Trump, the "Crypto President"

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain!

🗣️ We need your help! Complete this quick survey to help us improve. It’ll take you just a few minutes.

By the way, make sure to join our Telegram group 👾

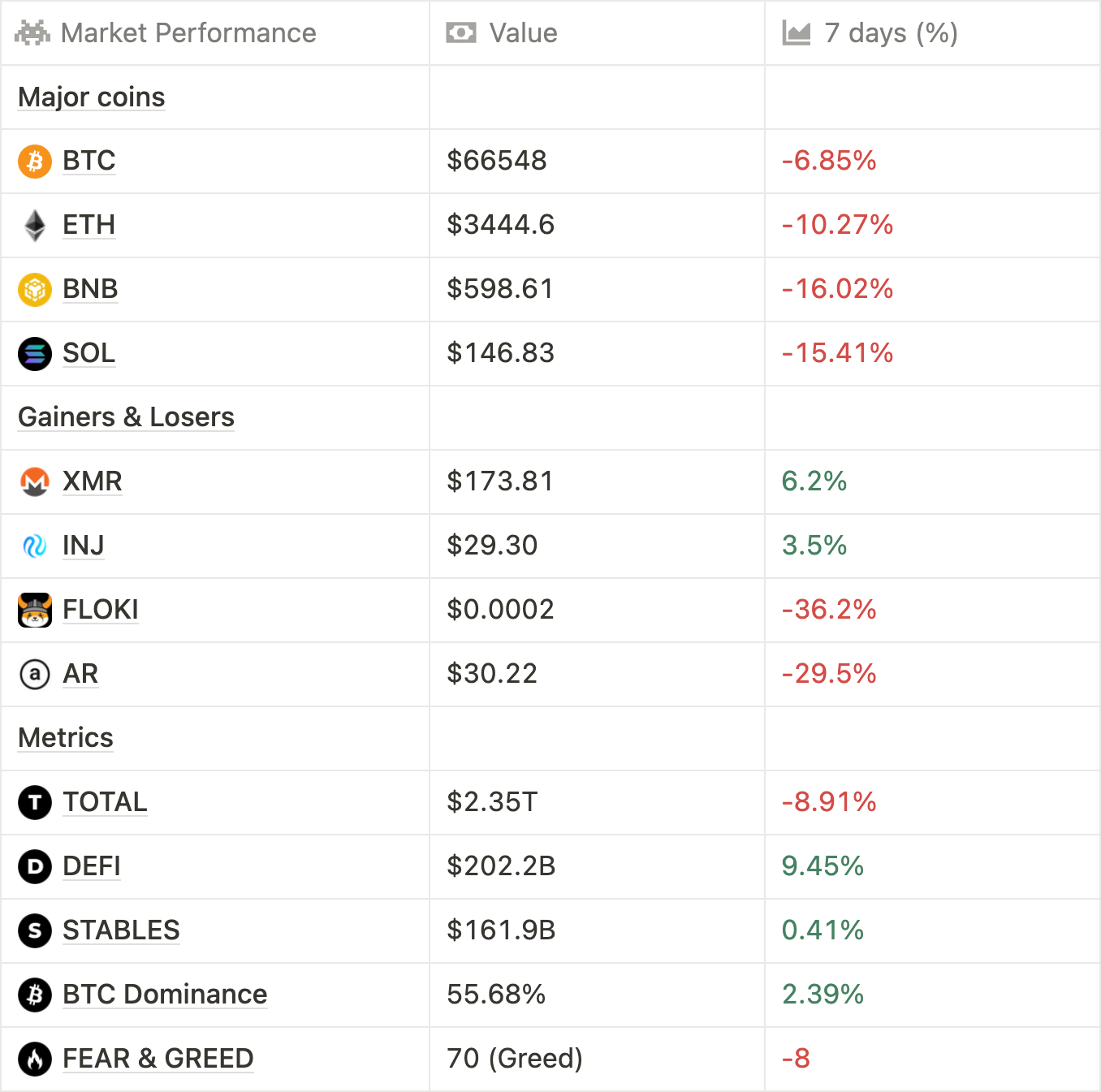

Let’s talk Macro first: during yesterday’s FOMC meeting the FED announced, once again, no interest rate cuts — despite growing pressure to cut, the U.S. Federal Reserve remains one of the few big banks holding the fort, while the ECB just announced a 25 bps reduction in rates. The consensus is now 0 to 2 cuts this year, with the first one priced in at 56% in September.

The past week’s crazy BTC ETF inflows have slowed down, and due to a couple of days with net outflows, we’re back ranging in the $60B in net assets range.

