The far west of Social Finance

Mixin Network, claiming decentralisation as its mission, lost $200M in a Cloud hack

Welcome to Stay on-chain!

In today's edition:

$200M stolen from Mixin, private keys were on cloud

Arbitrum launches $42M short-term incentive program

The FTX saga

Your weekly DeFi edge: should you ape in on FT’s forks?

Reading time: 5 min

$200M stolen from Mixin, private keys were on cloud

Until a few days ago, the Mixin network with its $350M TVL was the 10th biggest blockchain — yet, most investors never heard about it. Seems like Tron’s cousin.

They announced with a tweet that Saturday morning their cloud database was hacked, “resulting in the loss of some assets on mainnet”, promptly shifting the blame on their cloud service provider (seemingly, Google) and pausing the network until further notice. To date, $200M have gone missing affecting mostly users.

The most accredited rumor is that private keys were leaked, since the drainage of funds happened mainly through simple transfers on the blockchain. Which is laughable for a company whose mission is to “put security, privacy and decentralization first”.

Whilst waiting for a post-mortem on the incident and next steps for affected customers, the company sent an on-chain message to the attacker offering a $20M bug bounty if funds are returned. We can’t do nothing but speculate: was it NK’s Lazarus again? An inside job from the team?

Once again, centralisation was disguised as decentralisation. Yet, this only serves as a reminder to real builders innovating this space by building a better financial system for everyone.

You cannot make this up: PYUSD, the stablecoin, is far safer than holding your $ in a Paypal account. Read more here.

L2 Wars: Arbitrum launches $42M short-term incentive program

As Optimism gains momentum and other new L2s threaten Arbitrum’s hegemony, their DAO came up with the oldest trick in DeFi. Yeah, you got that right, ARB goes brrrr.

The rationale behind this proposal is simple: incentivising the use of Arbitrum dApps through the distribution of ARB tokens will bolster on-chain volumes, user activity, liquidity and transactions. Furthermore, the goal is to determine the efficacy of such programs — in other words, what’s the Customer Acquisition Cost (CAC) when distributing grants?

As Arbitrum’s DAO approved up to 50M ARB in grants, protocols flocked to their forum to apply for their share of the pie, detailing how they’d spent the ARB loot to benefit network growth.

Funnily enough, you could say Arbitrum funded this effort with unclaimed airdrop tokens. Just a few days ago, nearly 70M ARB tokens ($56M) have been sent back to the foundation’s treasury after being unclaimed since March. Moreover, they’re about to start back the Arbitrum Odyssey NFT program, you might want to give it a shot!

NFTs? Walmart to sell Pudgy Penguins toyline in 2,000 stores.

The FTX saga. Where we at?

The exchange case keeps going, intertwined with SBF’s misuse of customer’s deposits for personal affairs and bribing politicians. September 29th will be the last day for customers to support their claims to the exchange, whilst the bureaucracy keeps doing their thing in Washington to get as much cents of the dollars as possible for FTX’s creditors.

LayerZero recently made news for being sued by FTX on claims that they received a preferential treatment, allowing them to claw back $21M from the platform days before withdrawals were paused in November 2022. Whilst seemingly an obvious behaviour, the fact that they were able to withdraw their money at a time where FTX was already insolvent puts them at risk.

On a side note, the Mantle DAO just passed a proposal that disqualifies FTX from migrating their BIT tokens to MNT automatically, still leaving room to approve migrations on discretionary basis. Alameda had struck up a deal with BitDAO exchanging FTT tokens for 100M BIT, now worth roughly $43M and one of FTX’s biggest holdings. The tokens were exchanged agreeing on a 3 year lock-up, due on November 2 2024.

It is reasonable to expect that FTX creditors won’t accept the development, and try to claw back as much MNT as possible.

Paul Grewal says BASE token could be viable some point in the future

Stader labs to launch liquid re-staking token rsETH on Mainnet by mid November

Llama corp launches privacy-focused portfolio llamafolio

Celestia airdrops 60M TIA tokens to 7,579 developers and 576,653 on-chain addresses

Shortly after renaming to HTX, former exchange Huobi has been hacked for $8M. Justin Sun offered the hacker a “security advisor” role and a 5% white-hat bounty if funds are returned over the weekend

$30M OP tokens are set to unlock on September 30

Curve’s CEO repaid all of his AAVE debt.. by shifting it on Silo

There’s a spike in activity on NEAR driven by e-commerce app Kai-Ching

Jade protocols struggles as members ask to liquidate $31M treasury and dissolve the DAO

