Michael Lewis wrote a book on SBF

UBS fosters tokenisation for off-chain assets, while Ripple and Coinbase gain regulatory approval in Singapore

Singapore was hot this week: UBS launched another pilot program under Project Guardian’s guidance, and both Ripple and Coinbase received regulatory approvals.

Meanwhile, some major tokens are about to experience big unlocks.

As always, we filtered through the noise to deliver what matters straight to your inbox.

In today’s edition:

UBS launches on-chain tokenized money market

October sales are on the way?

Orbiter Finance bridge receives backlash for stuck transactions

Reading time: 5 min

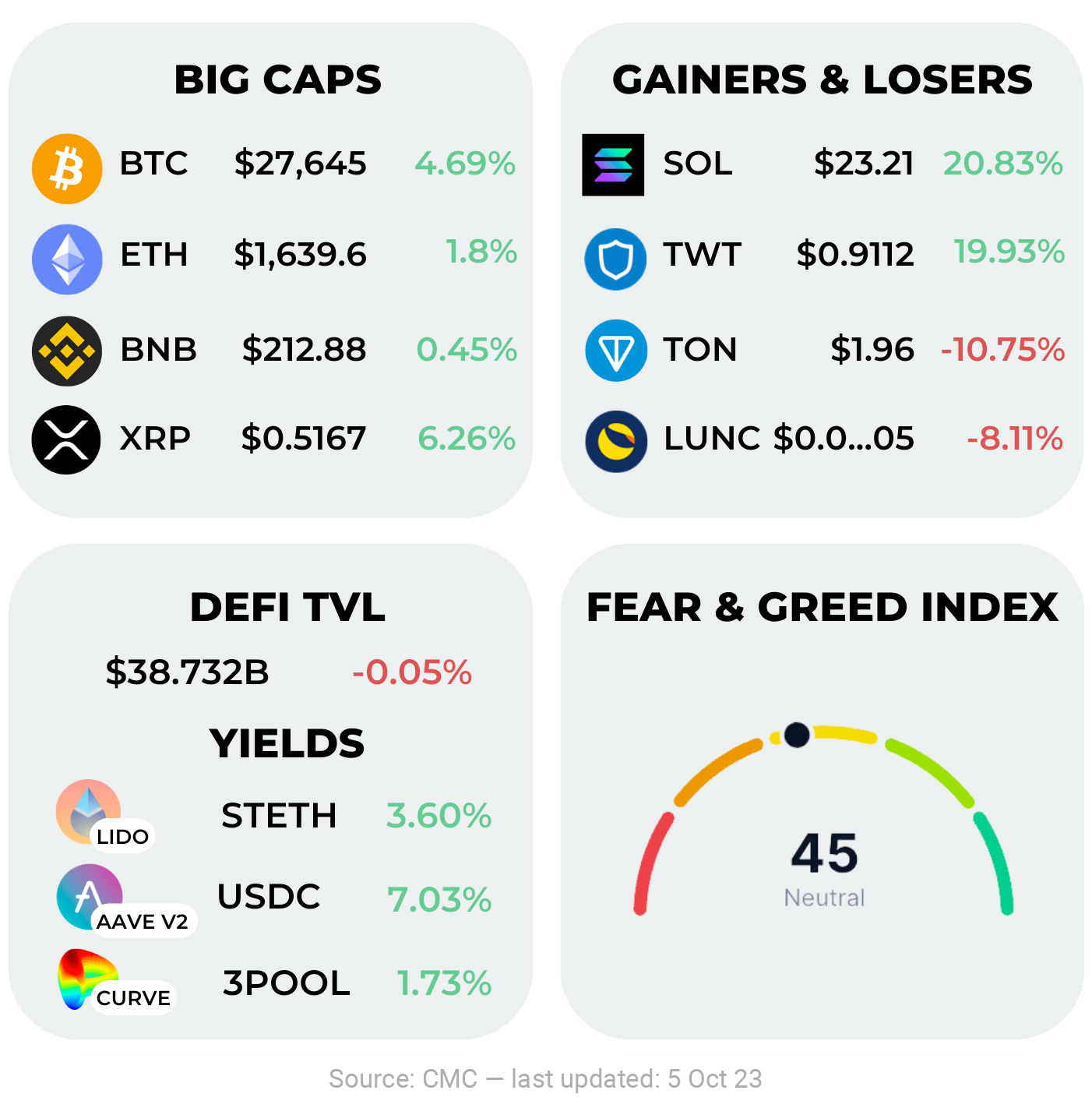

Bitcoin was strong this week — is it because of Uptober?

Historically, October has been a golden month for Bitcoin, delivering positive returns in nearly every instance, except for 2014 and 2018.

The star performer this week is Solana's $SOL, with its blockchain maintaining peak performance for seven consecutive months and its TVL reaching new 2023 highs. On the flip side, Telegram's TON token is the underperformer of the week. While there's no negative news about TON, it appears it’s just taking a breath after the recent sharp price surge.

UBS launches on-chain tokenized money market

The prominent banking institution is making no efforts to hide its interest in regards to the potential of bringing off-chain financial instruments on-chain. After playing around with tokenising bonds and fixed rate notes on-chain, UBS launched its pilot of a tokenized money market fund using an Ethereum smart contract that allows for subscriptions and redemptions.

The move falls under the umbrella of Project Guardian, which is a collaborative industry initiative led by the Monetary Authority of Singapore (MAS), designed to bring real-world assets (RWAs) on-chain.

You don’t wanna miss this: Michael Lewis, the author of “The Big Short”, just published a book on Sam Bankman-Fried called “Going Infinite”.

October sales on the way? AXS unlocks 11.5% of its supply

October means autumn leaves for some, chestnuts for others, but this time, it means token unlocks. AXS is set to unlock $67M in a couple of weeks, accounting for 11.5% of its circulating supply; the tokens will be split amongst AXS stakers, players, and the project’s team — historically, AXS has not suffered major drawdowns at the time of unlocks, but rather slowly wane in the weeks following.

Together with AXS, other big players are nearing unlocks as well: help yourself with the infographic below.

Burn baby, burn! USDC’s supply plummeted on Base, where some huge redemptions took it from 160M to 29.84M in one day.

Orbiter Finance bridge receives backlash for stuck transactions

Orbiter made a name for themselves in the cross-chain sector becoming the go-to choice for bridging coins across Ethereum roll-ups, especially now that Multichain isn’t a thing anymore. They bootstrapped their user base by being a token-less project, which amassed loads of users that use the protocol & engage in the Discord in the hope of receiving an airdrop someday.

But things took a wrong turn recently. Bridge transactions were getting stuck: users would be sending their coins on the origin chain, then waiting hours to receive them on the destination chain for what should be a couple minutes business. As a cherry on top the official Orbiter account on Discord got deleted, making everyone panic and allege an elaborate exit-scam by the project’s team.

The team shortly addressed both issues, stating that they’re sorry for not assisting users in a quick manner over stuck transactions, and that their Discord account was deleted by Discord itself for violating the platform’s guidelines.

As always, better safe than sorry. We advise you to revoke token approvals for the time being and be cautious.

Hackers are now using Thorchain instead of Tornado Cash to launder money

VanEck fund pleads to donate 10% of its ETH futures ETF profits to Protocol Guild for 10 years

Chanalysis laid off 150 employees, while Epic Games 830 citing failed metaverse initiative

Stars Arena, a Friend Tech fork, has been launched on Avalanche

The SEC wants Do Kwon deposed in Montenegro, where he’s currently in jail

SEC sees its appeal on the Ripple case denied, while the cryptocurrency gains Singapore regulatory license together with Coinbase

Telegram secures undisclosed 8-figure investment from MEXC

Blackbird, an Eat to Earn start-up, announces a $24M round led by a16z

FTX’s investment in Anthropic could make creditors whole

Osmosis 2.0 is unveiled at Cosmoverse 2023

Su Zhu and Kyle Davis have been arrested in Singapore for failing to cooperate with 3AC liquidators.

Follow us on X to not miss our latest insights on the defining topics of the DeFi space! There you’ll find edges, and threads containing curated alpha content, giving you all the tooling necessary to make fast and informed decisions.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.