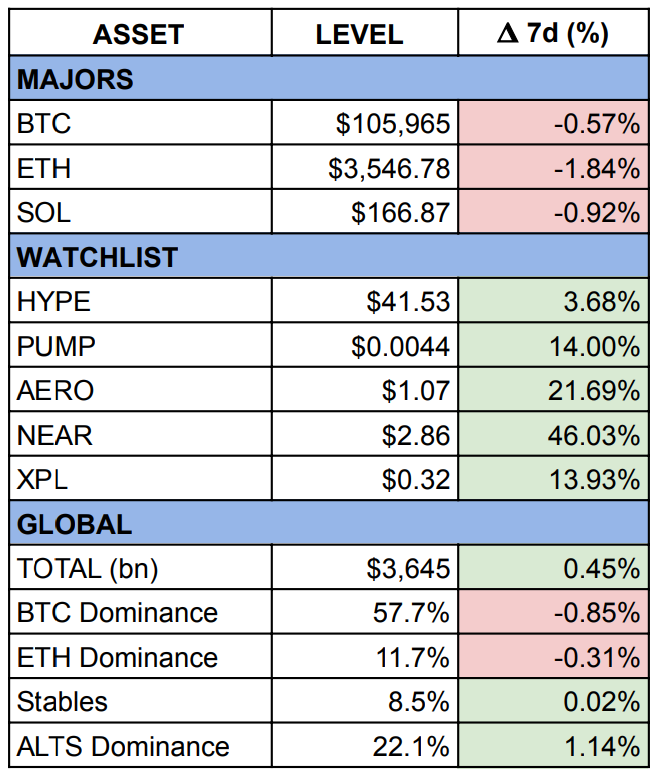

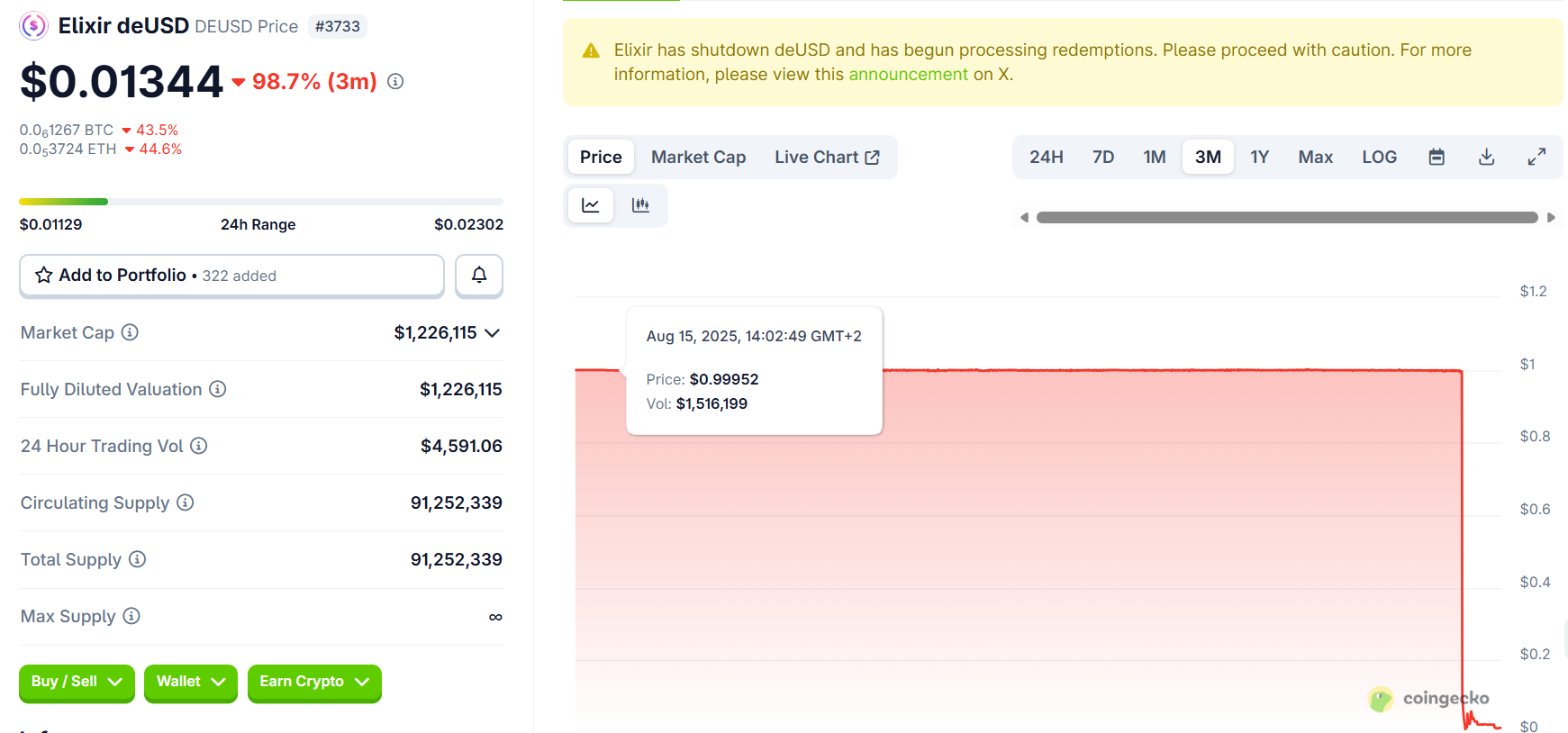

Three stablecoins down in a week

How one blowup cracked DeFi's "safe yield"

DeFi got hit again. Last week it was Balancer’s $128 million exploit, and this week three stablecoins depegged in just a few days.

Stream's collapse

It started with Stream Finance, a synthetic asset protocol that let users mint xAssets like xUSD, xBTC, and xETH backed by onchain collateral. Stream allocated part of its treasury to external fund managers running yield and market-neutral strategies on its behalf, effectively using user funds to chase off-chain yield. On Monday, Stream froze withdrawals after disclosing a $93 million loss tied to one of those managers, likely triggered by the October 10th liquidation cascade.

The xAssets were rehypothecated across multiple lending protocols, which are now dragging an important part of DeFi down with it. Analysts mapped roughly $285 million in total exposure to Stream across curators like Elixir, Re7 Labs, MEV Capital, TelosC, and Varlamore.

