DeFi Dive — LSD: Liquid Staking Derivatives

Leverage Staked Coins full potential thanks to Liquid Staking Derivatives protocols.

Liquid Staking Derivatives (LSD) protocols let you unleash DeFi’s full potential. But how does it all work?

Proof of Stake (POS) Blockchains [e.g. Ethereum] allow validators to stake a preset amount of coins in order to establish a blockchain node and validate the transactions of said Blockchain — nodes are large digital archives where each stores the same ledger of blocks (containing transactions) ordered chronologically. To show their commitment, validators are required to lock a set amount of coins [in the case of Ethereum, its 32 ETH ~ $56K] and set up lightning-fast infrastructure to allow fast and efficient communication between the network’s nodes. By doing this, you ensure that Ethereum remains a decentralized and secure way for individuals to communicate and transact. In return, you get paid a variable annual percentage rate (APR) ranging from 3 to 6% in ETH coins.

To keep it simple, we’ll use Ether (ETH) throughout this article as Ethereum is the preferred chain for LSD protocols; but mind that the same logic can be applied to other Proof of Stake blockchains.

But, where does the yield come from? The Ethereum blockchain mints new ETH tokens to incentivize validators (i.e. they’re inflating Ether). Additionally, validators can receive miner tips from network participants looking to get their transactions processed quicker than others, which fosters a healthy supply & demand market for blockspace. The aforementioned inflation is being kept under control thanks to EIP-1559, which burns increasingly higher quantities of ETH as network usage soars.

Ethereum has currently 609,000 validators, and just below 10,000 nodes. Validators must commit 32 ETH to start validating blocks (the execution layer), while nodes can be run for free (consensus layer) but only nodes that are also validators can propose blocks (execution + consensus layer). Read more on the nodes and validators here.

This is tedious, right? If you’re not passionate nor expert about Blockchains from a technical standpoint, we get you.

The reasoning behind Liquid Staking Derivatives

Using LSD protocols, you avoid all that.

You can lend your ETH to someone else operating a validator node on your behalf, in a permissionless and secure way — and you’ll receive a receipt token, usually a variation of the ETH ticker (stETH, frxETH, rETH..) that can be leveraged in other DeFi protocols and accrues staking rewards at the same time.

This helps to further secure the Ethereum network, as even less savvy and wealthy participants can get together and fund new validators that increase the distribution of nodes under different jurisdictions around the world, fostering higher decentralization of the network. Clearly, everything has its price: ETH borrowers will withhold a small percentage to cover their expenses of running a node, but leave you with most of the profit.

As Sam Kazemian outlines, one should aim for an LSD protocol that is decentralized, agnostic, and versatile.

At the time of speaking, almost 10M Ether out of a total of 19M total staked Ether is in LSD protocols, nearing 50% — Confirming that the narrative arguably drove up demand for staking Ether.

LSD protocols make ETH staking accessible to everyone, and solve staking’s opportunity cost: if you stake your coins directly, you won’t be able to leverage them further in DeFi — whereas receipt tokens (stETH, frxETH, rETH) can be used in a wide array of financial primitives. You could use them as collateral to borrow other coins or mint stablecoins (e.g. DAI, crvUSD), or add them to liquidity pools in a decentralized exchange and start earning rewards on top of your staking return (e.g. on Curve Finance).

At its core, LSDs can be simplified as peer-to-pool lending protocols. As long as validators can borrow ETH from users at a cheaper rate than what they get paid to run the validator minus operating costs, they’ll do it and fuel demand.

Not all that glitters is gold: risks involved in LSDs

The Ethereum blockchain can perform so-called “slashing” to validators that act maliciously (e.g. trying to counterfeit the blocks) or don’t meet quality standards in terms of efficiency: it penalizes those violating the rules by taking away a portion (or all) of their staked ETH. By using LSD protocols there’s an implied level of trust towards the nodes borrowing your ETH coins to stake them on your behalf — if they get slashed, the underlying ETH backing the receipt token you’re given is reduced, and your receipt token could be unbacked (meaning not all receipt tokens can be redeemed for their underlying, which is what can cause a bank run).

Moreover, LSDs pose a risk for cartelization, as if most users lean towards a single platform a risk of centralization arises. Luckily, this is becoming less and less of an issue as after The Merge the sector is flourishing with smaller protocols building innovative features that can potentially undermine the largest LSD operators.

On a pragmatic note, if one LSD protocol were to control over 50% of all staked Ether tokens, they’d be able to censor the blockchain at will — making it an easier target for regulators rather than the Ethereum network as a whole. As a reference, think of the recent OFAC sanctions towards Tornado Cash, where most validators complied and started rejecting transactions coming from addresses related to the protocol in any way.

