#54 Make Ethereum Great Again

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! This week saw EigenLayer’s token announcement in a market drenched in red, while CZ was sentenced and Tether announced its pivot to neurotech and its mind-blowing profits in Q1. Now sit back, relax, and let us sift through the noise for you.

🪂 Solana's latest airdrops have created billions of dollars in wealth overnight with projects like Wormhole, Parcl, Jito, Tensor, and Jupiter. Here at Stay on-chain we crafted a guide on what we’re farming, piecing together our list of top picks among under-farmed protocols with huge treasuries. Want to get it? Get one friend to subscribe to our newsletter, and we’ll deliver it straight to your inbox.

By the way, make sure to join our Telegram group 👾

It’s all fun and games until the music suddenly stops. Inflation’s taking longer than expected to settle back to the 2% target, and FED’s predicted 5 rate cuts this year may turn into none at all. With U.S. policy rates at 5.25-5.50%, economies are trying to dodge the stagflation doom scenario, with investors taking a cautious approach to speculation. Bitcoin spot ETFs registered on May 1st the biggest outflows ever, with $563M leaving the instruments and Blackrock’s IBIT fund realizing its first daily net outflow. Overall, the sentiment feels bearish and altcoins gains of the previous months are being eaten back, however, stablecoin’s supply hasn’t suffered the downtrend suggesting there’s dry powder ready to be deployed. Many praise the “Sell in May and go away” saying, and while current market conditions make us prone to a few months of sideways during the Summer with little to no catalysts, it’s hard to imagine the bear market’s over. Surprisingly, memecoins have held better than many altcoins, showing a pattern of distrust towards VC-fueled coins, with memes being perceived as more “democratic” coins to invest in.

Eigen makes scorched earth

EigenLayer was no doubt the most awaited launch of 2024 in the Ethereum ecosystem and.. well, it didn’t go that well. With the claim going live in 8 days, key details on its tokenomics have been shared:

1.67B initial supply for $EIGEN

15% stakedrop, 15% for community incentives, 15% for R&D, 29.5% to investors, and 25.5% to early contributors

Snapshot taken on March 15, 2024

The token is going to be claimable, but non-transferrable until enabled by governance (the timeline seems to be in the order of months, at least)

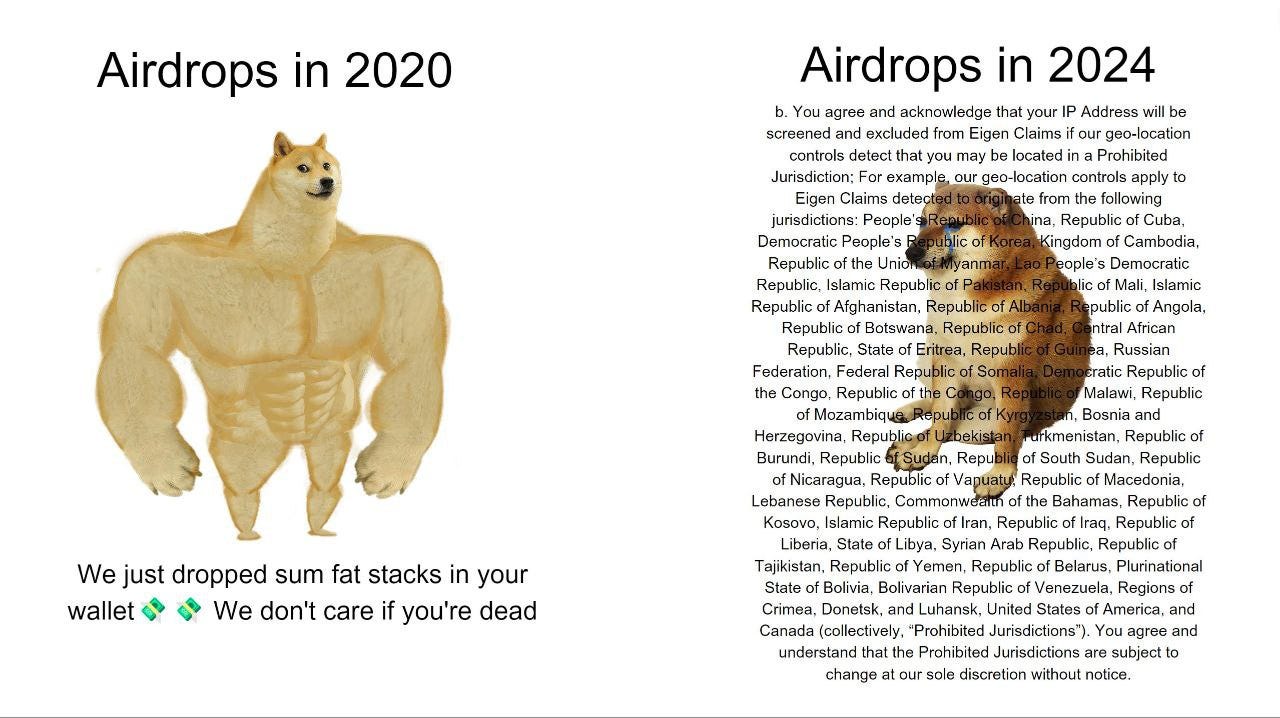

The stakedrop distribution is set to be linear, and prohibited in many countries, U.S. included, cutting off about 37% of the world’s population from claiming it.

