SafeMoon founders arrested

Markets are greedy, whilst projects announce updates riding the green wave

Welcome to Stay on-chain! The markets are green, Crypto Twitter is busy finding the new $SOL, the airdrop season is back with Celestia’s $TIA, and the Defi devs are grinding unnoticed, delivering interesting updates.

Sit back, relax, and let us be your eyes and ears in the crypto markets.

In today’s edition:

SafeMoon allegedly embezzled millions from holders

Bitcoin Lightning falls flat

Celestia introduces modular blockchains

Fantom announces Sonic

Paypal receives subpoena from the SEC

FTX is depositing funds on Coinbase and Binance

Reading time: 5 min

FTX’s bags are pumping, yeah. Solana is this week's top performer, thanks to the announcements at the Solana Breakpoint conference. On the other hand, Mina and Maker faced a downturn, possibly linked to their recent price overextension. The sentiment on 𝕏 is mostly bullish, nudging the feeling of a new bull market. Notably, the FED did not raise interest rates yesterday, which, despite already being high (5.25%), is seen as positive news for the market. A notable insight is the increase in USDT’s APY on Aave, indicating one thing — people borrowing to leverage their positions.

SafeMoon isn’t Safe, nor it’ll take you to the Moon

Once a multi-billion dollar shitcoin, SafeMoon’s SFM has left the throne to PEPE and now hovers at just $32M market cap whilst facing serious legal issues for allegedly committing fraud, money laundering, and selling an unregistered security.

Team members have been accused of diverting millions from the “locked” SFM liquidity for personal expenses, including real estate property and luxury vehicles such as a custom Porsche 911.

Two defendants, Braden John Karony and Thomas Smith, have already been arrested in the U.S. whilst Kyle Nagy remains unaccounted for.

Bitcoin lightning falls flat

Lightning is a popular Layer-2 solution built on Bitcoin to make BTC payments cheaper & faster. Started being developed in 2015, but available to the public only from 2019 onwards, the protocol is now facing strong criticism as a security flaw referred to as a “replacement cycling attack” has been exposed by Antoine Riard — a security researcher that has decided to step down from Lightning’s development team.

Furthermore, Anton Kumaigorodski, developer of the first mobile lightning wallet, doubled down announcing his departure from the project stating “I consider LN a done deal”.

Meanwhile, Lightning’s adoption keeps growing as the most popular payment solution for those looking to purchase goods and services in a day-to-day scenario, with $183M in liquidity representing a mere 0.027% of bitcoin’s capitalization.

Get smarter: Ethereum’s inventor Vitalik Buterin published a blog post on the tradeoffs of security and scaling amidst L2s — Post

Celestia introduces a new blockchain design

Celestia has successfully deployed its mainnet, uncovering its revolutionary modular network. This L1 network introduces the innovative concept of data availability sampling (DAS), a technology designed to steer in a new era of blockchain scaling. DAS empowers blockchain nodes to verify data availability without the need to download the entire dataset for a specific block. In simpler terms, “Celestia is the first modular blockchain network that securely scales with the number of users.”

Delphi Digital's report highlights how Celestia represents a groundbreaking fusion of two distinct blockchain domains: it combines the sovereign interoperable zones of Cosmos with Ethereum's rollups and shared security.

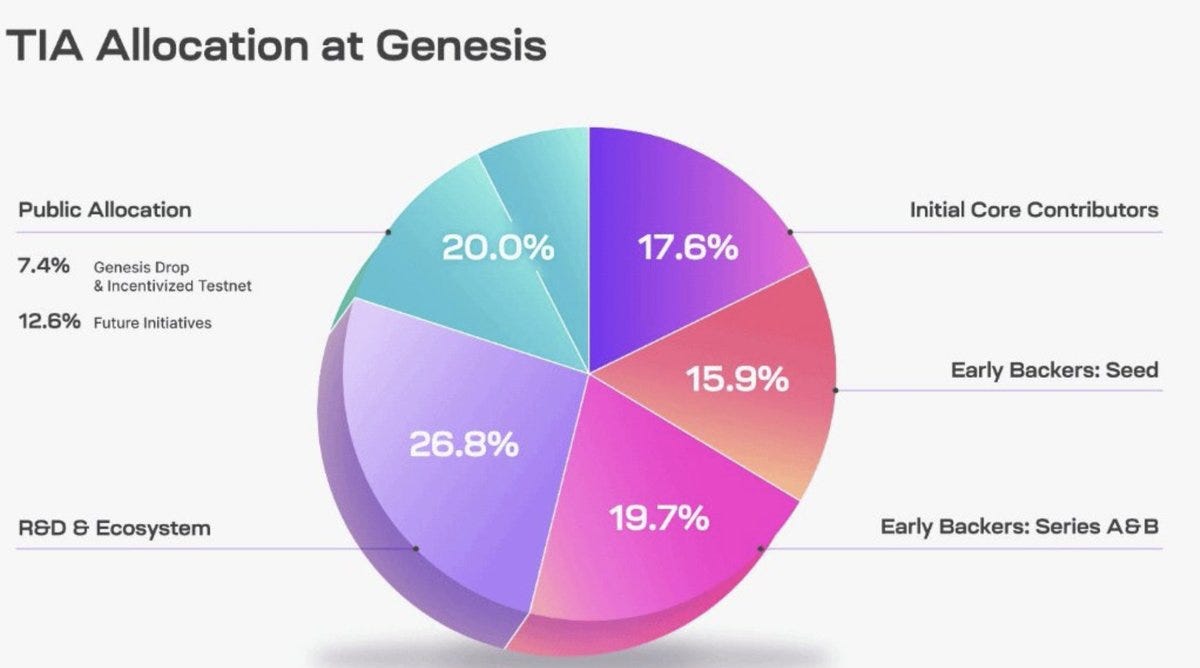

Alongside the mainnet launch, Celestia has introduced its governance token, TIA, which is now available on major CEXes and currently trading at $2.31 with a $325M market cap. The token's distribution reveals a noteworthy aspect: 53.2% of the token supply goes to insiders, while just 7.4% was allocated to the community.

Your size is not size: The Chicago Mercantile Exchange (CME) is now the second-largest Bitcoin futures exchange with an open interest of $3.5B, preceded by Binance at $3.8B

Fantom goes supersonic

Fantom is a Layer-1 blockchain that once presented itself as an Ethereum-killer, but nowadays shows only a remnant of its peak $15B TVL two years ago. Today Fantom is ranked #33 per TVL, with only $95M floating in its ecosystem — the chain is definitely struggling, with reasons to be found in unclear leadership and various exploits affecting the community.

But there seems to be light at the end of the tunnel: on October 24th, the Fantom Foundation announced both a closed and open testnet for Fantom Sonic, an upgrade posed to replace the Fantom Opera engine currently powering the chain, and possibly kick-off the Fantom narrative again.

Scheduled to reach mainnet in Spring 2024, Sonic boasts an upper limit of 2,048 transactions per second (TPS) with an average finality of 1.1 seconds; in real-world conditions, the finality is projected to stay under a second, given a potentially lower amount of TPS used by users. Moreover, storage requirements for validators (set at 21, with a quorum of 15) and archive nodes have been reduced by up to 90%, making it quicker, cheaper, and easier to deploy them.

VCs aren’t tired of games: $2.3B have been invested into blockchain games in 2023 — Cointelegraph

Paypal gets subpoena from the SEC over PYUSD

Released in August in collaboration with Paxos, PYUSD is PayPal’s stablecoin experiment to get a foot into crypto markets. Demand has been sluggish, with only $158M PYUSD in circulation, about 0.65% of USDC’s market cap.

Yet, this didn’t stop the U.S. Security and Exchange Commission, which summoned a subpoena directed at PayPal asking to produce documents with additional information on the stablecoin. The payments giant obliged, reporting the matter on their quarterly earnings report filed on Wednesday, but failing to provide more details on the case.

