#56 Wisconsin state apes BTC

We stay on-chain, so you don't have to. Get ahead of the curve weekly in 5 minutes.

Welcome to Stay on-chain! Sit back, relax, and let us sift through the noise of crypto to deliver you informative and actionable insights.

🪂 Solana's latest airdrops have created billions of dollars in wealth overnight with projects like Wormhole, Parcl, Jito, Tensor, and Jupiter. Here at Stay on-chain we crafted a guide on what we’re farming, piecing together our list of top picks among under-farmed protocols with huge treasuries. Want to get it? Get one friend to subscribe to our newsletter, and we’ll deliver it straight to your inbox.

By the way, make sure to join our Telegram group 👾

Markets keep ranging, and BTC hasn’t moved much. However, it’s interesting to note how in every rally memes are sucking liquidity & volume, with PEPE as #2 bigger gainer of the week and other memes conquering leaderboards as the most traded coins on numerous CEXes. The other side of the coin is that alt-coins are suffering, especially those labeled as “VCs grifts” because of their high FDV at launch with a low circulating supply — the market, rationally, asks: if those coins are underperforming even now, what’s to come when their unlocks start?

Total liquidity hasn’t moved much, with stables more or less unchanged, suggesting the market is in player-versus-player mode right now with little capital flowing in. This is confirmed by BTC’s dominance rising, seen as a safe haven for those already in crypto. Meanwhile, the FED’s monetary policy is still uncertain after CPI inflation numbers met expectations at 3.4% YoY and 0.3% MoM, with no rate cuts on the horizon (yet).

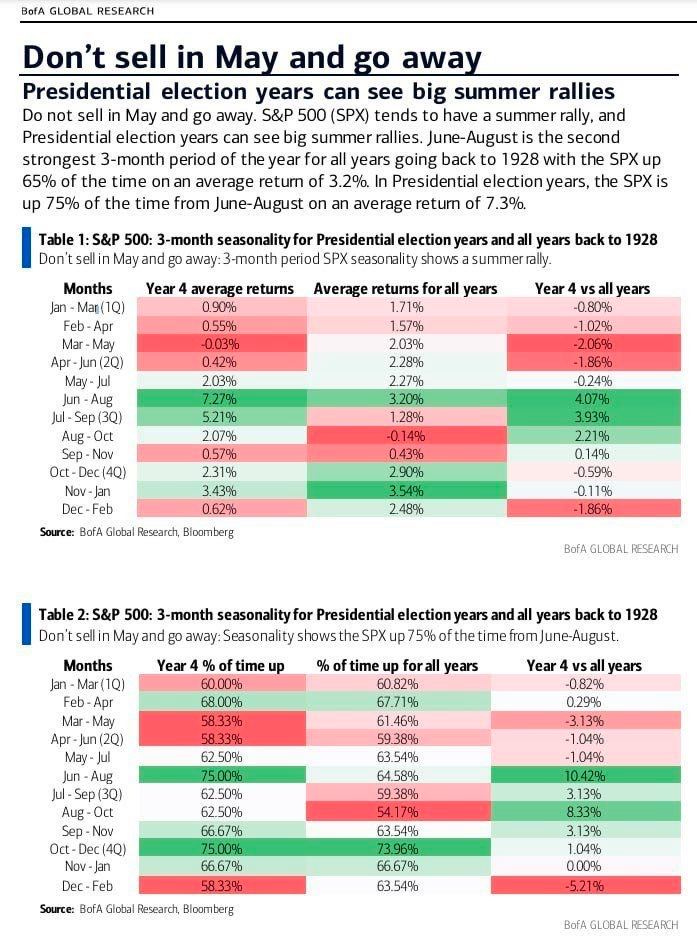

It’s interesting to note that this is a U.S. election year, and the expectations on the winning candidate may affect markets greatly, with Trump seen as a potential short-term catalyst for economic growth whilst Biden signaling a more stagnant economy.

The odds of the Ethereum spot ETF being approved in May

The first final deadline for the Ethereum spot ETF (VanEck’s) is coming on May 23, critical is assessing whether others will be approved as well. With Ethereum at cyclical lows, the market sentiment calls loudly for a rejection — with analysts backing it with an approval rate ranging from 0 to 25%. Similarly, the on-chain betting market Polymarket is pricing its approval at 10%.

However, not all chances are lost. Grayscale withdrew its ETH Futures ETF application (mind you: getting a futures ETF approved for BTC has been their trojan horse in court to then get a spot one approved!), saying they want to shift their focus on Ethereum spot products. Moreover, ARKInvest & 21Shares removed staking from their spot application — signaling they want to give the SEC fewer reasons to reject their application due on May, 24.

Now, there are two ways to read this. The optimistic one is that there’s already ETH futures ETF approved, Gensler said ETH was a commodity (and not a security) back in the day, and the BTC spot ETF already paved the way for the approval of crypto-based spot ETFs — all pointing to a potential approval. The pessimistic one is that issuers are losing their hopes, and tried the last tricks in their pockets to convince the SEC. While predicting the outcome is impossible, the R/R for betting on a potential approval seems appealing.