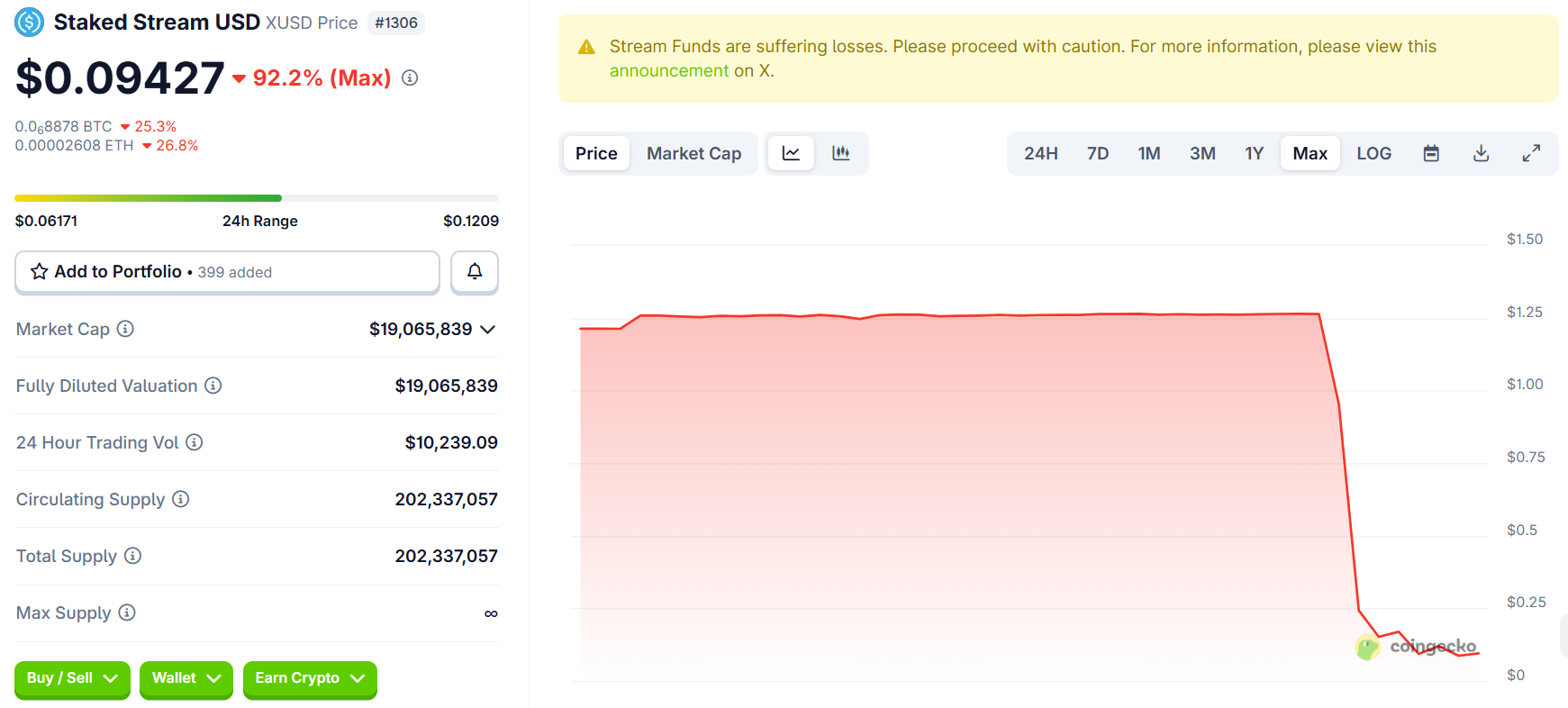

Stable's USDX depeg

Then came Stable Labs’ USDX. The protocol maintained its peg via delta-neutral hedging, and apparently, the depeg was triggered by forced liquidations of Stable Labs’ short hedges following the Balancer exploit. Traders also flagged suspicious wallet activity tied to the founder, who appeared to move collateral and drain liquidity from lending markets like Euler and Lista. As collateral dried up and borrowing rates spiked above 100%, the delta-neutral model collapsed.

