liquidity solutions for projects.

analoS raised $1M from Gotbit Hedge Fund. Description: MEME coin of the Solana ecosystem, and its name means Solana in reverse order.

Want to know more? Head out to Crypto Fundraising to get real-time investing data.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.