DeFi Dive — Stably launches first stablecoin on Bitcoin

The Seattle-based firm already operates in Web3 offering on-ramp and off-ramp services along with different stablecoins.

Welcome to DeFi Dive! The Sunday edition featuring an in-depth coverage of the week’s hottest topic.

Today’s topic is #USD, Stably’s stablecoin built atop the Bitcoin network, harnessing its security model and popularity. But let’s make a step back, what are stablecoins and why do we even need them?

What are stablecoins?

Stablecoins have emerged as pillars of Decentralised Finance, allowing investors to store value in the form of cryptocurrency avoiding the volatility intrinsic to the market. Stablecoins are essentially tokens representing 1:1 the value of different FIAT currencies, with the $ US dollar dominating with a more than 90% dominance. To operate within compliance, each stablecoin claiming to represent the value of a FIAT currency has to be at least 100% backed.

As a comparison, most traditional banks use fractional reserve: they are allowed to lend out depositors’ money to earn yield — this increases the circulating supply of money, easing access to credit and fostering economic growth through demand (Argentina’s RR is 44%, while the ECB’s goes as low as 1% and Canada doesn’t require one at all). This is what makes bank runs so threatening: it’s impossible for everyone to withdraw their money at the same time, the banks simply don’t have it. At their very core, banks borrow short-term through deposits and invest long-term in loans and bonds which yields returns. The mismatch in the time horizon exposes them to illiquidity — which is one of the reasons Silicon Valley Bank recently collapsed.

One could argue it’s safer to hold stablecoins than deposit one’s money at the bank because of that, as crypto firms are required to be notably more liquid than the banks and it’s possible to oversee their issuance 24/7 through the blockchain. On the other hand, you remain exposed to the underlying assets stablecoins represent with an extra intermediary in between.

Stablecoins play a massive role in the crypto landscape by offering quick access to strong currencies to countries suffering from high inflation, or countries where financial services are less developed. The major stablecoins per capitalization are USDT ($83B), USDC ($29B), BUSD ($5.3B), and DAI ($4.8B), all of them anchored to the US dollar and issued on the Ethereum blockchain (and some other EVM-compatible chains) — #USD is different. It’s launched by Stably, a Seattle-based fintech that already issues USDS on numerous EVM-compatible chains and offers on-ramp and off-ramp services.

Stably launches #USD on Bitcoin

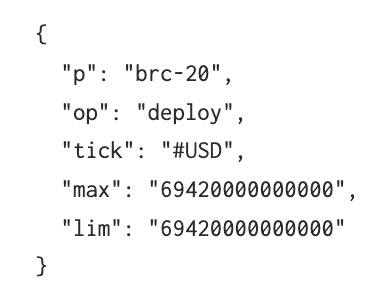

#USD leverages the Bitcoin network security and infrastructure by using Ordinals inscriptions. Each satoshi (the smallest unit a bitcoin can be split in, equal to 0.00000001 BTC) can be inscribed with data, allowing for the creation of so-called BRC-20 assets that emulate ERC-20 tokens using JSON metadata.

#USD has a curious max supply of 69,420,000,000,000; and a market cap of $100 thousand dollars as of May 24, which means that all the supply is being held in Stably’s treasury wallet and is issued over time. Users have to KYC on their website to mint and redeem #USD tokens in US dollars, and the accepted payment methods are Fedwire, SWIFT, USDC, and USDT.

The fintech company wants to build a seamless onramp from TradFi to “BitFi” using traditional payments, allowing people to be long on the US dollar in a sort-of decentralized manner. The concept — coupling decentralized finance with Bitcoin’s infrastructure — is indeed interesting, but could lack adoption and expose itself to high operative costs.

1 #USD is ultimately backed by the price of 1 satoshi as well, as a BRC-20 inscription is essentially a transaction that contains 1 satoshi with metadata attached to it that represents the token. Given that, in the event 1 satoshi reaches parity with the dollar (currently, one is worth circa $0.0002) and USDS gains enough traction arbitrageurs could intervene effectively pegging the price of 1 BTC to $100,000,000 — here’s your daily hopium.

As humans, we’re biased toward a familiar unit of account

One of the main critiques moved to bitcoin’s adoption as a mainstream currency for daily payments is its volatility, which ultimately determines the purchasing power of individuals holding bitcoin — even though historically it has done nothing but increase in the long term, the human perception isn’t comfortable dealing with risks and uncertainty that can potentially harm their well-being. For this very reason, governments are more eager to devalue the national currency using debt rather than taxing private property directly, even though the outcome is exactly the same.

That is why, essentially, we resort to stablecoins. They give us peace of mind, with the certainty that 1 #USD will be worth $1 tomorrow, in a week, and in a year — in that case, the cost of holding stablecoins is inflation. This shouldn’t let one guard down though, as risks are present: cryptocurrencies are experiencing confusing legislation from the US government and the SEC, and since Stably is based in the US it could be affected by further legislation. Stably publishes monthly attestations of the assets backing the stablecoins on-chain since December 2018, declaring over $7M in assets as of April 2023.

Can Bitcoin inscriptions thrive?

Bitcoin inscriptions have been the hottest topic of this May, dividing the community between supporters and haters. The chain saw a marked increase in daily transactions and fees generated, incentivizing more miners to join and secure the network. Besides some questionable uses of Ordinals, it did really help move the space forward — Binance is working on integrating Lightning network support, and Ordinals NFT into its marketplace, with an incredible amount of general interest directed towards Bitcoin. We’re all on the sidelines, waiting for something groundbreaking to happen.

An issue with Ordinals is that, at their core, it’s just a matter of how you see things. To represent the metadata attached to a satoshi you need an Ordinals-compatible wallet, while using any normal one you would only see a normal satoshi that can be stored or transferred at will; this, coupled with the highly illiquid and not-so-friendly user experience, makes them a great gamble at best — if adoption doesn’t endure, many inscriptions could one day be worthless beside their intrinsic value of one satoshi.

It feels like a gold rush once again, and many teams are heads down building new applications that might garner the general public attention. As fees are prohibitive on the Bitcoin mainnet, cheaper Layer-2 Bitcoin solutions — like the Lightning Network — could one day become the go-to option for inscriptions and applications built on top of Bitcoin.

And that’s a wrap! Thanks for reading DeFi Dive, a newly-created concept where we further delve into the rabbit hole of decentralization. While the newsletter aims to get you the latest news in a fast and easy-readable format, Dive dwells on the details and tries to give you a comprehensive outline of specific topics. See you next Thursday with the weekly news!

🐳 Feeling generous? Fund this newsletter and the degens behind it:

0x6480474717045771Ecf6561331458dcbA6229C75 (EVM)

1AXaP7Qe9cGzW6oYYs5xLfEgGHb3UppHjn (BTC)

Powered by Unibo Fintech Society.

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.