SEC delays decisions on proposed Ethereum spot ETFs from Ark, VanEck

Analytics company Nansen suffered a data breach

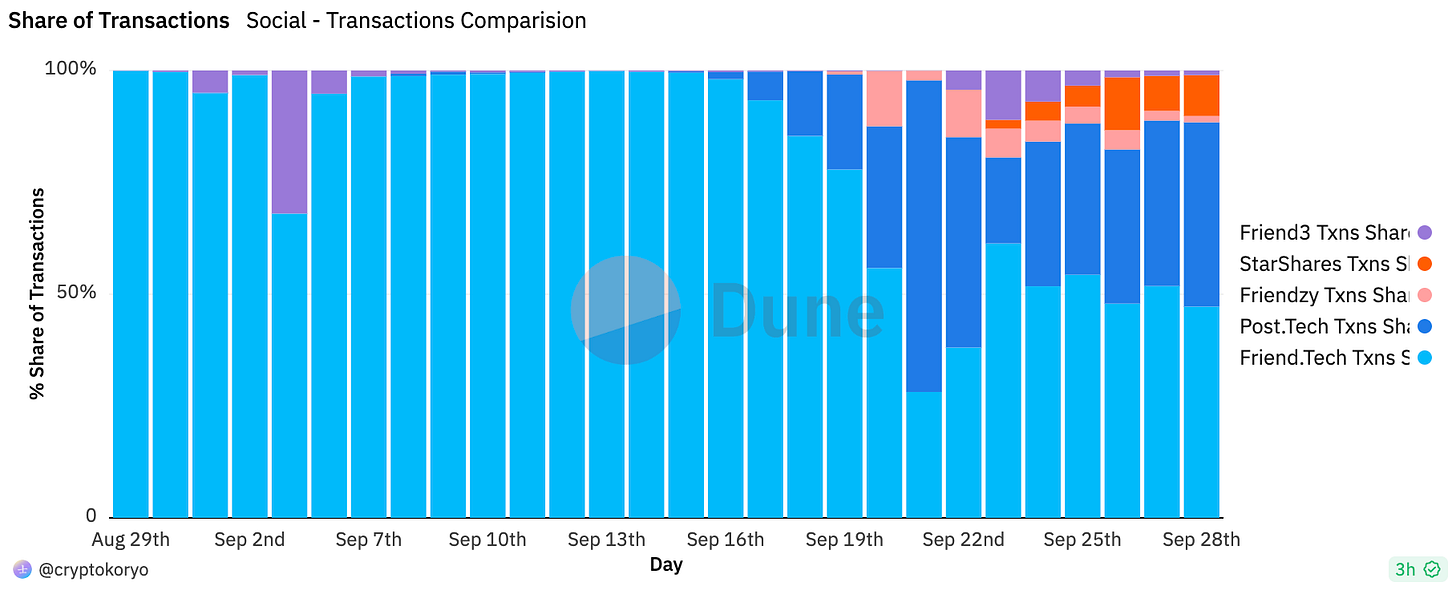

The era of forks is coming for Friend.tech with no exceptions.

After the emergence of DEXes, we saw the proliferation of Uniswap’s forks. The same happened with Olympus DAO, with forks springing up left and right. However, as history has shown, a few survived the test of time. Many failed due to their inability to offer distinctive features that added value. Nonetheless, a few standout examples, such as PancakeSwap and SushiSwap, not only endured but thrived as successful DeFi protocols.

Now, it’s the turn of Friend.tech forks, with almost every L2 chain launching one. Which of these will endure?

In our previous newsletters (here, and here), we delved into Friend.tech, but here's a brief recap of what you should know:

Friend.tech is a SocialFi dApp that enables users to issue "keys" by connecting their X account. These keys represent personal shares that can be traded and grant their holders access to private group chats with the issuer, the X "influencer." Friend.tech has surprised many (including us), with a consistent rise in its TVL, currently standing at $44.51 million.

It has also emerged as one of the top revenue-generating DeFi protocols, ranking among the top 5 with $22.9 million in collected fees over the last 30 days. Notably, Friend.tech charges a 10% transaction fee, evenly split between the creator and the platform treasury.

Now, let's turn our attention to the two most prominent Friend.tech forks that have emerged and pose strong competition to the original:

Post.tech

Post.tech, the most successful fork to date, launched on the largest DeFi liquidity hub, Arbitrum.

Many users praise its more user-friendly interface, similar to X’s, but the key distinction here is that 5% of the trading volume benefits shareholders, offering a compelling incentive for them to hold the keys of their favorite X influencers. Additionally, its launch on Arbitrum may provide a more favorable environment for user onboarding and offboarding, although this advantage may be short-lived as Base is rapidly catching up.

FanTech

Even the latest L2, Mantle, has launched its own version to attract user activity. Following the SocialFi model, FanTech introduces bidding through the Share Generation Event and features an effective referral system, which imposes a 1% tax on shares to onboard new users.

The list of Friend.tech forks continues to grow, with options like Star Shares on Avalanche, Friendzy.gg on Solana, and for those intrigued by Bitcoin DeFi, New Bitcoin City, which combines Bitcoin and Ordinals into a SocialFi dApp for the Bitcoin community.

Should we ape?

"Trend is your friend", they say, and there is clearly a SocialFi trend. Hence, getting involved in some of these forks before they reach the level of Friend.tech's growth could potentially offer a good ROI. However, they pose much higher risks, which must be considered. Some developers may be capitalizing on the trend without prioritizing product quality, potentially leading to security issues.

In any case, success in these apps may be closely tied to the growth of the respective L2 chains and their ecosystems. As the chains expand their ecosystems and communities, it's reasonable to speculate that their SocialFi dApps will also thrive.

This is not financial advice.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.