Telegram to onboard the next 1B users

Mark Cuban scammed for $870K, and yet another OP airdrop awaits

Welcome to Stay on-chain! As always, we've got your back. We've done the market research for you, so sit back, relax, and let us be your eyes and ears in the crypto world!

In today’s edition:

$OP’s new airdrop and its giant private token sale

Yearn’s recently launched yETH

Friend.tech exceeding expectations

Your weekly DeFi Edge: Telegram’s TON and the reasons behind its promising potential.

Reading time: 6 min

$OP’s new airdrop and its giant private token sale

Airdrops are well-known for driving engagement in crypto.

We all remember Arbitrum's recent massive airdrop, but, you should know that Optimism was the first to pioneer this approach. Optimism made headlines in May 2022 when it announced it would distribute a whopping 19% of its token supply via airdrops to reward its active users.

Optimism just announced another OP airdrop. This time, they plan to utilize the unclaimed funds, which represent roughly one-quarter of the allocation from the initial airdrop. As a result, 19.4 million OP tokens ($26 million), will be distributed to 31,870 addresses that participated in governance activities within its DAO.

But that's not the end. The Optimism team has just made another noteworthy announcement: they are selling 116 million OP tokens ($162.4 million) in a private sale, divided among seven purchasers. These tokens will be subject to a two-year lockup.

Arbitrum is not falling behind with incentives.

The Arbitrum DAO just announced it will give away 50 million ARB tokens ($41.5 million) to DeFi projects building on the chain. The projects themselves may then redirect some of them to their most active users. However, it's important to emphasize that this remains speculative and is by no means a certainty. In any case, what is certain is the upcoming Arbitrum Odyssey, starting next week, where participants will have the chance to win up to 16 NFT badges.

Catching up: stablecoins’ volume reached parity with VISA in just six years.

yETH: minimise trust, maximise yield

Yearn Finance recently launched yETH, a diversified basket of Liquid Staking Tokens (LST) that allows the everyday investor to leverage the potential of ETH’s liquid staking without having to rely on a single LST. The initial basket of LSTs is composed of Frax, Swell, Lido, Stader, and Coinbase liquid staking solutions — holders will be able to determine the weight each LST should have in yETH’s composition depending on its trustworthiness, and eventually add new LSTs (notably, rETH is missing).

In order to vote and accrue yield, holders have to stake yETH and obtain st-yETH: currently, the APR is at 18.72%. Which is incredibly high, considering that most Liquid Staking Tokens do not reach 4%. Don’t fret throwing all of your life savings into it though, as the rate is temporary and should adjust downwards over time — it includes whitelisting fees (paid by LST creators), LSTs bought at a discount, ETH’s staking yield, and misinformed users that didn’t realize yETH must be staked to accrue yield, who are now losing out on rewards.

Now, check out their promotional video for it. It’s a banger. Crypto marketing teams, please take note.

Happy Bday ETH! It’s been a year since Ethereum’s transition to Proof-of-Stake, the so-called Merge. To date, ETH’s supply decreased by 295,423 tokens.

Friend.tech exceeds expectations and keeps growing

The Social Finance experiment was launched more than a month ago and keeps crushing milestones. Its total value locked (TVL) currently sits at $38M, 222,000 users did at least one trade and boasts a volume ranging from $10M to $20M. What’s astonishing is that $24M in fees have been collected, 63% of current TVL — Friend.tech charges 10% per transaction, split equally between the creator and the platform treasury.

The system is inefficient, yet continues to expand: why? Mainly, users are hanging around to collect the airdrop (using FT you collect points, that should make you eligible for an airdrop), and creators are eager to share the novel application with their followers because they make bank with fees — with Non-Web3 influencers like Steve Aoki joining the ship as well.

Thus, current stats are skewed by the airdrop expectancy, and FT’s sustainability should be seen after that. What’d be interesting — yet a bit dystopian — are financial primitives built atop the platform, like money markets that could greatly improve the system’s liquidity. Come on man, could you imagine shorting X users you don’t like?

Security matters: famous investor Mark Cuban saw $870K disappear from his crypto wallet, possibly by signing a malicious transaction on MetaMask.

Yesterday the FED didn’t rate hikes, and we’re seemingly near the end of this tightening cycle. Grayscale on why this could be bullish for Bitcoin.

Binance’s L2 opBNB is live, and TXs cost less than a cent. Yet no one’s using it.

Ethereum launches HoleSky testnet

L1s keep jumping ship: Canto migrating to an Ethereum Zk-powered L2 using Polygon devkit.

Balancer front-end has been exploited due to DNS hijacking. Seemingly all .fi TLDs are at risk.

Native USDC is now available on Polkadot.

Japan now allows startups to raise funds by issuing crypto instead of stocks.

An incredible opening speech at Permissionless on why crypto matters.

In this week's edition of DeFi Edge, we'll delve into Toncoin, the native cryptocurrency of Telegram's Open Network.

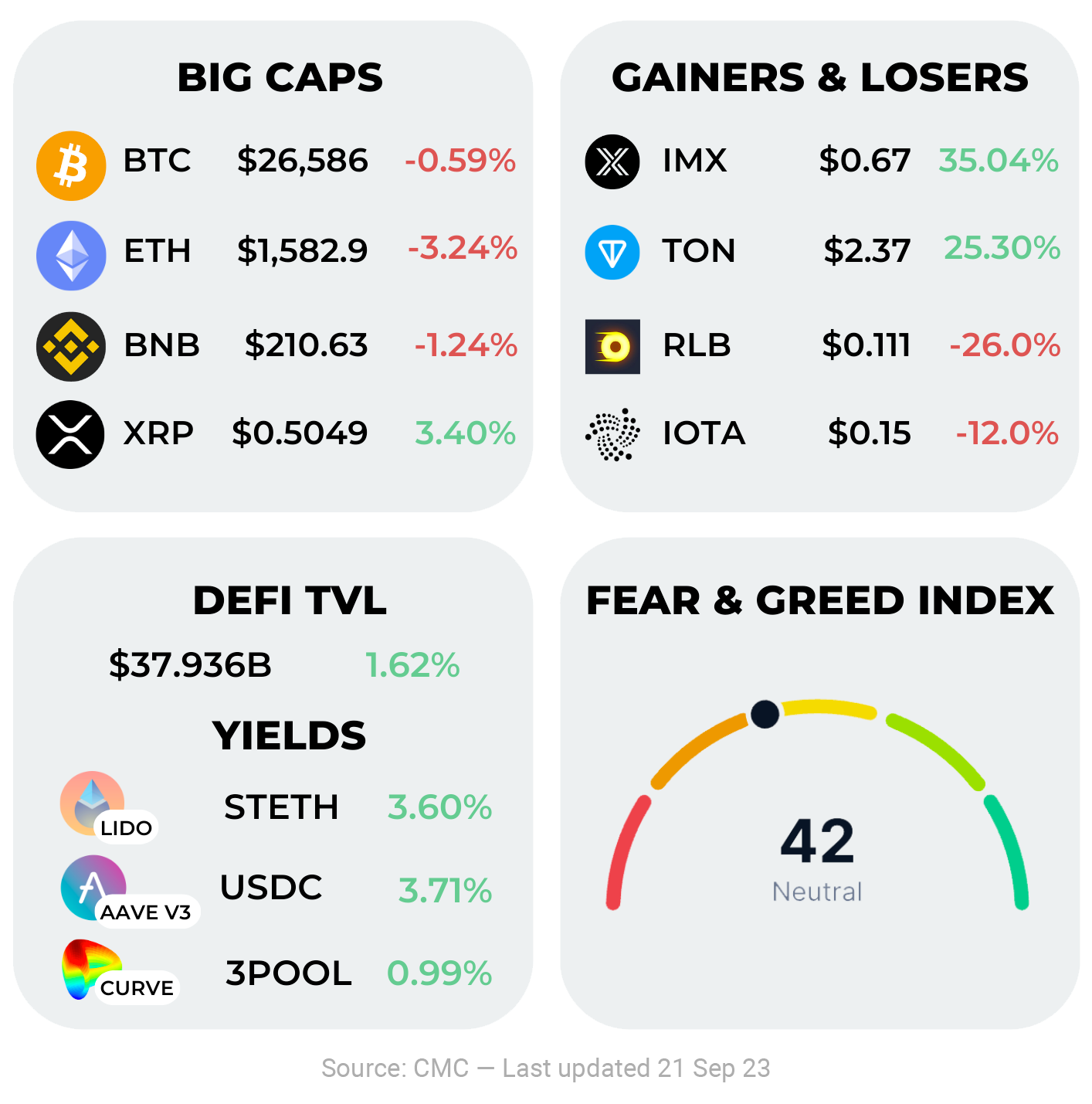

Toncoin, denoted as TON, rose in price by 25% this week, following the announcement made by Telegram and the TON Foundation during the Token 2049 conference. The duo introduced a new self-custodial wallet known as "TON Space", which pushed TON into the top 10 cryptocurrencies by market cap. Currently, it holds the 9th position, just behind $DOGE.

TON Space, the innovative wallet in question, will be seamlessly integrated into Telegram and will feature commission-free crypto transfers to any Telegram user. It will be available to all Telegram users except those residing in the United States and a few other countries.

Now, let's look at what The Open Network (TON) is all about.

TON Network is a Layer 1 blockchain with a sharded proof-of-stake consensus mechanism, capable of 55,000 transactions per second. The network's native cryptocurrency, TON, will serve as a means for network operations, transactions, games and collectibles. The TON ecosystem already boasts over 500 applications available in its app store, complemented by additional services like TON Storage, TON Proxy (a decentralized VPN service), and the TON naming system.

What about the tokenomics? TON has a max supply of 5 billion, with approximately 3.4 billion TON tokens currently in circulation. Validators are rewarded with TON tokens for their role in maintaining the network, bringing an annual annual inflation rate of 0.6%.

Despite TON's recent price surge, its full potential may still remain untapped. Telegram stands out as an exceptionally popular messaging application, boasting an impressive user base of 1.068 billion active users. In contrast, the crypto space comprises only 420 million active users! Telegram holds the potential to bring a substantial number of new users.

It’s also worth noting that Telegram’s TON actually survived the SEC. Which one could interpret as free highway for the project.

In 2019, the SEC filed a lawsuit against Telegram, alleging that the company had raised $1.7 billion (making it the second-largest ICO) through a token called Grams, which they classified as an unregistered security. To resolve the legal matter, Telegram reached an agreement with the SEC, involving the refunding of unused investor funds and the payment of an $18.5 million fine. Since 2020, Telegram has abandoned the Grams token, and TON has continued to thrive as an open-source community-driven initiative.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.