Saylor vs. MSCI and Monad launch for extra blockspace

Microstrategy vs. MSCI

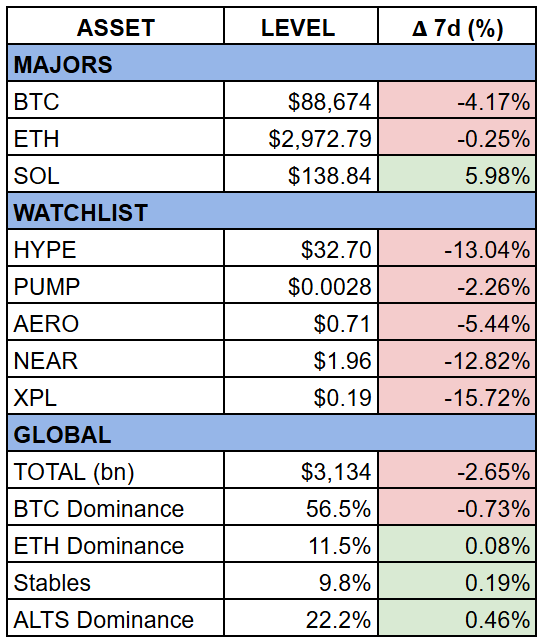

MSCI is reportedly considering removing MSTR from its indexes because the company no longer behaves like a traditional operating business. Too much of its market cap and risk profile is now tied to Bitcoin, which clashes with how equity index classifications work. MSTR looks, moves, and prices like a Bitcoin vehicle, not a software company. And it's not doing great:

BTC down 20%

while MSTR down almost 40%.

Saylor fired back with a long post arguing the opposite: “Strategy is not a fund, not a trust, and not a holding company,” and instead an “operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.” Idk sir.

On a related note, Matt Hougan had a great piece explaining how to actually value DATs. His point is simple: if a DAT had a fixed end-date, you’d discount for liquidity, expenses, and operational risk. If it trades at a premium, it’s only because it can reliably grow its crypto-per-share through debt, lending, derivatives, or buying crypto at a discount. Most DATs won’t clear that bar, and the gap between winners and losers will widen. Size helps the big ones. The rest? Probably trade at a persistent discount as the market realises they’re expensive ways to hold spot.

And if in any scenario, shareholders vote for selling underlying to buy-back shares, we spiral down hard.

Monad launches with Coinbase's ICO

Monad finally launched its mainnet after years of prepping, with (not so great) timing but good execution. The token went live today and the Coinbase’s first ICO, where 7.5%of supply was sold through a “commit-and-lock” mechanism, was successful. Users had 5.5 days to invest, so of course the sale looked dead mid-week and then spiked in the final hours, ending at $269m raised. Classic opportunity cost game theory: everyone waits until last minute. 50.6% of MON is locked at launch, with vesting starting in 2026 and stretching to 2029.

The chain itself is pitched as a hyper-performant EVM L1, with MetaMask, Phantom, Curve, Uniswap, and multiple stablecoins live on day one. In practice, it’s another high-throughput base layer in a world where we have much more blockspace than needed. Solana, Sui, Aptos, Sei, Injective, Sonic, and a dozen others are all running the same playbook.

What did I do? I sold, yes. MON lost 60% since pre-market, dumped at launch but had now a rebound. Sentiment is so bad it almost feels like a decent short-term buy, but structurally I’m as bullish (e.g. as for MegaETH).

Now it joins the long list of “next-gen” EVM chains fighting for attention, but we can all tell the founder is locked-in:

Crypto

- Ethereum Foundations working on an Ethereum Interop Layer → That's to make L2s feel like one chain, finally. So basically Ethereum becomes the Cosmos or Polkadot alikes. Jk, this is how it should be.

- Coinbase lists ASTER → I don’t get it, and it’s funny. Probably Coinbase and Binance doing each other favours. A “you list mine, I list yours” thingy.

- Ray Dalio holds 1% in BTC → And he’s scared of quantum and the lack of privacy. Feels like a bull post for ZEC.

DeFi

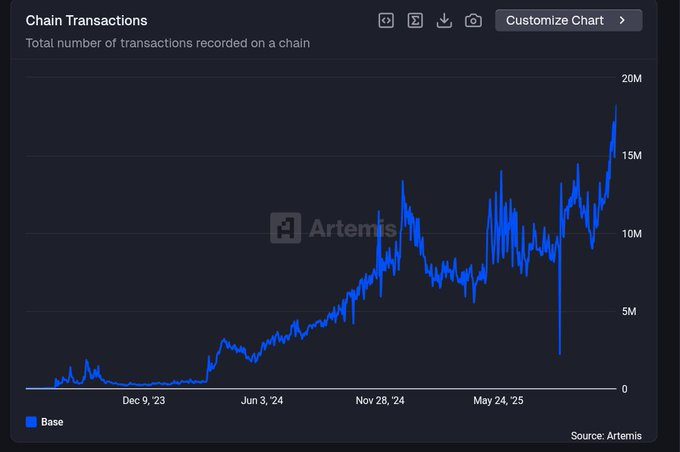

- Base with ATH in trasactions → Bullish Base. It’s a great chain and big apps will settle there. My prediction: Coinbase tokenizes the stock and airdrops it to users. Makes much more sense than a separate COIN token. ETH stays the gas token, and you get COIN on Base with the same rights as shareholders on Nasdaq. Would be cool.

- MegaETH pre-deposit bridge is open → If you didn’t get into the ICO, might be worth a shot. They’re allocating 2.5% to incentives, though very likely not all of it goes to pre-deposits.

- AERO gets its first buybacks → Bullish as I'm bullish for Base. Good revenues and good tokenomics.

TradFi & DATs

- Brevan Howard got a refund of their investment in Berachain → Funny. Nice venture investment with almost zero risk. Berachain was a disaster, but I didn’t know something like this could even exist.

- ETFs post record outflows → I’m actually a bit surprised by this move down. Makes me think TradFi came in late this time and ended up being exit liquidity, while the OGs sold the BTC top or exited ETH.

- Bitmine buys anothre $200m and holds 3% of the ETH supply → And the stock is down 50% in the last month. Starting really to think DATs are the FTXs and 3ACs of this cycle.

- GOOGL is the first tokenized stock by Robinhood to reach $1m value → Bullish. The future.

VC

- Coinbase acquires Solana's trading platform Vector.fun → This will very likely be integrated for on-chain trading on Base.

- Tether invest in Ledn for BTC backed loans → Probably one of the biggest actual use cases Bitcoin has.

- Kraken files for US IPO → Expected and good to see. I like Kraken, but demand for IPOs seems to be slowing and competition is tight already (+ DEXs are better).

- Kalshi secures $1bn funding at $11bn val → Great, though I’m not sure why they need a billion dollars for it.

From Great Minds

- Why Your Coin Isn’t Pumping → great read on why fundamentals up but price down

- Bitwise CIO on why DATs shoulde trade at a discount → imo the correct way to think about DATs

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA