FTX to liquidate $3.4B crypto holdings

Whilst Metamask launches Snaps, unleashing the wallet's potential

Whilst everyone else was partying at Hayes’ event after RWA-packed conferences at Token 2049 in Singapore, we were in the trenches curating the best news for you, fren.

In today’s edition:

MakerDAO’s next steps with T-Bills

PayPal’s off-ramp service

Metamask on the path to becoming an all-in-one Web3 app

An insight on FTX’s plan to liquidate their crypto holdings: should you worry?

Reading time: 5 min

MakerDAO’s next steps with T-Bills

MakerDAO contributors propose a $100M allocation for exploring tokenized U.S. Treasury Bills.

Steakhouse and Phoenix Labs, in collaboration, have proposed to MakerDAO to allocate up to $100 million from its reserves for the development and experimentation of tokenized U.S. Treasury Bill (T-Bill) products. The two firms argue that this move could bring transparency, simplified accounting, and reduced complexity to MakerDAO's investment strategy, potentially offering faster redeemability for stablecoins than traditional fiat methods. However, they also acknowledge the potential for increased counterparty risk in on-chain tokenized T-bills. The proposal is currently under discussion.

It's now well known that the DeFi sector sees real-world assets (RWAs) as a growth area. MakerDAO exploring tokenized T-Bill is not the only one. Other major players including Coinbase, Circle, and Aave Companies have formed the Tokenized Asset Coalition (TAC) which has the goal of bringing RWAs on-chain.

Did you know? Tether is ranked #22 in global buyers of US T-Bills.

Paypal is adding an “off-ramp” service

The payment giant enabled customers to purchase crypto long ago. Now instead, it’s introducing an “off-ramp” service, that allows users to effortlessly convert crypto into US dollars. Crypto wallet users will be able to directly convert their crypto holdings into USD within their PayPal balance, facilitating shopping, sending, saving, or transferring to their bank. The service will be available on wallet providers, dApps, NFT marketplaces and is already operational on MetaMask.

Additionally, Web3 merchants can utilize this integration to access robust security controls and tools for managing fraud, chargebacks, and disputes.

Fun fact: someone at Paxos fat-fingered a Bitcoin transaction, and paid 20 BTC in fees to transfer about $200 BTC. Read more here.

Metamask Snaps: superpowers to your wallet

The world’s most popular Web3 wallet has recently introduced Snaps: a novel way for users to unleash a whole new set of features and functionalities. Currently in Open Beta (i.e. accessible to everyone!), the update lets you discover third-party extensions — think of them like browser extension — that allow you to use Metamask on non-EVM chains (Cosmos, Algorand, Mina, Tezos etc.), get deeper insights on transactions, enhance your on-chain identity, customize notifications, and much more.

Possibilities are endless, but security is not forgotten: Snaps are running in a sandboxed environment (meaning they cannot interfere with usual Metamask operations), and are audited by Metamask itself and third parties — going forward, they plan on opening up to everyone to create a fully permissionless platform. Whilst this is a ground-breaking update, you won’t have to use Snaps if you don’t want to, and you’ll anyways get notified about any permission you’re granting to the extension.

Mind blowing facts: The North-Korean Lazarus group is estimated to have stolen up to $270M through exploits in the last 102 days, with an estimate of $2.64M per day.

Blockworks launched Blockworks Analytics — link

Franklin templeton fund ($1.5T AUM) files for Bitcoin Spot ETF

Binance US CEO resigns, and 1/3 of the workforce is laid off — link

Privacy pools: how to make Tornado Cash compliant thanks to Zk-proofs — link

Apple secures rights for writing a book on Sam Bankman-Fried — link

Crypto-X is in full PvP mode: ZachXBT report on influencers deceiving their following with undisclosed shilling — link

Starting Sep 15th, Google will allow advertising for NFT games

Court granted FTX permission to liquidate $3.4B crypto holdings: are we doomed?

