Louis Vuitton enters NFT space

The notorious high-end French brand makes its move into NFTs, while blood's on the street following SEC's lawsuit spree and FED's rates decision.

Welcome to Stay on-chain! While the drama surrounding the SEC's lawsuits against exchanges persists, this week has seen several exciting technical innovations in DeFi. In just 5 minutes, we'll guide you through these advancements, explaining them in simple terms and highlighting their positive impact on DeFi!

If you haven't subscribed yet or if this email has been forwarded to you, subscribe below and don't miss out on the next issue of the newsletter!

In today’s issue:

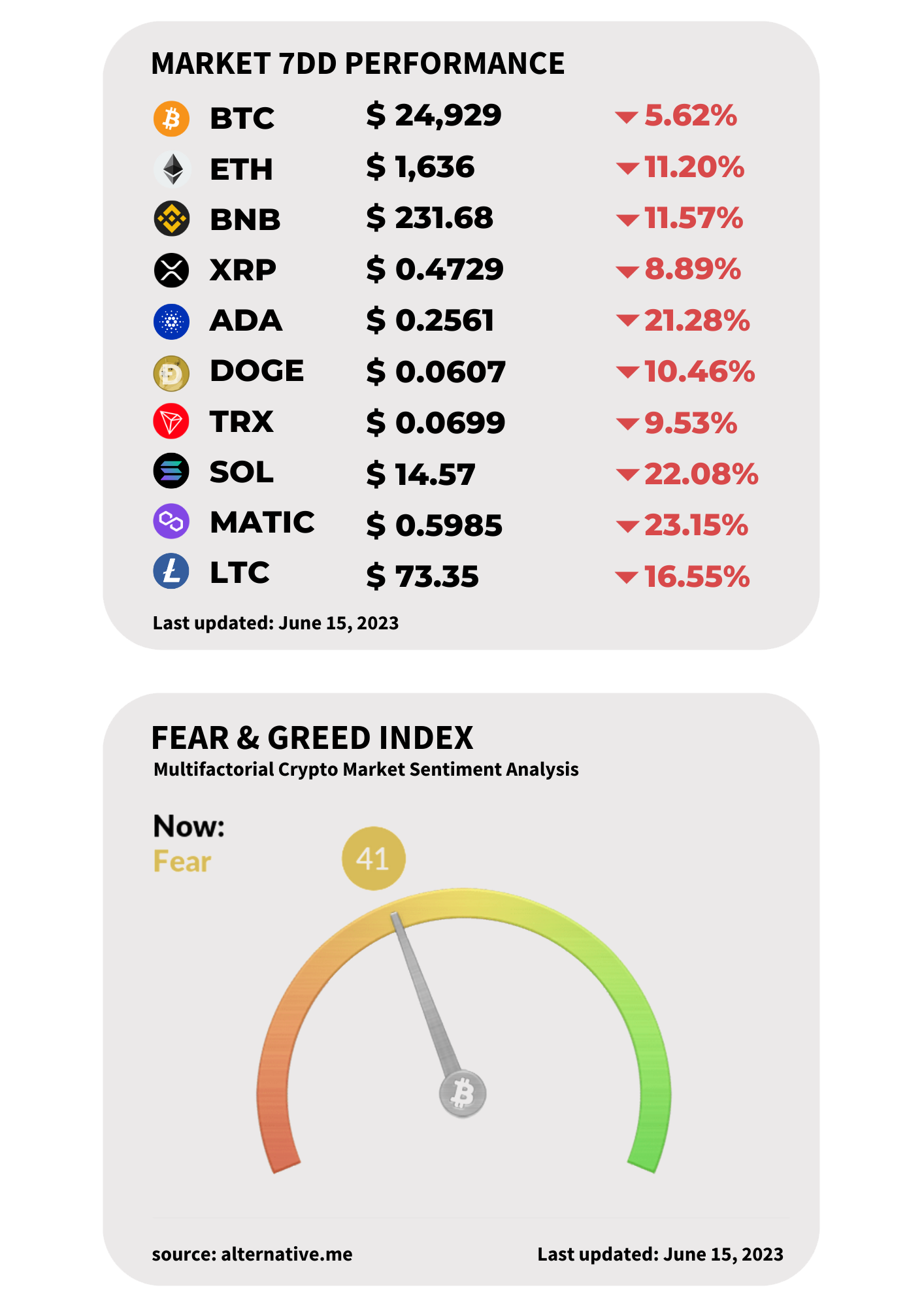

Weekly market performance

Crypto news round-up

Upcoming catalysts

Where is the money flowing?

One tool you should try

Further readings

Coinbase vs SEC in one meme

SEC: what’s the bottom line?