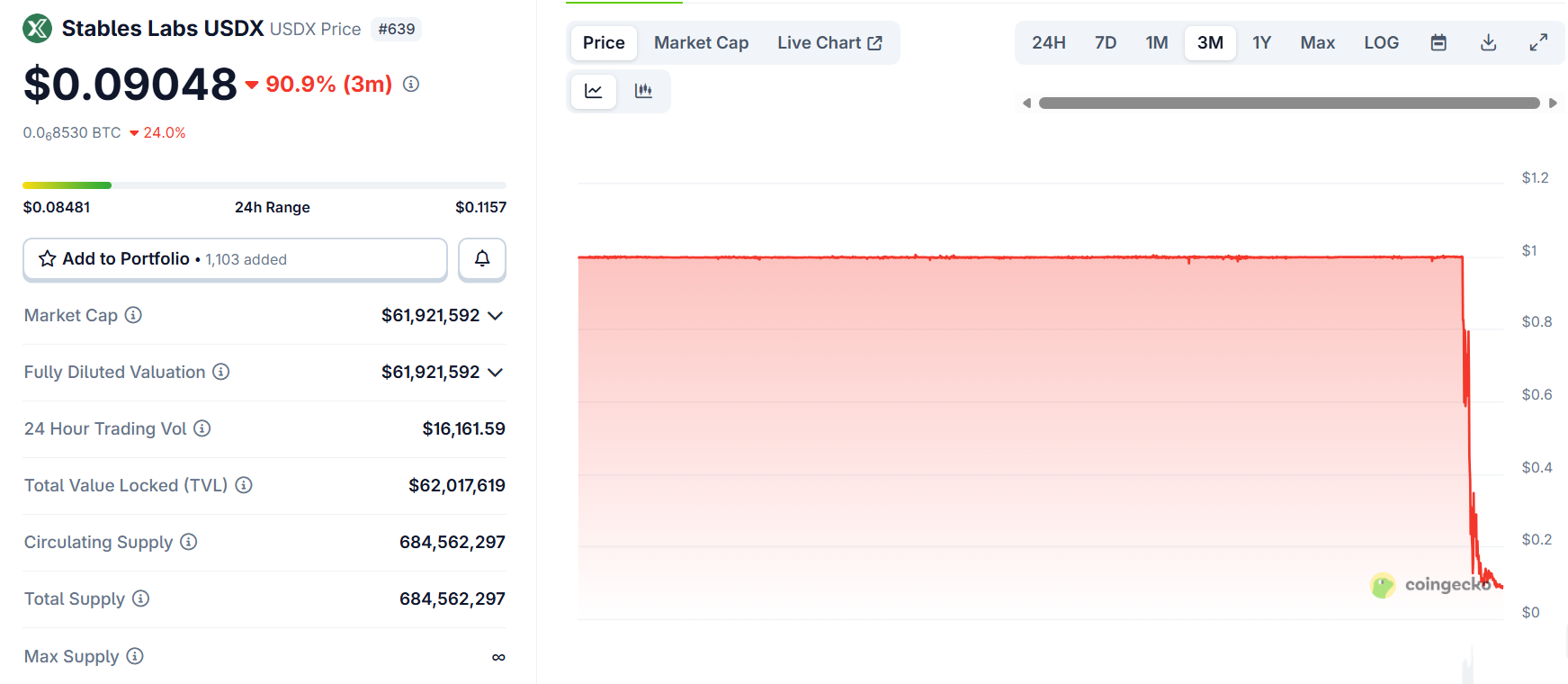

Elixir deUSD domino depeg

Finally, Elixir’s deUSD. Elixir lent $68m in USDC to Stream, roughly 65% of deUSD’s total backing. Once Stream froze operations, Elixir disabled minting and redemptions, and the stablecoin depegged. About 80% of holders were already redeemed, and Elixir says the rest will get 1:1 USDC via a claims portal, but that depends on recovering funds from Stream. The team is now working with other lending protocols to unwind positions and repay users as much as possible as funds are recovered.

"Safe-yield" vaults contagion

Vault curators like Re7 Labs, MEV Capital, and Varlamore got hit too. Many of their “safe-yield” vaults on Morpho, Euler, and other protocols were indirectly exposed through Stream-linked collateral and now face frozen assets or bad debt.

My takeaway: The DeFi stack is deeply interconnected. One blowup or leverage loop can ripple across many protocols and even different chains. "DeFi risk” doesn’t just mean exploits, but systemic contagion directly built in DeFi as well.

DeFi

- Monad mainnet and airdrop going live on Nov 24 → I was eligible for the airdrop, now let's see what the FDV comes out to. I'm targeting $5-8bn at launch.

- MegaETH's strategy for selecting allocations → The auction was super selective. Even the most active accounts got the minimum alloc.

- A rounding error was the root cause of the Balancer exploit → Funny, but sad. Balancer was a great protocol. Hard to see them recover, tbh.

