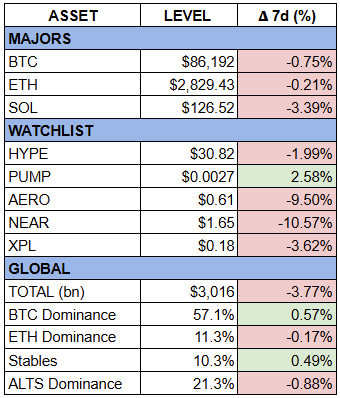

Tether's B/S under the microscope again

Tether FUD and their macro trade

The drama of the week is Tether again. Arthur Hayes kicked it off by arguing that Tether is basically front-running a macro trade. His take: they’re betting hard on rate cuts. Treasury income dries up when yields fall, so they’re rotating part of their surplus into BTC and gold, which should in theory fly if money gets cheaper. The problem: if BTC and gold drop 30 percent, Tether’s disclosed “equity buffer” gets wiped and USDT becomes insolvent on paper.

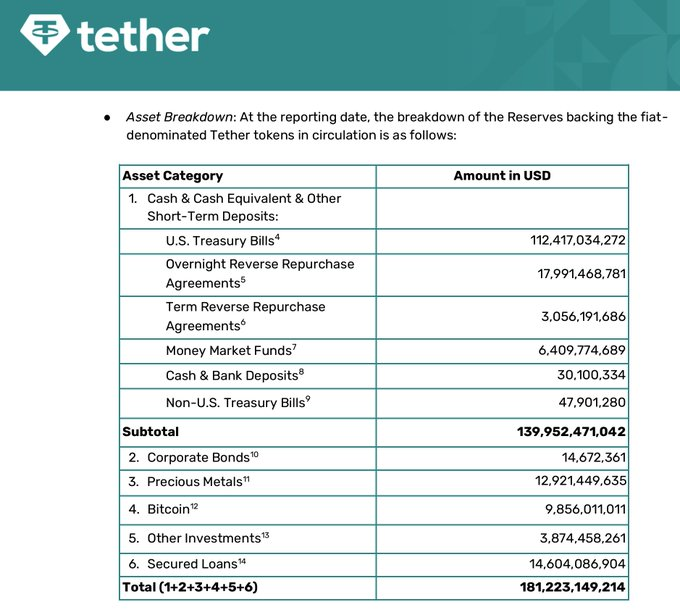

Some argued Hayes is misunderstanding something basic: Tether doesn’t buy BTC or gold with customer funds. The BTC and gold purchases come from profits and excess reserves. But if that’s true, why do these sit under Asset Reserves backing Tether?

That’s when Paolo jumped in. His take: Artur is bad at reading balance sheets. Tether has two layers. The attestation only covers the reserves backing USDT. It doesn’t cover their corporate balance sheet, which holds another $23bn in retained earnings plus whatever sits inside their mining operations, equity stakes, and non-reserve BTC. $30bn buffer:

Tether Group total assets: $215bn

Stablecoin liabilities: $184.5bn

Though we can't deny that, yes, Tether is running a macro trade. The mega profitable carry trade on US Treasuries, and using the surplus income to build a BTC and gold book. But the trade of putting part of their reserves in gold/BTC could nuke their buffer, if they are in fact reserves.

I hate the fact that when it comes to Tether, it's still comes down to assumptions and vibes. Tether won't blow up tomorrow, but it'd be cool to have some audited financial statements and B/S to stop the FUD forever. Audits > vibes.

Crypto

- HYPE cliff unlocks happening with some staking directly and others selling OTC through Flowdesk - around 2.6% of locked HYPE went to the team. All traceable. A few team members likely sold their allocation OTC via Flowdesk, others staked it immediately. Makes sense. I'd say there is quite some demand for HYPE ready to absorb any selling.

- Ethereum raises the block gas limit to 60m - Block capacity raised from 45m, so meaningful upgrade. More txs per block, L1 scales. Though from what I know it comes with a slight hit to security.

DeFi

- MegaETH returns all funds raised from the Pre-Deposit Bridge → Due to sloppy execution. They refund everything and will reopen the bridge for USDm with Frontier Mainnet.

- Infinex TGE to come in early 2026 through Sonar → Patrons gets guarateed allocations, while for the rest is randomized. They sell 5% at 300m FDV, though sad cause ppl were buying liquid patrons at 500m until now..

- Balancer redistributed $8m of the $128m lost → RIP

TradFi

- Solana ETFs log 20 consecutive days of net inflows → ETFs > DATs. Clear trend. Good to see steady SOL inflows. It'f the de-facto "American Blockchain" play.

- Robinhood is launching their prediction markets with Susquehanna → faster growing product line by revenue. Demand is real, especially for Robinhood which is GenZ's home.

- Amundi, Europe's largest asset manager, tokenizes a MMF on Ethereum → Europe finally making first moves in AM as well.

- $3.5bn outflows for BTC ETFs in November → Boomers selling the bottom.

- Bitcoin ETFs are Blackrock's top revenue source → Lots of AuM plus lots of volatility. Easy to monetize.

- Texas kicks off Bitcoin reserve with $5m IBIT buy → nice first precedent.

- Bitwise rolls out the Dogecoin ETF → DOGE feels a bit forgotten to me. Still sitting on wild val purely on the assumption Elon might tweet again about it.

VC

- Paxos is acquiring Fordefi → After Fireblocks and Copper, it's basically them the leader in custody.

From Great Minds

- Adapt or Die by Arthur Hayes → On everything perps. His view is that perps will eventually dominate equities and other derivatives thanks to 24/7 trading, leverage, and liquidity.

- Coinbase Ventures - ideas we're excited for in 2026 → TLDR: RWA perpetuals, exchanges and trading terminals, next-gen DeFi, AI and robotics.

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA