Social tokens on the rise

Hundreds of ETH are being poured into friend.tech, meanwhile crypto-companies keep scooping up cheap CRV.

Welcome to Stay on-chain! Middle August? Not enough to stop us. Today we delve deeper into the Base ecosystem, expoloring rug-pulls, exploits, but also potential catalysts including the popular social dApp friend.tech. Meanwhile, VISA publishes another paper in an effort to further lowering the access barrier to crypto, pushing forward the account abstraction narrative.

Base?! The far west

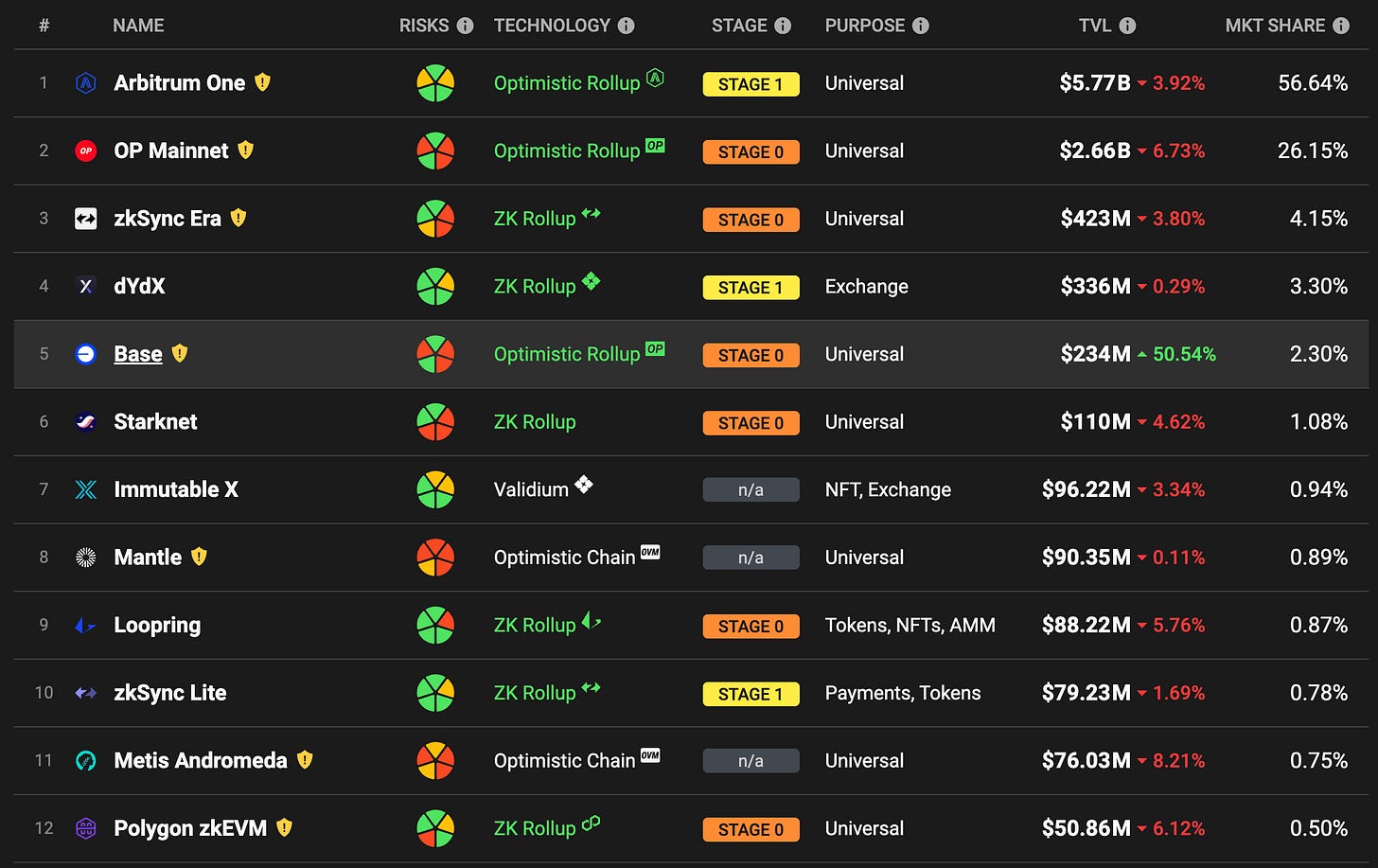

This Coinbase-backed chain is developing fast, man. They secured $171M in TVL in less than three weeks, with an exponential growth of 219% in the last seven days. 61 protocols deployed, including top-notch solutions such as Compound, Uniswap, Sushiswap, Balancer, Stargate.. you keep naming them!

Yet, the reality of facts is a bit grim. Starting off with a rug-pull worth several millions with $BALD, other exploits and rug-pulls happened. SwirlLend bridged out users’ funds and deleted its socials, while RocketSwap got its contracts’ private keys stolen because they were keeping them on a server (really?) that got hacked. They conclude their press release stating “We are very sorry for your loss”.

Thought that was all? There’s more to the saga, buddy. Someone deployed $FRENS on base, riding the current hype around the friend.tech platform, just to rug his own project a few hours later by draining the liquidity he previously added, and dumping the tokens he owned.

That netted him 14 ETH (~$25K), peanuts, right? Well, turns out the developer was AzFlin, previously employed as Software Engineer at Uniswap. Hayden Adams, Uniswap founder, promptly booted him out and stated that the org does not condone similar behaviour.

That’s not a good start indeed, yet Base has enormous potential in bringing together Web3 enthusiasts and traditional institutions. In fact, On-chain summer is ongoing, where you can mint exclusive collectibles featuring companies like Coca-Cola. Each day there’s a new one! Check it out here.

Remains to be seen whether Coinbase will continue to turn a blind eye to what happens on the chain, or whether it will soon switch to a semi-permissioned chain that acts against exploits and rug. What’s your take, anon?

