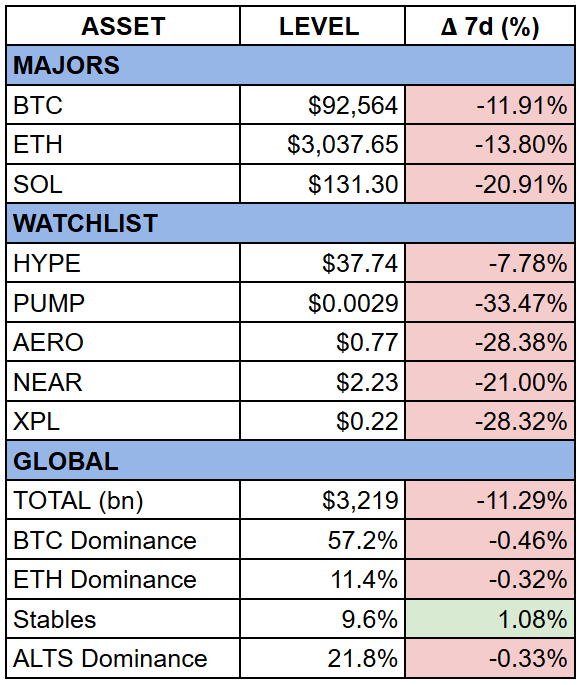

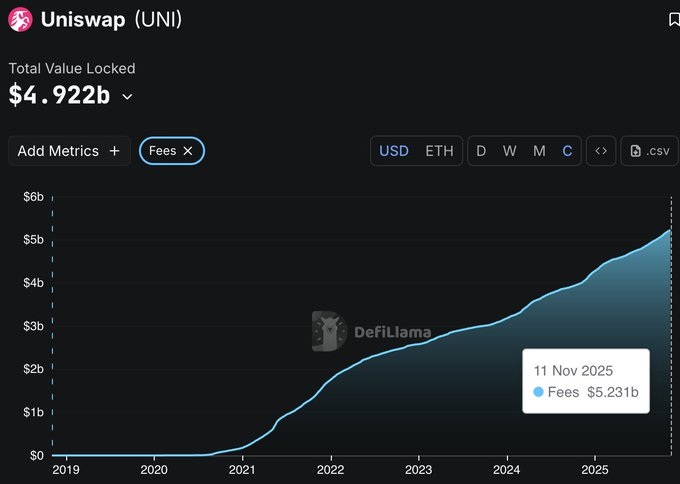

UNI finally gets a use case

Uniswap finally turns the fee switch on

Uniswap is finally formally proposing the fee switch after five years of arguments. Hayden Adams and the Uniswap Foundation put forward a plan to merge everything back under Labs, turn on protocol fees, and use those fees to burn UNI. They also want to burn 100 million UNI sitting in the treasury as a “this should have happened from day one” correction. The burn is IMO almost an admission that the token should always have been tied to protocol usage. But that's great, it's never to late.

Uniswap has earned over $5.2 billion in fees since launch

and just posted its highest monthly volume ever in October.

Uniswap definitely has a product market fit, but the token never benefited. If this proposal goes through, that gap finally closes. Labs will also stop charging interface and wallet fees, which removes a weird side-business and aligns everything under one structure. Bullish for UNI.

Lighter raises $68m at $1.5bn FDV

Lighter raised $68 million at a $1.5 billion FDV, with Founders Fund and Ribbit leading the round. Perp DEXs are moving from speculative toys to real market infrastructure. Volume has been eating into CEX share for a while, and Lighter is clearly the "second best" after Hyperliquid.

I still have mixed feelings about it. First, why does a perp DEX need to raise close to $100 million? Hyperliquid proved you can build the best product in crypto with a tiny team, no VC money, and no need for external capital. And used their own revenue to buy back more $1bn worth of HYPE. Though Lighter doesn't charge fees, so running the exchange on VC money while scaling fast can be the correct strategy. But it’s also a very different alignment model. Hyperliquid feels community-first, Lighter bit less. We'll be able to tell after the airdrop ;)

One reason HYPE went from $3 to $25 in its first two weeks is precisely because there were no funds having exposure to it through venture capital, so they bought spot at launch. It's not that VCs in Lighter will dump on day 1, they’re locked. But the truth is that a large part of HYPE’s rally came from funds and whales who weren’t allocated and had to chase spot on the way up. Although I expect something similar with Lighter as well, with the rounds, part of that demand was satisfied. Lighter will likely trade far above the $1.5 billion FDV once it lists, simply because a lot of people will want exposure. The unknown is where supply meets demand, especially with a huge group of point farmers ready to sell into strength. Let’s see how it plays out.

Crypto

- Coinbase launches ICO platform, with Monad as the first project → Curious to see how it plays out, but I’m generally a bit bearish on Monad. On the ICO platform, I’m wondering how this links to Sonar. Coinbase just acquired Echo, so did they really build another ICO platform?? They just acquired one.

- Sui launching USDsui → Just mentioning it here cause of Monad. Monad, MegaETH are hotter narratives, and SUI is sitting at $16bn FDV.. we have enough blockspace.

DeFi

- Vitalik: "Defi as a form of savings is finally viable" → Good to see Vitalik more active again. Last week was rough for DeFi, so good vibes are welcome.

- Aerodrome is expanding to Ethereum and Arc → I was bullish on Aero, but it’s starting to feel less special. Revenue/mcap ratio is great, but after this announcement it dumped hard. I’m worried UNI will steal the show now.

- Hyperliquid got attacked again → Same playbook as with JELLY JELLY, now with POPCAT. HLP got hurt a bit.. (zoom out)

- Aave to launch a savings app on Apple Store → Super cool imo. DeFi starting to compete with fintechs.

TradFi

- The Czech central bank bought $1m of BTC → Good first instance.

- JPM completed the PoC for its JPM Coin deposit token → Proof of concept after proof of concept, but it’s huge, and the most interesting part is that it’s happening on Base.

- a16z calls the US Treasury on to distinguish decentralized stablecoins from payment stablecoins → The goal is to keep regulation away from non-payment stablecoin projects. It makes sense. USDT and USDC are payment tokens and should be regulated based on their backing. Projects like Ethena aren’t the same, collateral is completely different.

VC & DATs

- The Winklevoss brothers launching a Zcash DAT company → Another DAT. Not surprising given the ZEC run, but still crazy how many are popping up.

- Saylor bought $835m of BTC at $102k → Not great to see Saylor buying more this week while we’re sitting underwater.

From Great Minds

- Why Lighter is be better positioned to capture institutional perp demand → For the Lighter bulls. Very good read breaking down the different structures Hyperliquid and Lighter use.

Trading on a perp DEX that hasn’t launched a token yet might still be +EV. Among the new ones, Extended is the best pick right now: smooth interface, wide token coverage, and an overall Hyperliquid-like feel. It’s the only one that actually feels ready for serious traders.

- Extended - The ref link gives 10% off fees

- Vest Markets - It gives you 10% boost in rewards.

- Pacifica - Gives you access to beta.

If you found this worth your time, pass it to a friend. Just forward this email!

Means a lot. Catch you next week 🫡

Disclosure: I am exposed to crypto and may own assets mentioned in this post. This article is meant for informational purposes only and should NOT be considered as investment advice. This research is independent and unrelated to my professional work. The views expressed are my own and do not reflect those of my employer. NFA