Outpacing TradFi: Blackrock’s IBIT ETF reached $10B in a record 49 days

The institutions are coming arrived

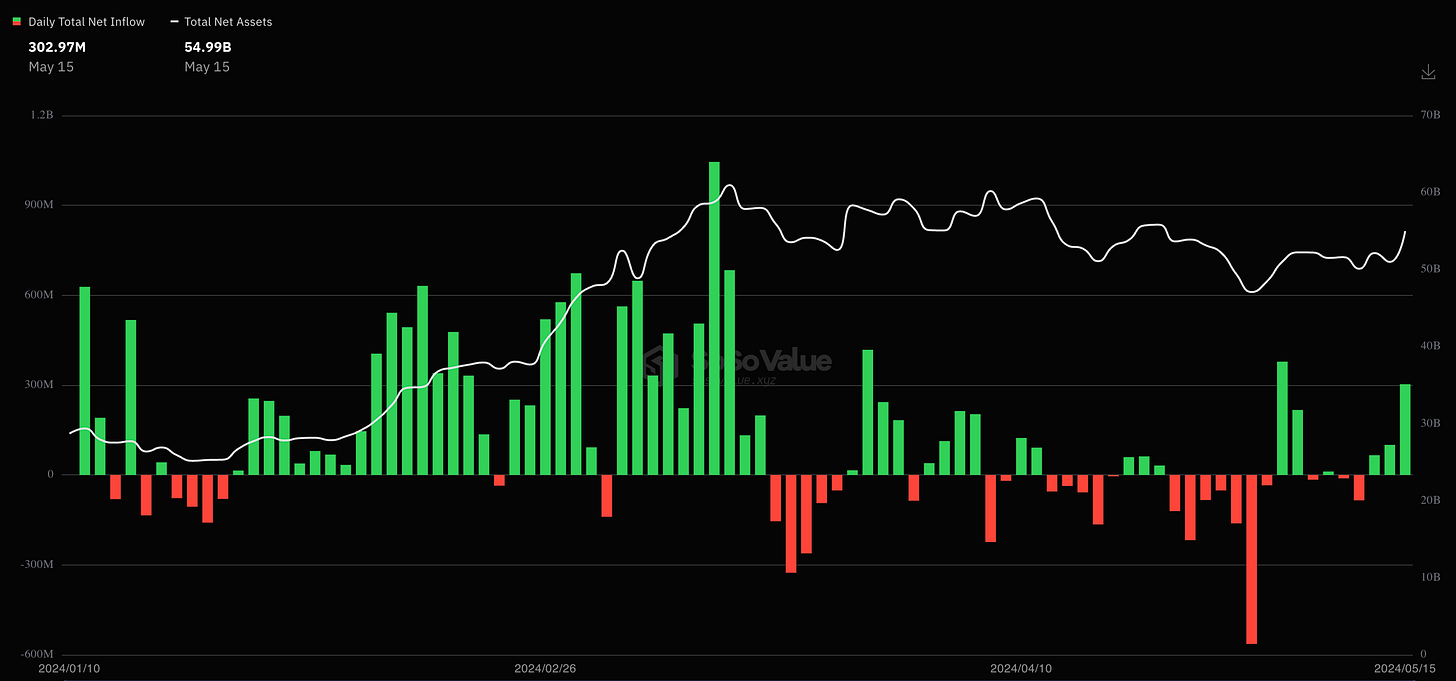

Due on May 15, the Q1 13F report revealed many firms (and even states) disclosing their BTC ETF holdings last minute. Most notably, the Millenium fund ($69B AUM) disclosed a $1.9B position in various BTC ETFs. Mind you, this position may be here today and gone tomorrow.

Schonfeld Strategic Advisors ($13B AUM) filed a $479M BTC ETF position. Others follow: Boothbay Fund Management ($377M), Morgan Stanley ($269M), Pine Ridge Advisers ($205M), Aristeia Capital LLC ($163M), and many others. To date, professional firms invested nearly $5B by May, 15 — however, retail investments remain the bigger chunk of the ETFs pie.

The cherry on top? The State of Wisconsin investment board bought $99M of Blackrock’s IBIT fund. Slowly, then all at once.

Geothermal energy at its finest: El Salvador mined 474 BTC since 2021 thanks to its volcano-fueled geothermal power plant — Reuters

You can now delegate your EIGEN

Following the recent updates on EigenLayer’s airdrop, and the claim going live on May, 10 you may be sitting on an unproductive EIGEN stack. What are you waiting for? Put it at work! You can stake your Eigen, and then delegate them to an operator of your choosing. While you should be deciding on your own which one to choose, we suggest aiming for one that has a genuine background, and commits to redistributing any airdrop that their operator receives to delegators.

