How a tweet caused $180M in liquidations

The Bitcoin spot ETF might be closer than we think, whilst Paolo Ardoino becomes Tether's CEO

Welcome to Stay on-chain! This week was fun; Cointelegraph is spreading false news, the SEC is taking a step back, and the Arbitrum degens are revving up for some incentive farming.

Buckle up and let us tell you the stories!

In today's edition:

How Cointelegraph's tweet sent BTC to $30K

Arbitrum distributing $40M incentives

SEC is not appealing Grayscale’s court decision

GBTC’s gap continues to shrink

Uniswap charges 0.15% fee to swap tokens

Reading time: 5 min

This week's market was a wild ride. Cointelegraph tweeted about BlackRock's supposed approval of a Bitcoin ETF, which sent prices up by more than 10% in less than an hour. However, this excitement was short-lived as the news turned out to be false, causing the market to retract its gains almost immediately. In addition to the high volatility, Bitcoin variants appeared to perform well. Conflux and Sui instead, are the top losers of this week. Both coins were hyped during the previous leg-up, causing overextended price charts.

How Cointelegraph's tweet sent BTC to $30K

On the 16th, Cointelegraph sent BTC on a roller coaster ride by announcing that the SEC had given the green light to BlackRock's iShares Bitcoin spot ETF. We all know the impact of similar news; Bitcoin's price skyrocketed by 10% in less than an hour, hitting the $30,000 mark and triggering $180 million in liquidations, as per Coinglass.

But the euphoria didn't last long, as doubts quickly began to surface. Bloomberg’s analyst James Seyffart couldn't find any credible sources to confirm the claim. In a somewhat funny twist, Cointelegraph swiftly edited their tweet to include the term 'reportedly.'

Just moments later, BlackRock clarified to a FOX reporter that the news was, in fact, false, and their ETF application is still under review. This caused Bitcoin to nosedive, completely retracing the upward move.

X (Twitter) exploded with memes, playfully suggesting that a Cointelegraph intern had orchestrated a clever market manipulation scheme.

Nonetheless, this incident raises serious questions about Cointelegraph's credibility and integrity. It's highly likely that an investigation will be launched regarding this matter. Cointelegraph promptly deleted the tweet and issued an apology, but the damage to its reputation is undeniable.

Damage control: Tether and Binance are actively freezing wallets related to terrorism in Israel and Ukraine. Coinbase showed its support as well.

STIP ended, 49M ARB will be distributed to 29 protocols

Short for Short-term incentive program, following the voting period Arbitrum’s STIP is going to distribute 49M ARB (~ $39M) to 29 protocols. Roughly 40% of the incentives are going to be distributed to the top 5 protocols in terms of votes received: Camelot, Jones, Dopex, GMX, and Galxe. Unfortunately, 35 protocols didn’t make the cut, with prominent names like PancakeSwap, Stargate, Wormhole, and Curve.

From the chart below we can clearly see that the Derivates sector was the ultimate winner, with over 44% of the grants being allocated to derivatives protocols. The true winners here, though, are users who are going to provide liquidity for these protocols and take advantage of the incentives.

Wen Lambo Ferrari? Ferrari started accepting crypto payments in the U.S. as a way for crypto millionaires to invest their wealth into luxury cars — though you still have to pay capital gains.

SEC is not appealing Grayscale’s court decision

The Security and Exchange Commission of the United States does not plan to appeal the court decision that it was wrong to reject the creation of a Bitcoin spot ETF submitted by the asset management firm Grayscale — a digital currency asset management company founded in 2013, and based in Stamford, Connecticut. The rumor, coming from a source familiar with the matter, didn’t seem to move the markets significantly.

This morning, Grayscale submitted a new filing to the SEC in an attempt to get its flagship fund GBTC converted to a spot Bitcoin ETF following the pivotal court ruling.

GBTC’s gap continues to shrink

Grayscale's GBTC price is finally bridging the gap. During the past year, GBTC's price had been detached from BTC's price. The difference in price was mainly a result of significant GBTC selling triggered by the bear market and limited arbitrage opportunities. The discount offered by GBTC had reached very high levels, peaking at almost 50% below the Bitcoin market price in December last year.

However, the trend reverted when BlackRock filed for a spot BTC ETF in mid-June, gradually reducing the discount and bringing GBTC to its rightful value.