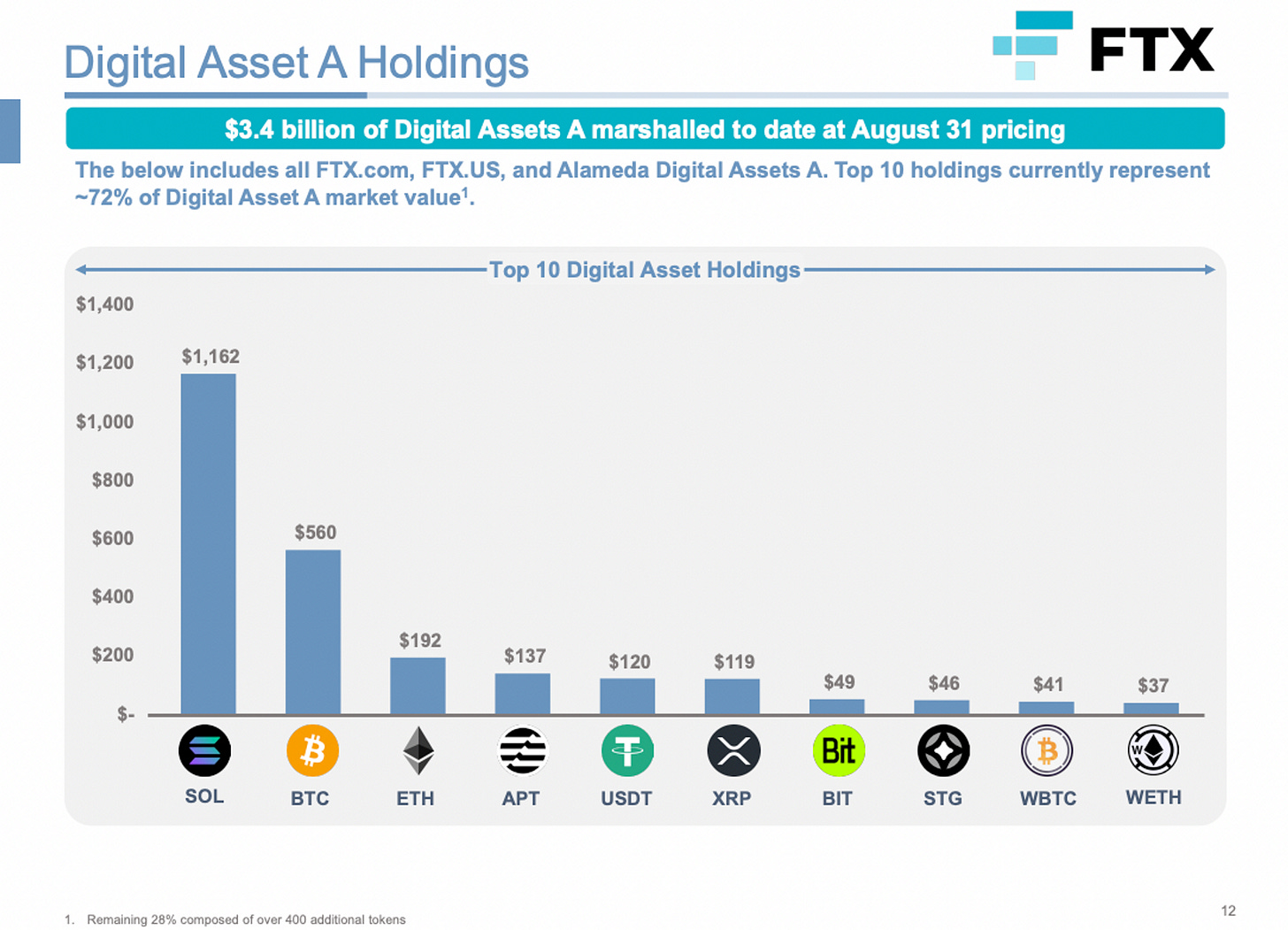

Fret not shorting, anon. Quick answer is no, we’re not doomed. Whilst your X timeline probably went nuts in the hours following the news, we analysed the facts: the Judge John Dorsey gave FTX approval to sell, stake, and hedge crypto holdings. You can get a sense of FTX’s crypto holdings from the image, we agree that $1.16B in SOL — roughly 16% the circulating supply — can be scary, though the picture is not as grim as it sounds.

All these tokens are not going to be market sold on the open market, FTX is now managed by folks that know a thing or two about bankruptcies and restructuring, and they will definitely do their best to get as much as possible for what they got. Selling fast and openly isn’t the way to do that.

Furthermore, the court demanded FTX to limit their selling to $50M per week, allowing them to increase the limit not higher than $200M per week. Rumor has they’ll be looking to sell coins off-the-counter (OTC), reducing sell pressure on the open market — arguably, one could say that OTC buyers would otherwise buy said assets on the market, hence resulting in reduced buy-pressure.

Doing some digging, it turns out that most SOL are either locked or pre-sold to the Solana Foundation, as speculated by an X user here. They could possibly sell the wallet that has the right to claim locked tokens in the 2025-2028 timeframe, but this would hardly be noticeable in short-term price action. On a similar note, APT tokens seems to be mostly locked.

Considering the OTC approach, liquidating BTC, ETH, and XRP holdings shouldn’t bother prices that much. So, a nothing-burger? In the short-term, quite. Yet, in the long-term, SOL holders must factor in that in four years those SOL holdings will be unlocked.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.