DeFi Dive — Sei Network, the fastest L1

A L1 blockchain with ultra-high performance DeFi

Hey there! Welcome to the DeFi Dive. The Sunday edition that takes a closer look at a defining topic of the space.

In today's dive, we delve into Sei Network, a Cosmos L1 blockchain optimized for DeFi applications. We'll explore the following key areas:

What is Sei Network?

Sei’s tech

The SEI Token

Considerations about Competitors

Binance reminded all of us about the Sei network by announcing the launchpool for the $SEI token. So, it was obvious to think that the Sei mainnet launch was just around the corner.

However, before we jump into the $SEI tokenomics, let’s first explore the improvements Sei Network brings to the table.

What’s Sei?

When it comes to blockchain technology, we often classify them into two main groups: general-purpose and app-specific blockchains. General-purpose blockchains, like Ethereum, serve as flexible platforms where various decentralized applications (DApps) can coexist, encompassing everything from DeFi and NFTs to gaming and social networks. On the other hand, app-chains like Osmosis, are open-source but permissioned blockchains designed for specific use cases. Sei strikes the perfect balance between these two categories.

Sei sets out to be a blockchain explicitly optimized for DeFi applications, requiring central changes and strategic tradeoffs at the L1 level to ensure optimal performance for DeFi. Standing apart from app-specific chains, Sei emerges as carefully crafted to cater to a diverse range of DeFi applications (lending and borrowing, dex, and derivative protocols) without compromising on its speed.

The major drawback of general-purpose blockchains, such as Ethereum, lies in the constant competition for resources (block space) among different types of applications. Activities like gaming or high-frequency trading can lead to congestion on the chain, negatively impacting other applications.

Sei tackles these issues by trimming away all non-DeFi activities from its chain, creating an ad-hoc ecosystem precisely optimized for DeFi growth, still allowing more than one application to live on it. This approach allows any DeFi project seeking higher performance to build confidently upon Sei, and join its ecosystem. Additionally, as an IBC-enabled (Inter-Blockchain Communication) Cosmos chain, Sei fosters seamless composability with other Cosmos projects, enhancing the overall DeFi landscape even further.

Sei’s tech

As we mentioned earlier, the key to optimizing a blockchain for DeFi lies in its specific design. An example of this could be the integration of order books. The existence necessitates fast block times, finality, and low latency to function properly. Prices must be updated every block, and shorter block times result in smaller price updates between blocks, tighter spreads, and reduced risks for traders and market makers. In essence, the blockchain must be fast, and Sei aims to be exceptionally fast.

Here's how Sei aims to achieve its speed:

Optimistic Block Production: blocks are processed immediately as received by validators.

Intelligent Block Propagation: validators can construct blocks locally.

Parallelization: the ability to process multiple independent transactions at once.

These technologies enable Sei to offer some intriguing features:

Native Price Oracle: An oracle integrated into the base layer, requiring validators to agree on prices before committing to a block.

Single Block Order Execution: Users can place and execute an order within a single block.

Order Bundling: Market makers can update prices for multiple markets in a single transaction.

Frequent Batch Auctioning and front-running (MEV) prevention.

Sei is going to have a vibrant ecosystem too, with over 50 projects already expressing interest in building on it.

The $SEI Token

Now, let's delve into the more intriguing aspects 😎 , the tokenomics. Currently, the total supply of $SEI stands at 10 billion with the circulating supply upon listing amounting to 1.8 billion (18.00% of the total token supply). Notably, the Binance launchpool I mentioned earlier will have an allocation of 300,000,000 tokens.

Furthermore, it's important to highlight that the project has successfully raised $35 million through three rounds of equity investment, resulting in a distribution of 2B SEI tokens to equity investors.

Let's explore the token distribution:

