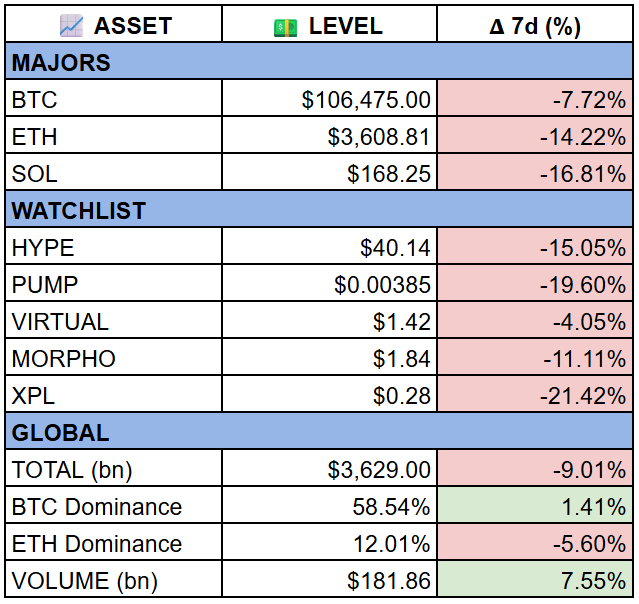

SOL ETFs launch strong and 100% staked

Are 100% staked Solana ETFs fully liquid?

The first Solana ETFs just launched in the US, and they’re the first ever to include staking. Bitwise’s BSOL and Grayscale’s GSOL now hold over $400m in assets combined after only a few days of trading. Bitwise took the clear lead, with nearly $200 million in net inflows since launch and a lower 0.2% fee. Both funds stake their SOL to earn yield, and Bitwise aims to stake 100% of holdings.

Staking adds yield but also a layer of complexity. On Solana, unstaking takes about two days, meaning the tokens can’t be instantly redeemed. To keep the ETF liquid, Bitwise has a mechanism in place: if there are large redemption requests while SOL is still staked, the fund can swap its staked (but pending-unstake) tokens with third parties for already unstaked and freely transferable SOL. In other words, they trade “cooling down” tokens for liquid ones to meet redemptions without disrupting the ETF. Clever, but I hope it works in stressed markets too ;)

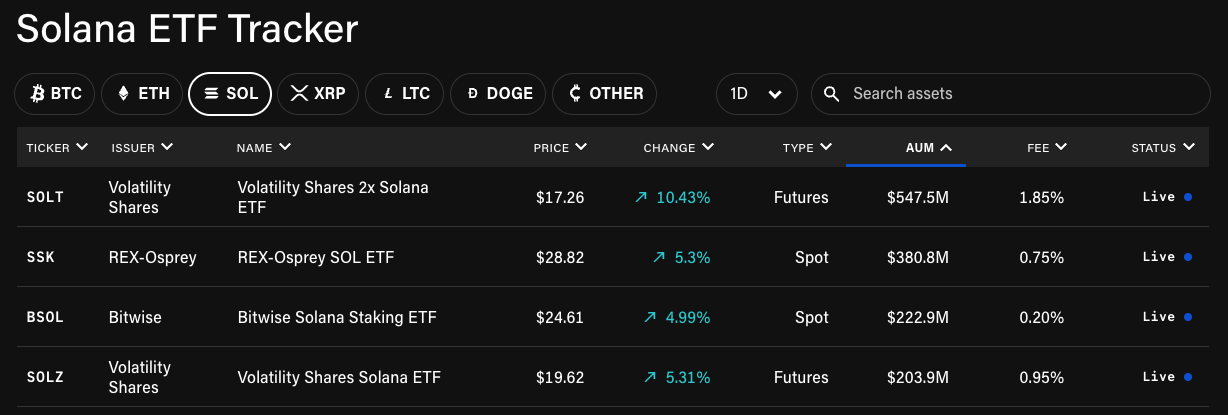

MegaETH - the $1.4bn auction and a free call option

MegaETH’s public sale officially closed this week. And it was big. The auction ofc went to its max price of $0.0999 almost immediately, and ended 27x oversubscribed, implying a “hypothetical” $27.8 billion FDV. Over $1.3 billion in bids chasing a $50 million cap. Anyone who bid below the max is being refunded (that process already started on Oct 31), while final allocations will be announced and on Nov 5.

Who gets in now depends on more than just the bid. The team is selecting wallets based on on-chain activity, ecosystem contributions, testing history, etcetc. MegaETH is rewarding real users and early contributors, not just the biggest checks.

This one was a no-brainer opportunity imo, and I joined it myself. MegaETH is trading pre-market around a $3–5 billion val, so if you get an allocation, it’s basically a free 3x. You’re essentially buying a call option on MegaETH, with your gas fee as the premium. Worst case, you lose a few bucks in gas and get fully refunded. Best case, you get a ticket into what is probably the biggest L2 launch of the cycle.

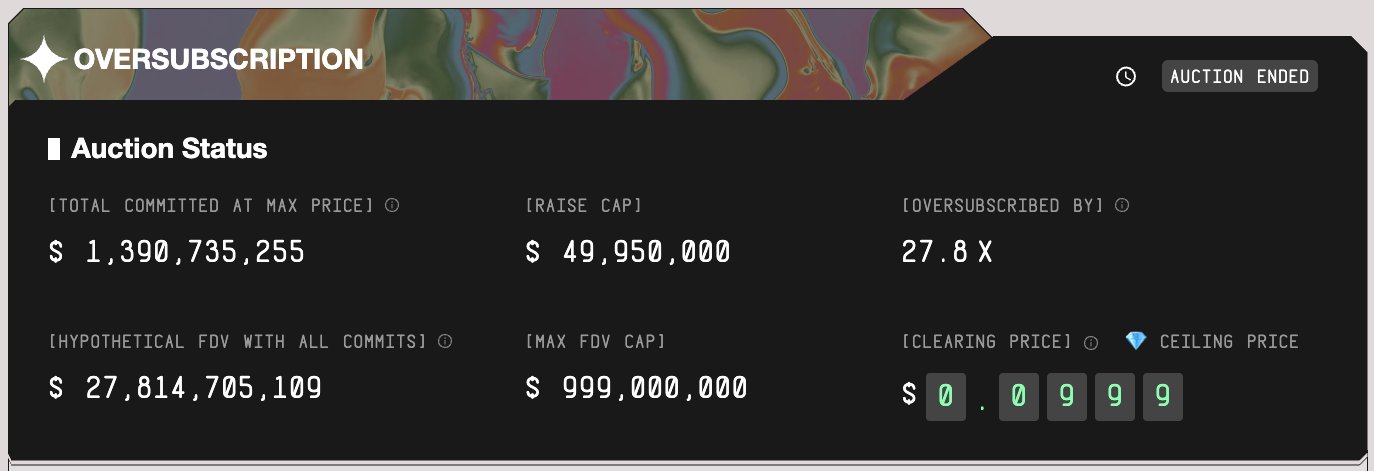

Balancer exploited for ~$128m

Balancer has been exploited this morning, with over $120 million drained from its wallets across multiple chains. Onchain data shows large withdrawals of WETH, osETH, and wstETH from one of its main addresses, due to a faulty contract check in older Balancer versions, but exact details still to be confirmed.

The Balancer v2 hack isn't about lost funds. It’s a trust collapse.

— Lefteris Karapetsas (@LefterisJP) November 3, 2025

A protocol live since 2020, audited and widely used, can still suffer a near-total TVL loss.

That’s a red flag for anyone thinking DeFi is “stable.” No serious capital allocates into systems that fragile.

He has a point..

At this point, it seems the only way to make serious money in DeFi is to exploit a protocol XD.

DeFi

- Ether.fi DAO proposes a $50m buyback of token → Copying Aave, but only when the token trades below $3. Hopefully more projects start putting revenues back into the chart.

- Unichain adds support for non-EVM assets → Unichain needs to keep up when HL and other are launching spot markets, and this might be a good step. DOGE, XRP, ZEC as the first ones.

Tech

- Ethereum targets Dec 3 for Fusaka upgrade → Focused on security and scalability of both L1 and L2, aiming to double blob capacity for rollups. Great to see upgrades coming, though the ETH Foundation still feels a bit off lately.

TradFi

- 21Shares files for Hype ETFs → The most profitable crypto business will now get institutional demand through an ETF. Hyperliquid.

- Tether reports $10bn profits Q1-Q3 2025 → $10B net profit YTD, 500M users, $175B circulating supply, and $23B in reserves split between gold and BTC. Goats.

- SBF is back and claims FTX was always solvent → Wild. Zero remorse this guy. As ZackXBT points out, he's telling BS.

- JPMorgan executes fund-servicing transactions on Kinexys → Slowly getting the crypto efficiency treatment.

VC

Quiet week for VC. The only one worth noting:

- Bron Labs raised $15bn for retail institutional-grade custody → better custody for normies is a must for the crypto adoption we want. Most people won’t sleep well with seven figures sitting on a Ledger and private keys in a drawer.

From Great Minds

- Why investing matters in the AI era → Good read.

- Non-Arbitrage Conditions for Perpetual Forwards → On pricing equity perps with dividends to have a non-arbitrage condition.

- Technocapitalcore → An aesthetic collection of finance and philosophy related posts

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA