Stablecoins at war

DAI wants to be first, while PayPal could possibly onboard the next 400M users in crypto

Welcome to Stay on-chain! This week we delve deeper into stablecoins, with the big boys fighting to gain market share. As if there wasn’t enough competition, Paypal’s about to join the arena as well. Brace yourselves, today we go down the decentralized rabbit hole.

PayPal wants to get its share of profits in the stablecoin business

The payments firm recently announced it’ll be launching a stablecoin on the Ethereum network issued by Paxos, and call it PayPal USD, or PYUSD. Pegged to the US dollar, the coin will be backed by dollar deposits, short-term treasuries and similar cash equivalents. This doesn’t come as a surprise, since it was rumored they were exploring the release of a stablecoin since 2021, but then held on amid regulatory uncertainty.

The move hyped thousands of crypto degens as PayPal could quickly become THE gateway to crypto, counting on about 426M users on the platform. From just a numbers perspective, launching a stablecoin seems like a no-brainer. You get USD deposits, throw them into T-bills (at 5.5% interest), and issue digital coins representing the deposits 1:1. This way, Tether made $1B in Q2 2023, and Coinbase about $240M.

PayPal clearly wants to get a foot in the door, just in case this thing called ‘crypto’ becomes successful one day. And we don’t blame them. Though keep in mind that if Tether and Circle can easily freeze assets at will, TradFi is possibly worse than that so holding the keys to your wallet won’t guarantee you to truly own your money. On the other hand, PYUSD could be the go-to choice for institutions and risk-averse individuals. Just here to build a strategy upon it? Taiki got you covered.

Get paid 8% to hold DAI — too good to be true?

MakerDAO, the entity behind the notorious stablecoin DAI, raised the DAI savings rate (DSR) from 1% to 3% in December, and again from 3% to 8% on August 8.

The move aims to help DAI get traction among its competitors (with USDT and USDC leading the game) — and unsurprisingly it’s working! Spark is a lending protocol powered by MakerDAO that lets you convert DAI in sDAI and earn the DSR rate, which is in turn decided by the governance — its TVL went nuts, rising from 76M to 342M in 48 hours, a whopping 450% increase.

Too good to be true? Currently, you can borrow DAI directly at Spark paying a fixed 3.19% APY, and deposit it into sDAI to earn 8%, hence the massive capital inflows. At the time of writing, there’s already a proposal in Maker’s forum to decrease the DSR to 5% and equal the borrowing rate to it in order to zero out capital efficiency.

On a side note, an interesting narrative is popping up in the space with MakerDAO sustaining those expenses by going hard on Real World Assets (RWA), namely US T-bills. Read more here. (spoiler: the US Government is pumping our bags)

Did you know that DSR peaked at 61.8% in 2020? Ah yes, good ol’ DeFi summer. Learn more here.

Curve recovers 73% of funds

Curve Finance has managed to recover 73% of the funds that were stolen in the recent hack. In case you missed the details, you can catch up on the entire story in our previous issue here.

As a response to the breach, Curve took a direct approach by sending an on-chain message to the hacker(s), offering them the chance to retain 10% of the stolen funds as a bounty and assuring them no legal repercussions if they returned the remaining 90%— quite a good deal for them!

The attacker has initiated the process of returning funds to Alchemix but, a substantial sum of over $18 million in stolen funds is still outstanding. Curve thus extended this offer to the general public as well with another on-chain message stating: "The deadline for the voluntary return of funds in the Curve exploits passed at 0800 UTC. We now extend the bounty to the public and offer a reward valued at 10% of remaining exploited funds (currently $1.85M) to the person who is able to identify the exploiter in a way that leads to a conviction in the courts. If the exploiter chooses to return the funds in full, we will not pursue this further."

Coinbase’s BASE launches and Uniswap joins the ship

Coinbase's Base mainnet opened its doors to the public on August 9. Built on Optimism's OP Stack software, Base operates as a roll-up network that processes transactions away from the Ethereum main blockchain, resulting in a more budget-friendly network for dApps.

What's more, this Layer 2 solution is gearing up to be the go-to network for Coinbase's on-chain products. Over 100 dApps and service providers are set to launch on Base, seamlessly coupled with the broader Coinbase product ecosystem.

A substantial liquidity boost for the Base network comes through Uniswap, Ethereum's premier decentralized exchange in terms of trading volume. It has been deployed on Base right with its launch.

Remember BALD? Its deployer has been potentially revealed here. No, it’s not Coinbase’s bald CEO.

Saddle Finance wants to cease operations — link

Microsoft partnered with Aptos — link

Fantom wants to add optimistic rollups to connect to Ethereum — link

This is pure speculation and there’s no hard evidence supporting this. h/t to DeFi_made_here for the insight.

