Solana crypto phones are selling for $6000

We stay on-chain, so you don't have to. Get ahead of the curve in 5 minutes.

Welcome to Stay on-chain! Let us sift through the noise for you, delivering only curated and actionable insight into your inbox.

In today’s edition:

Market performance

News roundup

Farms of the week

Meme of the week

Reading time: 5 min

This week has been pretty exciting.

The big deal: Solana passed Ripple in market cap. It's now in the 4th place (not counting stablecoins) and got added to our 'Big caps'. Solana has been super trendy recently, with a sharp increase in SOL's price and activity on its network. You could have made an x5 by buying the Solana phone as well! But that's a topic for later.

The whole narrative about L1s as "Ethereum killers" is back. But it's not just Solana; Avalanche has been doing really well too. On the other hand, Ether didn't perform as expected. Will it bounce back? Will L2s shine again?

Near has been the star performer this week. Its network, pretty much endlessly scalable thanks to sharding, is gaining attention as an alternative to Celestia for on-chain data availability. We'll have to wait and see who comes out on top. Additionally, Sei, a DeFi-optimized cosmos chain, has been doing great. If you're interested in the tech details, check out our dive here. On the flip side, FTT, FTX's token, hasn't been doing so well as recent news revealed that the company is burning tons of money in legal fees.

Retirement plan? Degens have Saga phones

Solana’s crypto-phone Saga release in May 2023 was met with criticism, doubts about its security model, and low sales. With its pricing starting at $1000, then cut to $599 to encourage demand it is estimated that 2,500 units have been sold in the past 7 months. That is until Solana developers decided it was time to revamp the Saga — and started allocating airdrops to its owners. To date, one Saga Phone makes you eligible for $930 in $BONK and $ACS liquid airdrops, not considering that OG owners had plenty of other opportunities that could yield up to several thousand dollars.

That, coupled with the steady hype surrounding the Solana ecosystem, acted as a catalyst that made Saga phones sell out in the past weekends — with an estimate of 17,500 units ordered so far.

Solana Mobile states that 20,000 phones have been built, with demand now strongly outpacing the offer side. As a matter of fact, secondary markets have seen Saga phones being bought by latecomers for as high as $6000 on eBay.

With many other Solana developers teasing exclusive airdrops, the Saga is primed to become a profitable revenue source, rather than just a daily crypto smartphone.

Inscriptions are taking over every chain

Avalanche users spent $13.8 million on transaction fees during the last week for creating and moving inscription-based tokens.

Inscriptions are a way of creating tokens by adding text to regular blockchain transactions and using a separate numbering system to keep track of them. They were originally invented on the Bitcoin network as a workaround to create tokens or NFTs. They're now used on many other blockchains due to them being cheaper to transact with in comparison to ad-hoc tokens. Avalanche's inscription-related transaction fees reached $5.6 million daily recently, comprising 70% of all fees across tracked blockchains. The sudden increase doesn’t matter much to miners and validators as long as they can handle the extra workload and earn more fees—except for Avalanche validators, who don't receive the extra transaction fees, as they get burned instead.

Up and down: despite the tumultuous macroeconomic environment in 2023, Bitcoin recorded its lowest annualized volatility in history, standing at 41.53% — link

Phantom adds support for Bitcoin

Phantom, Solana's primary wallet known for its user-friendly interface, is expanding its support to include other blockchains alongside Solana. The journey began with the addition of Ethereum and Polygon. Now, Phantom has introduced support for Bitcoin, including Ordinals (Bitcoin-based NFTs) and other BRC-20 tokens.

Although this new feature is currently in beta and optional, it’s a significant step toward introducing new users to Bitcoin and its new features, like Ordinals, which might have been challenging to explore before.

L2s are there to securely scale Ethereum, yet they are failing

Layer-2s harness Ethereum’s security model by periodically rolling up their transactions into a single big transaction settled on Ethereum — making their block space cheaper compared to the mainnet. With Ethereum’s Dencun upgrade coming soon, the leading narrative was for L2s to dominate the scene, but recent outages have proven differently, with many doubts arising.

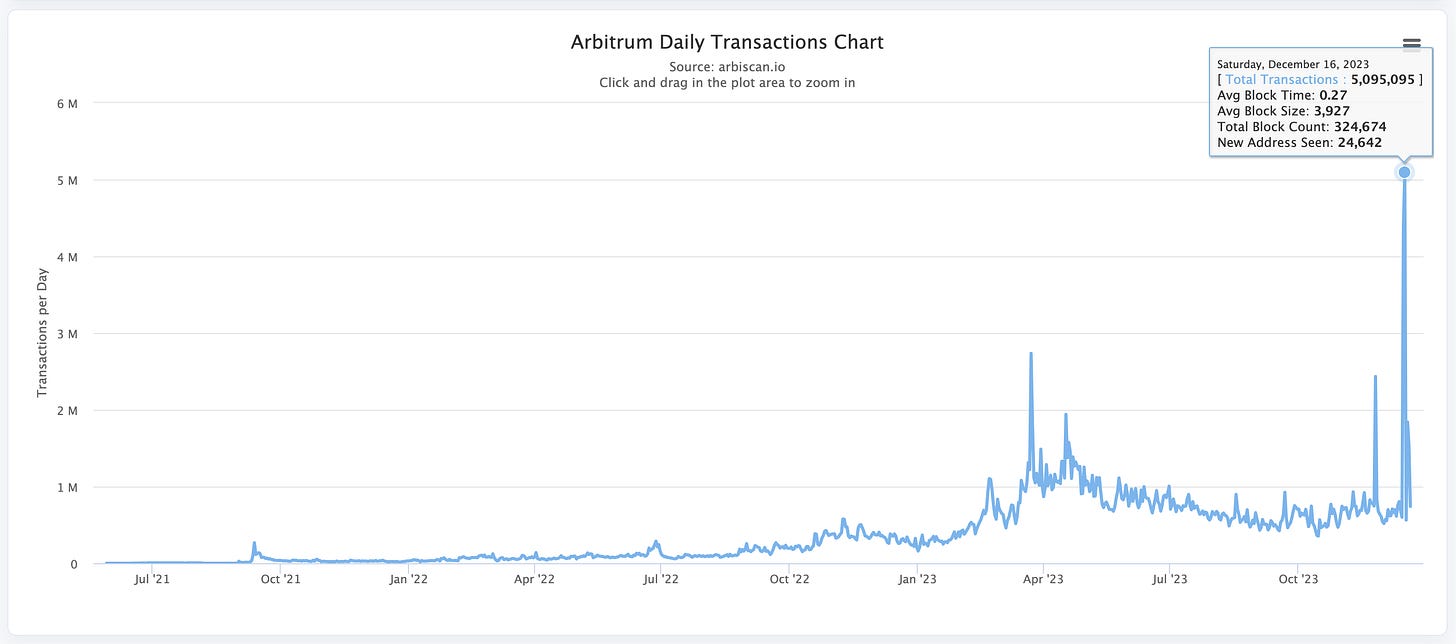

Arbitrum in particular, the biggest Ethereum L2 per TVL, experienced a ~ 90-minute outage because of a spike in inscriptions on-chain, that resulted in 4.39 million transactions submitted on December 15th alone. More specifically, the chain’s sequencer failed to post transactions on Ethereum timely and had to spend 795 ETH ( ~ $1.75M) in fees to get up to speed.

Moreover, a similar incident happened to ZkSync, apparently fixed within 15 minutes. On the bright side, Polygon, another L2, has been able to keep up with the inscription-induced surge in transactions.

Bitcoin’s thriving: transaction fees hit their highest level of all time. $23.6 million of fees in one day — 𝕏/reflexivityres

Tether collaborating with the FBI

Tether, the giant stablecoin issuer, publicly shared its "commitment to security and close working relationships with law enforcement". The CEO, Paolo Ardoino, mentioned that Tether has worked with the Department of Justice, U.S. Secret Service, and FBI to freeze 326 wallets holding 435 million USDT so far. He also announced that they've added the United States Secret Service to their platform and are in the process of doing the same for the FBI.

Circle adds Solana to the list of chains used by EURC stablecoin — The Block

Coinbase secures crypto license in France — CNBC

Trader Joe lands on Mantle with “Merchant Moe” rebrand — 𝕏/MerchantMoe_xyz

Grayscale risks not winning the ETF race with their GBTC funds for tax reasons — 𝕏/NorthRockLP

FTX valuing claims at bankruptcy date, pocketing the difference — 𝕏/sunil_trades

EigenLayer raised caps to 500,000 ETH, but demand has been sluggish

Montenegro cancels extradition approval for Do Kwon — 𝕏/News_Of_Alpha

Vivacity Finance is an RWA-focused lending protocol on Canto, offering a staggering 46.81% APY on Canto’s stablecoin $NOTE.

Manta’s New Paradigm, similarly to Blast, is a L2 offering native yield on deposits. Seemingly under-farmed, poses a great opportunity to obtain your fair share of $MANTA tokens. The platform is currently invite-only, so here’s a couple #1 #2.

Meteora is a protocol enhancing [the much-needed] liquidity on Solana, with one of their beta products being the Dynamic Liquidity Market Maker (DLMM), offering rates as high as 832% APY for SOL-USDC Liquidity Providers. Whilst the yield is enticing, this is not a farm suited for beginners, read more here. Moreover, Meteora is currently token-less, making it a great chance to farm their airdrop as well.

Celestia’s $TIA token is certainly an inflated term within the crypto ecosystem right now. Yet, the upside potential seems to justify so — their huge ecosystem, using Celestia’s Data Availability service, includes many token-less projects that are rumored to be planning to airdrop tokens to $TIA stakers following the Cosmos’ airdrop ethos. Hence, staking some $TIA seems quite an asymmetric bet.

MapleStory Universe raised $100M in an undisclosed round, with Nexon as the only investor. Description: innovative MMORPG that integrates NFT ownership, offering players ownership of in-game assets with real utility.

Farcana raised $10M in a Seed round from Animoca Brands, Polygon Ventures, and others. Description: free-to-play team-based shooter, emphasizing 4v4 gameplay, unique abilities, and a Bitcoin prize system.

Lolli raised $8M in a Series B round led by Bitkraft. Description: rewards application that gives you bitcoin when you shop at your favorite stores.

Fiat Republic raised $7M in a Seed round from Kraken Ventures, Fabric Ventures, and others. Description: London-based fintech platform designed to bridge traditional banking with the Web3 ecosystem.

Pave Bank raised $5.2M in a Seed round led by 468 Capital. Description: programmable bank providing a secure and regulated platform for businesses to transact in stablecoins, CBDCs, and tokenized RWAs.

Want to know more? Head out to Crypto Fundraising and get real-time investing data.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.