VanEck files for Solana ETF

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain!

Enjoy reading our weekly roundup? Send this newsletter to your friends, it’ll be greatly appreciated and motivate us to improve the content we offer you every Thursday.

By the way, make sure to join our Telegram group 👾

The past few weeks saw altcoins get absolutely crushed, with many tokens down 70%+ from their highs in March and April — the reasons can be summed up by the fact that there are too many new projects launching with high dilution in their tokenomics, and too little new capital flowing in.

As a matter of fact, during peak euphoria periods people tend to speculate more on the market cap of assets (i.e. their circulating supply), rather than their fully diluted valuation (the FDV), calling the latter a ‘meme’. Yet, in every cycle, the same pattern repeats itself: as soon as inflows in the market stop the FDV instantly starts to matter again.

Whilst majors held up pretty well, the performance of the soon-to-be-launched Ether ETFs is key here: should we get little inflows there could be a longer period of going sideways if not negative price action — that, until liquidity stemming from rate cuts starts piling in again.

So, as much as the future looks bright with plenty of catalysts, the following months are uncertain and suggest a more risk-averse approach to investing. To make matters worse, there’s quite a bit of overhang supply for BTC: Mt. Gox is set to distribute $9.6B BTC in July, the German government holds $3B in Silk Road sized funds, and the U.S. government just got the approval to sell $240M BTC.

It’s curious to note, however, how NFTs are particularly suffering. Notably, they’re considered to be a levered bet on the ecosystem due to their illiquid and volatile nature: in fact, they often marked tops and bottoms. Meanwhile, BTC ETFs continue their slight downtrend, now sitting at just over $52B in net assets.

VanEck files with the SEC for a Solana ETF

You could say this was just a marketing stunt from VanEck and, well, we sort of agree. Whilst the chances for approval are slim with the current administration, the stance could change abruptly in 2025 if we see Trump becoming once again president and Gensler removed from his position. But these are the facts:

The SEC previously declared SOL to be an unregistered security, causing Robinhood to delist it

To approve ETFs, a de facto requirement is to have futures trading already with good volumes. Solana doesn’t, and the CME said last month they had no plans to list it

But VanEck doesn’t care. They’re trying, and this sends a strong signal across the industry — in fact, SOL rallied 6% following the news. This comes at a time when the tide seemed to be turning back to the Ethereum ecosystem as its ETFs are about to start trading, but the return of the SOL frenzy might very well be just a short-term fade.

Going into the technicalities of the ETF filing (a 19b-4 form), VanEck states that the SOL in the trust won’t be used for staking (~ 7% yield). The current deadline for its approval is in March, 2025. Besides, the filing proposes both an ETF and a Trust — potentially creating a trojan horse for later approval (this happened with BTC, with GBTC from Grayscale).

All in all, the key factors at play here are what inflows are the Ether ETFs going to get, and whether we’ll see a pro-crypto administration rise up in the following months or not.

We like the art: VanEck 𝕏 profile starts using Pudgy Penguin as a profile picture — 𝕏/vaneck_us

Ton, prime to flip the Ethereum ecosystem?

Telegram’s token TON is one of those coins: you forget about it, and a month later it has tripled in value without making any major headlines. This seems to be a peculiarity of this ecosystem: they live outside of the traditional “crypto bubble” that takes place on 𝕏 and within Ethereum and Solana social circles. Their engineers are mostly outsiders, coding applications in a different language (FunC and Tact).

Yet, they’re trying to onboard 900M people to crypto through games and simple apps, seemingly succeeding. A few stats:

Hamster Kombat, a tapping game, reached 200M users and went as far as causing concern by the Iranian Government. They’ll be launching a token in July

$500M+ USDT are now on TON, roughly 0.50% (Solana is 0.69%, Polygon 0.81%)

TON recently flipped Ethereum in daily active addresses

As some describe it, TON is a dark horse. There’s currently a lack of meaningful applications on the chain, yet demand is here, and the ground seems fertile enough.

Citing a wise man, why should you fade a narrative on an app that you use every day?

Decentralization? according to Broadridge, private blockchains handle over $1.5T of security financing a month — CoinDesk

Mt. Gox plans to distribute $10B in BTC to creditors starting in July

Back at it.. Mt. Gox has been a yearly occurrence as a source of FUD since 2014 when it lost 850,000 BTC in investor funds due to being reportedly hacked six times.

Since then, an extremely long repayment process has taken place, jokingly defined as the “biggest forced holding of all times”. To date, Mt. Gox owes ~ 140,000 BTC ($9.6B) to ~ 127,000 creditors, and about $50M in BCH tokens.

The current deadline for repayments is set to October this year, and token transfers should begin taking place in July according to this recent note.

While the amount transferred back to retail investors is somewhat scary, and could potentially cause a crash in the price, a couple of things should be noted:

Despite going sideways for the past few months, the sentiment remains somewhat bullish suggesting many could decide to hold their coins

It’s been ten years, and many creditors reportedly sold their claims to other entities that hence have a higher cost base making - perhaps - selling less appealing at current prices

Paradigm shift: ByBit surpassed Coinbase in March, and has now become the second biggest exchange after Binance at 16% market share

Blast has launched a token

Yesterday’s Blast airdrop was on par with recent launches: pretty much underwhelming. The token has now settled at a $2.5B FDV, right under ZkSync ($3.5B) and the other major L2s.

Hype aside, the narrative for Blast seems weak and the market is pricing that in. L2s are being essentially commoditized, unless there’s some peculiarity to it (see Zero-knowledge tech, or a strong community & sticky usage as with Arbitrum & Optimism).

As with yesterday’s launch, Blast is calling itself a “Fullstack chain”, trying to go as far as “Unbanking the banked”. Notably, the claiming process involved downloading the Blast web app, which seems a way to get users for their wallet, launching in about 4 months.

We’ll see where that goes — but one thing’s certain: the golden era of airdrops seems to have ended, and launch valuations are reflecting that.

Memes are over? Pump.fun revenue plummets more than 60% from its highs — The Block

ZkSync introduces the “Elastic Chain”

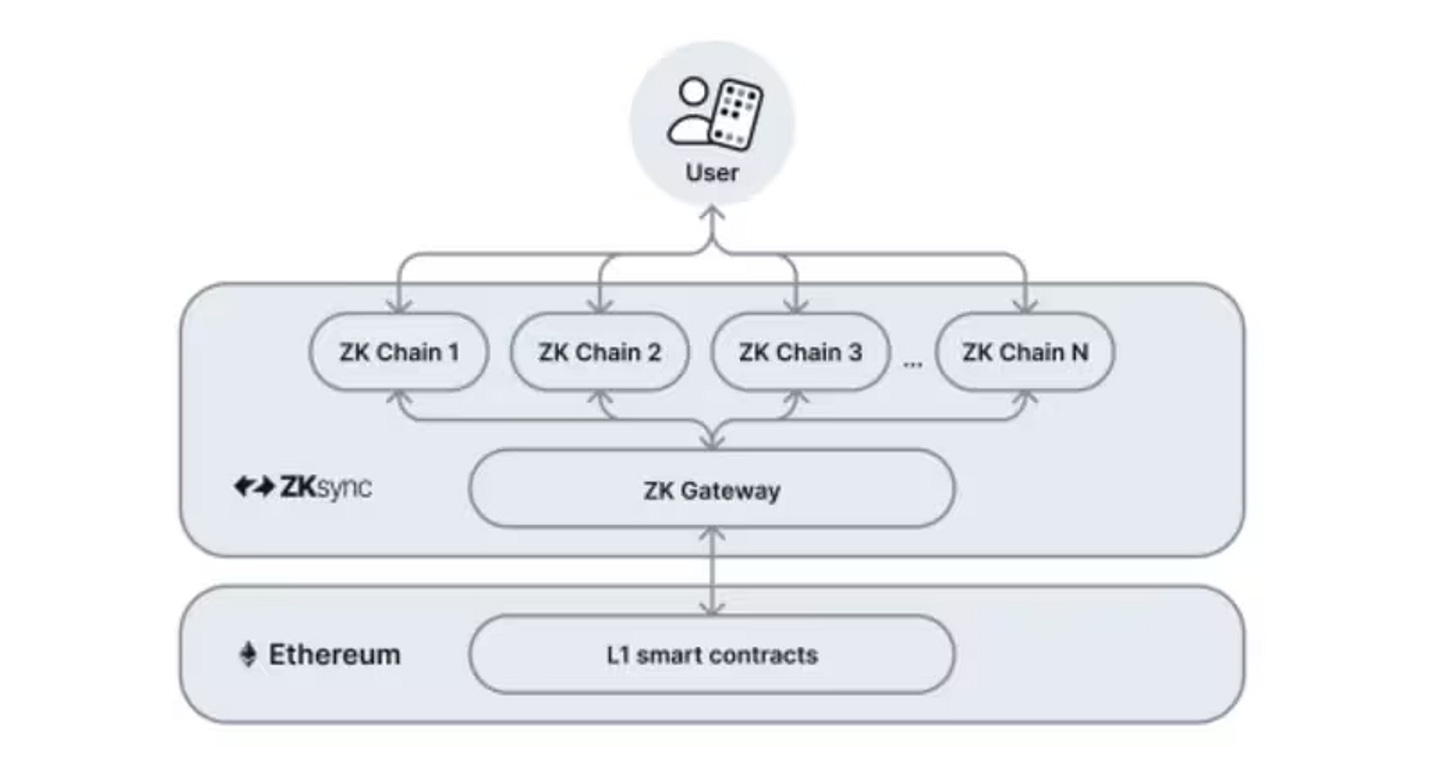

Matter Labs, the company behind ZkSync’s development, recently introduced the ZkSync 3.0 roadmap. Having ecosystem interconnection as a goal, what catches the eye is the term “Elastic Chain” — somewhat resembling Polygon’s Agg(gregation)Layer.