SEC has been messing around with crypto firms in the past few weeks, suing Binance and Coinbase while labeling many tokens as securities. Some of which decided to openly disagree with the SEC’s judgment bringing their views to the table — Polygon and Solana in particular have been very vocal. The SEC’s motion to freeze Binace.us assets (roughly $2B) has been denied, as the judge deemed it’d be counterproductive to the case. Nevertheless, the crypto giant has been able to honor as much as $4B in daily withdrawals. Meanwhile, the company decided to halt FIAT deposits on the 9th and stop FIAT withdrawals on the 13th as banking on-ramp and off-ramp services became increasingly difficult to handle — Binance.us will remain active as a crypto-only for the foreseeable future.

Coinbase, on the other hand, saw the SEC asking for 4 more months to respond to the crypto company's request for clearer rulemaking on digital assets.

On a side note, the Hinman docs covering the Ripple case have been released on the 13th — inside those, it’s made very clear that at the time Ethereum Proof-of-Work was not considered as security, read more here.

Moreover, the judges that have been assigned to the XRP case and the Coinbase & Binance ones operate within the same Manhattan court, with the chance of one influencing the other’s decision.

The regulatory situation in the US remains very entangled, with one congressman going as far as filing the SEC Stabilization Act that wants Gensler out. We continue to observe the big picture, hoping it unfolds positively for the crypto landscape in the following months.

Louis Vuitton enters the NFT space

Louis Vuitton, the high-end French brand, is entering the non-fungible token (NFT) market with a limited "Treasure Trunk" collection. NFTs represent ownership of unique items or experiences, stored on blockchain. These exclusive trunks, part of the brand's "Via" project, offer unique access to future products and experiences. This move extends Louis Vuitton's commitment to technology and customer engagement. Priced at €39,000, they have been launched on June 8 in the US, Canada, the UK, France, Germany, Japan, and Australia. This paves the way for other luxury brands to use NFTs for engagement and differentiation. Louis Vuitton's NFTs promise holders not just a symbol of luxury, but a unique gateway to a world of exclusive experiences.

Uniswap Launches V4, bringing innovative features to DeFi

A few days ago, the Uniswap team unveiled the draft code and white paper for Uniswap V4. The standout feature of this latest version is the introduction of Hooks, which are separate contracts that can be seamlessly integrated into liquidity pools. These Hooks bring a range of new functionalities such as dynamic fees based on volume or volatility, on-chain limit orders, auto-compounding, and much more.

To delve deeper into the potential game-changing impact of Uniswap V4, make sure to subscribe to Stay on-chain. This Sunday, we will be featuring an in-depth analysis, exploring why Uniswap V4 has the potential to revolutionize the DeFi landscape!

Optimism upgrades to Bedrock, and is now saving tons in fees

Optimism, a layer 2 scaling solution for Ethereum, has completed its Bedrock upgrade, bringing the blockchain closer to its goal of becoming a "Superchain" with interoperable mini-blockchains. The hard fork (a major blockchain upgrade), reduces deposit-confirmation times from 10 minutes to 1 minute and lowers gas fees by 40%, enhancing the chain's functionality. The upgrade also improves proof modularity for the OP Stack, an open-source platform for developers to build customizable blockchains with Optimism. Bedrock has transformed Optimism into a multi-client ecosystem, reducing the risk of network downtime. Following the upgrade, the native token $OP experienced a 10% increase in value.

Fun fact: where does the money stolen by North Korean Lazarus group go? (hint: ballistic missiles) — link

MiCa has been published in the EU Journal. It’ll be effective from December 30, 2024.

a16z VC fund looks to expand to London, with London’s major cheering the decision — link

Polygon zkEVM TVL booming — link

Polygon announces Polygon 2.0 blueprint — link

EigenLayer goes launches on mainnet with $17M cap — link

Lens Protocol, a user-owned Web3 social graph, raised $15M in a round led by CoLab.

HyperPlay, Web3 game launcher, raised $12M in a series A led by Griffin Gaming Partners and Bitkraft.

Taiko, open-source community-driven project, raised $12M in a seed round led by Generative Ventures.

Gensyn, a trustless protocol for P2P deep learning computation, raised $43M in a Series A round led by a16z.

Bit2Me, Spanish cryptocurrency exchange, raised $15M in a round led by Investcorp.

When considering investments in crypto projects, it's crucial to look at those that generate consistent revenue. If you're interested in identifying projects with the highest revenue potential in future bull markets, CryptoFees.info is the ideal tool for you.

This platform provides valuable insights into the fees generated by top protocols. If these fees have been sustained over time, it's a positive indication that the project is robust and widely utilized. Take a look at CryptoFees.info!

Vitalik’s three transitions needed to prevent Ethereum’s failure — link

Trading & Research Twitter Megathread — link

Four reasons why crypto startups fail — link

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you on Sunday with a special Dive!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.