Aave is shopping CRV tokens too

Aave's DAO has given the green light to a governance vote aimed at acquiring $2 million worth of CRV tokens from Michael Egorov, the founder of Curve Finance (still in trouble with the loan). The acquisition is set to be carried out via an OTC transaction, utilizing USDT from the Aave DAO treasury.

This strategic step taken by Aave is quite noteworthy, as Curve is famed for its top-tier liquidity when it comes to stablecoin swaps. Now, Aave stands to score some major voting power on the Curve platform, effectively allowing Aave to guide the flow of CRV rewards towards its recently launched stablecoin, GHO. This serves to incentivize liquidity providers to rally behind GHO, boosting its liquidity and overall market stability.

It's interesting to point out that while the vote sailed through, not everyone on the team gave it a thumbs-up, with 57% of the votes leaning in favor of the purchase.

Crypto-twitter wins: MachiBigBrother dropped the defamation suit against ZachXBT.

Friend.tech, the hottest dApp on Base

The application has been one of the most popular topics on Crypto-twitter (or shall we say Crypto-X?) in the past few days. Let’s dig right into it, understand it, and see whether there’s a chance to profit off it.

Friend.tech is a project deployed on the Base network, featuring “social tokens” aiming to strengthen the bond between content creators on X and their followers. It’s simple: registered users link their X account to the platform, and their token gets created. From then on, everyone can buy or sell shares of every other user, with the price increasing exponentially when new shares are issued.

By owning someone’s share, you get to chat with them directly (is that our own version of OnlyFans?), creating a two-way incentive for users to buy shares, and for popular creators to engage with their communities and profit off their own shares and trading fees (5%).

Mostly, this is pure speculation right now and resembles a boom-and-bust cycle. See this for yourself using FriendMEX: top social tokens that reached highs of over 2 ETH per share are now sub-1 ETH.

On top of the speculation, there’s an huge ego aspect to consider that drove traffic to the platform. Coupled with the fact that it’s invite-only and you need a code to join it to make it exclusive, it’s the perfect recipe for a successful launch.

But man, how do we profit off it?

As a creator, you can engage with your community and drive traffic to the platform. That way, your share’s price can potentially increase and you’ll pocket 5% on every transaction.

As a user, you can bet on creators you deem undervalued. But if you’re more of a geek, you could try setting up a bot that buys-in early shares of newly created accounts associated to popular X accounts (Someone bought Hsaka shares two seconds after he created the account!).

Finally, there’s an airdrop tab in the app that gives you codes for inviting frens to join the beta. There’s no guarantee they’ll issue a token, nor that airdropped points will be of any use in the future.

To join the app you’ll also need to deposit some ETH on the Base network to the wallet (self-custodial) associated with the account. Since the Base official bridge only connects Ethereum (with its expensive gas-fees), consider Orbiter Finance and Hop as cheaper alternatives to get your ETH on Base.

Want a code for yourself? Follow us on X!

Think outside of the box: someone performed the Curve exploit on ETH Proof Of Work (ETHpow), resulting in $16K profit.

Visa makes Ethereum gas fees simple

Visa has taken a big step in making Ethereum transactions easier. They made it possible to pay blockchain gas fees with a card.

The idea was successfully tested on Ethereum's Goerli testnet. It leveraged account abstraction and the ERC-4337 standard, by creating the so-called Paymaster smart contract — able to pay for gas fees instead of the user. The system is now

allowing users to pay for gas fees without needing Ethereum's Ether. Normally, you'd need Ether to pay for these fees, requiring you to buy it on a centralized exchange like Coinbase or Binance. Visa's solution instead lets you use any other token, like for example USDC, which is already integrated with Visa’s systems, making it possible to pay those fees with your card directly. This move makes things smoother and more user-friendly when dealing with Ethereum on-chain payments.

SBF is jailed after a judge revokes his bail for ‘tampering evidence’ — link

Sei Network, a DeFi-optimized L1 chain, goes live and Coinbase is set to list its token — link

After an overwhelming success, SparkDAO wants to reduce the DAI savings rate to 5%, and compensate for missing rewards with an airdrop in the form of SPK — link

StaderLabs launches ETH Liquid Restaking — link

PancakeSwap launched on Arbitrum

Binance Labs invested $5M in Curve, supporting its deployment on the BNB chain

Zynga, creator of Farmville, launches Web3 game Sugartown

Curve now has a button to leverage your crvUSD. Unsurprisingly, not one to deleverage.

The CFA exam now includes digital assets questions. Can you get them right?

In this week's Defi Edge section, we'll delve into Ethereum Layer 2 chains and explore the reasons behind its potential to outshine a significant chunk of the crypto market in the upcoming years.

On Crypto Twitter, there's a buzzing debate about whether L2 chains will outperform other L1 solutions, often dubbed as Ethereum-killers. The prevailing consensus? "L2s are the new L1s."

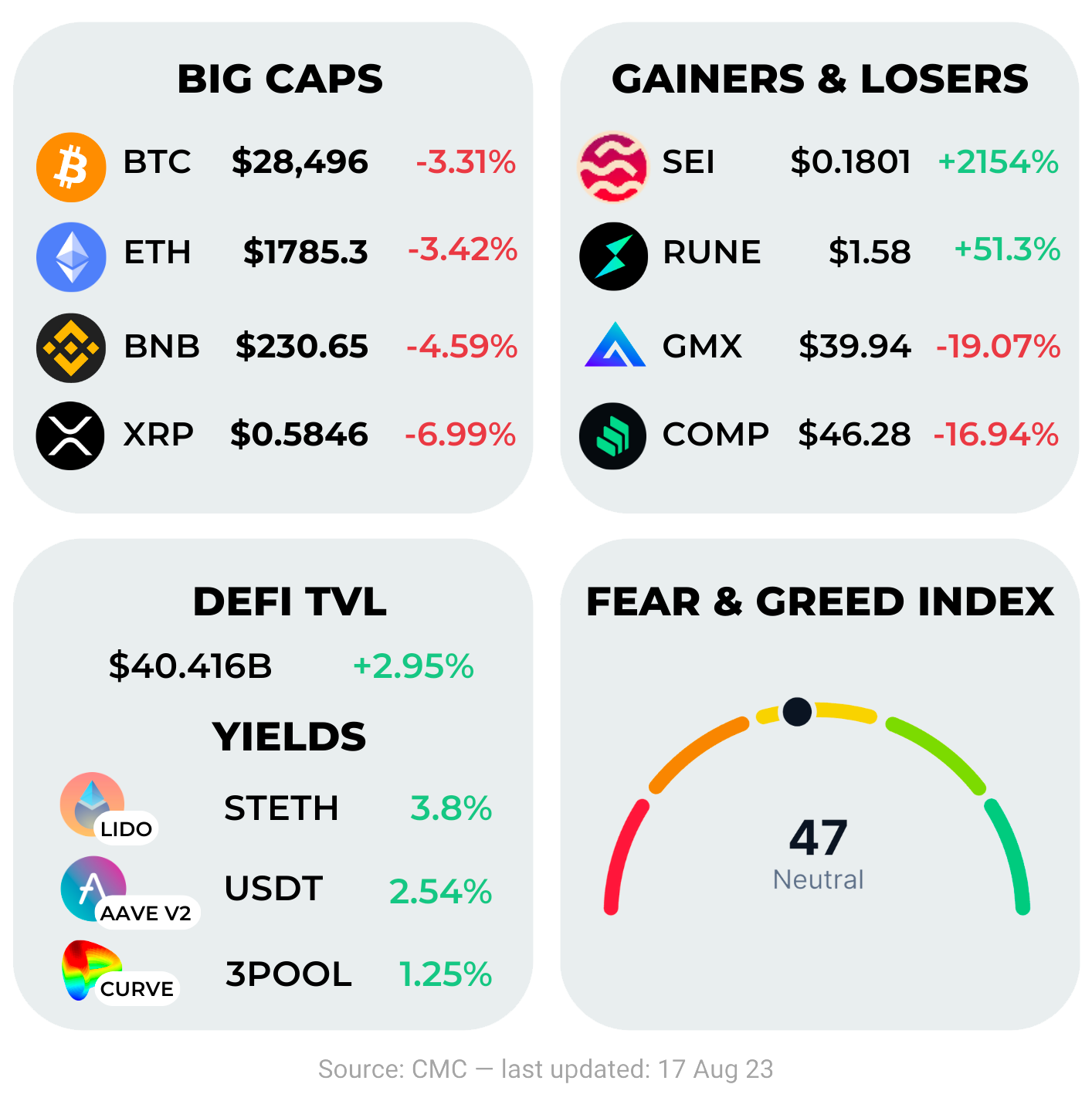

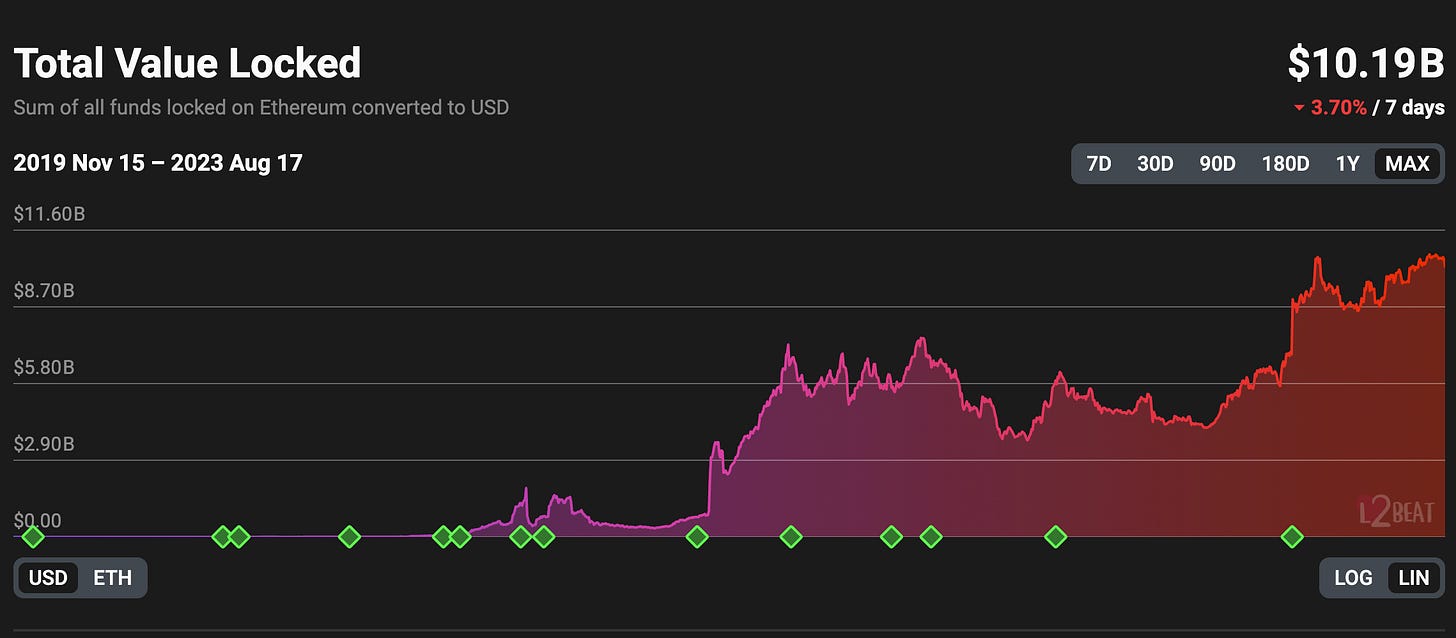

This sentiment finds its roots in two main factors: their seamless integration into the massive Ethereum ecosystem and their enhanced security, leveraging Ethereum, the most decentralized blockchain (second only to Bitcoin). Notably, TVL on L2 chains is showing a strong upward trend.

Being part of the Ethereum grants these L2s rapid growth due to their compatibility with the EVM and milking in the already active user base of the Ethereum base chain. Furthermore, they act as a complementary force to Ethereum, providing what it lacked and what other L1 solutions were advertising: cheap gas fees and speed.

As represented in the graph below, the on-chain activity on L2 is very robust. This surge in activity is greatly attributed to cheap fees, which nudged many on-chain activities from the base layer to the L2s. And the cheap fees will become even cheaper with the EIP-4844 upgrade later this year.

Now, let's turn our attention to the current state of the L2 ecosystem, as illustrated in the graph. The dominant players are undoubtedly Arbitrum and Optimism, both optimistic rollups and the sole major rollups with tokens ($ARB and $OP). No zk-rollup has yet matched the activity, adoption, or TVL of these two, though it would be negligent not to keep an eye on zkSync and Polygon zkEVM.

While Arbitrum boasts the biggest’s share of on-chain activity and a thriving DeFi landscape, Optimism holds its own ground with a focus that appears geared towards institutions with offerings like its OP Stack for Coinbase's L2 chain BASE or infrastructure for dApps like Worldcoin. From an investment standpoint, both $ARB and $OP carry potential, particularly given their launch during a bear market and less-than-ideal market conditions. A performance similar to $AVAX and $SOL during the previous bull market isn't implausible. With relatively modest all-time highs, $ARB and $OP, could easily surge in price discovery in a potential new bull market.

Has DeFi bottomed? Is everything just a derivative of a derivative? — link

Why UniswapX could change the DEX landscape — link

The Humble farmer digest — link

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.