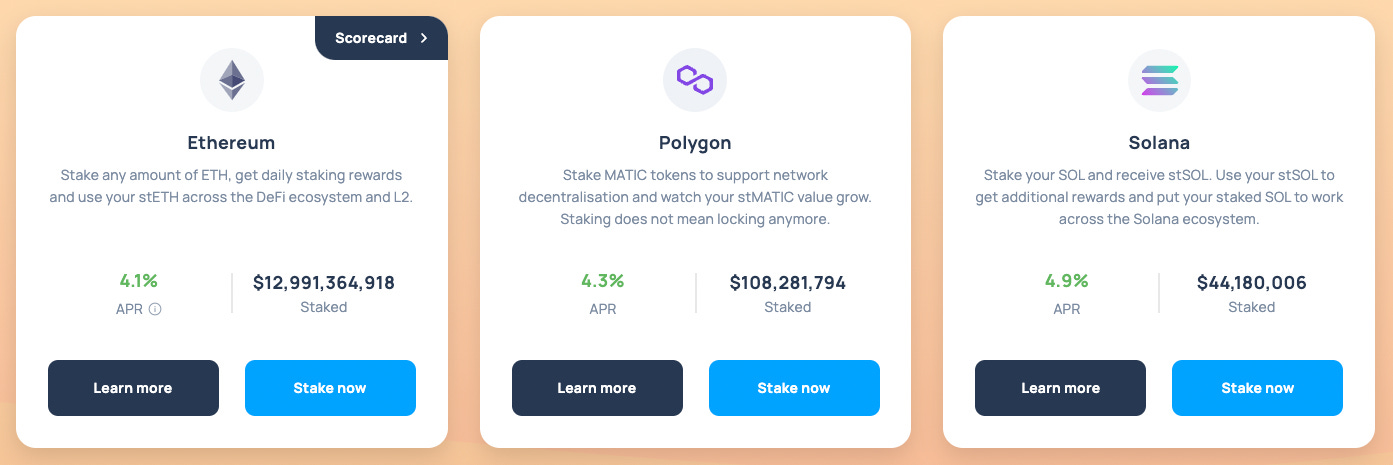

Largest LSD protocols: an overview

We’ll now analyze the three largest LSD protocols: Lido Finance, Rocket Pool, and Frax Ether.

Lido Finance

Born in 2020, Lido is the go-to choice for most to put their ETH to work. The way it works is quite easy: you lend ETH and receive stETH in return; stETH can then be wrapped into wstETH and used in a variety of DeFi Financial primitives. Permissioned validators will be able to borrow deposited Ether and run validators, taking a small cut for themselves to fund operational costs. Lido accounts for about 75% of all ETH deposited into LSD protocols, and 36% of all staked Ether.

Rocket Pool

Rocket Pool is the second-largest LSD protocol, born in late 2021 it has since been slowly capturing bits of Lido’s market share, currently counting about 7% of LSD deposits. Rocket Pool lets you lend ETH and receive rETH in return; additionally, you can post 8 ETH in collateral and borrow the remaining 24 ETH required to run a validator yourself to increase rewards substantially (subsidized with Rocket Pool’s token RPL rewards as well). This is the main difference between Lido and Rocket Pool: while the former is permissioned (meaning validators are picked manually), the latter is permissionless and lets anyone willing to meet collateral requirements run a validator themselves.

Frax Ether

Frax Ether, part of the Frax Finance ecosystem, is the underdog of all three. It aims to build the most decentralized, agnostic, and versatile LSD protocol in the space with intrinsic high programmability. Frax Ether currently holds a 2% market share of LSD deposits, bound to increase as they release their updated v2. By lending ETH to Frax Ether you receive frxETH, which can be further leveraged in DeFi and within Frax’s huge ecosystem. If you’re eager to learn more about the upcoming v2, find Frax’s CEO workshop here (if you’re more of a reader, it’s been summarized here):

Avoid centralized exchanges (CEX)

ETH can be staked on centralized exchanges (Binance, Coinbase, Kraken..) as well: this involves high trust assumptions towards the middleman (the exchange), fading away the core principles we were looking for in an LSD protocol. Delegating your ETH to protocols accessible on-chain directly should be preferred and helps increase Ethereum’s security. For the purpose of this article, only decentralized LSD protocols have been analyzed.

And that’s a wrap! Thanks for reading this Sunday’s Dive on LSD protocols. This article covered the fundamental logic behind liquid staking and the main platforms operating in this space, hoping to give you a headstart in DeFi.

Please note that many dashboards are tracking statistics for Liquid Staking Derivatives Protocols, but each may account for numbers differently and thus show different outputs. This article aggregated and tried to obtain a homogeneous result from the following dashboards: Lido’s Dune Dashboard, beaconcha.in, hildobby’s Dune Dashboard, Defillama.

If you found this Dive valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.