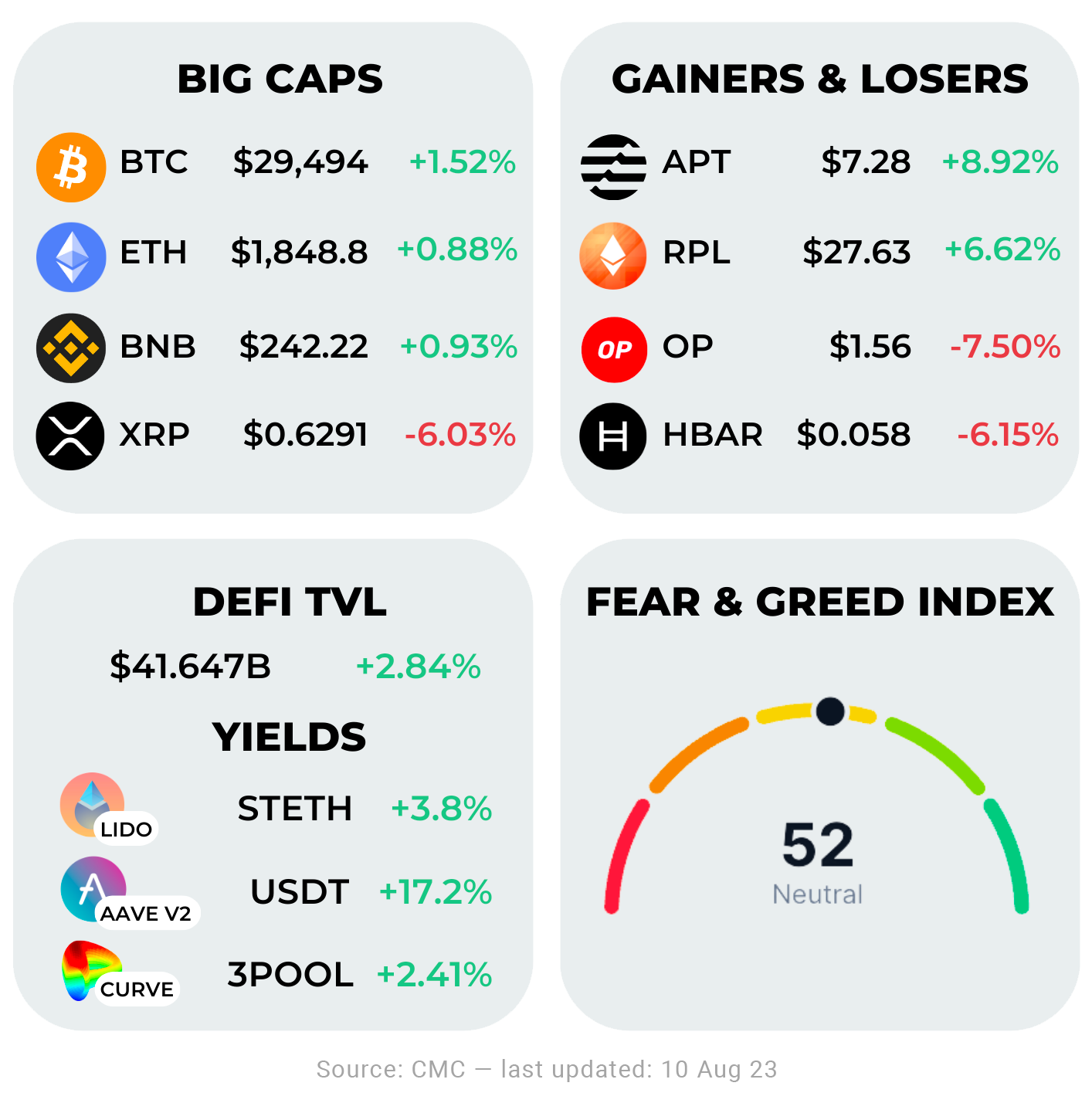

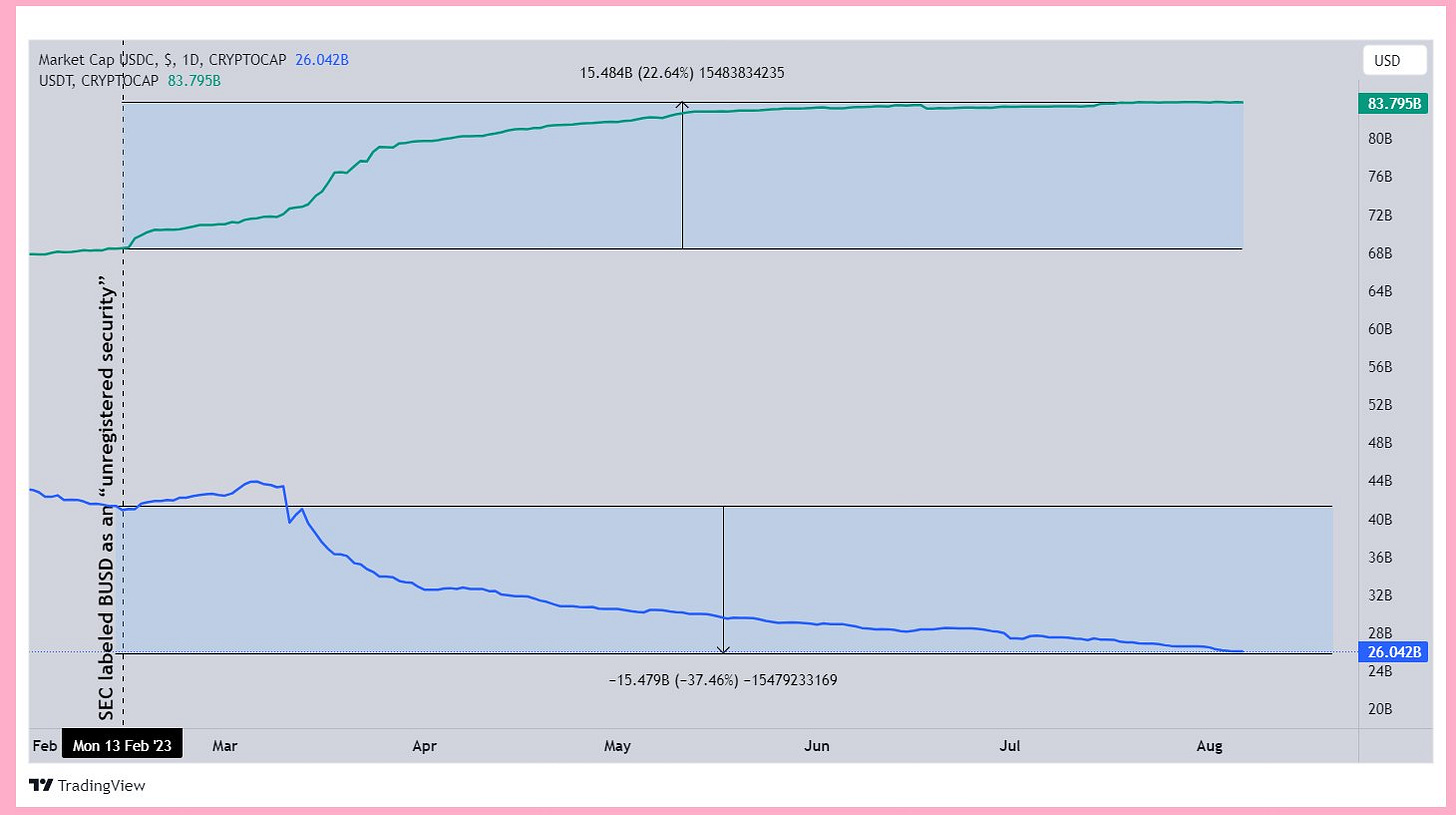

Ever wanted the know the dynamics lying behind the stablecoins we use on a daily basis? USDT boasts a market cap of $83B, USDC trudges behind at $26B and others follow suit. Zooming out, and looking at the big picture, it’s reasonable to think everyone wants to pull water to their own mill, and disfavor the competition.

Recently, a narrative featuring a vampire attack put up by Tether’s USDT against Circle’s USDC has been gaining traction. To understand this, we must first explain in simple terms how the stablecoin business works: you get deposits in FIAT currency, earn interest on them with ‘risk-free’ assets (e.g. US T-bills), issue the digital token representing the stablecoin and pocket all the interest minus operational costs.

This is something that every firm with enough expertise can do. So, how does one capture market share? One of the strategies adopted consists in offering cheaper mint & redeem fees, meaning the cost to either deposit FIAT and receive the digital stablecoin or the opposite.

USDT has been first here, allowing them to pocket a 0.1% fee for both operations. Circle came four years later, and trying to make a name for themselves started offering free minting and redemptions of USDC.

While this helped them almost catch USDT last year, it’s a double-edged sword. It allows for the aforementioned vampire attack, which results in drainage of Circle’s reserves.

Here’s how it works, as if you were Tether:

Mint USDT

Swap USDT for USDC

Redeem USDC for cash (for free!)

Mint USDT

While the net value creation of this is none, it works as in draining liquidity from USDC in favor of USDT. As a side effect, though, this enables a slight downward pressure on USDT since it’s being sold — but hey, that’s the biggest stablecoin in the industry, and market makers will happily adjust the peg.

This so-called strategy scared many including crypto-giant Binance, making them flee USDC for BUSD on their exchange. Reasonably so, they need their pairs to be liquid to avoid market manipulations. Except that a few months after that, BUSD has been marked an unregistered security by the SEC, and Binance had to take shelter and come up with new ideas to avoid Tether’s monopoly.

Binance’s CEO CZ has been open regarding their skepticism towards USDT reserves, and their active work on other stablecoin alternatives. In fact, they recently started pushing the newly created First Digital USD (FDUSD) issued by First Digital under Hong Kong’s digital assets rules — and have long been supporting True USD (TUSD) as an alternative to USDT.

What’s to come? Hard to say, as it’s difficult to predict whether Circle will choose to increase their redemption fee as it’d on one hand make those vampire attacks extremely costly, while on the other make USDC less attractive for institutions and investors looking to adopt it.

All in all, this is a power game, and everyone is trying to deceive the public about who’s the villain. What’s certain is that monopolies hardly benefit the public.

Large token unlocks in August

$BLUR Airdrop in detail

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.