Overall, Bitcoin has been stuck in the $60-74K range since February, with no end in sight. The major catalysts lie in this year’s presidential election, where a Trump win could propel short to medium-term growth fueled by his pro-crypto and overall pro-growth stance (at the expense of long-term deficit). Last but not least, if Ether ETF flows were to be mispriced and surprise to the upside, we could see a considerable bump in ETHBTC.

The market is in a “boring” phase, where investors are in disbelief towards heavily VC-backed altcoins — suggesting a switch to a Barbell strategy, where portfolios rebalance in order to hold major assets and tiny allocations to the attention-seeking economy (i.e. memecoins, see $MOTHER).

Trump, the “Crypto President”

Trump keeps bolstering his pro-crypto stance, participating Tuesday night in a meeting with a number of bitcoin miners to discuss policy, where he pitched himself as the “Crypto President”. The running candidate has a clear dominance in political consensus if we consider the crypto field, with most founders supporting his innovation mindset over excessive regulations. On the other hand, Biden is re-working his crypto policy and is rumored to start accepting crypto donations as well.

Talking ‘bout mass adoption: according to this report, 562M people use crypto worldwide, making up 6.8% of the world’s population

ZkSync releases ZK airdrop allocations

Finally, ZkSync spilled the beans revealing the allocation checker for their ZK airdrop. The token is set to have a total supply of 21B, 3.6B (17.5%) of which have been set apart for the initial distribution claimable on June, 24th.

While there’s been some backlash as usual by non-eligible folks, the general sentiment is that this was a well-crafted airdrop. The distribution has been generous, and anti-sybils measures quite lax. In total, 700K wallets are eligible with an average distribution of 4924 ZK per wallet.

Currently, the pre-market price for ZK is $0.35 on Aevo & Hyperliquid, signaling a potential FDV of $7.35B — which is on the low end, considering its competitor Starknet is currently boasting a $10B FDV for STRK.

Talk about growth: Binance now counts 200M users, doubling in 2 years — 𝕏/binance

Telegram introduces internal currency: Stars

To be used for paying digital services in mini apps, Stars allows for Telegram apps developers to accept payments hassle-free. Furthermore, to circumvent the 30% commission charged on their purchase by Google Play and the App Store, Telegram is going to subsidize ads purchased with Stars to make up for it — creating a virtuous cycle that makes developing Telegram apps cheaper than traditional ones.

We’ve done the heavy lifting for you: Here’s a TON ecosystem review — 𝕏/DWFVentures

Symbiotic, the EigenLayer competitor

All good tales start with a conflict: here, you have two prominent VC firms. a16z, which happily funded EigenLayer; and Paradigm, which couldn’t. But Restaking is gonna be huge, right? So, together with Lido, they raised $5.8M and secretly funded Symbiotic — a competitor introducing permissionless restaking.

The protocol launched restaking vaults with very limited caps at $200M, compared to Karak’s $1B and EigenLayer’s $20B TVL. Stay on-chain community members got a heads up before they filled, so make sure to join us to not miss any more opportunities. Partnerships-wise, they’re boasting huge names like Ethena, LayerZero, HyperLane, and Bolt. Want to know more? Check out our fren Ignas deep dive.

The flippening: TON now has more daily active addresses than Ethereum — 𝕏/Delphi _Digital

Terraform Labs plans to dissolve after settling $4.47B SEC fine

Terraform Labs, the entity behind the Terra blockchain and the infamous tokens $UST and $LUNA, settled with the U.S. Security and Exchange Commission on a $4.47B fine for its wrongdoings. The fine is unlikely to be paid, and is in any case to be collected after harmed investors and other unsecured creditors recover in full. Per the current CEO's words, the company is going to be dissolved and its unvested tokens burned. At its peak in April 2022, UST was worth $19B, and LUNA $41B. Do Kwon, the former public face of the company, has been released on bail in Montenegro and it’s still unclear whether he’ll be extradited to the U.S. or to South Korea to serve his time.

Don’t f*ck with the CCP: a 24-year-old Chinese college student has been sentenced to 4 years and 6 months for “rug-pulling” liquidity on a BNBChain token

Curve’s founder CRV loans have been liquidated

Curve’s founder Michael Egorov CRV-denominated loans have been on the verge of liquidation multiple times — always avoiding it by a whisker, not this time though.

He had $140M worth of CRV lent across five lending protocols (Silo, Fraxlend, LlamaLend, Inverse, UwU Lend), borrowing $95M in stablecoins against it paying a ~ 60% APY.

Why on earth would you do that, you may be wondering. While not intuitive, multiple reasons: (1) you could never sell that much CRV on the markets without zero-ing its value, (2) in many legislations, borrowing assets is not fiscally relevant, hence non-taxable, (3) he owns a huge chunk of the CRV supply with a zero cost-basis, allowing him to replenish his collateral and not worry much about the high borrowing costs.

To date, most of the CRV-based debt has been cleared (plunging 38%, down to $0.21) to avoid bad debt. Wondering where’s all that cash going? A nice mansion, of course. Crypto founders are the nouveau riche.

Happens on-chain

Wormhole introduces W delegation module amidst Monad airdrop rumors — 𝕏/Wormhole

$30M from the Gnosis DAO treasury to be used for GNO buybacks — 𝕏/ThanefieldRes

Polygon starts 10y community grants worth 1B MATIC — CoinDesk

Friend.tech announces migration off Base, FRIEND to be the gas token — 𝕏/friendtech

Sushi Swap introduces Sushi Labs — sushi.com

Hyperliquid has launched ZK pre-market alongside Aevo — hyperliquid.xyz

Arbitrum’s STIP incentives are going live next week — arbitrum.foundation

Arbitrum passes $215M gaming incentives proposal — The Block

Sanctum unveils additional details on $CLOUD launch — 𝕏/soleconomist

More than 30 Solana validators kicked out of the Solana Foundation for facilitating sandwich attacks — CoinDesk

Traditional rails

Gensler said Ether ETFs are likely to be approved over the course of this summer — 𝕏/EleanorTerrett

Io.net CEO resigned two days prior to $IO TGE — 𝕏/shadid_io

Tether to unveil a new class of digital assets products on June, 17 — 𝕏/paoloardoino

Bitcoin Suisse ($5.5B AUM) is issuing tokenized bonds on Polygon — The Defiant

Ripple announces Ripple USD ($RLUSD), 1:1 stablecoin coming later this year on Ethereum and XRP — 𝕏/Ripple

Paxos cuts 20% of the workforce (65 people) — The Block

Medical device maker Semler Scientific now holds 828 BTC (~ $59M) — CoinDesk

Microstrategy plans to buy another $500M worth of BTC — 𝕏/saylor

MetaMask launches pooled staking for Ethereum — The Block

Chinese users living abroad can now register to ByBit — South China Morning Post

The shitposting corner

Iggy Azalea goes to the NYSE to pitch $MOTHER — 𝕏/DegenerateNews

PleasrDAO serves Martin Shkreli — 𝕏/PleasrDAO

Andrew Tate accepts to fight Ansem in a boxing match — 𝕏/Cobratate

Tech go up

Explorer SolanaFM launches 2.0 release — 𝕏/solanafm

Fuse introduces the first Solana smart wallet — 𝕏/fusewallet

Solana 1.18 update goes live — helius.dev

Optimism launched Fault proofs reaching Stage 1 decentralization — 𝕏/Optimism

Sifu’s AAVE fork UwU lend has been exploited (two times) for $20M+ — 𝕏/CyversAlerts (2)

Economic security is a meme? Solana vs Ethereum debate goes on — 𝕏/0xMert

VCs go brrr

Layer3 raised $15M in Series A Round led by ParaFI and Greenfield — 𝕏/ICODrops

NEAR Foundation’s new independent entity Nuffle Labs raised $13M Round — The Block

Squads, behind Fuse smart wallet, raised $10M Series A Round led by Electric Capital — Crypto-fundraising.info

Uniswap Labs acquires “Crypto: The Game” — Fortune

Airdrops

LayerZero continues Sybil filtering cause — 𝕏/PrimordialAA

Rabby announces S2 points program — Rabby.io

EtherFi S2 ends on June, 30 specifying linear distribution — 𝕏/ether_fi

Upcoming events

June, 15: STRK to unlock 5.60% of its circulating supply

June, 24: ZK claim

June, 26: Blast airdrop

June, 27: Biden-Trump debate

July, 15: ASI token merger launch (delayed, again)

September, 18-19: Token2049 in Singapore

September, 20-21: Solana Breakpoint in Singapore

December, 5-6: Emergence conference in Prague

Q1 2025: Ethereum’s Pectra upgrade

Stargate released its V2, and APYs are JUICY! USDC single-sided on Aurora (Near’s EVM-compatible blockchain) is paying 32.36% APY.

Aptos aficionado? Say no more. By looping your USDC on Aries, you can achieve up to a 90% APY, paid in USDC and APT.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.