FTX is depositing funds on Coinbase and Binance

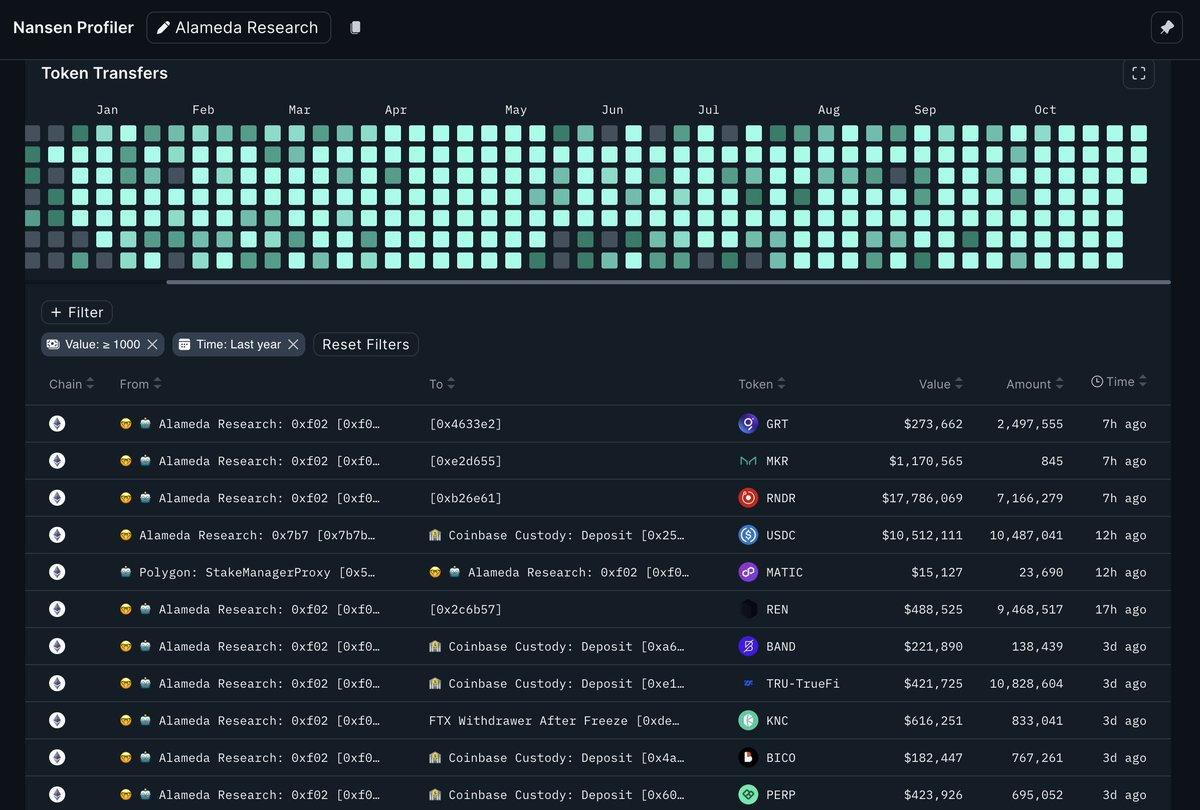

Nansen has been monitoring and reporting the on-chain activities of FTX and Alameda's wallets, revealing some intriguing moves. FTX's on-chain funds are being transferred to centralized exchanges, specifically Coinbase and Binance, amounting to $156 million thus far.

These funds are distributed across a variety of tokens and networks, with notable allocations including 845 MKR ($1.17M), 7.16 million RNDR( $17.8M), and 943,000 SOL ($32M). Furthermore, there are several less-known coins, each held in six-figure dollar amounts. Equivalently significant are the movements in stablecoins (USDT and USDC) and ETH. Perhaps the most worrying aspect is the recent unstaking of an additional 1.6 million SOL, which represents a staggering $57.6 million.

Following Asia’s spree of crypto regulation, Taiwan introduced a new crypto bill requiring all platforms to comply to continue operations

BlackRock's Bitcoin ETF might have trading support of heavyweights like Jane Street, Jump, and Virtu — CoinDesk

PayPal UK Unit Registers as Crypto Service Provider — CoinDesk

Dencun upgrade, featuring EIP-4844, is postponed to 2024 — Blockworks

Unibot, a popular telegram bot, suffered a token approval exploit resulting in ~ $750K in losses

Strike, Bitcoin’s payments platform led by Jake Maller, denies security breach although many users claimed receiving phishing emails — The Block

WalletConnect complies with OFAC sanctions blocking Russian IPs from using the application along with Iranian, Syrian, Cuban, and North Korean ones — 𝕏/Cameron

Frax Finance’s website DNS was hijacked during Halloween night, but is now operational again.

$396M token unlocks in November, get shelter! — WuBlockchain

Starknet to hand out 50M STRK tokens to early ecosystem contributors — Starknet

Not my fault! Terra Co-Founder Daniel Shin denies all charges against him, pointing fingers against Do Kwon — DL News

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.