- The amount of ETH in Tornado Cash just hit ATHs → Privacy very sought-after. And yes, plenty of money laundering too ;)

TradFi

- Solana DAT HSDT approves share buybacks →. Here we go, the first instance where assets are sold to rebuy DAT shares. We all know how this can spiral down... getting some PTSD vibes.

- JPMorgan predicts BTC at $170k in the next 6-12 months – LFG, institutinos shilling their bags.

- Google Finance is adding Polzmarket and Kalshi to its search results → That's great, and actually prettz insightful to have in any google search imo.

- Cathie invests $9m into Bitmine → Still wild that ETH DATs now hold close to or over 10% of ETH, and it isn't even at ATHs..

VC

- Ripple raises $500m at a $40bn valuation → Not sure wtf they're pitching, but I know no one who actually uses Ripple.

- Crypto trading app Fomo raising $17m in Series A → Heard about it, but haven't tried. Makes degening even more addictive than it already is. Trading terminals are basically PMS for retail.

- The Swiss BTC DAT, Future Holdings, raises CHF 28m → The Swiss kickstarting DATs. Same exposure as Strategz, but on the SIX exchange.

From Great Minds

- Hallelujah by Arthur Hayes → tldr:

- Stimulating into a bubble by Ray Dalio - Great read, and yes, Pax Americana feels like a bubble. Though a bit everyone on X is calling it, which almost makes me think it won't happen. Usually when too many people expect something, it ends up going the other way. Let's see, but be cautions.

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA