Sam Bankman-Fried is guilty

OpenSea lays off 50% of staff and Kraken plans to launch its L2

Welcome to Stay on-chain! This week was again, green. Sam Bankman-Fried was found guilty on all seven criminal fraud counts, HSBC is making moves in RWA tokenization and OpenSea laid off 50% of staff.

Sit down, relax, and let us tell you the stories.

In today’s edition:

SBF will face decades in prison

HSBC makes moves in RWA tokenization

OpenSea lays off 50% of staff

Kraken plans to launch its own L2

The Bitcoin strategy: Microstrategy and El Salvador

Reading time: 5 min

Bitcoin's strong performance this week, touching 38k, may suggest a Bitcoin ETF is closer than we think. Ethereum and other altcoins are not lagging behind anymore. The top performer of the week was BLUR, the token of the NFT marketplace with the most volume. LINK, the oracle provider, was also a strong performer. Overall, the market was green, with the only exception of red from Tether and Paxos’s gold coins. DeFi TVL is rising, and stablecoin rates on Aave too.

Is the bull market back? It's still too early to say for sure, but the signs are encouraging.

SBF will face decades in prison

That’s it. Sam Bankman-Fried, the former CEO of the disrupted FTX exchange that he left with a $8B hole has been convicted of fraud and money laundering by a New York jury. His lawyers did their best to paint Sam as the innocent “math nerd”, but that didn’t work out — He’s now facing up to 110 years in prison, but according to experts he will probably face only 20 to 25 years of a hard time.

This is the highest-profile cryptocurrency-related trial, significant in setting a precedent and discouraging similar narratives from occurring again.

Sam is set to be sentenced on March 28, 2024, but he will likely appeal the verdict. Furthermore, he may be facing further charges in another trial scheduled for March on allegations that include bribery of foreign officials and campaign finance violations.

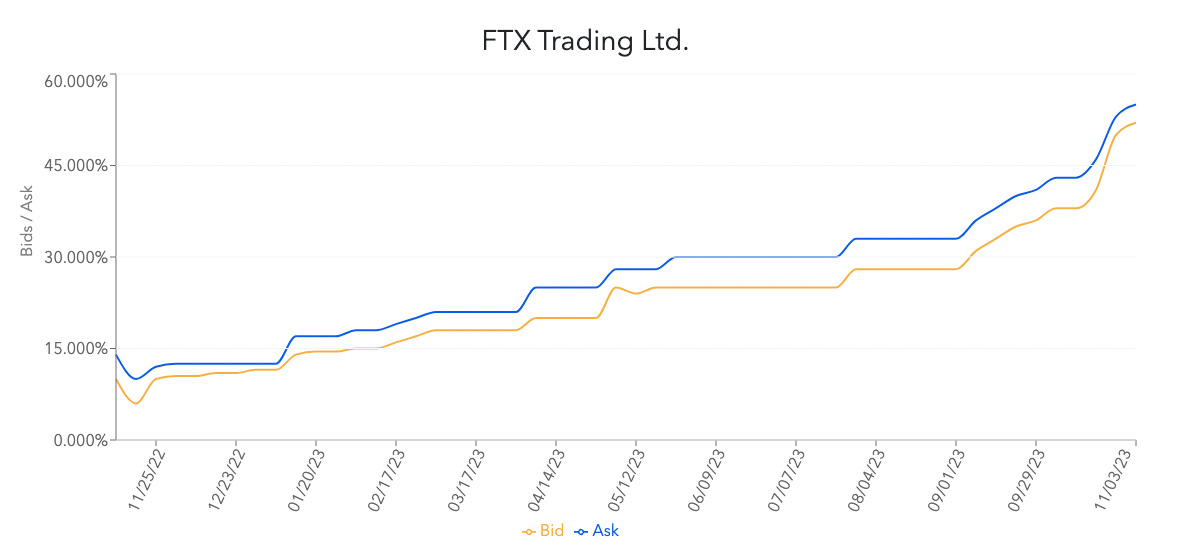

Meanwhile, FTX’s claims reached their all-time high at 55 cents on the dollar, meaning that speculators are buying up chunks of claims against FTX estate for 55% of their nominal value. The reason mainly lies in the rising valuation of one of the companies FTX invested in, Anthropic — an AI start-up that after a $6B investment from Amazon and Google has a predicted valuation of $20B to $30B. Speculations have it that the FTX chunk in Anthropic could potentially make creditors whole.

Lightning speed: TON reached 104,715 transactions per second, making it the fastest blockchain on the planet — Ton Community

HSBC making moves in RWA tokenization

HSBC is yet another big bank getting into tokenizing real-world assets. Last week, they launched a blockchain app for gold tokenization, so investors can buy tokens representing their gold in London vaults. This week, they announced plans for a digital assets custody service for institutional clients, focusing on tokenized securities.

Partnering with Swiss firm Metaco (now owned by Ripple), HSBC will launch HSBC Orion, a platform for issuing digital assets, including gold and other securities. This platform aims to offer a complete digital asset offering for institutional clients.

HSBC isn't the only major bank moving into blockchain. JPMorgan recently launched the Tokenized Collateral Network, and Deutsche Bank has partnered with Swiss fintech company Taurus to offer digital asset custody.

OpenSea lays off 50% of staff as CEO unveils OpenSea 2.0.

As the market sentiment is turning positive in a blistering fashion, company downsizing continues. This time it’s the turn of OpenSea — a leading company in the now fading NFT industry, reducing its headcount by a staggering 50%.

Devid Finzer, co-founder and CEO of the company cites a re-imagination of the culture at OS, orienting towards a smaller team focusing on faster innovation and building in public the soon-to-be OpenSea 2.0.

OpenSea seeks a revamp as NFT volumes continue plummeting, down 98.7% since April last year. Not only that, OS has been losing traction in relative terms as well, with Blur having a ~ 65% volume dominance, and OpenSea trudging along with a mere 13.8% according to Defillama.

NFTs go on Television: Simpsons release NFT-themed episode — 𝕏/essentialceo

Kraken plans to launch its own L2

Kraken, the US's second-largest exchange, is reportedly exploring a partnership to develop its own Layer 2 blockchain, taking inspiration from its closest competitor, Coinbase. Much like Binance's BNB Smart Chain, crypto.com's Cronos, Bybit's Mantle, and Coinbase's Base, Kraken is looking to offer its users an on-chain, self-custody option for digital assets. They're reportedly working with Polygon, Matter Labs, or Nil Foundation to make it happen.

The Bitcoin strategy: Microstrategy and El Salvador

What could possibly have in common between an American business intelligence company and a small country in Central America? Apparently, a Bitcoin strategy as their investment pillar.

Michael Saylor (chairman and co-founder of Microstrategy), and Nayib Bukele (President of El Salvador), have been the two main characters of the last crypto cycle, overwhelmingly showing off on social media their conviction in Bitcoin’s long-term success. But how is their strategy playing out so far?

Saylor’s dollar-cost-averaging seems to be the most successful, up $860M (18%) on its investment. Microstrategy currently holds $5.8B in BTC, acquired at an average price of $29874.

Microstrategy, other than loving BTC to its gut, is also quoted on the NASDAQ with the MSTR ticker. Not only they’re up big, but MSTR has been outperforming BTC itself — the very pillar of its strategy — by a 50% figure.

But Nayib does not fare as well, in fact, El Salvador’s BTC portfolio — acquired through government deficit spending operations (i.e. straight from the printing press) — is currently down $17M (13.32%), holding $108M in BTC purchased at an average price of $40542.

Bukele has probably been one of the most controversial crypto-characters to date: he did great things to foster adoption such as pushing BTC as legal tender of El Salvador, building mining plants powered by geothermal energy, and promoting Bitcoin education in schools. On the other hand, El Salvador is still a problematic country with a fragile economy, with many inhabitants not agreeing to see public spending pivoted towards buying bitcoins rather than fixing the country's many issues.

LidoDAO launches official version of wstETH on Base — Cointelegraph

Binance rolls out its first-ever self-custody web3 wallet — Coindesk

Arbitrum community approves initial vote on proposal to activate token staking — The Block

EU Parliament Approves Data Act With Smart-Contract Kill Switch Provision — Coindesk

WalletConnect steps back and re-enables access to Russian IPs, but other sanctioned countries remain blocked.

Defiwars, monitoring top governance holders for main blockchains and protocols, is shutting down

Analytics platform Dune launches Dune AI — 𝕏/DuneAnalytics

Unknown security breach drains 2675.73 XMR from Monero's community crowdfunding wallet — CoinTelegraph

Robinhood to expand crypto trading into EU, plans to start UK brokerage — Coindesk

Join the community on Telegram.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.