The Elastic Chain aims to be composed of multiple Zero-knowledge chains, but lets the user feel as if he is using a single one.

At a glance, this seems a positive development, since it’d allow for better user experience and less fragmented liquidity across the space. However, there’s three players building on a similar narrative already: ZkSync, Polygon, and Optimism with its Superchains. Is this going to be a ‘winner takes all’ scenario, or we’ll end up with more fragmentation than what we began with?

Happens on-chain

Arbitrum puts forth proposal to enable fee switch — 𝕏/breshhb

Aave DAO signals unanimous support for ZKsync deployment — The Block

Sanctum, liquid staking protocol on Solana, introduces Profiles referencing to it as an airdrop requirement — 𝕏/sanctumso

RWA platform Swarm Markets to offer tokenized gold via NFTs as MiCA stablecoin rules begin — The Block

Mellow protocol opens sUSDe and ENA vaults via Symbiotic — 𝕏/mellowprotocol

EtherFi deploys on Scroll — 𝕏/ether_fi

Elmnts introduces app to access oil & gas mineral rights and royalties, built on Solana — 𝕏/elmnts_

Jupiter’s CEO Meow announces mysterious PPP (Player Pump Player) experiment — 𝕏/weremeow

US Government sends ~ 4,000 BTC ($240M) to Coinbase after getting approval to sell by judge — mempool.space

Wintermute starts market making $MOTHER — 𝕏/IGGYAZALEA

Traditional rails

The CFTC is probing Jump Crypto — Fortune

3iQ files to launch the first Solana ETF in Canada — 𝕏/JSeyff

Gemini’s founders, the Winklevoss brothers, donated $2M BTC to Trump — 𝕏/cameron

Pudgy Penguins and NFT licensing platform OverpassIP unveil parent firm IGLOO — The Block

Tether to terminate USDT support for EOS and ALGO starting June 24th — tether.to

The U.S. posted a $5M bounty to collect info on OneCoin’s founder Ruja Ignatova, whose project allegedly stole $4B until its collapse in early 2017 — CoinDesk

Coinbase sues SEC and FDIC saying federal regulators are trying to cut out crypto — The Block

Worldcoin’s competitor RariMe launches using ZK proofs to verify uniqueness of individuals — CoinDesk

Gang in Florida kidnapped residents forcing them to transfer cryptocurrencies, now risks life sentence — justice.gov

UAE rules that payment tokens in the country must be backed by dirhams, de-facto banning other stablecoins — Cointelegraph

Tech go up

Light Protocol and Helius introduce ZK compression on Solana — 𝕏/0xMert_

Bitcoin developer Burak, known for exploiting Lightning network bug in 2022, introduces Bitcoin L2 called Brollups — Protos

Solana launches ‘Actions’ protocol to enable seamless User-Experience on every website using embeds — 𝕏/solana

Jupiter announced v3 ‘Metropolis’ — 𝕏/JupiterExchange

Someone tried (and failed) a DDoS attack on Cardano — CoinDesk

VCs go brrr

Coatue invests $150M into Bitcoin Miner ‘HUT 8’ — Bloomberg

Solana-focused startup accelerator Colosseum raises $60M to invest in early-stage projects — CoinDesk

Conduit (Rollup-as-a-Service) raised $37M Series A led by Paradigm and Haun — 𝕏/KAndrewHuang

Berachain liquid staking protocol raised undisclosed amount from Binance Labs — The Block

Airdrops

EtherFi announces S3 starting July, 1st — snapshot.org

How to farm Scroll, HyperLane, Mitosis, EtherFi together — 𝕏/Beacon_Early

Zeta Markets on Solana starts ZEX distribution — The Block

Upcoming events

June, 27: Trump - Biden debate on CNN @ 9 pm ET

June, 30: European MiCa regulations go into effect

June, 30: Cronos zkEVM mainnet launch — coincarp.com

June, 30: Apechain to launch on Arbitrum — theboredapegazette.com

July, 2: Ether ETFs expected to launch

July, 8-11: EthCC in Brussels

July, 15: ASI token merger launch (delayed, again)

July, 25th: Trump is rumored to be speaking at Nashville’s Bitcoin convention — Axios

September, 18-19: Token2049 in Singapore

September, 20-21: Solana Breakpoint in Singapore

December, 5-6: Emergence conference in Prague

Q1 2025: Ethereum’s Pectra upgrade

Mantle introduces the ‘Metamorphosis’ campaign: stake mETH to farm upcoming token COOK — mantle.xyz

Aptos aficionado? Say no more. By LPing wUSDC/zUSDC on Cellana, you can earn a 24.55% APR paid in CELL tokens.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.