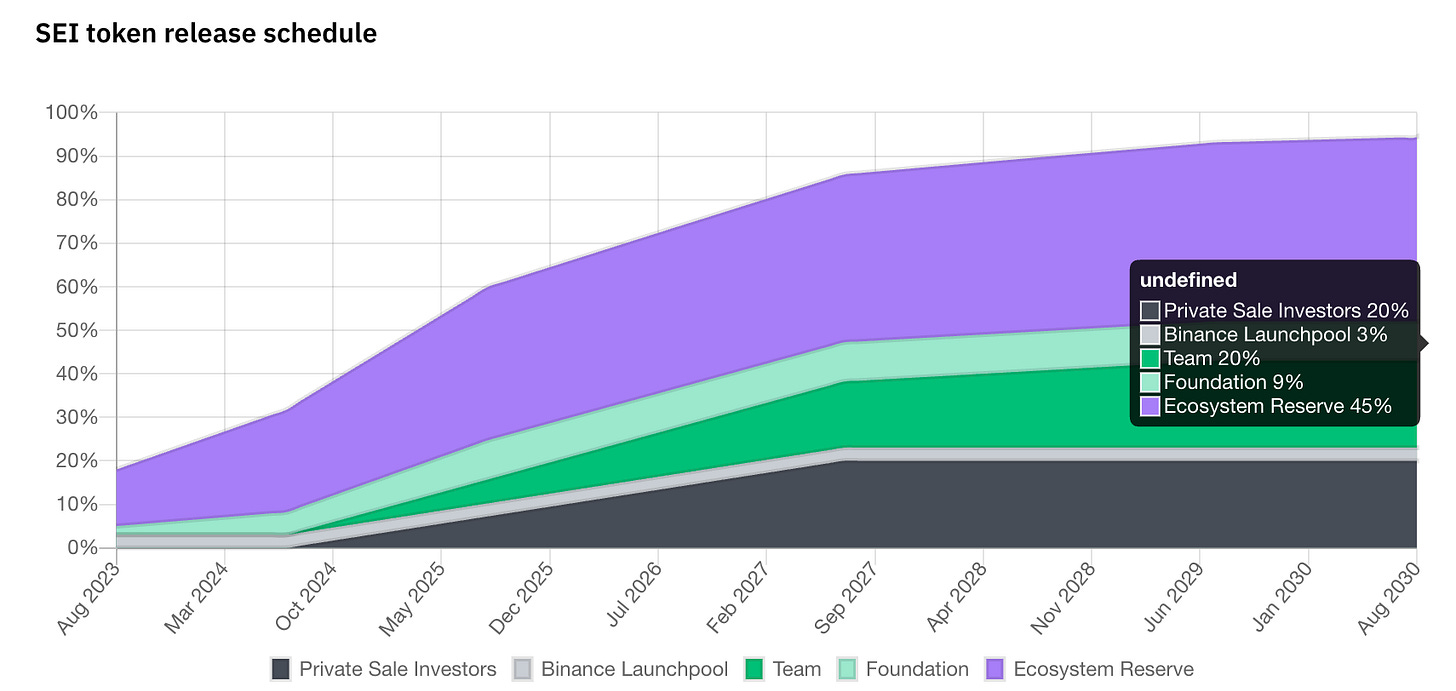

The Ecosystem Reserve will account for 48% of the total token supply.

Both the Team and the Private Sale Investors will receive a 20% allocation each.

The Foundation will possess 9% of the total token supply.

3% of the supply will be allocated to the Binance Launchpool

It is essential to note that the allocations will be subject to a vesting schedule, as illustrated in the following graph:

where the remaining Ecosystem Reserve tokens will continue to vest beyond Aug 2030.

Sei will operate as a proof-of-stake L1 blockchain, and the $SEI token is a utility token used for network fees, staking, and governance. While its value accrual is intended to be low due to low fees, the main factor contributing to value growth will be MEV (miner extractable value) redistribution. Sei plans to use a private off-chain auction where bots can bid for MEV transactions like liquidations and arbitrage opportunities.

Furthermore, $SEI will also support several DeFi functions:

Native Collateral: SEI can serve as native asset liquidity or collateral for applications developed on the Sei blockchain.

Fee Markets: Users have the option to pay a tip to validators to prioritize their transactions.

Trading Fees: SEI can be utilized as fees for exchanges operating on the Sei blockchain.

Will Sei keep up with competitors?

It’s important to keep in mind that Sei faces many competitors in the field. One of the most comparable ones is Injective Protocol, also a Cosmos chain optimized for DeFi, which has recently experienced significant growth. Other competitors include dYdX, known for being one of the top decentralized perpetual exchanges, and Fantom, led by the DeFi mastermind Andre Cronje.

With its on-paper superior tech, Sei aims to conquer the competition and pave the way for the evolution of DeFi. Only time will reveal the outcome. Meanwhile, if you wish to delve deeper, you can explore the Sei Network docs and whitepaper.

Thank you for reading, and be sure to subscribe to Stay on-chain for more research like this!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.