The unstaking period is 21 days, and EIGEN is expected to become transferrable (hence, tradable on the markets) in September, so plan accordingly.

Numbers go.. down: NFT trading on Ethereum is down 66% in the last two months — dune.com

Happens on-chain

Rabby expands free gas campaign to 24 chains total — 𝕏/Rabby_io

Stader Labs lands on HBAR with HBARx — 𝕏/HBAR_foundation

Ethena unveils 2024 roadmap — mirror.xyz TLDR

Celo will be using the OP stack to develop its L2 — CoinDesk

100,000 addresses self-reported as Sybils for the LayerZero airdrop — 𝕏/PrimordialAA

Anthony Juliano steps down as DyDx CEO — 𝕏/AntonioMJuliano

Layer-3 chain Degen experienced 50+ hours outage — The Block

Jack Melnick leaves Polygon Labs to join Berachain as Head of Defi — 𝕏/jackmelnick_

Neel Somani steps down as CEO of Eclipse Labs following sexual assault allegation — 𝕏/EclipseFDN

Liquity publishes v2 whitepaper — liquity.gitbook.io

Initia launches 8-week long public incentivized testnet — 𝕏/initiaFDN

First MakerDAO SubDAO called ‘Spark’ set to launch — 𝕏/MakerDAO

DRIFT added to the roadmap for potential listings on Coinbase — 𝕏/CoinbaseAssets

PancakeSwap offers to compensate Uniswap frontend fees — The Block

Lens network to migrate to ZkSync — Blockworks

Traditional rails

Tornado Cash developer Alex Pertsev sentenced to 64 months jail time by Dutch court — 𝕏/AaronvanW

Digital Yuan in China barely gets any adoption — Scmp

Turkey set to regulate crypto — Dailysabah

El Salvador creates public dashboard for its Bitcoin holdings — bitcoin.gob.sv

Ex-Blackrock and Bitcoin-friendly Salim Ramji to replace Vanguard's outgoing CEO, Tim Buckley, who denied Bitcoin ETF products to clients — BitcoinMagazine

MSCI World index fund adds Microstrategy stock — Yahoo

193 suspects arrested in China for an alleged money smuggling scheme in USDT worth $1.9B — baidu.com

Circle moves legal HQ from Ireland to the U.S. in preparation for its IPO — CoinDesk

Pudgy Penguins toys are now available in GameStops — 𝕏/pudgypenguins

Tech go up

Two brothers exploited Ethereum MEV bots for over $25M, arrested in the U.S. — 𝕏/blockworksres

Vitalik Buterin drafts EIP-7706, proposing new calldata gas type for Ethereum — The Block

Lending protocol Sonne Finance suffers $20M hack — 𝕏/SonneFinance

Hyperliquid latency nears impressive 200ms per block — 𝕏/laurentzeimes

Fantom is undergoing the Opera “Sonic” upgrade — fantom.foundation

VCs go brrr

Polymarket raised a $45M Series B round led by Founders Fund, with Vitalik as investor — crypto-fundraising.info

Humanity Protocol raised a $30M Seed Round led by Kingsway Capital valuing it at $1B — crypto-fundraising.info

Lido Co-founders and Paradigm secretly back EigenLayer competitor Symbiotic — CoinDesk

Binance Labs invests in Zest Protocol to bring on-chain BTC lending to Stacks — binance.com

Airdrops

Layer3 quests platform announces L3 token details — 𝕏/layer3xyz

DRIFT airdrop claim is live — 𝕏/DriftFDN

Notcoin’s NOT has been launched on major exchanges

Blast L2 delays airdrop to June 26th, announcing two additional Gold rounds distribution — 𝕏/Blast_L2

Upcoming events

May, 20: PYTH unlocks 141.67% of the circulating supply

May, 22: NVIDIA earnings

May, 23: SEC deadline for VanEck’s ETH spot ETF application

May, 24: SEC deadline for ARK 21Shares’ ETH spot ETF application

Infinex, backed by Syntethix’s founder Kain Warwick, is trying to take over CEXes with the ease of use of blockchains. For a limited time of 30 days, you can deposit USDC on multiple blockchains, and farm points that can be converted to governance NFTs at a later stage. Skipping the regulatory shenanigans, napkin math suggests that points should floor at $0.025 each, suggesting a 25% return or 300% APR on deposits.

Aptos aficionado? Say no more. By looping your USDC on Aries, you can achieve up to a 60% APY, paid in USDC and APT.

Want to be part of the Stay on-chain community? Join the crew on Telegram, and follow our latest announcements here.

If you found this edition valuable, why not share it with a friend?

Forward this email—it's the best gift you can give us!

Thank you for reading and see you next week!

Disclosure: Authors may own crypto assets named in this newsletter. Stay on-chain is meant for informational and educational purposes only. It is not meant to serve as investment advice. Please consult your investment, tax, or legal advisor before making investment decisions.