Being a U.S. based team, it’s clear that the $EIGEN launch had to go through legal teams trying to comply with the SEC — hence the non-transferability to allow ample time for “decentralization”. Yet, doubts have arisen as if the vesting were to start at TGE on May 10, investors would in fact have a shorter cliff since users’ tokens wouldn’t be tradable straight away. That, coupled with a distribution strongly skewed towards investors & the team enacted backlash on social media towards the EigenLayer foundation.

The issue seems to be bigger than the $EIGEN airdrop, though. As they started the points farming lore, they might as well be ending it. Airdrop farming has been the meta for months, and with so much demand (EigenLayer topped at $16B in TVL) it’s becoming increasingly hard for teams to meet users’ demands to keep them happy.

Being one of the largest catalysts for Ethereum along with the most probably denied U.S. spot ETF, it’s hard to envision compelling activity on the network, and subsequently on ETH charts for the forthcoming months. In the grand scheme of things, only 0.75% of the ETH staked on EigenLayer is currently queued for withdrawal, confirming how it’s mostly the shrimps making the most noise — while whales are sticking to their strategy.

However, sooner than later EigenDA is going to be released and AVS services built atop EigenLayer will start flocking in, determining whether there’s going to be a real demand for restaking.

End of the points era? — 𝕏/chudnovglavniy

CZ sentenced to 4 months

Changpeng Zhao, so-called CZ and former CEO of Binance, has been able to secure a “light” sentence of 4 months in the Seattle Court yesterday, after the DOJ tried to press for a 36-month one prior to the hearing. Different factors played a role, including (1) numerous letters of support by prominent individuals, outlining CZ’s good faith during his time at Binance, (2) comprehensive and good cooperation with the U.S. government, and (3) clean criminal records. Acknowledging his mistakes, CZ is set to do his time and focus on his next chapter, education. He says he’ll remain a passive investor in crypto, and emphasized the importance of compliance in today’s crypto landscape. With an estimated net worth of $33B, CZ is going to be the richest inmate ever in the U.S.

You gotta pump those numbers up. Those are rookie numbers in this racket: 0.54M tokens have been launched so far in 2024, with a daily issuance of 5300 tokens — CoinGecko

Tether invests in neurotechnology

The stablecoin giant announced the acquisition of a majority stake in BlackRock Neurotech for $200M, unveiling their Tether Evo strategy. Focusing on neural implants, Evo focuses on the synergy between neurotechnology and AI by “crafting brain-computer interfaces that open new realms of communication, rehabilitation, and cognitive enhancement”. Following its restructuring into multiple divisions, it’s clear how Tether is fueling innovation through its mind-blowing profits with USDT.

North Korea eating well: how Lazarus group laundered $200M from 25+ crypto hacks since 2020 — 𝕏/zachxbt

Aave Labs lays out the next steps for the protocol

Titled “Aave 2030”, Aave Labs’ proposal plans to release Aave v4 next year, focusing on enhanced modularity, reduced governance overhead, higher capital efficiency, and higher GHO integration. Moreover, additional efforts would be put towards RWAs integration with GHO, and towards a chain-agnostic future for Aave leveraging cross-chain liquidity and the creation of an Aave network built atop Ethereum in 2026 & 2027. Additionally, Aave Labs plants the thought for deployments outside the EVM sphere. The cost for all this? Roughly $17M for the first year alone, with 2 & 3 year costs to be evaluated in the future.

Numbers go up: Base TVL has doubled in a month, now sitting at $1.6B — 𝕏/Dynamo_Patrick

Heroglyphs: Make Ethereum Great Again

Led by 0xMaki, former chef at SushiSwap (for the lore: the first real competitor of Uniswap back in the days), Heroglyphs is set to leverage “graffiti” — arbitrary data included into Ethereum blocks. For the sake of simplicity, think of Bitcoin Ordinals, but on Ethereum. The goal is to make Ethereum more decentralized and cyberpunk, creating incentives for ETH solo stakers.

To kickstart it, they enabled the minting of different NFTs on their website, raking in ~ $5.6M to date. While the website is cryptic, decoding the message on the mint page you get hints that these NFTs are going to grant you access to an airdrop sometime in the future. If you’d like to delve more into it, here’s the whitepaper.

MilkyWay, a juicy opportunity for TIA enjoyoors

Behind milkTIA, the first liquid staking solution on Celestia, MilkyWay has been cooking whilst we’ve been desperately trying to decide whether we should be longing $BODEN of $TREMP with the nearing elections. They raised $5M in a round led by Polychain and Binance Labs (suggesting a listing on TGE), and now boast a $26.5M TVL with numerous DeFi integrations across multiple ecosystems. As a cherry on top, they’ll be launching their own MilkyWay chain in collaboration with Initia, running Celestia DA underneath.

