Grayscale wins dispute over SEC

While BASE is the fastest-growing L2 chain and $PEPE rugs

Grayscale won against the SEC in court, lifting the hopes for a Bitcoin ETF. A $15M market sell order of $PEPE hits the market and Base reaches 1M users in just 11 days.

Don’t rush to buy the $PEPE dip! Sit down, relax, and let us tell you the story.

Grayscale wins over SEC and markets soar: what now?

It’s the gold orange rush once again. On Tuesday, Grayscale won an appeal against the SEC decision to reject the conversion of GBTC — a bitcoin’s mutual fund — to a bitcoin spot ETF. Funnily enough, the judges considered SEC’s rejection to be “arbitrary and capricious”.

There’s nothing set in stone yet, i.e. the SEC doesn’t have to approve their ETF following the ruling, and both parties have 45 days to appeal the judges’ decision. But the speculation cannot wait, right?

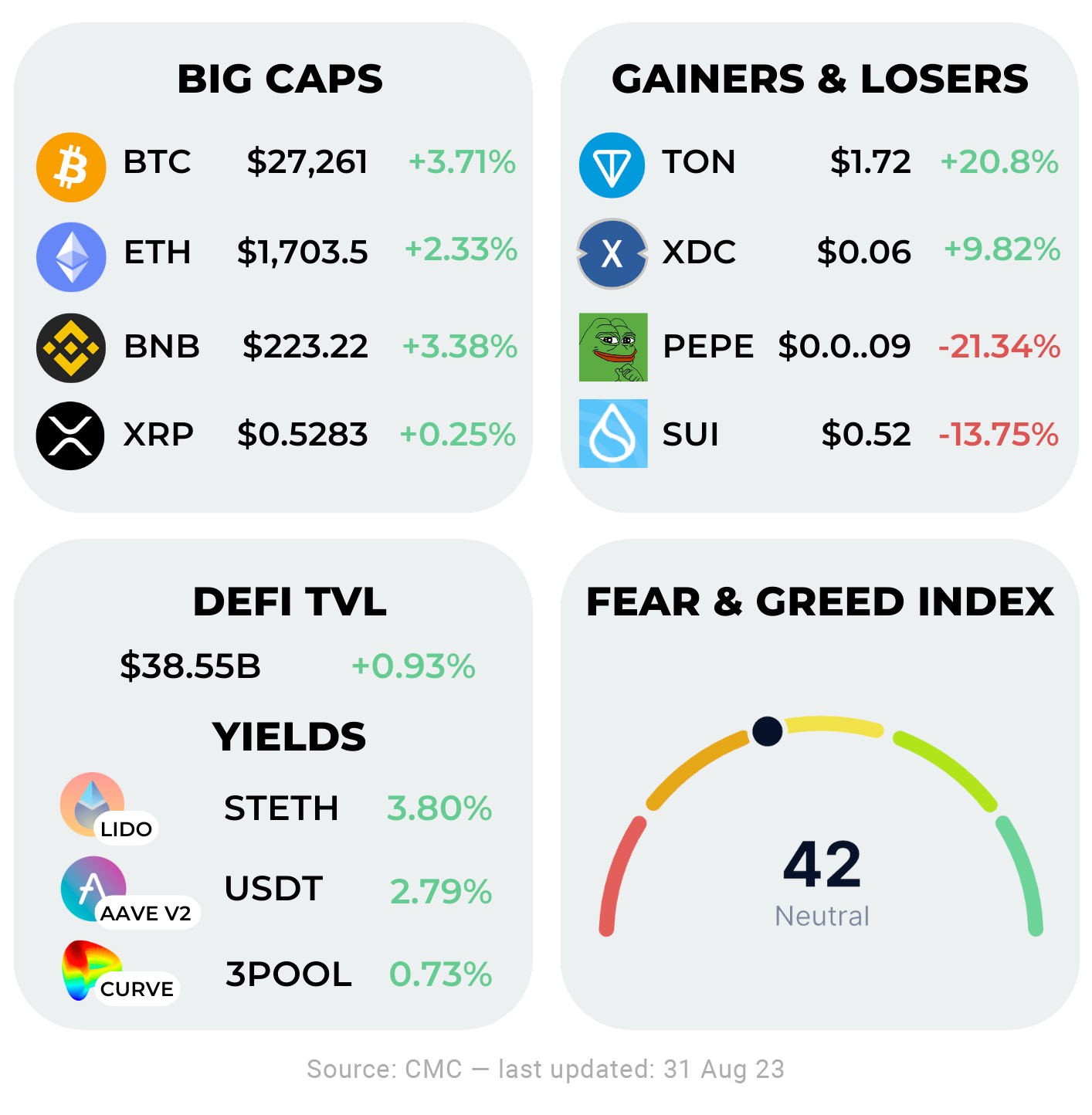

Markets fit the narrative well enough to justify a mind-blowing increase in prices all over crypto charts — namely, BTC alone registered an 8.60% increase in price during the day. What no one expected was BCH leading the way with a 21% daily candle (really?).

On a more serious note, the approval of a spot bitcoin ETF would have huge implications for adoption. Whilst futures contracts (already available in the US) allow you to speculate with no need to own the underlying asset, spot contracts instead require you to do so. And they’re easier to understand and use for the average Joe trying to set aside some money for retirement.

Per Bloomberg intelligence, the market share for BTC spot ETFs lies around the $150B figure, which currently accounts for about 28% of Bitcoin’s market cap — making it the perfect catalyst.

..However, Grayscale is not alone in the spot ETF rush.

In a few days, many filings are set for consideration by the SEC, which can decide whether to approve, reject, or delay them. Many speculate that given how the courts overturned the SEC decision, it’s now very likely that ETFs will be approved.

No one’s immune to scams: the US Drug Enforcement Agency (DEA) was scammed for $50K worth of USDT.

PEPE’s inner strife exploded: $15M market sold

Everyone talks about it, including our market performance infographic above: the memecoin PEPE crashed hard, securing the #1 place in the top losers. The following days a statement is posted on their official X account, which narrates about inner conflict within the team that was controlling the 3 out of 4 multi-sig treasury, containing roughly $26T tokens. This led to 3 team members removing themselves from the multi-sig, taking with them a lil’ severance: $16T PEPE (~ $15M), quickly sold on the major exchanges.

Many, apart from other team members, didn’t like the move — and it quickly got personal. Within hours, most personal details of one of the alleged founders (previously anonymous) that left were published online, presumably in revenge.

Takeaway lesson? Agree on structured tokenomics and proper governance, even for the worst shitcoin. But most importantly, learn to use TWAP and limit orders to rug-pull more efficiently.

Base will get 118M OP tokens

Base, the Coinbase-backed L2 scaling solution, will receive 118 million OP tokens vested over six years. The OP allocation will give the Base ecosystem some governance voting power over Optimism. In return, Base will contribute 2.5% of its sequencer revenue or 15% of its net profits (which is much more in $) to the Optimism Collective. The deal is part of "a shared commitment to the rules for upgrades and sequencing of OP Chains". Base will share the upgrades with the OP Mainnet so that both chains remain compatible, homogeneous, and eventually interoperable in a Superchain future.

Did you know? Base is the fastest-growing L2 chain. It only needed 11 days to reach 1M users. Optimism needed 191 days, while Arbitrum 303.

Is PayPal’s stablecoin a flop?

PayPal's new shiny stablecoin, PYUSD, got a quite choppy start. As on-chain data reveals, only a few are utilizing and holding the token in self-custody wallets. Paxos, the stablecoin issuer Paypal partnered with, is still holding over 90% of the PYUSD supply, while exchanges like Kraken, Gate.io, and Crypto.com hold just over 7%. A minimal number of non-contract or non-exchange holders have balances exceeding $1,000. This suggests a lack of demand from crypto users for yet another centralized stablecoin.

We should keep in mind tho, that PayPal is targeting a completely different user base, where many may be new to crypto.

Tether updated its reserves on Aug 24 — link

PancakeSwap expands to Linea

Magnate Finance rugpulls $6M on Base

Velodrome debuts on Base as ‘Aerodrome’ — link

Polygon announces dev-kit to launch ZK-powered L2s — link

OpenSea fosters ERC standard for redeemable NFTs — link

Is Friend.tech, just a fad? Volume down 95% since top — link

Base vs Mantle - which is best for DeFi degens?

Let's compare the two just launched L2 chains, Base and Mantle. They both are less than a month young but already provide juicy opportunities. We know you don’t have time to try out everything, so which one is best?

Base

Base was recently launched by Coinbase, the largest US centralized exchange, and a publicly listed company. It's built using Optimism's OP Stack, meaning it doesn't bring revolutionary tech to the table. The real deal with Base? Simple, it's backed by Coinbase. The strong reputation attracts many projects to hop on and deploy its products on the chain, rapidly growing its ecosystem. The interesting thing for us, DeFi degens, is that many blue-chip protocols like Uniswap, GMX, Synthetix, Aave, etc are launching on it too, making it the perfect playground; sweet farming APRs from protocols that want our liquidity.

Moreover, Base's reputation has attracted partnerships with giants like Coca-Cola. That hints at more users pouring in. Newbie users = exit liquidity 🤓 (JK)

Mantle

Mantle instead, is being developed by BitDAO, the biggest DAO in the space with a liquid treasury of around $3.2B -- so they probably won't run dry anytime soon. Additionally, they have support from Bybit, a major centralized exchange.

Mantle does bring innovation to the L2 landscape by combining an optimistic roll-up protocol with a new data availability solution called EigenDA. The promise here is, as usual, lower gas fees compared to competitors. With over 100 applicants for the ecosystem fund, Mantle will probably grow fast too.

Conclusion

With the risk-to-reward ratio in mind, Base seems like the more tasty deal right now. It's hanging out with the cool kids – those blue-chip DeFi protocols that are already live on it. Having these big names with an already proven track record around makes the DeFi playground safer, but still full of interesting opportunities. While Mantle introduces innovative technology, it's important to note that the L2 scene is bustling with strong competition and rapid developments occurring every week.

If you found this Leaks edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.