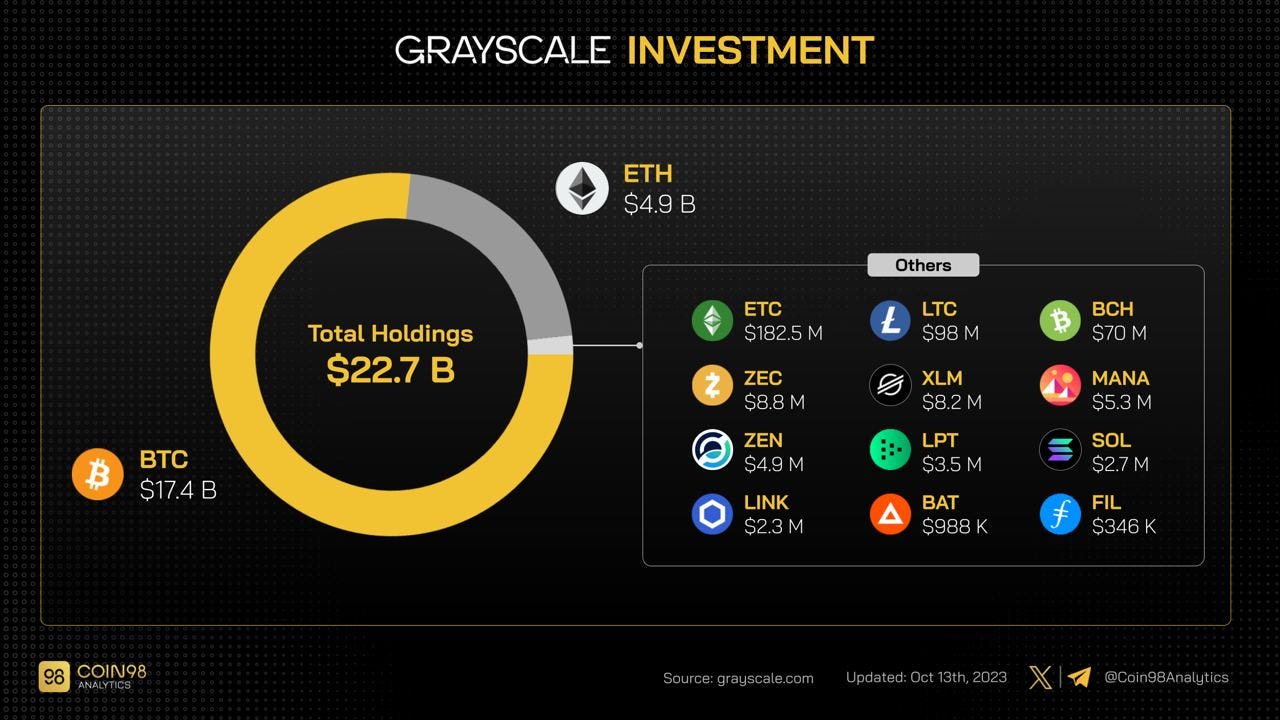

Grayscale is undeniably an important player in crypto. It stands as one of the biggest BTC holders, with 622K BTC in its wallets ($17B), representing almost 3% of the entire Bitcoin supply.

Grayscale's influence doesn't stop at Bitcoin. You can explore the allocation details in the chart below:

Sayonara, Crypto Reddit. The social network has decided to discontinue its community points experiment, with related tokens sinking.

Uniswap charges 0.15% fee to swap tokens

Uniswap is the most known DEX in the space, with $3B in total value locked and counting. Whilst their impact in the space is undeniable, it comes at a cost: in order to cover expenses for Uniswap Labs — the centralized entity behind the protocol development — the CEO Hayden Adams announced a 0.15% fee for swaps on the Uniswap front-end for a few selected tokens (ETH, USDC, WETH, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, XSGD). The fee won’t affect stablecoin swaps and the wraps between ETH and WETH.

The move has generated criticism, as Uniswap has long denied a fee that accrues to UNI holders, but instead went on with this with no prior DAO governance vote. Let’s be clear: Uniswap Labs has control over the interfaces by which users access the Uniswap protocol, which is somewhat centralized. Yet, the Uniswap protocol (i.e. the underlying smart contracts) itself is truly decentralized and works independently — in fact, using an aggregator like 1inch allows users to bypass the front-end fee.

To date, Uniswap has generated roughly $100K in fees, with ~ 5% of its volume passing through the Uniswap front-end (previously ~ 25%).

Paolo Ardoino becomes Tether’s CEO, whilst remaining Bitfinex’s CTO

Radiant plans to launch on the Ethereum mainnet this week

Binance burns $450M BNB closing Q2

Lido Finance to end Solana staking service following DAO vote

Platypus recovers 90% of stolen funds after third protocol hack

Fantom Foundation wallets have been phished on Ethereum and Fantom, resulting in a loss of $550K.

Stars Arena relaunched after receiving Paladin audit, and yet another potential vulnerability has been outlined on X

The Scroll blockchain is live on mainnet

The Ethereum blockchain validator queue has emptied for the first time since the Shangai update, with the staking yield dropping from 5% to 3.5%

FTX creditors may be able to get back up to 90% of their funds

The Aptos blockchain suffered a downtime of ~ 5 hours

Yearn Finance revamps tokenomics and releases veYFI

The Social Finance phenomenon

This Sunday we’re going to delve right into Social Finance — the latest trend that has been fueling innovation and development in the crypto space in the past month or so. But are those platforms efficient, with a true potential to thrive long-term regardless of the initial hype? Let’s delve right into it.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.