Jito on Solana printed hard for those who farmed it in the early days, and while MilkyWay won’t be nearly as profitable, it might be worth a shot considering their latest campaign quadrupling points for those bridging milkTIA to Arbitrum using Hyperlane (a tokenless bridge!) and LPing on the Camelot DEX.

Happens on-chain

Stripe to accept USDC on Ethereum, Solana, and Polygon starting this summer — TechCrunch

Rabby enables free gas campaign for Ethereum, Arbitrum, Avalanche, Base, BNB Chain, Fantom, Linea, Optimism, Polygon, ZetaChain — 𝕏/Rabby_io

Kelp to enable rsETH withdrawals on May, 3 — 𝕏/KelpDAO

Immutable launching crypto gaming rewards program worth $50M — The Block

Mining pool ViaBTC auctions first satoshi unit mined post-halving for $2.13M — CoinEx

CoinJoin facilitator Wasabi blocks U.S. users following Samourai crackdown — 𝕏/AutismCapital

Mantle released a dashboard for EL points for mETH holders on L2 — mantle.xyz

EthXY crypto-game to launch L3 on top of Base — 𝕏/ethxy

Scroll enables EIP-4844 slashing fees 75% — DLnews

Rest of the world

Consensys filed a lawsuit against the SEC after receiving Wells Notice — Blockworks

Celsius reported creditors data breach on April, 17 — velodata.app

BAYC NFTs owner Yuga Labs cuts jobs, CEO says company “lost its way” — Blockworks

Samourai wallet co-founder Rodriguez released upon $1M bail — CoinDesk

Hong Kong BTC & ETH spot ETFs push $11M volume on launch day, ChinaAMC BTC ETF rakes in $123M AUM — CoinDesk & 𝕏/EricBalchunas

Tether sees record profits of $4.52B in Q1 2024 — 𝕏/theblockupdates

Worldcoin eyeing partnership with PayPal and OpenAI — Fortune

BNP Paribas bought $41,000 in Blackrock’s IBIT shares — Decrypt

Bitcoin Cash advocate Roger Ver has been arrested in Spain — The Block

Microstrategy acquired 122 BTC ($7.8M) in April, now holds 214,400 BTC — 𝕏/saylor

Tech go up

Dymension introduces eIBC standard — 𝕏/dymension

BNB Smart chain will enable liquid staking following plans to sunset BNB Beacon chain — Cointelegraph

Solana Firedancer validator client might be around the corner — 𝕏/martypartymusic

Bitcoin’s proposed OP_CAT upgrade goes live next week on testnet — 𝕏/udiWertheimer

Fantom Sonic coming this Spring — 𝕏/AndreCronjeTech

Coinbase enables Lightning Network integration — The Block

Jupiter brings on board Chaos Labs risk management firm — jupresear.ch

VCs go brrr

RWA-focused Securitized raised $47M round led by BlackRock — CoinDesk

a16z bought $90M OP tokens in a private sale — Unchained

Movement Labs raised $38M to build Ethereum L2 using Facebook’s MOVE language — Fortune

Pantera Capital scoops up second lot of locked SOL from FTX estate, price rumored to hover around ~ $100 — Bloomberg

Tokenized asset issuer Backed raised $9.5M round led by Gnosis — CoinDesk

Airdrops

LayerZero snapshot has been taken — 𝕏/LayerZero_Labs

Lyra’s LDX airdrop farming is live — 𝕏/lyrafinance

Helius launches hSOL LST on Solana teasing a surprise — 𝕏/0xMert_

Sanctum launches ‘Wonderland’ points program

Drift airdrop checker is live

Upcoming events

May, 2: Friend.tech v2 launch (should include their token)

May, 2: Coinbase earnings, at market close

May, 3: MEME unlocks 31.92% of circulating supply

May, 13: Targeted launch for Infinex DEX, created by Syntetix founder Kain

May, 14: Dutch judge rules on Tornado Cash developer Alexey Pertsev

May, 15: U.S. announces April CPI (inflation data)

May, 15: AEVO unlocks 757.95% of circulating supply

May, 20: PYTH unlocks 141.67% of circulating supply

May, 23: SEC deadline for VanEck’s ETH spot ETF application

Ton and Tether turn on the printing machine: you can earn a slice of $70M TON incentives set aside to foster USDT usage on-chain. If you’re willing to KYC, you can enjoy a 50% APY for the first two weeks (then, 25% APY for another two) on your USDT using @wallet on Telegram, with a 3000 USDT cap. Otherwise, head over to DeDust.io, which offers a 93.88% APR on the TON/USDT LP.

Blue chip yields: Aave’s stablecoin GHO can be staked as stkGHO, yielding a 49% APR through the Merit program. Mind you, staking acts as an insurance model, meaning funds will be used to cover exploits that Aave might suffer.

Scratching the degen itch? Fantom got you. Equalizer is one of the premier DEXes on the chain, offering a 193.61% APR on lzUSDC-axlUSDC LPs, 82.01% APR on wFTM single-staking, and 52.67% APR on wETH single-staking.

To avoid impermanent loss, stick to LPs as single-staking enables concentrated liquidity strategies.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.